How Does Interest Work On An Fha Loan

FHA loans can be either fixed- or adjustable-rate loans.

- With fixed-rate loans, the rate doesnt go up or down based an index rate, so your mortgage payment is more stable and predictable throughout the life of the loan.

- Adjustable-rate mortgage loans, or ARMs, move along with a specific benchmark index interest rate, such as the London Interbank Offered Rate, or Libor, which is a rate used by some large banks to charge each other for short-term loans. That means the interest rate and monthly payment can adjust periodically.

Adjustable-rate loans may have lower initial rates than fixed-rate loans, but they can go up over time.

For example, an adjustable-rate loan may be structured as a 3-1 ARM. This would mean your interest rate would be fixed for the first three years and could change annually after the initial three-year period. The loan could be set up so its interest rate could increase by up to 1% each year, with a maximum increase of 5% over the life of the loan.

The length of your mortgage loan also affects the rate you pay. The Consumer Financial Protection Bureau has an online tool that lets you explore potential rates based on a number of factors, including where you live, loan type, down payment and loan term.

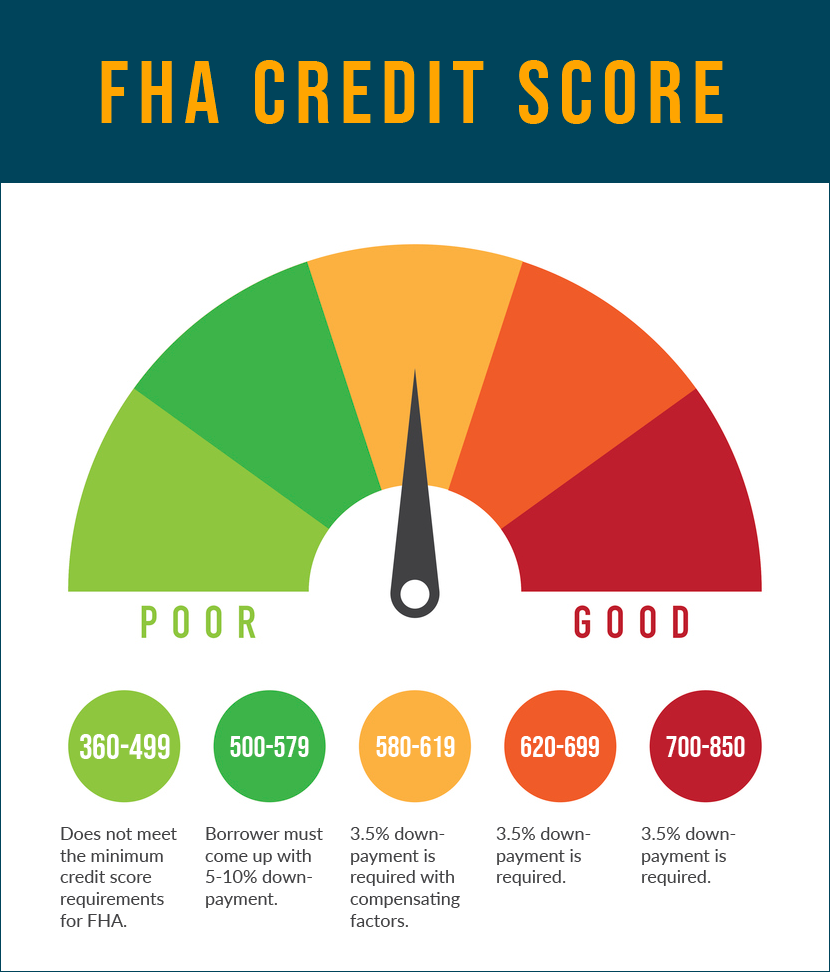

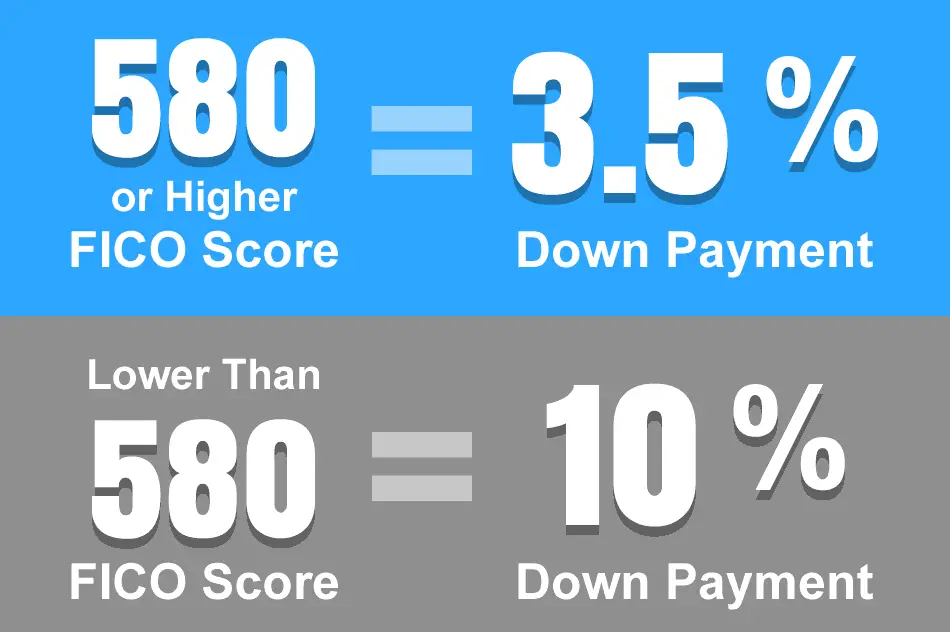

Understanding Federal Housing Administration Loans

In 2021, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of just 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lendera bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers who qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

Though FHA loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| For How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is an FHA Mortgage Still a Bargain?

Hud Wants To Increase Lending To ‘underserved’ Borrowers

A few years ago, HUD launched an initiative to get lenders to relax and lower some of their overlays, particularly where credit scores are concerned. It’s all part of their “Blueprint for Access” program. According to the program announcement:

“… the average credit score for loans sold to is 752. Currently, there are 13 million people with credit scores ranging from 580 to 680. Shutting these consumers out of the market hurts American families … FHA is committed to finding ways to responsibly increase access for underserved borrowers.”

The Department of Housing and Urban Development is currently revising their policies and procedures to reduce lender overlays. According to HUD, lenders often impose these overlays because they are fearful of “back-end enforcement actions” resulting from improper underwriting and loan origination. In other words, they are afraid of being penalized for making bad loans, and later having to repurchase those loans. So HUD and FHA officials are currently working with lenders to ease these fears and, by extension, reduce the overlays on FHA credit score requirements.

“We want to work with lenders to provide clarity and transparency in FHA’s policies

to encourage lending to qualified borrowers across the credit spectrum,” HUD officials stated. “Our initial efforts are paying off as some lenders are already beginning to reduce overlays.”

Don’t Miss: Fha Loan Limit Texas

Fha Loans For Bad Credit Or No Credit History

If youre applying for any kind of mortgage, including FHA, its a good idea to have at least two or three accounts open and reporting on your credit whether those are revolving accounts, like credit cards, or monthly loan payments. However, its possible to get an FHA loan with a bad or nonexistent traditional credit history. Before moving forward, there are some things you should know.

First, Rocket Mortgage requires that at least one client must have a median FICO® Score of 640 or better in order for another client on the loan to have no credit score. This means you cant apply a loan without credit, but your income can be used if youre applying with a spouse or other co-applicant.

These loans are manually underwritten. That means your mortgage process can take longer. To get an FHA loan with no credit history from Rocket Mortgage, you need to have a minimum of three nontraditional credit references.

Those references have to include at least one of the following:

- Utilities not reporting on the credit report

- Telephone service

The other two references may come from any of the following:

Finally, because you have no credit history, youll have to keep your DTI low. Rocket Mortgage requires a housing expense ratio no higher than 31% and a total DTI of less than or equal to 43%.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: Usaa Mortgage Credit Score Requirements

Nonqualified Mortgage : Minimum Credit Score 500580

The qualified mortgage rule, also known as the QM Rule, went into effect in 2014.

The federal government set the QM Rule to create safer loans by prohibiting or limiting certain highrisk mortgage products.

This rule is the reason most loans require a minimum credit score in the 600s as well as a down payment and/or private mortgage insurance.

But there are still some nonQM loans available that have more flexible rules.

When banks dont sell their mortgages to investors, theyre free to set their own criteria like lower minimum credit score requirements.

Thus, some nonQM loans can be found with credit scores as low as 500. But like with an FHA loan, youre much more likely to find a lender who will approve you with a FICO score of 580 or higher.

The downside is that nonQM loans usually have significantly higher rates than conforming mortgages. So if your credit score is a little too low for a mainstream home loan, it might be worth waiting to buy until you can raise your credit score and lower your borrowing costs.

If youre interested in a nonQM loan, check out the specialty mortgage programs some banks and credit unions offer that are neither conventional loans nor governmentbacked. Or, work with a mortgage broker who can recommend products from various lenders that might fit your needs.

How To Qualify For A Fha Loan At A Glance

FHA loans are guaranteed by the government, but the funding itself comes through FHA-approved lenders. That means youll still need to apply for your FHA loan directly through an approved lender just as you would for a conventional loan. The FHA has set these minimum qualifying guidelines for applicants:

-

A minimum down payment of 10% if your credit score is between 500-579 OR

-

A minimum down payment of 3.5% if your credit score is above 580

-

Evidence of steady income and proof of employment

-

MIP payments

-

A debt-to-income ratio of 43% or less

-

The home in question must be your primary residence

-

The property must meet FHA-specific appraisal requirements

-

FHA loan maximums apply to certain properties and locations

These minimum qualifying guidelines are a helpful framework for understanding the general parameters of FHA loans, but the exact requirements can vary from lender to lender. You may have trouble qualifying for an FHA loan if you have insufficient credit history, a track record of making late payments, outstanding debt, or any recent foreclosures or bankruptcies. Each lending institution ultimately has the final say when it comes to approving borrowers based on their unique evaluation criteria.

Recommended Reading: Usaa Rv Financing

Fha Credit Score Requirements Vs Conventional Mortgage Credit Standards

A conventional mortgage requires a minimum credit score of 620. That’s the short answer. However, this assumes the borrower has at least two months of mortgage payments in reserves, puts at least 25% down, and has a debt-to-income ratio of 36% or less.

According to Fannie Mae’s current underwriting standards, a borrower who wants to put just 5% down, doesn’t have much cash in reserves, and has a 36% DTI must have a 680 credit score. And depending on the borrower’s specific down payment, reserves, and DTI, minimum score requirements for a conventional mortgage range from 620-720.

Some specialized mortgage types, such as a VA loan or USDA loan, have credit standards somewhat more flexible than a conventional mortgage. But not every borrower can obtain them.

History Of The Fha Loan

Congress created the Federal Housing Administration in 1934 during the Great Depression. At that time, the housing industry was in trouble: Default and foreclosure rates had skyrocketed, loans were limited to 50% of a property’s market value, and mortgage termsincluding short repayment schedules coupled with balloon paymentswere difficult for many homebuyers to meet. As a result, the U.S. was primarily a nation of renters, and only one in 10 households owned their homes.

In order to stimulate the housing market, the government created the FHA. Federally insured loan programs that reduced lender risk made it easier for borrowers to qualify for home loans. The homeownership rate in the U.S. steadily climbed, reaching an all-time high of 69.2% in 2004, according to research from the Federal Reserve Bank of St. Louis. As of the second quarter of 2021, it was 65.4%.

Read Also: Www.lowermycarloan.com

How To Calculate Your Dti Ratio

There are two ways to calculate a DTI ratio. Most loan officers call one the front-end ratio and the other the back-end ratio. The FHA uses different terminology to express the same ideas. Your loan officer might use either set of terms to describe your DTI.

How does your DTI measure up? Use our quick and easy calculator to find out.

Conventional or conforming lenders call the typical maximum ratio the “28/36 rule.” For FHA loans, it’s the “31/43 rule.”

What Are The Requirements For An Fha Loan

Government backing and mortgage insurance mean FHA loans can have more relaxed borrowing criteria than conventional loans. Here are some of the requirements to keep in mind when preparing to apply for an FHA loan:

If you need assistance determining your eligibility for an FHA loan, find a HUD-approved housing counseling agency in your area. Their counselors can also help you navigate the application process.

Read Also: Prequalify Capital One Auto Loan

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

Don’t Miss: Usaa Rv Loan Calculator

Fha Loan Credit Issues

Your FHA lender will review your past credit performance while underwriting your loan. A good track record of timely payments will likely make you eligible for an FHA loan. The following list includes items that can negatively affect your loan eligibility:

- No Credit History If you don’t have an established credit history or don’t use traditional credit, your lender must obtain a non-traditional merged credit report or develop a credit history from other means.

- Bankruptcy Bankruptcy does not disqualify a borrower from obtaining an FHA-insured mortgage. For Chapter 7 bankruptcy, at least two years must have elapsed and the borrower has either re-established good credit or chosen not to incur new credit obligations.

- Late Payments It’s best to turn in your FHA loan application when you have a solid 12 months of on-time payments for all financial obligations.

- Foreclosure Past foreclosures are not necessarily a roadblock to a new FHA home loan, but it depends on the circumstances.

- Collections, Judgements, and Federal Debt In general, FHA loan rules require the lender to determine that judgments are resolved or paid off prior to or at closing.

What Are The Most Commonly Used Fico Scoring Models

As mentioned previously, there are many different FICO score versions and models, depending upon the type of creditor who uses them. This explains why free credit scores from online sources and apps may differ significantly from the credit scores a creditor or lender uses for a credit decision.

An understanding of which credit scores mortgage lenders use may influence your strategies during the homebuying process.

- The consumer credit scores you receive from free sites such as Credit Karma are based on VantageScore 3.0, which is a completely different credit scoring model than FICO.

- Auto lenders use FICO Auto Scores 2, 4, 5, 8 and 9

- Mortgage lenders use FICO Scores 2, 4 and 5.

Recommended Reading: Diy Loan Agreement

Fha Credit History Standards

Your credit score is just a three-digit number. Your credit history details your payments for each of your debt accounts.

Lenders look for red flags in your credit history that might indicate you will not repay the loan. Occasional, infrequent late payments on a credit card, for example, will not raise a concern if you can explain why they occurred.

Collections and late payments are evaluated on a case-by-case basis. Lenders may overlook occasional late payments on your cable bill or clothing store credit card. A serious delinquency in these types of accounts would reflect negatively on your credit score. However, lenders are more concerned about late payments on your rent or mortgage. Lenders see a history of late rent and mortgage payments as a sign you may default on future home loans.

If you defaulted on a federal student loan or have another unpaid federal debt, you will be required to come up to date and have the debt either paid off in full or be current for several months. Similarly, judgments against you must be paid. Sometimes credit issues are beyond your control. The FHA realizes this and creates programs that take into account how one’s credit history may not reflect that person’s true willingness to pay on a mortgage.

If you experienced a bankruptcy, short sale, foreclosure or a deed in lieu of foreclosure in the last two years, check out this foreclosure page to learn about your mortgage options.

Whats The Minimum Credit Score To Buy A House

Home buyers are often surprised by the range of low credit home loans available today.

Many lenders will issue governmentbacked FHA loans and VA loans to borrowers with credit scores as low as 580. Some even start at 500 for FHA .

With a credit score above 600, your options open up even more. Lowrate conventional mortgages require only a 620 score to qualify. And with a credit score of 680 or higher, you could apply for just about any home loan.

So the question isnt always, Can I qualify for a mortgage?, but rather, Which one is best for me?

Recommended Reading: Rv Loan Rates Usaa