What Does Parent Plus Loan Repayment Look Like

This is the part they dont tell you about on campus visits or in glossy college catalogsyou have to pay back whatever you borrow, and then some! Millions of people every year go to college, forgetting theres a high price to pay since there are no immediate bills coming in.

And while students with private loans can live in that bubble as long as theyre in school, the same doesnt hold for people with Parent PLUS Loans. The repayment schedule begins as soon as the college receives the money. Its as punctual as a credit card bill.

As with any debt, you should pay off a Parent PLUS Loan as fast as you can. And the best way to do that is to put it on a list with all of your other debts, and focus all extra money on the smallest amount firsteven if thats not your PLUS Loan. Everything else gets the monthly minimum until youve eliminated that first debt. Then you roll what youd been paying on that one to the next smallest.

Here are the options for PLUS payback:

If youre already in a Parent PLUS Loan, there is one solid approach we would recommend for some people, and thats refinancing. But its only a good option if your loans are delaying other goals . Refinancing will help you pay off your student loans faster by getting you into a shorter term, with a better fixed-interest rate. That means you can focus on becoming debt-free and attacking your next financial goals.

*plus Loan Award Year

On Section 2 of the loan application, you must select the appropriate Award Year that corresponds with the loan period for which you are applying. If the Award Year does not correspond to the appropriate Loan Period dates, your loan will not be awarded.

2019-2020 loan award year periods| Loan Period |

|---|

| Loan Period |

|---|

What To Do Before You Take A Plus Loan

Many times, a school will present the student’s financial aid package with a Direct PLUS Loan added in. The school might say that it wants to make families aware of all of their available funding options, but including the Direct PLUS Loan in the package can make the true cost of college confusing. When considering the costs of college, ask for a financial aid package breakdown without the PLUS loan.

Instead of a Direct PLUS Loan, you might have your child opt for a private student loan for any leftover costs that grants, work-study, federal student loans, scholarships, and other aid do not cover. If you want to help your child financially, you can make payments on the private loan while they are still in school. This allows you to subsidize your childs college costs but doesn’t hold you solely accountable for the debt.

You may be able to refinance your PLUS loan to lower your interest rate or spread payments over a longer period.

You May Like: Loan Originator License California

Parent Plus Loan Eligibility

Parent PLUS Loans are available only to the parents of dependent undergraduate students. The parents of independent undergraduate students are not eligible for the Parent PLUS Loan.

If a dependent students parents are divorced, both parents can take out separate Parent PLUS Loans with separate Master Promissory Notes . But the combined Parent PLUS Loans cannot exceed your students cost of attendance minus other financial aid received.

Calculate How Much Much You Want To Borrow

You can borrow the total amount of attendance costs for your child, minus any financial assistance or scholarships received. This includes tuition, fees, room and board, books, supplies, transportation and loan fees. Miscellaneous expenses, including a personal computer, child care, study abroad costs and disability-related expenses, may be eligible as well. The total amount varies by school.

Note that you can always borrow more in the future if you need. Do your best to only borrow what you need.

You May Like: How To Find Student Loan Number

Consider All Your Funding Options

The lack of a credit score requirement and guaranteed loan amount makes parent PLUS loans a good fit for some parents who want to help pay for a child’s college expenses, but it might not be the best option for everyone. For example, sometimes having a child borrow more in federal student loans and then making payments on their behalf may make more sense in your situation. Or, if you have good credit, you may find private student loans offer a better rate than federal parent PLUS loans, but remember that private loans usually don’t offer the same types of benefits federal loans do. Additionally, you should encourage your child to apply for scholarships and grants every school year to limit how much both of you might need to borrow.

Parent Plus Loans: A Quick Review

We have shown two of the major problems with Parent PLUS Loans, and really its a Catch 22. When parents dont meet Parent PLUS Loan eligibility requirements and are denied, their children suffer by taking on more debt, usually with bad terms.

Parents who do meet Parent PLUS Loan eligibility need to be very careful about taking on too much debt. While the PLUS loan has no limit, parents should not abuse this perk.

Luckily, if parents are struggling to pay back PLUS Loans, a student loan counselor can help explain their repayment options. Sign up for today for more assistance.

Thomas Bright is a longstanding Clearpoint blogger and student loan repayment aficionado who hopes that his writing can simplify complex subjects. When hes not writing, youll find him hiking, running or reading philosophy. You can follow him on .

Don’t Miss: How Do I Refinance An Auto Loan

How To Make Parent Plus Loans Affordable

If you took out loans to help fund your childs education, such as Parent PLUS Loans from the federal government, youre eventually going to have to start paying them back.

Parent PLUS loans cant be transferred to your child even once they graduate and get a steady job so youre the one whos on the hook for paying them off in full. That prospect can be daunting since this may be your largest chunk of debt outside of a mortgage.

But you have lots of options for temporarily putting off payments on Parent PLUS Loans or making them affordable. The choices can get overwhelming, so heres a guide to help you figure out which plan is right for you.

Parent Plus Loan Denied

Parent PLUS loans are easy to get if you have had a good credit history, but if there are a few bumps in your financial road, your request can be denied.

Then what? Try using one of the detours.

The easiest way out of trouble is to find someone with good credit who will co-sign the loan. Its also the hardest thing to ask because that person has to assume responsibility for paying back the money if you stumble financially.

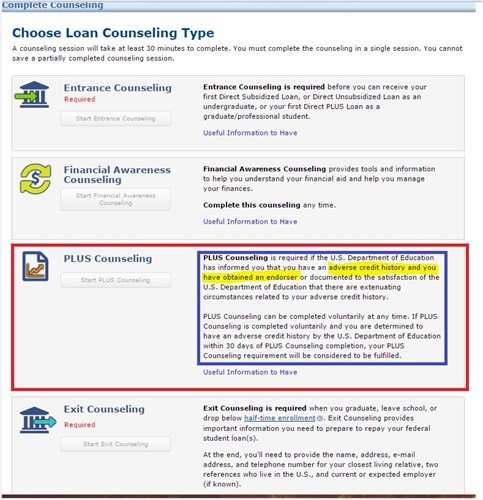

To include a co-signer, the applicant needs to complete the Electronic Endorsement Addendum section of the loan application. In addition, the parent must complete PLUS credit counseling and sign a PLUS master promissory note.

You also can appeal the rejection, a step that involves providing documentation of an extenuating circumstances that led to the denial. In addition to filing the appeal, the parent or parents need to complete PLUS credit counseling.

Its possible only one parent has a bad credit rating, in which case, the other parent could apply solo for the loan.

Finally, the student whose parents were rejected can apply for a Federal Direct Unsubsidized Stafford Loan. Under that plan, the student can borrow $4,000 to $5,000 annually, and up to $26,500 in pursuit of a degree. These are the same limits available to independent students.

7 Minute Read

Read Also: Becu Car Repossession

Fill Out A Fafsa And Review Your Student Aid Award

First, fill out a Free Application for Federal Student Aid with your child. The Federal Student Aid office uses the information from this packet to determine your need and eligibility for financial assistance to pay for college.

To complete a FAFSA, you and your child first need to create FSA IDs. Make sure you remember your FSA ID youll need it when you submit your parent PLUS loan application.

Once you submit the FAFSA and it has been processed, your child will receive a financial aid award summary. It should list all financial aid the Department of Education has approved for your child, so see if parent PLUS loans are listed.

Eligibility Criteria For A Parent Plus Loan

First, its good to know the qualification criteria to understand potential reasons why your loan request was denied.

In order to be eligible for a Parent PLUS loan, youll need to meet the following eligibility requirements:

- You must be the biological or adoptive parent of the student.

- Stepparents are eligible to borrow a Parent PLUS Loan while they are married to the students custodial parent.

- Your student must be a dependent undergraduate student enrolled at least half-time in a college that is eligible for Title IV federal student aid and participates in the Direct Loan program.

- You cannot have an adverse credit history, though there are some exceptions for extenuating circumstances.

- You and your child must be U.S. citizens or eligible non-citizens, not be in default on federal loans, and must meet other general eligibility requirements.

If you fail to meet any of these criteria, you might find that your loan application is denied. If thats the case, there are some options you should consider.

Also Check: Does Va Loan Work For Manufactured Homes

Parent Plus Loan Eligibility Denials And Limits

Many parents want to help fund their childs college education. One common way to do this is through the Federal Parent PLUS Loan. Like with other student loans, the Parent PLUS Loan offers advantages to private student loans, including safer repayment terms and the option to enroll in repayment programs. As the name suggests, this loan goes to the parent of a dependent college student and limits how much debt the student will have to take on. But, parents with bad credit may not qualify. Parents should be aware of Parent PLUS Loan eligibility requirements, because a denial can impact their childs ability to finish college and can create more debt for the child. Parents and students also need to evaluate the cost of higher education carefully, because PLUS Loan amounts can be dangerously high at some schools.

The Basics Of Plus Loans

To be eligible for a Parent PLUS loan, your child must be enrolled at a qualifying school and take at least a half-time course load. You and your child must also meet the basic eligibility criteria, such as demonstrating financial need and being a U.S. citizen or eligible noncitizen.

Youll also have to fill out and submit the Free Application for Federal Student Aid, or FAFSA, which you can now fill out and submit as early as October 1.

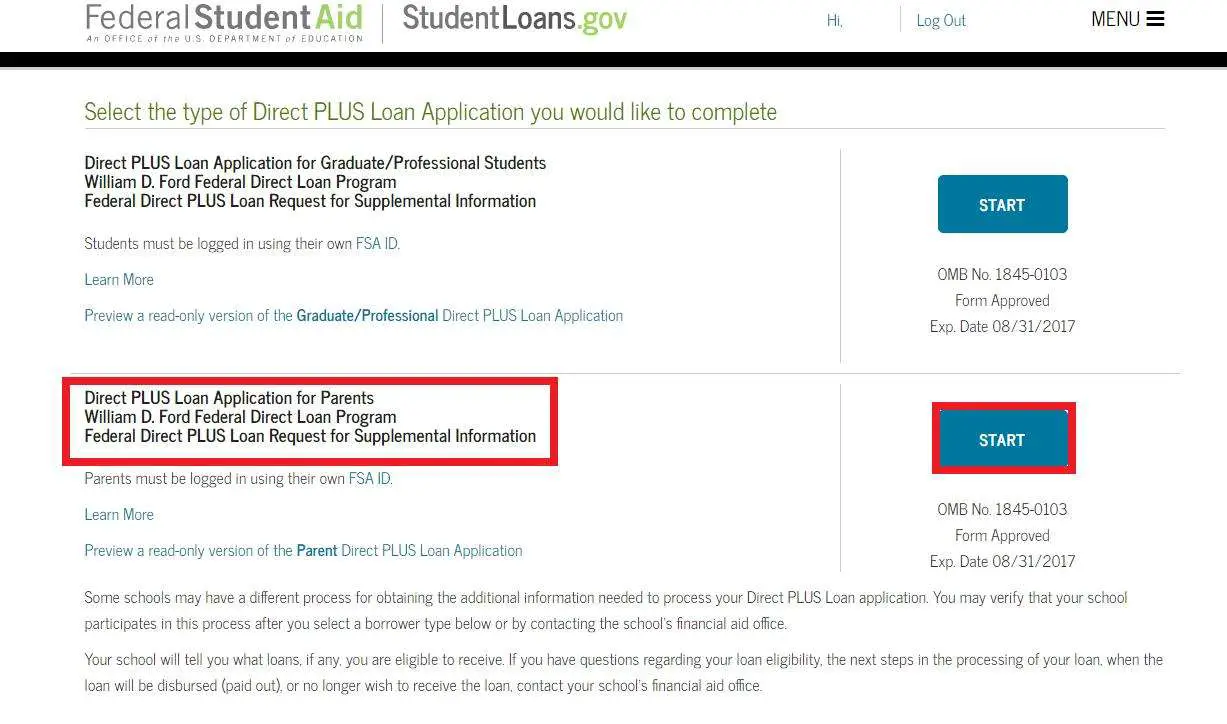

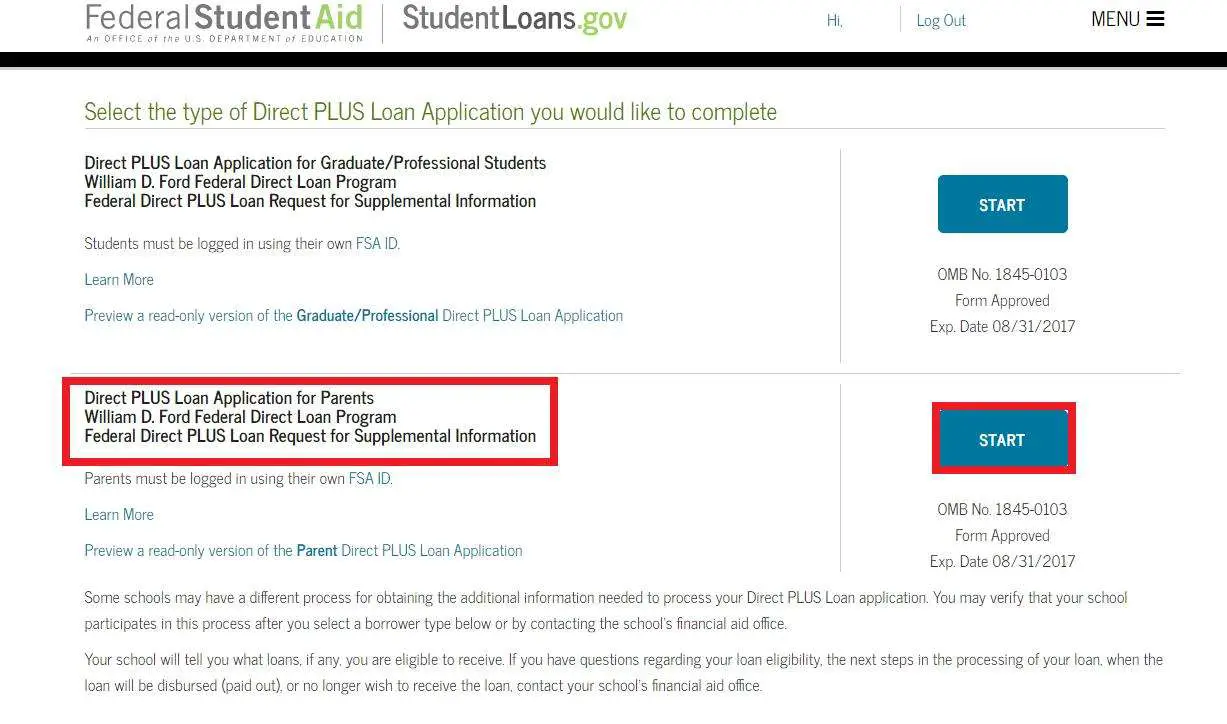

Schools have different application processes for Parent PLUS loans. Youll either be able to request the loan from StudentLoans.gov, or you may have to check with the schools financial aid office for information on their process.

As with private student loans, Parent PLUS loans require a credit check. Your application might be denied if you have an adverse credit history as defined by the Department of Education. For example, you cant have charged-off accounts, accounts in collections or a 90-plus-day delinquent account with a combined balance of $2,085 or more.

You may be able to appeal the denial if your negative credit history is based on extenuating circumstances and you complete PLUS .

You could also get approved if you have an endorser who doesnt have an adverse credit history and youve completed PLUS credit counseling. The endorser takes a similar role to that of a cosigner and will be responsible for repaying the loan if the borrower doesnt.

Don’t Miss: How To Get Pmi Off Fha Loan

Choices To Make Before Applying:

- Amount to request

- Loan period: We suggest borrowing for the full academic year .

- Designate whether the school pays any credit balance to the student or to the parent.

- Request a deferment while the student is in school or begin repaying 60 days after disbursement.

- Request an additional deferment for 6 months after the student ceases to be enrolled at least half time.

Students can determine the amount for which their parents may be eligible by accessingMyFIT. The student logs in using their FIT ID and password, then click on:

- Go to FIT Applicant or Student TAB

- Under Financial Aid Resources go to My Financial Aid Checklist

- Click on Award by Aid Year on the drop down choose the Academic Year

- SELECT the appropriate Academic Year. Click on the Award Overview Tab – you will see your total Cost of Attendance

NOTE: You will not receive the full amount requested due to a loan origination fee of 4.228% which is charged by the Department of Education.

Grad Plus Loan Repayment Options

The rules on Grad Plus loan repayment treat the borrower for what he/she is, namely a student who likely is just entering the workplace and needs some time to get their financial feet on the ground.

For that reason, Grad PLUS borrowers dont have to start repayment until six months after they graduate, leave school or drop below half-time status.

They have access to all the same repayment programs as Parent PLUS borrowers Standard, Extended, Graduate, Income Contingent and Consolidated and a few more. Grad PLUS borrowers can use the Consolidation Loan plan to get access to Income-Based, Pay As You Earn and Revised Pay As You Earn repayment plans.

Also Check: How Much To Loan Officers Make

When Do I Begin Repaying My Plus Loan

Repayment of the Parent loan begins within 60 days of the full disbursement of the loan. For a full year loan repayment will generally begin sometime in February. Information about repayment terms and timing will be provided to you by your federal loan servicer. Repayments are made directly to the loan servicer. Borrowers generally have from 10 to 25 years to repay the Parent PLUS Loan. To calculate estimated loan payments, use the Direct Loan Repayment Calculator. Additional information is also available on the Federal Student Aid website under Repayment.

What Are The Eligibility Requirements For A Plus Loan

Plus loan applicants and the student must meet general eligibility requirements for federal student aid.

To qualify, the parent’s child/student must be enrolled full or at least half-time at an eligible school and the parent must meet the credit criteria. The Direct Parent/Plus loan is a loan that a parent takes out on behalf of their child/dependent student. The loan is in a parent’s name and usually requires the applicant to be credit-worthy. A cosigner may be required.

Services are also available online at Direct Lending. They can also be reached by phone at 1-800-557-7394.

Important: If for whatever reason a Direct Parent/Plus loan is denied, the student should contact his/her college financial aid office for additional information and instructions.

Also Check: How To Get An Aer Loan

Breaking Down Parent Plus Loans When More Than One Child Is In College

I am applying for two Parent PLUS loans because I have twins goingto school at the same time. Is it possible one loan will be deniedbecause we are applying for two at the same time? What can I do ifone of the applications is denied? We have good credit 730 and 780for each of us. Michelle L.

Parent Plus Loan Fees

Loan disbursement and default fees are effectively a form of up-front interest. Assuming a 10-year repayment term, a 4% fee is the equivalent of an increase in the interest rate of about seven-eighths to one percentage point. Assuming a 30-year repayment term, a 4% fee is the equivalent of an increase in the interest rate of about one-third to half a percentage point.

The relative impact of a fee is greater with a shorter repayment term or if the borrower prepays the loan, since the fee will be amortized over less time. This is why borrowers who plan to pay off a loan early may wish to avoid up-front fees, if possible.

History of fees on PLUS loans| Year |

|---|

| 4.292% |

Don’t Miss: Aer Loan Balance

Should You Get Parent Plus Loans

Parent PLUS loans can help some families pay for college, but they wont be right for everyone. First, consider whether you should borrow for your childs education at all.

Consider how adding new student loan payments will affect your finances. If theyd stretch your budget too thin or detract from other important financial goals like retirement, that might be a sign that its wise to reconsider.

If you can afford this new debt, also investigate alternatives to parent PLUS loans. Max out other , such as scholarships, savings, and lower-cost undergraduate federal loans, first.

Private student loans might be a better fit for some borrowers, too. Parents who dont want to shoulder this debt alone, for example, could co-sign a private student loan with their childmaking both family members legally responsible for this debt.

How Are Loan Proceeds Paid

Loan proceeds are applied by the Coe College Office of Financial Aid directly to the student account, provided that all administrative requirements have been met. A loan for two terms will be divided in half. We will send an email to the address you provide on the Parent Loan application to let you know that the loan is approved and the final loan amount. Please review this email and contact our office with any questions.

Read Also: How Do I Find Out My Auto Loan Account Number