How To Apply For An Auto Loan By Wells Fargo

Applying for a Wells Fargo auto loan is a simple process that can be completed in very little time. Wells Fargo has put in place an efficient online mechanism for auto loan applications and approvals.

All you have to do is to go online and apply for the auto loan and wait for a decision on your loan.

What Are The Interest And Fees

Wells Fargo auto loans come with one of the most competitive interest rates in the auto loan segment. However, the exact rate of interest and your monthly payments will depend on a number of factors.

These factors include your amount, your income levels, and even the kind of vehicle that you are planning to buy. The catch here is that the interest rates on new vehicles are generally lower as compared to used or second-hand vehicles.

Another important factor that will determine your interest rate is your overall score. What this means is that if your credit score is low, you still can get the loan but at a higher interest rate.

What We Love About Wells Fargo Auto Loans

Wells Fargo offers flexible auto loans, giving you the option to buy a new or used car from a dealer or in a private transaction. This lack of restrictions makes it very easy for you to shop around to find the best deal on a car. Keep in mind that if you make a private transaction, you have to finalize the loan in-branch.

The banks loans are also flexible. You can choose a term up to 72 months and may not need to provide any down payment to secure the loan. Wells Fargo banking customers can also enjoy an interest rate discount that will save them money over the life of their loan.

Don’t Miss: How Much Will The Va Home Loan Give Me

Wells Fargo Auto Loan Calculator

Before starting the auto loan process there are a couple of things you should familiarize yourself with and the Wells Fargo Auto Loan Calculator is a great tool.

You should be aware of the current interest Wells Fargo Auto Loan rates, and the Wells Fargo auto calculator will be helpful in determining how much of a loan and payment you can afford.

My Vehicle Was Damaged In An Accident Do I Still Need To Pay My Auto Loan Payment

Yes. You are responsible for making your regular monthly payments until the loan is paid off. You should contact your insurance company to begin the claims process.

If you have Guaranteed Asset Protection coverage on your loan, and your vehicle is a total loss, some or all of the balance after the insurance settlement is applied may be covered. If there is a remaining balance on the loan after the GAP payout is determined, you are responsible for making regular monthly payments until the loan is paid off. You can also make a one-time payment, if you prefer.

You May Like: Loans For People On Ssi

What Could Wells Fargo Auto Loans Do Better

Wells Fargo has had some controversy in the past, including a situation where many people had accounts opened without their consent. This has given the company a reputation for poor customer service and left some consumers wary about dealing with the company.

The auto loans themselves are relatively good, giving borrowers lots of options to customize their loans, but these past controversies are something that Wells Fargo has to work to overcome.

Wells Fargo Auto Loan Reviews

One of the best ways to find a great auto loan lender is by reading third-party reviews. You can discover what actual customers are saying about them before you choose to do business with them.

The Better Business Bureau currently gives Wells Fargo Auto Loan a B . They have very few complaints for a big bank. You will find plenty of 4- and 5-star Wells Fargo Auto Loan reviews at several other review sites as well.

Don’t Miss: Can Student Loan Interest Be Deducted In 2020

Can I Cancel An Aftermarket Product

The aftermarket product contract will state whether the product can be canceled. Generally speaking, products or services that have already been provided cannot be canceled. Contact the dealership or coverage provider if you have questions.

If you purchased Guaranteed Asset Protection , Credit Life Insurance, and/or Accident & Health Insurance, and would like to cancel the product, you may call us at 1-800-289-8004 to begin the cancellation process. If you would like to cancel any other products, contact the dealer or coverage provider.

How Is Interest Calculated On My Auto Loan

With a simple interest loan, interest accrues daily. As you pay off the principal balance, the daily interest charge will decrease.

To calculate the daily interest charge, first convert the interest rate percentage into a decimal by dividing the interest rate by 100. Multiply that number by your principal balance, and then divide by the number of days in a year . This will give you the daily interest charge.

ExampleIf the loan has a 9% interest rate and a $10,000 principal balance, you convert the interest rate into a decimal: 9 / 100 = .09, and calculate the daily interest charge: .09 x $10,000 / 365 = $2.47 daily interest.

Read Also: How To Cut Your Mortgage Loan In Half

How Do I Update An Account Holder Name On My Auto Loan

Your request should include a copy of your birth certificate, U.S. passport, or state-issued identified identification as well as your signature.

You can send the documentation to us online through your Wells Fargo account. Sign on and select Upload Documents from your auto loan. Follow the steps to upload and submit your documents.

Keep these guidelines in mind:

- Attach accepted file formats: PDF, JPEG, JPG, PNG, or GIF

- Upload no more than 25 files and 25 MB total

- Make sure your files are not encrypted or password-protected

- Make sure your documents are clear, legible, and include all pages even blank ones

We will review your documents and contact you if we need additional information.

Note: Changing a name on your auto loan does not update the name on the vehicle title. Learn more about changing a name on a vehicle title.

How Do I Enroll In Online Banking

With Wells Fargo Online, you will need to complete a one-time enrollment process. You will need your Social Security number and date of birth to get started.

You can access and manage your auto loan account from your desktop or mobile device to:

- View account details and transactions

- View, download, or print up to 12 months of statements

If you have questions or need assistance with the enrollment process, please call us at 1-800-956-4442.

Recommended Reading: What Is The Va Home Loan Process

How Do I Request Authorization To Take My Vehicle Out Of The Country

Before you drive or ship your financed vehicle out of the country, you need a signed authorization from us. Authorization is for temporary travel only, not to exceed 60 days for non-military travel. We do not approve permanent relocation for non-military purposes. Your account must be current and in good standing to qualify for authorization.

To request an authorization, please send us a written request with the travel dates and the destination country, along with a copy of the vehicle registration. Also, please provide the additional documentation for your specific request type:

Driving to other countries

Fax

1-844-497-8670

Please allow three to five business days for processing from the date that we receive the required documentation.

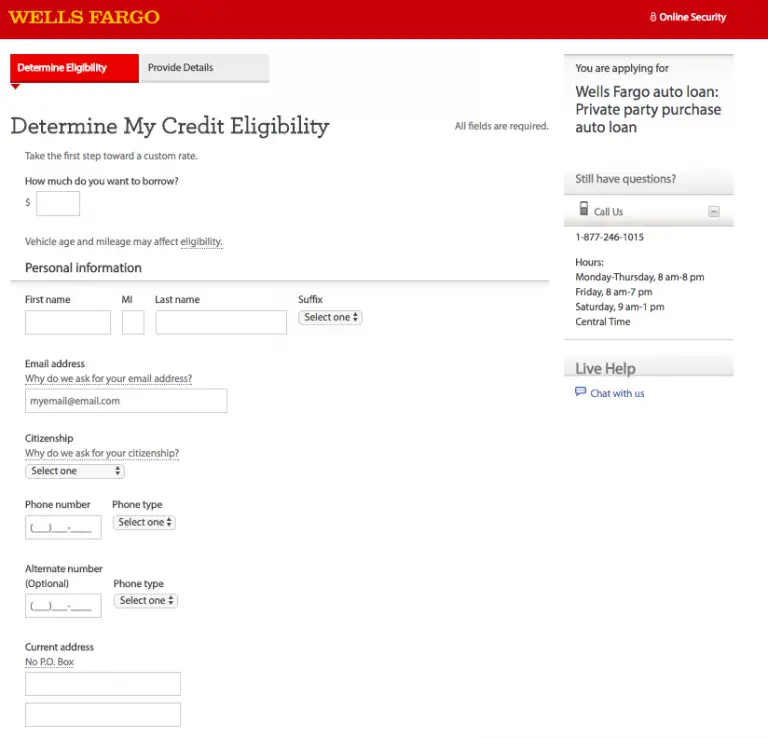

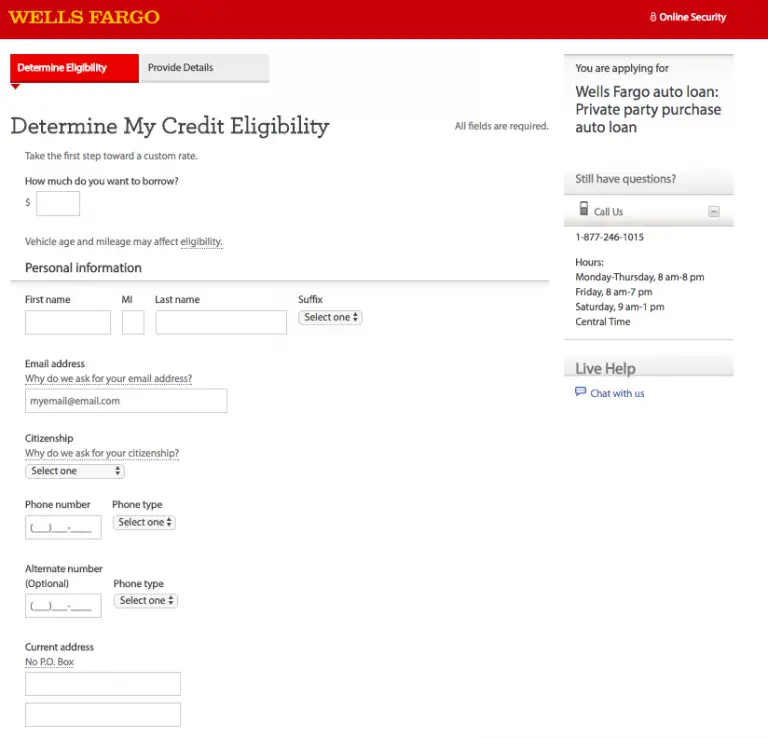

Wells Fargo Auto Loan Application Requirements

When youre ready to apply for a loan, youll need to have the following information:

- Personal information, including your Social Security number

- Citizenship information

- Housing information, including your current residential address and previous addresses

- Income information, including your gross monthly income, your previous employer, and your current employer

- Details about the car, including its make and model, year, mileage, VIN, and condition

If youre applying for a new or used car loan, the dealership selling the car will provide details on the vehicle. If youre refinancing and working with Wells Fargo directly, youll need to have this information on hand. Be sure to have details on your current loan ready, too.

Wells Fargo Bank works with lower credit scores for refinance loans, so even if your credit isnt the greatest, you may still get approved. However, keep in mind that your loan will probably have a higher interest rate if you have a lower credit score.

If you have a low credit score, you may want to apply for a loan with a co-applicant who has a stronger credit score. A co-applicant will apply for and open the loan with you. Having a co-applicant may mean youll enjoy a lower rate. Also, if your credit rating is too low for approval on its own, a co-applicant may be able to help you get approved.

Read Also: How To Calculate Bank Loan

Wells Fargo Reviews And Reputation

Wells Fargo is not rated or accredited by the BBB, though it does have a BBB customer review score of 1.1 out of 5 stars. However, this number is based on fewer than 400 reviews, which represents a tiny fraction of Wells Fargos overall customer base.

The handful of positive Wells Fargo reviews mention positive customer service experiences. Negative Wells Fargo reviews report issues with account closures, problems with autopay, and the Wells Fargo online banking service providing inaccurate information. One BBB customer complaint reads:

Wells Fargo not reporting payment history to credit bureaus. I have made several attempts to Wells Fargo to provide current payment history to three credit bureaus with no success.

Anonymous via BBB

My Vehicle Was In An Accident And I Received An Insurance Check For The Repairs How Do I Cash The Insurance Check When It Is Payable To Both Wells Fargo Auto And Me

If the check amount is $2,500 or less, you can take the check to a Wells Fargo branch and ask an employee to endorse it on behalf of Wells Fargo Auto. Find a Wells Fargo banking location near you. If you are unable to visit a branch, please call us at 1-800-825-8506, Option 4.

If the check amount is more than $2,500, please call us at 1-800-825-8506, Option 4, for instructions on how to endorse the check and for next steps. Were available to assist you Monday Friday, from 7 am to 7 pm Central Time.

Don’t Miss: Are Student Loan Forgiveness Programs Legitimate

What Happens To My Account If A Mailed Payment Or Correspondence Is Received Late As A Result Of The United States Postal Services Service Standards That Went Into Effect On October 1 2021

The USPS service standards may result in a delivery window of up to five days for certain First-Class Mail items. Please take this delivery timeframe into account when mailing items, such as a payment, to us via USPS.

If your mailed payment is received after the payment due date, and any applicable grace period, there may be a fee for making a late payment. For a more convenient way to pay, consider making a payment online. Sign on and select your auto loan from Account Summary. You can make a payment immediately or schedule a payment up to 30 days in advance. Not enrolled in Wells Fargo Online®? Enroll now.

How Do I File A Claim Or Use My Aftermarket Product

Contact the coverage provider for information on how to file a claim or how to use the product their contact information is listed on the aftermarket product contract. Your coverage provider will let you know if they will reimburse you for expenses or if they will pay the expenses at the time a covered service is performed. They will also explain other conditions, such as requiring that the maintenance be performed at the dealership where you purchased the vehicle.

You May Like: Best Place To Get Student Loans

Will I Get A Refund If I Cancel The Aftermarket Product

The aftermarket product contract may say whether you are entitled to a refund. If it does not, contact the dealership or your coverage provider for information regarding whether you are entitled to a refund and what amount, if any, is owed. The coverage providers information is listed on the aftermarket product contract. To request a copy of the aftermarket product contract, contact the dealership or call us at 1-800-289-8004.

Wells Fargo Auto Loans: Conclusion

Wells Fargo auto loan was rated 2.5 out of 5.0 stars by our review team due to its poor reputation and lack of a streamlined application process. Overall, sentiment around the companys car loan services is not good and we recommend searching elsewhere. When searching for the best auto loan for you we recommend getting together companies in a list and comparing your options before committing.

Below you can start comparing auto loan rates from multiple top lenders.

Read Also: How To Get 150k Business Loan

Why Consider Wells Fargo For An Auto Loan

Wells Fargo offers competitive rates and a variety of loan products through its network of 11,000 dealerships. The bank does not offer loans directly to borrowers, and requires that a dealer submit all applications. That said, Wells Fargo is not known for its customer service and may not live up to your standards if you expect top notch responses and help when you have a problem.

Every Year Millions Of Americans Turn To Private Sellers To Buy Their Next Car Unlike Most Auto Dealers However Private Sellers Rarely Offer Financing Private Party Auto Loans Can Fill That Gap

When buying a car directly from an owner rather than an auto dealer, your financing options can be limited. If you dont want to pay entirely in cash, you might be able to get an unsecured personal loan or you could consider a private party auto loan, which often has lower interest rates. As a result, a private party auto loan can be less expensive than a personal loan because the car serves as collateral. Heres what youll want to know about private party car loans before you get started:

Also Check: What Does Pre Qualified Loan Mean

Who Is Wells Fargo Bank Na

Wells, Fargo & Co. was founded by Henry Wells and William Fargo in 1852 to serve the West coast with banking and express delivery.

Over the years Wells Fargo Bank NA has moved away from its pony express days and focused on the financial services industry.

Today Wells Fargo Bank N.A. is one of the largest banks in the U.S. with over 6,314 branches, 13,000 ATMs, and 259,000 employees.

Wells Fargo Bank Auto Financing offers new, used, and refinancing for automobiles under eight years old with flexible mortgage terms between 12 months and 72 months.

They have partnered with over 11,000 dealerships to offer new and used auto financing through their dealer services program.

Wells Fargo Cuts Back On Auto Student Loans To Minimize Risk

UPDATE: July 5, 2020: Wells Fargo will only grant student loans for the upcoming academic year to people who submitted applications before July 1 or to customers who have an outstanding balance on a previous student loan from the bank, Bloomberg reported Thursday.

Its the latest type of loan the bank has de-emphasized in an effort to minimize risk. More than 40 million student-loan accounts were in deferment as of mid-June, according to Equifax.

Wells Fargo said last month it would no longer accept auto loan applications from most independent car dealerships. The bank in late April retreated from part of the mortgage market, too, saying it would temporarily stop accepting new applications for home equity lines of credit.

Wells Fargo has decided to narrow its student-lending focus, Manuel Venegas, a spokesperson for the bank, said in a statement.

The bank held $10.6 billion in private student loans at the end of the first quarter.

Also Check: How Do They Determine Mortgage Loan Amount

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

When You’re Struggling To Pay Your Auto Loan We’re Here To Help

If you are experiencing financial challenges, or have long-term or more permanent financial difficulties, we may be able to help.

If you are unable to make your payment in full, please call us at 1-800-289-8004, and we will review your account with you to determine whether payment arrangements are an option. Please keep in mind that if we don’t receive the full payment amount by the due date, your account is still considered past due.

Here are some actions that may help:

Also Check: Can You Get Home Equity Loan Without Job

Advantages Of The Wells Fargo Auto Loan

- Rate discounts available: As we mentioned earlier, Wells Fargo offers customer relationship discounts. To qualify, you must have a Wells Fargo account or open one at loan booking. The discount is only available for business or personal loans, not consumer auto loans.

- Competitive rates: Wells Fargo auto loan rates are on par with other lenders weve seen, but its always a good idea to shop around so you get the best auto loan rate possible.

- Poor credit considered: You dont have to have great credit to qualify for a Wells Fargo auto loan. But it isnt the only lender to consider if you need a bad credit auto loan.

- No origination fees or prepayment penalties.