Federal Employee Loan Programs And Legislation

The federal government offers a variety of loan programs and legislation to help employees finance their education. The most popular loan program is the Federal Stafford Loan. This program is available to undergraduate and graduate students, and it offers low interest rates and generous loan limits.

The Federal Perkins Loan is another popular loan program. This program is for students who demonstrate exceptional financial need. Perkins loans offer low interest rates and generous loan limits.

The government also offers a number of legislation programs to help employees finance their education. The Higher Education Act of 1965, for example, provides grants, scholarships, and work-study programs to students.

The U.S. government offers a number of loan programs for federal employees. These loans are designed to help federal employees meet their various financial needs, including home mortgages, education expenses, and other personal expenses.

In order to be eligible for a federal employee loan, you must meet certain eligibility requirements. You must be a U.S. citizen or permanent resident, and you must be employed by the federal government in a full-time or part-time position. You must also have good credit and meet other credit requirements.

Why Is A Review Important

We verify these calculations so that your employees or their beneficiaries will receive the proper:

- CPP benefits if the employees retire, become disabled, or die

- EI benefits if the employees become unemployed, take maternity, parental, adoption, or compassionate care leave, leave to care for or support their critically ill or injured child, or are injured, ill, or on leave without pay

How Can I Get Free Money From The Government

The idea that the federal government has so much money that it hands it out for free is part myth and part fact. The myth is that anyone can apply for and receive a cash grant from the government that they dont need to pay back. Thats false.

The fact is the federal government does not offer free money or grants to individuals. Offers and statements to the contrary usually mean someone is trying to sell you something, or is an outright scam. The confusion often stems from us hearing or reading about government grant programs designed to help stimulate the economy in certain regions or sectors.

Programs of this type are almost always aimed at entities like state and local governments or agencies that spend the grant money on public projects. Grants are also available for researchers and nonprofits, but even these are limited.

The best way to learn about government grants and eligibility requirements is to check out the official Grants.gov website. There youll find information about government grant policies, the agencies offering grants, their eligibility and qualification requirements, and how to recognize grant scams.

As Americans, we trust our government to spend our tax dollars wisely. The federal programs that administer loans, grants, emergency relief, and other socially-minded programs are there to benefit all of us when and if we need it. But free money to individuals would hardly serve the greater good.

Donât Miss: Can I Sue The United States Government

Also Check: Who Can Qualify For An Fha Loan

Ei Premium Rate And Maximum

You have to deduct EI premiums from your employees insurable earnings. As an employer, you must contribute 1.4 times* the amount of the EI premiums that you deduct from your employees remuneration.

Each year, we determine both of the following:

- the maximum annual insurable earnings from which you deduct EI

- a premium rate that you use to calculate the amount to deduct from your employees .

Note

Different EI rates apply for employees working in Quebec because of the Quebec Parental Insurance Plan . See Employment in Quebec.

Example

$273.70

$469.20

You stop deducting EI premiums when the employees annual earnings reach the maximum insurable earnings or the maximum employee premium for the year .

The annual maximum for insurable earnings applies to each job the employee holds with different employers . If an employee leaves one employer during the year to start work with another employer, the new employer also has to deduct EI premiums without taking into account what the previous employer paid. This is the case even if the employee has paid the maximum premium amount during the previous employment. If your business went through a restructure or reorganization, see If you change your legal status, restructure or reorganize.

The employees EI premium rate for the next year can be found in the Payroll Deductions Tables, which are usually available in mid-December at Payroll.

Notes

Example

Hassans maximum premium is calculated as follows:

Total insurable earnings

$759.56

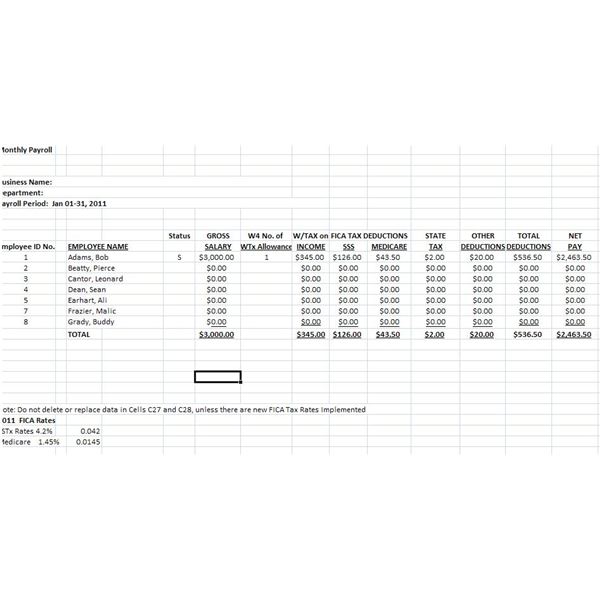

Appendix 2 Calculation Of Cpp Contributions

You can use this calculation to determine the CPP contributions you should deduct for your employee for a single pay period. To determine the CPP contributions for multiple pay periods, or to verify the annual contribution at years end, use Appendix 3.

Note

Before using this calculation, read Starting and stopping CPP deductions.

Step 1 Calculate the employees pensionable earnings for the pay period.

Enter the employees gross pay for the period…………………………………………………………………… $ 1

Enter any taxable benefits and allowances for the period……………………………………………………. $ 2

Line 1 plus line 2…………………………………………………………………………………………………………… $ 3

Enter any income from Employment, benefits, and payments from which you do not deductCPP contributions, described in Chapter 2 of this guide……………………………………………………… $ 4

Pensionable earnings …………………………………………………………………….. $ 5

Step 2 Enter the basic exemption for the pay period. Use the table below, or the following equation:

Annual basic exemption divided by the number of pay periods in the year.. $ 6

Step 3 Line 5 minus line 6…………………………………………………………………………………………… $ 7

For more information, go to E-services for Businesses.

Read Also: How To Find My Mortgage Loan Servicer

Chapter 4 Pensionable And Insurable Earnings Review

Each year, we check the calculations you made on the T4 slips that you filed with your T4 Summary. We do this to make sure the pensionable and insurable earnings you reported correspond to the deductions you withheld and remitted.

We check the calculations by matching the pensionable and insurable earnings you reported with the required Canada Pension Plan contributions or employment insurance premiums shown in the Guide T4032, Payroll Deductions Tables. We then compare these required amounts with the CPP contributions and EI premiums reported on the T4 slips.

If there is a deficiency between the CPP contributions or EI premiums required and those you reported, we print the figures on a PIER listing. If you file electronically and report an employee number on your T4 slips, we will display the employee number on the PIER listing.

We will send you the listing showing the name of the affected employees and the figures we used in the calculations. We will also include a PIER summary that shows any balance due.

What Can I Use A Payroll Deduction Loan For

Payroll deduction loans can be used for practically anything.

How is this relevant? Even an unplanned expense as little as $400 is enough to create financial hardship for many families. Nearly half of Americans lack an emergency fund large enough to cover at least three months of expenses.

According to research, around thirty-two percent of payroll deduction loan borrowers use the loans to pay for unplanned expenses or to bridge temporary budgetary or income shortfalls, while nine percent use them for large significant purchases.

If borrowers face income shortfalls regularly, using a payroll deduction loan can only help so much. Its critical to work on finding longer-term solutions to help enhance your financial security, such as finding ways to increase your income, reduce debt, or save and invest more of your money.

Recommended Reading: How Do You Qualify For First Time Home Buyer Loan

Expect The Standard Bank To Take Advantage Of Sources Which Can Be Alternative Present Focus On Profits And Affordability Instead Of A Credit Check

The automatic deduction from your paycheck makes finance institutions comfortable approving prospects without having a credit check that is conventional. Consider it as being a tiebreaker that is significant those people who have a repayment history that is negative.

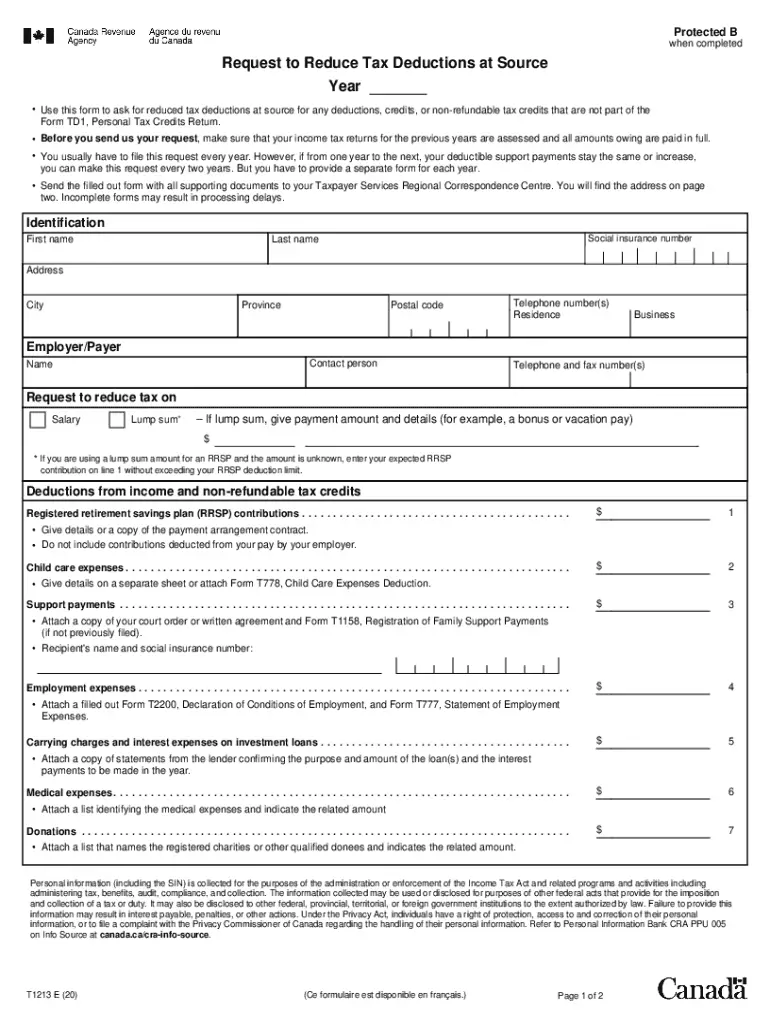

Form Td1x Statement Of Commission Income And Expenses For Payroll Tax Deductions

Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out this form in addition to Form TD1. They can estimate their income and expenses by using one of the following two figures:

- their previous years figures, if they were paid by commission in that year

- the current years estimated figures

Employees who choose to fill out Form TD1X have to give you the form by one of the following dates:

- on or before January 31 if they worked for you last year

- within one month of the date their employment starts

- within one month of the date their personal tax credits have changed

- within one month of the date any change occurs that will substantially change the estimated remuneration or expenses previously reported

Note

There is only one Form TD1X for federal, provincial, and territorial tax purposes. For an employee in Quebec, see Employment in Quebec.

Tax deductions from commission remuneration

If an employee is paid on commission or receives a salary plus commission, you can deduct tax in one of the following ways:

Employees who earn commissions without expenses

Employees who earn commissions with expenses

To calculate the amount of tax to deduct, you can use the Payroll Deductions Online Calculator , the Payroll Deductions Formulas , or the manual calculation method found in Section A of the Payroll Deductions Tables .

Note

Don’t Miss: Do Pawn Shops Loan Money

Trueconnect: An Alternative To Allotment Loans

TrueConnect is aware of the need for a responsible lending approach for federal government employees. Its also important that employees have a better understanding of their loan options and help with making financial decisions in the future. This can help them avoid predatory lenders.

TrueConnect is partnering with cities, counties, schools and other government employers to offer an alternate solution to traditional allotment loans. Because TrueConnects employee loan programs are offered by employers as a benefit, employees are protected against the hazards of taking loans from predatory lenders. Employees wont borrow more money than they can pay back, the terms of the loan are fair, employees can receive financial counseling, and their repayments are reported to credit agencies, which can help them improve their credit scores. TrueConnect can help ensure that your employees feel confident that they are getting the help they need to pay their debt.

Recommended Reading: Government Lifeline Cell Phone Program

Lenders Or Lending Partners Disclosure Of Terms

The lenders and lending partners you are connected to will provide documents that contain all fees and rate information pertaining to the loan being offered, including any potential fees for late-payments and the rules under which you may be allowed to refinance, renew or rollover your loan. Loan fees and interest rates are determined solely by the lender or lending partner based on the lenders or lending partners internal policies, underwriting criteria and applicable law. AnyDayCash.com has no knowledge of or control over the loan terms offered by a lender and lending partner. You are urged to read and understand the terms of any loan offered by any lenders and lending partners and to reject any particular loan offer that you cannot afford to repay or that includes terms that are not acceptable to you.

Recommended Reading: When Do You Repay Student Loan

Barbers And Hairdressers Taxi Drivers And Drivers Of Other Passenger

If these workers are your employees, you have to deduct Canada Pension Plan contributions, employment insurance premiums, and income tax as you would for regular employees.

When the workers have an interruption in earnings, you generally have five calendar days after the end of the pay period in which an employees interruption of earnings occurs to issue an electronic Record of Employment .

Note

A different deadline may apply if you file the ROE on paper.

If these workers are not your employees, the following special rules apply and you have to report the gross earnings of barbers and hairdressers, taxi drivers, and drivers of other passenger-carrying vehicles on their T4 slip. For reporting instructions, see Guide RC4120, Employers Guide Filing the T4 Slip and Summary.

Barbers and hairdressers

This class of workers is restricted to barbers or hairdressers who provide their services in an establishment that offers barbering and hairdressing services.

CPP contributions and income tax

For CPP and income tax purposes, we consider individuals who are not employed under a contract of service to be self-employed. They are responsible for paying their CPP contributions and income tax when they file their income tax and benefit returns. Do not deduct CPP or income tax from these workers.

EI premiums

There are two ways to determine the insurable earnings for a week, depending on whether you know the workers actual weekly earnings and expenses:

CPP contributions and income tax

Payroll Allotment & Installment Loans For Federal Employees

Federal government employees have multiple ways to quickly borrow money to help with emergency expenses or accelerate meaningful purchases.

Installment contracts such as personal loans and auto financing feature uniform monthly payments over a pre-defined period and appeal to people with reasonable borrowing credentials because the terms are often more affordable.

Payroll allotment loans are also installment contracts and appeal to individuals with bad credit histories. These lenders often approve applicants without pulling a copy of their consumer report or considering their low FICO score.

Also Check: Will Bankruptcy Clear Car Loan

Can A Federal Employee Apply For A Payday Loan

The number one requirement in applying for a payday loan is to be employed. Cash advances like payday loans allow you to borrow a small amount of money instantly in case of emergencies. This loan must be paid on your next paycheck and will be electronically debited from your account.

Lending companies highly prioritize applicants that are government employees. For lenders, approving a loan to a federal employee is much safer than other employees due to the career stability and larger income. If you are a federal employee, you shouldnt worry if you have a bad or good credit history. Your employment background is enough to apply and get approval.

A payday loan is an unsecured loan, and you can borrow money without providing collateral. Lending companies will not ask why federal employees need the money. Lenders also prefer federal employees as applicants because the repayment is guaranteed as long as you are employed by the federal government.

Canada Recovery Hiring Program

Budget 2021 introduced the Canada Recovery Hiring Program . The CRHP is an alternative to the Canada Emergency Wage Subsidy , and will be available for qualifying periods from June 6 to November 20, 2021. Eligible employers will be permitted to claim the higher of the CRHP and the CEWS. For more information, go to Canada Recovery Hiring Program .

Don’t Miss: Do Loan Companies Verify Bank Statements

It Is Possible To Apply For An Installment Loan Just In Case You Want To Borrow In A More Substantial Sum Of Money Which You Can Use For A Period That Is Certain Of And Certainly Will Repay In A Small Amount What Things To Find Out About Allotment Loans For Federal Workers Official Certification Is Truly Easier For Authorities Employees Compared To Those In Individual Companies

They are able to tide you over until your cash tend to be more stable. There are two main forms of allotment loans, and are generally speaking possible for federal government employees to utilize for. This kind of allotment loan resembles the discretionary loan in that you could have a lot of your paycheck designated towards the intent behind the borrowers option, except in this instance, the allotment can maybe not begin and end whenever you want. Loans for federal workers can protect any quantity a debtor calls for, as an example, from $200 to $5000.

Read Also: Government Contracts For Disabled Veterans

Working For The Federal Government What Every Employee Should Know

If you have never worked for the Federal Government, it is important that you take a few minutes and read this information. If you have worked for the Federal Government and have been away for a while or are a current Federal employee, you should also review this information because a number of rules and procedures have changed. A word of advice – there are many things you will learn throughout your employment in the Federal workforce. Pay close attention, save all your paperwork, learn where to go and get answers, and never assume anything is the same from day to day. Please keep this booklet as a handy reference. Should you have any questions or concerns, please call the Office of Human Resources Management on 301-504-7925.

You May Like: What Are Current Mortgage Loan Interest Rates

Employees Of A Temporary

You may be the proprietor of a temporary-help service firm. Temporary-help service firms are service contractors who provide their employees to clients for assignments. The assignments may be temporary, depending on the clients needs.

Workers of these firms are usually employees of the firms. As a result, you have to deduct CPP contributions, EI premiums, and income tax from the amounts you pay them. You also have to remit these deductions and report the income and the deductions on a T4 slip.

If you or a person working for you is not sure of the workers employment status, either one of you can request a ruling to determine the status. If you are a business owner, you can use the Request a CPP/EI ruling service in My Business Account. For more information, go to My Business Account.

A worker can ask for a ruling by using the My Account service, at My Account for Individuals and selecting Submit documents and then You may be able to submit documents without a case or reference number.

For more information, see Guide RC4110, Employee or Self-Employed?