What Happens If You Default On Your Student Loan

The consequences of defaulting on your student loan can be bad for your financial health.

Heres what happens when you default on your student loan.

- Your loan and its interest becomes due and payable

- You will not be able to become eligible for programs like student loan forgiveness, forbearance, deferment, and changing repayment plans

- You will not be eligible for additional financial aid

- Your loan will be reported to the 3 credit bureaus as a delinquent

- Defaulting on loans can hurt your credit score

- Your wages can be garnished to repay the debt

- Your lender can send the loans to the collection agencies for collection.

- You could have your tax return, social security and federal payments garnished.

The Downside Or Danger To Paying Off Student Loans In Full

Elimination of student debt is the goal of any student loan borrower, but there are few items to consider before making that last payment.

Scenario: After saving and sacrifice, you finally have enough money in your bank account to pay off your entire student loan balance. Before sending off the final check, you want to make sure that there are not any negative consequences you are overlooking.

Knocking out a student loan balance in full is a dream come true for many borrowers.

As the dream starts to become a reality, fear sets it. Am I making a mistake? What is the downside to sending in that final big check to pay off my student loans?

Before spending thousands of dollars on anything, it is a good idea to double-check your decision. In the case of a final payoff of student loans, most borrowers will find that the pros of a final massive payment outweigh the cons of debt elimination.

However, it is worth looking at the potential negatives to paying off your student loan because it is a big decision. Once you understand the possible consequences of your choice, it becomes much easier to move forward.

Downsides Of Student Loan Settlement Negotiations

Student loan debt negotiation may free you from some or all of your debt, but it comes at a price.

That price used to include having to pay tax on the cancelled amount, but thats no longer the case through 2025, thanks to the student loan stimulus relief passed by Congress in March 2021.

Still, there are a couple of other repercussions you may face upon settling:

- It can impact your credit score. Despite settling a student loan, your credit history and score will still reflect the delinquency and default for seven years though you can negotiate with your lender or loan servicer to mark your debt as current and paid up, if not in full.

- Settlement might wipe out your savings. Federal loan settlements must be paid at once, and its a good idea to do the same with private loans. This isnt easy for many borrowers and could wipe out your savings. And as Cohen advised: If dont have enough money for groceries, then you really shouldnt have paid the lump sum.

Read Also: Genisys Auto Loan Calculator

If You Need Additional Student Loan Help

If youre struggling with your student loan debt, first speak with your servicer or lender to:

-

Discuss repayment options.

-

Take a temporary payment pause.

-

Temporarily reduce your monthly payments.

If your problem is with your lender or servicer or youre not getting the help you need, look for a legitimate student loan help organization that offers counseling. Consider these vetted resources for student loan help they are established organizations with verified histories:

|

Student loan help resource |

|

|---|---|

|

Advice on debt settlement, bankruptcy, default and forgiveness. Licensed in Missouri and Illinois. |

Many of these organizations offer advice for free. In some cases, you may need to pay a fee, as with a certified nonprofit credit counseling agency or if you hire an attorney.

None of the organizations above calls, texts or emails borrowers with offers of debt resolution.

Offers of help that you have not sought out are likely to be scams. While its not illegal for companies to charge for services such as consolidation or enrollment in a payment plan, those are steps you can do yourself for free.

Avoid any debt relief companies that demand money upfront.

Your Private Student Loan Settlement Options

If your student loans are in good standing, refinancing for better interest rates and repayment terms is an excellent route to consider. You can use the lump sum to pay off a big portion of the loan, and then refinance the remaining amount so that monthly payments are much smaller.

If your loans fell into default, lenders may be willing to negotiate if your loan is beyond the statute of limitations, is unenforceable for other reasons or if you have limited assets and income. In all cases, the lender may fear not receiving the remaining balance and is more willing to accept a settlement to dismiss the debt.

The statute of limitations on student loans varies by state. Until your loan reaches that point, lenders may sue and receive payments by garnishing wages or withdrawing from your bank account if they win in court.

Read Also: Usaa Auto Loan Approval

Alternatives To Settling Student Loans

If coming up with at least half of your loan balance isnât feasible, you still have options to get out of your student loan debt and get back to living your life.

The first option is to enter a repayment plan with your lender. A private lender isnât required to provide student loan repayment options for borrowers in default, but federal student loans allow repayment plans.

Once the payment plan is complete, the loan is considered current, and the default status will be removed from your credit report.

Another option is to refinance or consolidate your defaulted student loan. These options may allow you to get a lower interest rate and monthly payment. Rehabilitation can suit some borrowers with defaulted student loans.

How Much Will I Need To Pay After I Settle

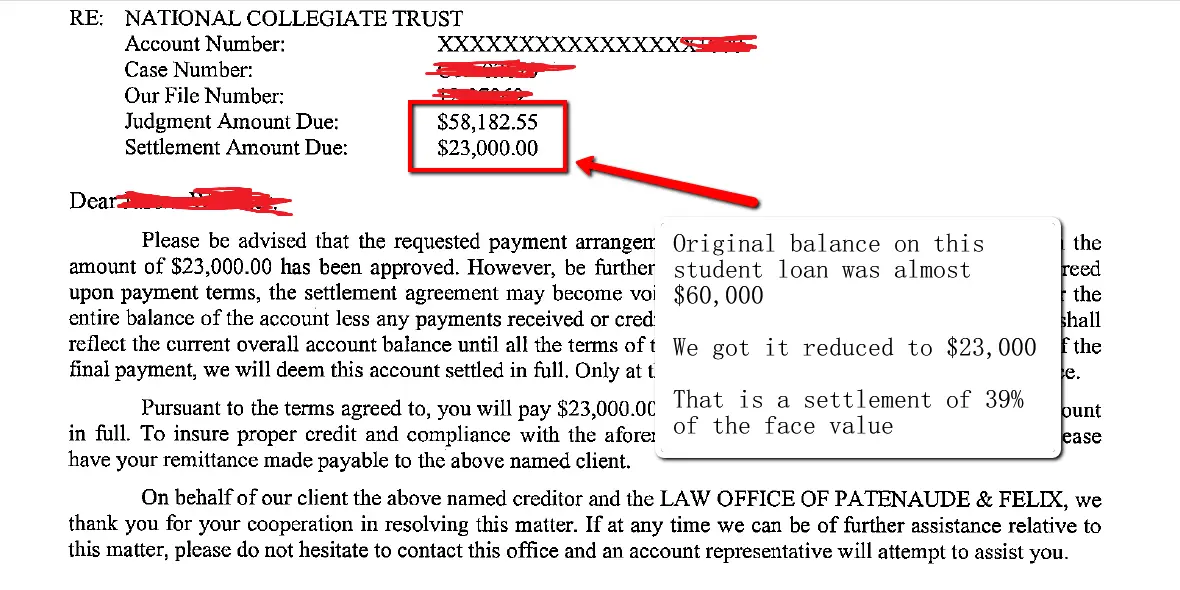

The exact amount youll need to pay will depend on your lender and what youve negotiated. When you and the lender agree to a settlement, you pay this amount in one installment, or a lump sum. Again, it can be as high as around 90% of your remaining loan balance or as low as less than half of what you owe.

Regardless of the amount you settle for, you may still have to pay interest and collection fees until the settlement is complete. Plus, settlement could severely impact your credit, which could affect interest rates for future loans. A higher interest rate means youll need to pay more over the life of a loan.

Settlement should probably be your last resort when it comes to finding ways to pay back your student loans. Yes, there are benefits, but settlement can negatively impact your credit. Consider alternatives such as refinancing your loans through Juno to get back on track with loan payments.

Recommended Reading: Usaa Loans Auto

Reasons To Bring Up Your Student Loans

Did you go to a great college? Was it expensive? Was that great education part of the reason you were hired?

If your education is a big factor in your selection for the position, it makes sense to point out that it wasnt free. Student loans are a huge expense for many graduates, and if paying them off is a big challenge for you, it is definitely fair to bring them up.

Do you have multiple job opportunities?

This issue especially applies whether you are looking at a government position and a private sector position. If you are negotiating with a private sector company, you should point out that student loan forgiveness programs are a HUGE perk for government employees. If they want to secure your services, merely beating the salary isnt enough, they have to compete with this amazing benefit.

Even if you dont have multiple job opportunities, it still pays to research what other employees in your industry pay. If you just took a job at one of the three large accounting firms in your city, and you know the other two provide student loan assistance programs, you could use the competition as an example of the current trend.

When Can You Settle Student Loans

You can negotiate a student loan payoff, but it depends on the current status of your loans. If your loans are in good standing, lenders wont consider a settlement request. Adam Minsky, an attorney specializing in student loan law, says youre eligible for student loan payoff only if your loans are in default.

In most cases, only defaulted student loans can be settled or negotiated, he says. Defaulting can have very serious consequences including penalties or fees, negative credit reporting, collections and litigation.

Don’t Miss: Refinance Options For Fha Loans

Youve Come Into A Disproportionately Large Sum Of Money

Lenders wont typically approve a settlement if you have enough cash to make your loan payments or pay your debt balance in full.

If, for example, you received an inheritance, won the lottery or received another type of financial windfall, itll be more difficult to prove the hardship necessary to seek out a debt settlement to begin with.

Opportunity Costs: A Con To Consider

In economics, an opportunity cost is the loss of a benefit because of a decision you made.

For example, if you make a large payment towards your student loans, you miss out on the opportunity to put that money into a retirement account.

The larger the final student loan payment, the higher the opportunity cost.

Borrowers should consider their other financial goals before making the big final payment. These other goals might include:

- Buying a house,

- Having children, and

- Starting a business.

The opportunity cost will vary from one borrower to the next. However, all borrowers should consider the missed opportunities as potential downsides to paying off a student loan balance.

Also Check: Usaa Student Loans Review

Federal Student Loan Settlement Options

The Department of Education offers a variety of settlement options based on your situation. The types of settlements typically offered include:

- Waiver of collection costs Allows you to only pay the current principal balance and interest while waiving collection costs

- Waiver of 50% interest Allows you to pay the current principal balance and only half of the interest amount

- Waiver of 10% of principal and interest Requires you to pay as much as 90% of the combined principal and interest balance

- Discretionary settlement Might be offered if you dont agree to any of the above amounts and its approved by the Department of Education

- Non-standard compromise Agreeing on an alternative settlement with the Department of Education that falls outside the standard agreements

If youre hoping to negotiate the settlement of your federal student loans, its important to remember that you have rights as a federal loan borrower. Contact the Department of Educations Federal Student Aid Office or Consumer Financial Protection Bureau for more information.

Am I Able To Discharge A Federal Student Loan Without Having To File Bankruptcy

In most situations, neither federal student loans nor private student loans are eligible to be discharged in bankruptcy. However, in some cases, you can have a federal student loan discharged if you experienced serious problems with your school, worked in public service, or have a severe disability.

Don’t Miss: Usaa Pre Approval For Mortgage

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Is It Worth It To Pay Off Student Loans Early

Yes, paying off your student loans early is a good idea. … Paying off your private or federal loans early can help you save thousands over the length of your loan since you’ll be paying less interest. If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans.

Don’t Miss: How Long Sba Loan Take

Commonbond Disclosures: Private In

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access . If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

Why You Need A Student Loan Lawyer To Fight For You

The CFPB, the governments financial watchdog agency, recently reported that the federal governments own student loan debt collectors are breaking the rules. According to the CFPB, Some of the debt collectors, who work under contracts from the Education Department and werent identified by the CFPB, threatened borrowers with lawsuits even though they had no intention of suing. Some used call scripts and letters that misled borrowers about the benefits of repaying their defaulted federal student loans. Misleading borrowers about their debts is generally illegal under the Fair Debt Collection Practices Act.

You May Like: Car Loan Balance Transfer

Statute Of Limitations And Student Debt

Do student loans ever go away? Unless you qualify and file for formal loan forgiveness through a bankruptcy or proposal, the student debt itself never goes away. Whether collection can be enforced depends on whether your creditor is the federal or provincial government or a private lender. Private student loans are subject to provincial statute of limitations laws. In Ontario, that means if there has been no activity on your student credit card or bank loan for two years, your defense to a lawsuit or wage garnishment action would be that the debt is too old. These same debts would fall off your credit report after six years. You will continue to receive collection calls during this time. Government Student Loans are not subject to a limitation period for collection action. The only way to stop paying government student loans in Canada is to file a bankruptcy or consumer proposal. For example, in Ontario if you owe money to the Ontario Student Assistance Program , CRA will continue all possible collection actions until your OSAP loan is discharged through the Bankruptcy & Insolvency Act or paid in full.

Negotiating Interest Rates On Federal Loans

Federal loans are a different animal when it comes to negotiating lower rates.

Interest rates on federal loans are set by Congress. This means that federal loan servicers will not lower interest rates, regardless of the strategy used by the borrower.

Borrowers do have the option of income-driven repayment plans and student loan forgiveness, but despite these excellent federal protections, the rate will remain the same.

The only way to get a lower interest rate on this debt is to refinance the federal loans with a private lender. This move can be dangerous because it means that all of the federal protections will be gone forever. As a result, a private refinance of federal debt is only recommended for borrowers who are in a strong financial situation.

Recommended Reading: How Long For Prosper Loan Approval

Negotiating A Payment Plan On Student Loan Debt

Under federal law, the businesses and organizations that disburse federal student loans must offer deferment options to debtors. Deferment options allow borrowers to postpone payments if they can show financial hardship.

Also, some lenders are required to give borrowers the chance to modify repayment plans at least once every year. The majority of student loans must be repaid within ten years, but some can be extended to 25 years in a repayment plan. That could allow borrowers to pay as little as $50 a month. Some repayment plans are also contingent on a persons gross annual income. With this type of plan, borrowers can pay anywhere between 4 and 25 percent of their income each month.

Certain repayment plans involve step-up payments. In these arrangements, borrowers pay a fixed amount for the first one to three years. After that time, the amount they must repay steadily increases every two years for the remaining life of the loan. If a borrower is never able to earn enough to pay off the loan fully, any principle left over is often forgiven after 25 years.

An option that has been available in recent years is an income-based repayment plan. These plans cap, or limit, the amount a borrower has to pay at ten percent of a students discretionary income. This cap applies to loans taken out after July 1, 2014. For students that took out loans prior to that date, the cap is increased to 15 percent of their discretionary income.

How To Negotiate Student Loan Payoff

If you believe that negotiating a student loan settlement is the best fit for your financial situation, follow these four steps:

You can compare private student loan refinance rates using Credible, and it wont affect your credit score.

Recommended Reading: Refinance Through Usaa