Saving For A Home Purchase

When youre saving up money to purchase a home, keep a few possible expenses on your radar. These include the down payment, closing costs, moving expenses, and your first couple of mortgage payments.

You dont have to be overwhelmed by all these expenses. There are ways to keep these costs lower:

- Down payment: This could be lower than you think depending on the type of home loan you choose. Your loan officer can show you the options that you qualify for so you can make the best decision for your financial goals.

- Moving expenses: You can significantly reduce these costs by cleaning, prepping, packing, and moving yourself, without any hired help. Friends and family may also be an option if theyre willing to lend a helping handor a truck!

- Mortgage payments: There wont be a monthly payment due during the first month of your mortgage. This gives you a little extra time to build up for your first payment.

Understanding the many facets of your mortgage loan is key before you sign your final documents. Closing costs and down payments should certainly be considered carefully.

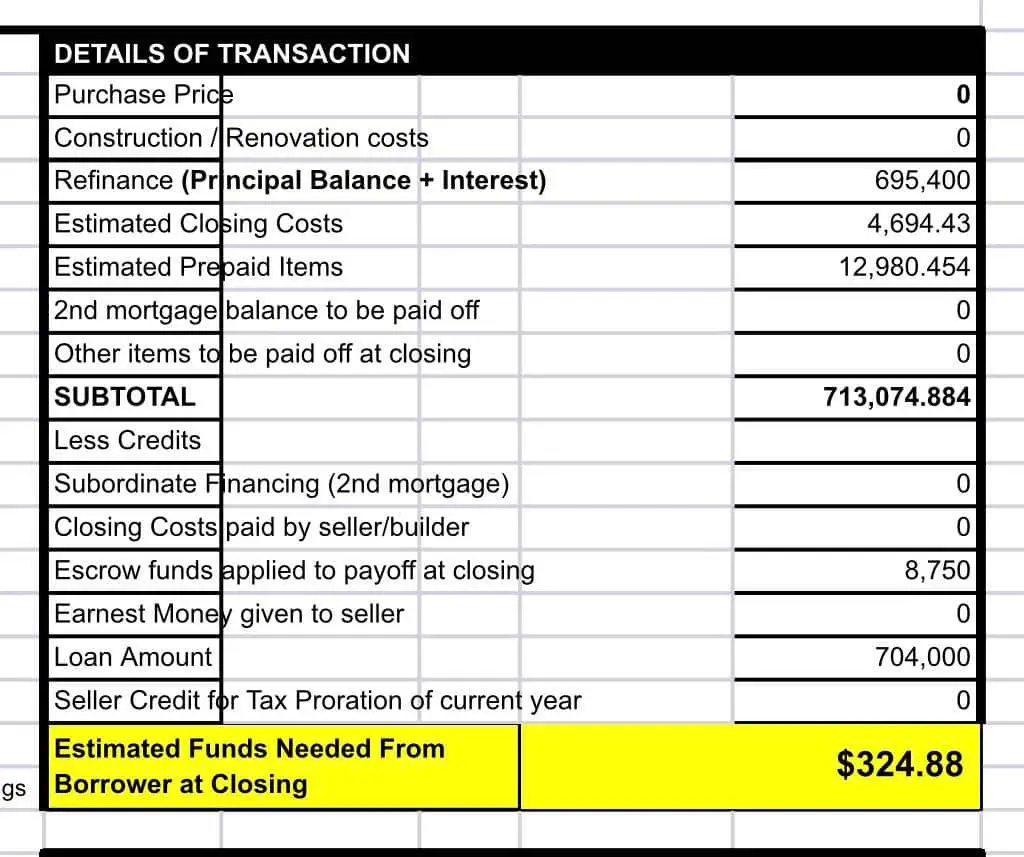

There is a number called cash to close in the transaction, which combines all the closing costs and down payment money into one number. Be sure to take a look at that number and build it into your plan and ask about alternatives early in the process.

APM Loan Advisors are happy to help you decide which option will best fit your situation. Chat with us today!

How Much Are Closing Costs For The Buyer

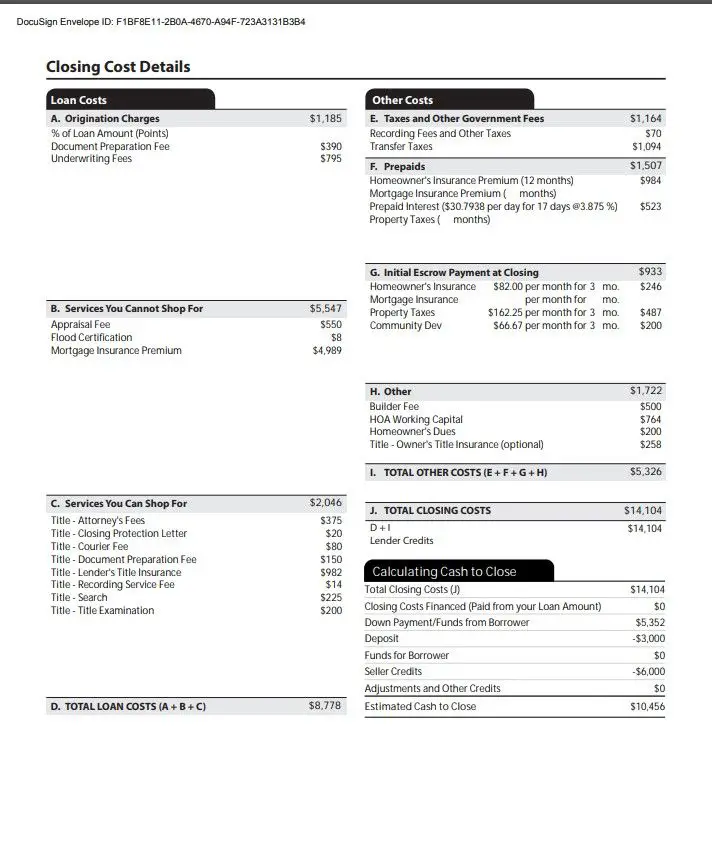

Closing costs vary depending on where youâre buying your home, the home itself and the type of loan you choose. Here’s a list of some common fees you may need to pay when closing. While itâs not intended to be all-inclusive, this list reflects what is generally required of homebuyers.

Property-related fees

- Appraisal fee: A valuation of the property should confirm the homeâs value aligns with the purchase price.

- Home inspection: The home inspection verifies the condition of the property. It can also uncover problems with the home that need attention before closing.

- Recording fee: Your local city or county government requires a recording fee to update public land ownership records.

- Transfer tax: When your local government updates your homeâs title and transfers it to you, youâll pay a transfer tax fee. This fee varies depending on where you live.

Taxes and insurance

- Homeowners insurance: A type of protection that compensates you if your home gets damaged. Often, lenders require this as a condition of your loan.

- Private Mortgage Insurance : Depending on the type of loan you choose and the amount of your down payment, you may have to pay PMI. PMI protects the lender against any loss if you fail to pay your mortgage.

- Property taxes: The buyer usually pays the city and county property taxes due from the date of closing through the end of the tax year at closing.

Loan-related fees

Title fees

The Downsides Of Rolling Closing Costs Into Your Mortgage Refinance Loan

When you roll your closing costs into your mortgage refinance loan, you’ll have to pay interest on that money the entire time you’re paying off your home loan. This can actually make these fees more expensive.

Consider the difference between that $200,000 loan and the $206,000 loan mentioned above. If you took out a 30-year $200,000 loan at 3.25%, your monthly payment would be $870 and your total interest costs would be $113,428 over the life of the loan. But if you borrowed $206,000 because you tacked on closing costs, monthly payments would be $897 and you’d pay $116,831 in total interest over the life of the loan. Instead of paying $6,000 up front, you’d pay an extra $27 per month every month for three decades. That means you’d end up spending about $9,700 on closing costs and the interest paid on them.

Increasing the amount you borrow and your monthly payment could also make loan approval more difficult. That could be an especially big issue if you’re close to exceeding your lender’s allowable debt-to-income ratio or if you’re refinancing a loan with a balance close to 80% of your home’s current value.

Also Check: What Is The Minimum Income For Fha Loan

Can You Waive Closing Costs On A Home

Some closing costs must be paid, no matter what. But you can try to negotiate origination and application fees with your lender. You may even be able to get your lender to waive certain fees entirely.

SoFi Loan Products SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 , and by SoFi Lending Corp. NMLS #1121636 , a lender licensed by the Department of Financial Protection and Innovation under the California Financing Law and by other states. For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.SoFi Mortgages Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility for more information.Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Typical Closing Costs For An Fha Loan

15 @3%. How am I getting screwed …” alt=”Refinancing from 30 yr @ 4% > 15 @3%. How am I getting screwed …”>

15 @3%. How am I getting screwed …” alt=”Refinancing from 30 yr @ 4% > 15 @3%. How am I getting screwed …”> You can expect your FHA closing costs to be anywhere from 2%-4% of the loan amount. You will have standard fees that you cannot avoid and will need to be paid regardless as to which lender you choose. Some of these fees or closing costs include your credit report, home inspection or appraisal, the title search and title insurance, and flood certification just to name a few.

Next, you will have some lender based fees which may vary from lender to lender. These fees include discount points, origination fees, and possibly an underwriting fee.

Finally, you have unavoidable fees that are FHA specific such as the upfront mortgage insurance premium. Read our article about FHA mortgage insurance premiums for more information.

If you would like to see a detailed breakdown of all FHA closing costs that you may incur, then read our article on FHA closing costs.

You May Like: How To Be Eligible For Fha Loan

Cost Of Financing Mortgage Insurance

As unwelcome as upfront mortgage insurance might be, by any of its various names, it will also cost you more over time. Once you need mortgage insurance, youll be paying monthly premiums for at least two to five years, possibly longer per PMI rules. If you add this premium to your mortgage amount, youll pay interest on this money each month. For example, FHA requires that you keep its mortgage insurance for five years or until your loan-to-value ratio declines to 78 percent, whichever takes longer.

References

Is It Smart To Roll Closing Costs Into Home Loans

Whether or not rolling closing costs into a home loan is the right choice for you will depend largely on your personal circumstances. If you dont have the money to cover closing costs now, rolling them in may be a worthwhile option.

However, if you have the cash on hand, it may be better to pay the closing costs upfront. In most cases, paying closing costs upfront will result in paying less for the loan overall.

No matter which option you choose, you may want to do what you can to reduce closing costs, such as negotiating fees with lenders and trying to negotiate a concession with sellers in which they pay some or all of your costs. That said, a seller concession will be difficult to obtain if the housing market in your area is competitive.

Recommended Reading: Average Interest Rate On Car Loans

The Fees Roll Into Your Principal

This option takes your closing costs and rolls them into your principal balance. In other words, theyre added to the amount you borrowed from your lender and factored into your monthly payment. While this doesnt affect your interest rate, youll pay more interest over the life of your loan since this increases the overall amount borrowed.

Unless youre purchasing a home with an FHA, VA or USDA loan and building in certain fees, you can only choose to roll your closing costs into your principal with a refinance. Essentially, you would use your home equity to pay for the costs.

Also Check: What The Highest Apr For Car Loan

Can I Roll In My Closing Costs When I Refinance

-

Yes. Rolling closing costs into your new loan is known as a no-cost refinance and may be a good strategy if your short-term priority is to keep more cash in your pocket. There are two key ways to bake upfront costs into your new loan:

The first is by taking lender credits. In exchange for a higher interest rate on your loan, your lender will give you credits to cover your upfront closing costs. The second is by applying your closing costs to the principal of your new loan amount. This means your interest payments will be calculated based on this higher number.

While each of these strategies can offer financial advantages, you are ultimately delaying payment on your closing costs rather than avoiding them altogether. Make sure you understand the overall impact before you decide to do a no-cost refinance.

Better is a family of companies serving all your homeownership needs.

We cant wait to say Welcome home. Apply 100% online, with 24/7 customer support.

Connect with a local non-commissioned real estate agent to find out all the ways you can save.

Shop, bundle, and save on insurance coverage for home, auto, life, and more.

Get a loan up to $50,000 for all your home needs, including moving, renovations, and furniture.

Get free repair estimates, 24-hour turnarounds on reports, and rest easy with our 100-day inspection guarantee.

Get transparent rates when you shop for title insurance all in one convenient place.

Better Home Line of Credit Terms and Conditions

Don’t Miss: Low Rates For Personal Loans

Rolling Closing Costs Into Fha And Va Loans

FHA and VA loans have some unique features and fees that require additional consideration when deciding if you want to roll your closing costs into the loan. You should discuss all features of the loan program with your lender to make sure you fully understand your obligations as a borrower.

FHA loans require the borrower to pay an upfront mortgage insurance premium . The UFMIP is generally 1.75% of your loan amount, and it can be rolled into the loan amount. There is one caveat: FHA loans require a minimum 3.5% down payment, not counting your closing costs. This means if you’re borrowing $100,000, you are required to pay at least $3,500 toward your down payment in addition to your closing costs.

VA loans require the borrower to pay a VA funding fee, which can be financed. This fee goes directly to the Department of Veterans Affairs to help cover losses and keep the loan guarantee program viable for future generations of military homebuyers. The amount of your VA funding fee will depend on your type of service and whether this is the first time you are obtaining a VA loan.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Should You Roll Your Closing Costs Into Your Mortgage

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Buying a home is an expensive prospect. You have to come up with a down payment, pay for movers, and buy furniture for your new home. But theres another expense many home buyers forget to account for: closing costs on a mortgage.

Closing costs arent universal. Each mortgage lender sets its own fees that are then passed on to borrowers when they finalize their home loans. Typically, closing costs range from 2% to 5% of a borrowers loan amount. Nationally, they average $5,749. Your loan estimate should include your closing costs so you know what fees to expect. In fact, your lender should break down each fee for you in your closing disclosure so you know everything youre paying for.

The good news is that as a borrower, you usually dont need to come up with a check for your closing costs when you sign your mortgage. You could go that route, but you often get the option to roll those fees into your mortgage and pay them off with the rest of your loan. This applies to new home purchases and refinances. The question is: Which is the better choice?

You May Like: What Is The Cheapest Student Loan Repayment Plan

Don’t Miss: How Much Loan I Can Get For Business

What Should You Do

Having a solid grasp on your financial goals will help you decide if rolling closing costs into your mortgage is a good decision for you. If you need the extra money in your pocket right now, rolling closing costs into the loan may be a good decision. It actually may help you buy a home sooner than youd be able to otherwise.

If you dont really need the money right now, you may want to skip the higher monthly costs and just pay the costs upfront to save money in the long run.

If you have any questions about this or would like to go over any specific scenarios together, please dont hesitate to reach out to our team.

This review is about Mark and Darci Richardson from CSMC Mortage in Simi Valley. This team is the BEST! For the past 12 years our home was “underwater” due to the “crash” in 2007, and unable to do anything with the mortgage except pay it. These two kept on top of things and finally the house qualified to REFI. We just completed everything and it closed last week… and they saved us over $900 a month!! That’s a huge savings for a couple of senior citizens! We are SO happy now and finally can breathe. Thanks to Mark and Darci and CSMC Mortgage for following through, jumping through all the hoops necessary and helping us out! I can’t recommend them more… they are the BEST!!!

– Shari S.

– Heather C.

– Mark L.

– Paula K.

– Taline S.

– James Z.

How To Lower Closing Costs

The less you have to spend on closing costs, the smaller the check youll have to write outor the less youll add to your mortgage balance. Thats why its wise to keep your closing costs to a minimum. You can do so by seeing if the seller will pay some or all of your closing costs.

In a normal housing market, its not uncommon for sellers to be asked to pick up some or all of a buyers closing costs. Sellers often are willing to do so if they want to solidify the offer theyve received. But this strategy may not work right now because its a sellers market.

You May Like: Reverse Mortgage For Condominiums

Read Also: Is Direct Plus Loan Good

Can My Spouse Get An Fha Loan If I Have One

you can get a FHA loan in your own name. FHA will not consider spouses FICO But if you are married they will add spouses debts credit card auto the other mortgage PITI into your qualifying ratios. They wont use rental income to offset unless you spouse filed Federal taxes with rental income showing.

Why You Shouldn’t Roll Closing Costs Into Your Mortgage

by Christy Bieber |Updated July 19, 2021 – First published on April 13, 2021

Image source: Getty Images

There’s a host of downsides to rolling closing costs into your mortgage.

When you get a new mortgage or a refinance loan, you’ll usually need to pay closing costs. These are usually around 2% to 5% of your home’s value, and they can add up to several thousand dollars.

Typically, when you’re getting a new mortgage, you have to pay these costs out of pocket up front. However, when you refinance a mortgage, some lenders let you roll these costs into your new loan. That means if you were going to borrow $200,000 and pay $6,000 in closing costs, you’d instead borrow $206,000 and pay no closing costs up front.

This may sound like an attractive option since you don’t need to come up with several thousand dollars to close on a refinance loan. But, in many cases, it’s actually a far better idea to pay the closing costs up front and be done with them rather than dragging out repayment over time. Here’s why.

Don’t Miss: What Is The Largest Student Loan I Can Get

What Our Clients Are Saying

My experience with Sondi has been exceptional. Every time I work with or even ask advice from Sondi he is very eager to assist. His knowledge is incredible as well as his professionalism. He makesRead More

Incredible team!!! Brian, Cindie and Alex it was such a pleasure working with you all. Very professional, always quick with a response when I had a question. The whole process was a breeze, thanks againRead More

I would like to acknowledge the exceptional service that I received during my refinancing process. While we hit some snags along the way but the team at Florida Home Funding went above and beyond toRead More

First time home buyers and Shahram and Cindie made the process so smooth! We were nervous and didnât even know where to startâ with their patience and expertise my wife and I now own ourRead More

Just purchased our home with the assistance of Shahram and his teamâ¦I would recommend them to anyone. From day one everyone was so caring and diligent!!! Thank you so much for everything you did! WeRead More

TRULY GOD SENT!! Shahram and Cindie arrived just within the nick of time. Shahram stated that we would close within 30 days, and we did just that! I had a very LONG and drown outRead More

Florida Home Funding was great to work with. Shahram and Cindie made our 1st home purchase a wonderful and memorable simple process.

Read Also: How Long Can You Finance An Rv Loan