How Many Years Can You Take Off Your Mortgage By Paying Extra

Adding Extra Each Month

Just paying an additional $100 per month towards the principal of the mortgage reduces the number of months of the payments. A 30 year mortgage can be reduced to about 24 years this represents a savings of 6 years!

What happens if I pay an extra $1000 a month on my mortgage? Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, it’d shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

What happens if you make 1 extra mortgage payment a year? 3. Make one extra mortgage payment each year. Making an extra mortgage payment each year could reduce the term of your loan significantly. For example, by paying $975 each month on a $900 mortgage payment, you’ll have paid the equivalent of an extra payment by the end of the year.

Increase Monthly Payments To Repay Your Loan Faster

Renting Vs Owning A Home

There are many advantages to owning a home versus renting. Among them is the fact that you gain equity with each payment as opposed to giving your money to a landlord and the ability to paint your living room with zebra stripes if you so desire.

However, theres a mathematical piece of this as well. You have to know how much you need for a down payment and whether owning a home will be cheaper or require you to pay more when looking at the monthly cost of homeownership.

In many cases, its better to get a mortgage because the rate can be fixed for the life of the loan. There are very few controls that can stop landlords from raising your rent every year if they want to. However, not every situation is the same.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: Usaa Car Loans Bad Credit

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

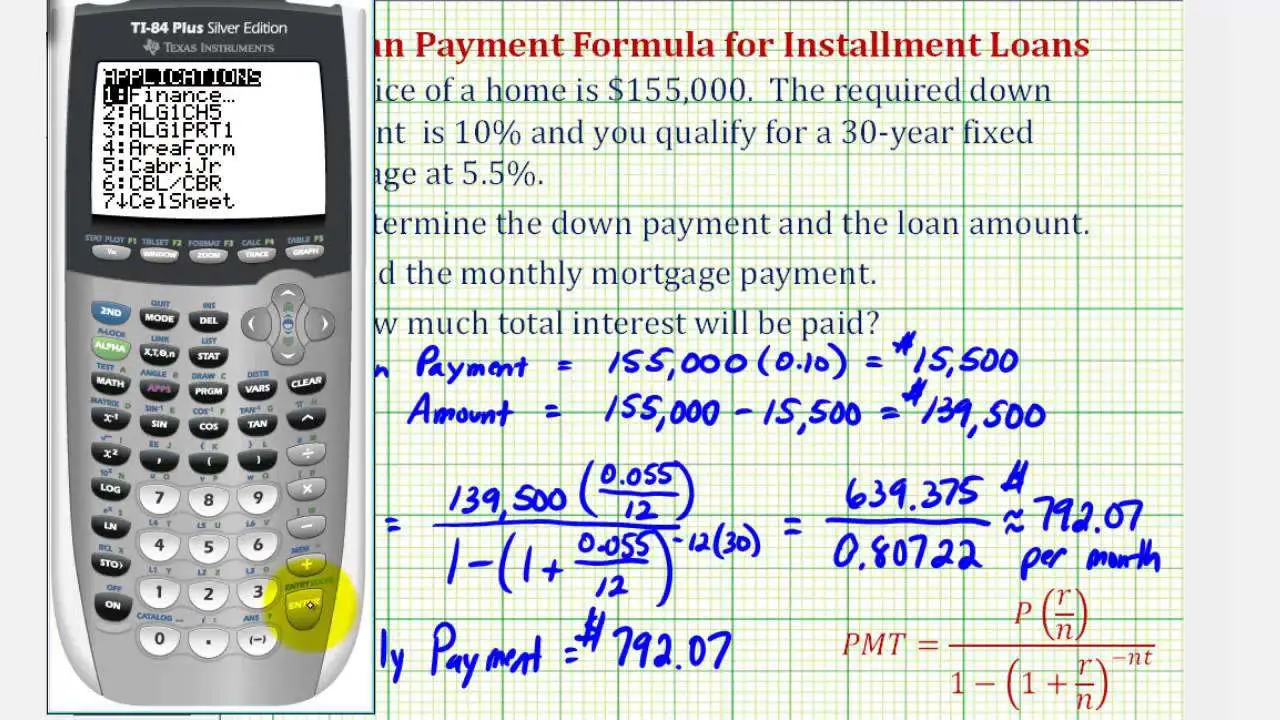

Using The Auto Loan Calculator

- This calculator uses your original loan amount, length of the loan and interest rate to calculate your current monthly payments. From there, enter the number of months left on the loan, then enter how much extra you’d like to pay each month to see how much sooner you’d pay it off.

You can adjust that figure using the slide bar to experiment with how varying the additional payment would affect how early you can pay off the loan and how much interest you’d save. Your results appear instantly at in the blue field at the top of the calculator and just below it at right as you adjust the extra payment figure.

- FAQ: Arm yourself with various scenarios that fit your budget goals

Start by entering the number of months remaining on your car loan, than enter the full length of the loan, in months. If you want to see the effect of making extra payments over the entire length of the loan, just enter the full length of the loan in both places. Next, enter the amount of the loan and the interest rate. The calculator will immediately display your regular monthly payment for the loan in the place indicated. Next, enter any additional amount you’d like to pay each month. The number of months you’ll shorten your loan by and your interest savings will appear at the top of the page.

Also Check: Diy Loan Agreement

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

Recommended Reading: Loaning Money To Your S-corp

How To Use Credit Karmas Debt Repayment Calculator

If youre trying to get out of debt, Credit Karmas debt repayment calculator can help you figure out how long it could take.

Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans, student loans or personal loans and how much youll need to pay each month, based on how much you owe and your interest rate. Youll also be able to see how much principal versus interest youll pay over the lifetime of the debt.

Of course, its important to keep in mind that these are only estimates based on the info you provide. This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan, but it doesnt consider other factors such as your cards annual fee , late-payment fees or any other fees you might incur. It also assumes you wont use the card to make any new purchases.

Here are some details on the information youll need to use this debt calculator.

Use The Early Mortgage Payoff Calculator To Determine The Actual Savings

- This calculator will illustrate the potential savings

- Of paying off your home loan ahead of schedule

- Knowing the actual numbers can help you determine if it makes sense

- To make extra payments based on your financial goals

For example, if youre interested in paying off your mortgage off in 15 years as opposed to 30, you generally need a monthly payment that is 1.5X your typical mortgage payment.

So if youre currently paying $1,000 per month in principal and interest payments, youd have to pay roughly $1,500 per month to cut your loan term in half. Of course, thats just a ballpark estimate. It will depend on the mortgage rate and the loan balance.

This early payoff calculator will also show you how much you can save in interest by making larger mortgage payments.

You might be surprised at the potential savings, but be sure to consider where youd put that money elsewhere. It might earn a better return in the stock market or someplace else.

You May Like: What Is Congress Mortgage Stimulus Program

Also Check: Is Usaa Good For Auto Loans

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

What You Should Know About Loan Payoffs

As I demonstrated with the loan examples above, loan payoffs are something of a trade-off between the monthly payment and the total cost of the loan. The lower the monthly payment you choose, the longer the loan term will be, and the more interest youll pay over the life of the loan. That will increase the total cost of the loan.

Youll need to decide whats more important a low monthly payment, or getting the loan paid off as soon as possible and saving money on the total cost.

Theres one other factor you should be aware of, especially when it comes to personal loans. Some personal loan lenders charge origination fees equal to between 1% and 6% of the amount you borrow. That means you may pay between $100 and $600 on a $10,000 loan.

But an origination fee shouldnt discourage you from considering a personal loan. For example, lets say you have $10,000 in with an average interest rate of 23%. That means youre paying $2,300 per year in interest.

You have an opportunity to get a personal loan at 12% over 60 months with a 6% origination fee. Even though youll pay $600 for the origination fee, youll still save hundreds of dollars compared to your current credit card debt.

And since the origination fee applies only when you accept the loan, the savings each year thereafter will be even higher. And equally important, the debt will be completely paid off in five years. Thats unlikely to happen with credit card debt.

Don’t Miss: Carmax Pre Approval Hard Pull

How To Pay Off A Loan Faster

The first rule of overpaying is to speak to the lender to ensure that any extra money you send comes off the principal debt, and not the interest. Paying off the principal is key to shortening a loan. Our Loan Payoff Calculator shows you how much you might save if you increased your monthly payments by 20%.

How To Pay Off A Car Loan Early Using A Lump Sum Calculator +

Dropping a huge sum on the principal balance is an excellent way to shorten the life of a car loan and cut spending on loan interest. You can use our auto loan early payment calculator to do this effectively. Crunching the numbers with this calculator will tell you exactly how much you’re saving in terms of time and money.

How fast can I pay off my car loan? +

This is up to you. There is no limit to how fast you can clear your car loan. The quicker you pay it off, the less you will pay in the long run. This is because you will accrue less cost in terms of interest. However, to create a realistic budget and financial plan, you need to use an auto loan early payment calculator to guide you.

When will my car be paid off? +

Judging by your current monthly payment and extra monthly payment, the time it will take to pay off the loan can be accurately computed using the auto loan early payment calculator.

How to determine the payoff amount on my car loan? +

You can use the auto loan early payment calculator backward to find out how much you’ll be spending to pay off the car loan within a specific period. In doing so, you will arrive at the payoff you will need to pay every month over the life of the loan. You can pay extra payments to save on the loan interest.

What about car loan amortization calculators with extra payments? +

Don’t Miss: Capital One Preapproved Auto Financing

Early Mortgage Payoff Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Current Loan Balance And Loan Payoff Amount Are Not The Same

The current balance on your monthly loan statement is not the same as the payoff amount, which is the amount necessary to completely satisfy the loan and close it out. The payoff amount will almost always be higher than your statement balance because of interest. Interest may accrue on a loan every day between the statement date and the time you intend to pay off the loan. The loan payoff figure will include this interest and any other fees allowed by the loan terms, such as a prepayment penalty.

Recommended Reading: Usaa New Car Loan Rates

What Happens When You Pay Off Auto Loan

An auto loan is an installment account, or one with a level payment every month. Once your auto loan is repaid, you could lose points on your credit score, especially if you dont have other installment accounts. Thats because a factor in your credit score is called credit mix, or types of credit accounts.

How An Early Payoff Works

Most auto loans are simple interest loans in which interest on the principal balance the amount your borrowed is calculated daily. Increased or additional payments go only toward this principal, so the loan is paid off more quickly and less interest is charged.

Some lenders, such as RoadLoans, offer loans with no prepayment penalties that allow borrowers to pay off the loan early, if they wish, and reap the full benefits. Once youve done your calculations, youll have a better idea of what you want to do.

Recommended Reading: Usaa Student Loan Rates

About The Mortgage Payoff Calculator

The calculator has four main sections. First, the top section where you enter the information about your loan and the additional amount youd like to pay each month. Below that is a short summary showing your new monthly payments and comparative savings. Further down is a chart comparing the trends in your mortgage balance and interest payments over time with both your regular and additional payments.

At the top, theres a green box labeled See Report. Clicking that will display a detailed amortization schedule showing exactly what your total payments, loan balances and accumulated interest payments will be over the life of the loan, on either a month-by-month or year-by-year.

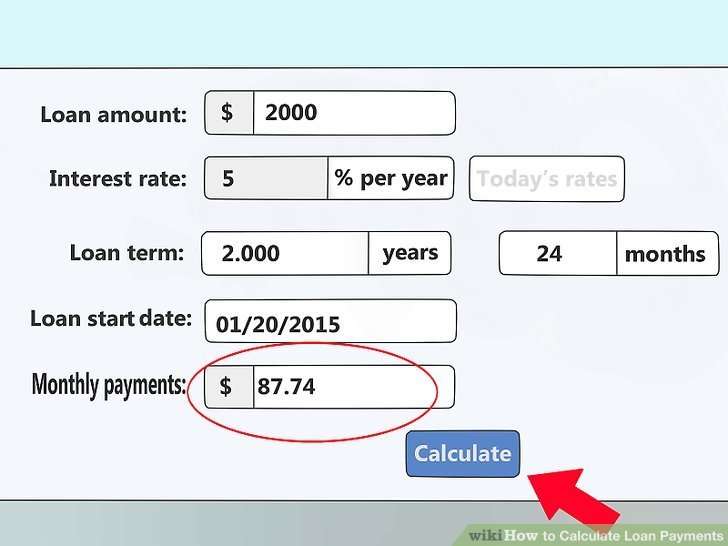

Calculate By Loan Term

This option will help you to determine how long it will take to pay off your loan, based on the loan amount, the interest rate, and the proposed term of the loan. If youre simply playing around with different numbers, you can adjust the length of the loan term to determine a payment level thats acceptable to you.

But this option will also give you another important piece of information you need to know, and thats the amount of interest youll pay over the length of the loan. The longer the term, the higher the total interest paid will be. In that way, youll be able to make an intelligent decision about both the monthly payment and the total interest cost of the loan.

When you select this option, youll be asked two additional questions:

- Loan term ranging from 12 to 84 months.

- Extra monthly payment enter any additional principal you plan to add to your monthly payment, but leave it blank if you only intend to make occasional additional payments.

For demonstration purposes, enter 60 months for the loan term. Then hit the black Calculate button.

The loan payoff calculator will display two results:

- Your estimated monthly payment will be $198.01.

- Interest paid $1,880.60, which is the total amount of interest youll pay over the 60-month term of the loan.

Don’t Miss: Fha Build On Own Land