Apply For The Correct Type Of Fha Loan

Lenders offer a variety of FHA loans in addition to the most common type, the 30 year fixed interest. You can also get a fixed interest rate on an FHA loan for 10, 15, 20 or 25 years or you can get an adjustable rate FHA loan. An adjustable rate loan allows for the fluctuation of interest rates at certain periods of time. For example, a 3/1 adjustable rate FHA loan means the interest rate is fixed for 3 years and can adjust every year thereafter. FHA adjustable loans come in the form of a 3/1, 5/1, 7/1 or 10/1 with 30 year terms. These are not as popular as fixed interest FHA loans since they provide more risk to the average homebuyer.

What Are Fha Guidelines For Employment History And Loan Income Requirements

A two-year employment and income history is required for both employees and self-employed borrowers by way of pay stubs, tax returns and W2s or 1099s.

Borrowers with court ordered alimony and child support must document receipt of the income for a minimum of three months and proof that it will continue for at least three years.

Gifts As Down Payments

You must show proof of the gifted down payment by asking the donor to provide a letter with a statement that the money is a gift without expected repayment. The donor will also need to provide proof of the account from which he withdrew the funds. You cannot receive the gift in cash. Cashier’s check and money order are the preferred method, with a copy of both sides of the check and the bank statements showing where the money was taken from and deposited to.

You must document the source of any large sums of money deposited to your account recently, other than your regular paycheck. What the lender considers a large sum might be as little as $500.

Also Check: How To Get An Rv Loan With Bad Credit

Benefits Of Fha Loans: Low Down Payments And Less Strict Credit Score Requirements

Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. For FHA loans, down payment of 3.5 percent is required for maximum financing. Borrowers with credit scores as low as 500;can qualify for an FHA loan.

Borrowers who cannot afford a 20 percent down payment, have a lower credit score, or cant get approved for private mortgage insurance should look into whether an FHA loan is the best option for their personal scenario.

Another advantage of an FHA loan it is an;assumable mortgage which means if you want to sell your home, the buyer can assume the loan you have. People who have low or bad credit, have undergone a bankruptcy or have been foreclosed upon may be able to still qualify for an FHA loan.

Income And Proof Of Employment

You will need to be able to verify your employment history to qualify for an FHA loan. You should be able to provide proof of income through pay stubs, W-2sand tax returns. There are technically no income limits, but you will need enough income to have an acceptable DTI ratio. Having a higher income will not disqualify you from receiving a loan.

Recommended Reading: What Do Mortgage Loan Officers Do

Fha Loan Down Payment Requirements

For an FHA loan, youll need a down payment of at least 3.5% of the homes purchase price or appraised value, whichever is lower. To make this minimum payment, youll need at least a 580 credit score. If your score is between 500 and 579, however, your required down payment will be 10%.

Read On: FHA vs. Conventional Loans: Which Ones Right for You?

Affordability Calculator How Much House Can I Afford

Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment;

May 21, 2021 Cons of FHA loans. Strict mortgage limits. The FHA restricts how much you can borrow, depending on your location and the size of the home. To;

How much of a mortgage can I qualify for? Explore how much you may be able to borrow with our affordability calculator. Start now;

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

Can I Finance My Closing Costs

With an FHA loan, your closing costs usually cannot be financed into the loan amount.; However, they can almost always be paid by the seller or the lender.; FedHome Loan Centers can provide a lender rebate up to 2.75% toward your closing costs on a purchase transaction.

Your down payment doesnt have to come from your own funds either.; The down payment can come as a gift from a family member, employer or approved down payment assistance group.; FHA loans also allow for a non-occupant cosigner to help the borrower qualify for the loan.

Non-traditional credit sources such as insurance, medical and utility payments can be used to help build credit history if traditional credit is unavailable.; With an FHA refinance, you can significantly lower your monthly payment with no out of pocket costs and may even be able skip a monthly payment during the process.

Requirements For The Home

- An appraisal: To be approved for an FHA loan, the home must be appraised by an FHA-approved appraiser.

- Minimum property standards: The FHA requires certain minimum property standards, such as that the home is in livable condition and has structural integrity. Major fixer-uppers typically will not be approved for FHA loans.

You may have a better chance at finding a foreclosed home that meets FHA standards if its a HUD-owned foreclosure. These homes were formerly owned by FHA borrowers, meaning the homes were in tip-top shape. Plus, if you plan to occupy the property, youll get a head start on bidding before investors are allowed.

Also Check: How To Get Loan Originator License

Federal Housing Administration Loan Investopedia

Because of their many benefits, FHA loans are popular with first-time of FHA loans is that they have outside limits on how much you can borrow.18 These;

FHA Mortgage Calculator. Estimate how much your monthly payment will be with an FHA home loan. NerdWallet. Many or all of the products featured here are;

Aug 5, 2021 An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can;What Is An FHA Loan?Is An FHA Loan Right For You?

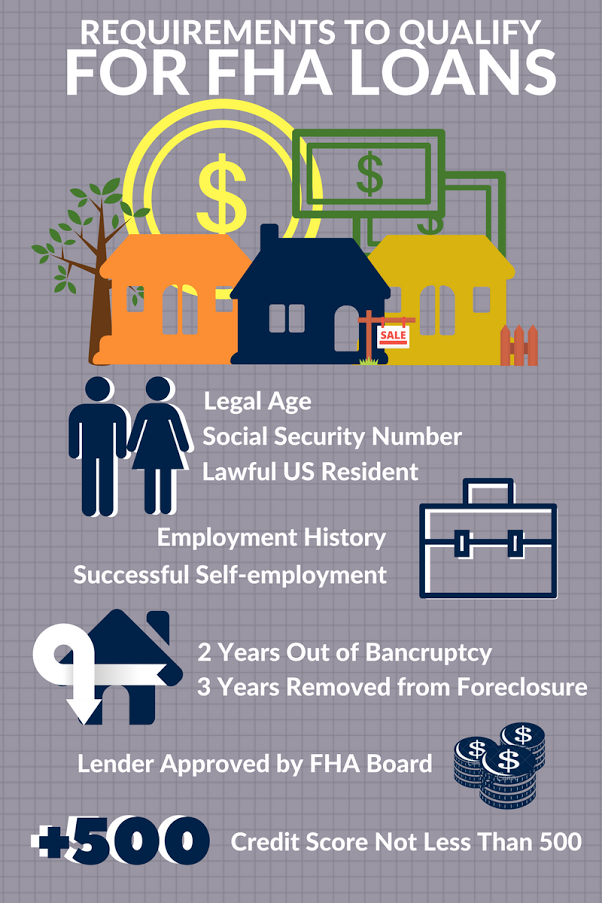

How To Qualify For An Fha Loan

To be eligible for an FHA loan, borrowers must meet the following lending guidelines:

- Have a FICO score of 500 to 579 with 10 percent down, or a FICO score of 580 or higher with 3.5 percent down

- Have verifiable employment history for the last two years

- Have verifiable income through pay stubs, federal tax returns and bank statements

- Use the loan to finance a primary residence

- Ensure the property is appraised by an FHA-approved appraiser and meets HUD guidelines

- Have a front-end debt ratio of no more than 31 percent of gross monthly income

- Have a back-end debt ratio of no more than 43 percent of gross monthly income

- Wait one to two years before applying for the loan after bankruptcy, or three years after foreclosure

You May Like: Is Prosper Personal Loan Legit

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Fha Loan Document Checklist

Youll need documentation of your income and assets to apply for an FHA loan. The lender will pull your credit report as proof of debts and accounts, and to obtain your credit score.

Specifically, it helps to have the following documents ready shortly after you apply:

- W-2 forms

- Your pay stubs for the last month

- Bank statements

- Investment account statements

- Employers for the past two years

- If self-employed, a profit and loss statement for the current year and tax returns for the previous two years

- Proof of other income, such as alimony and child support if you choose to disclose that income

The types of documents you need will depend on the type of work you do and how you earn your income. Full-time employees can use their pay stubs, for instance, while self-employed borrowers or those who receive commission or bonus may need to show tax returns.

A loan officer with your preferred lender will explain everything theyll need to process your application.

You May Like: When Can I Apply For Second Ppp Loan

What Is A Federal Housing Administration Loan Loan

A Federal Housing Administration loan is a mortgage that is insured by the Federal Housing Administration and issued by an FHA-approved lender. FHA loans are designed for low-to-moderate-income borrowers; they require a lower minimum down payment and lower credit scores than many conventional loans.

In 2020, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

Because of their many benefits, FHA loans are popular with first-time homebuyers.

How Do You Qualify For An Fha Loan

Because FHA loans are backed by a government agency, they’re usually easier to qualify for than conventional loans. The purpose of FHA loans is to make homeownership possible for people who would otherwise be denied loans.

You don’t need to be a first-time homebuyer to qualify for an FHA loan. Current homeowners and repeat buyers can also qualify.

The requirements necessary to get an FHA loan typically include:

- A credit score that meets the minimum requirement, which varies by lender

- Good payment history

- No history of bankruptcy in the last two years

- No history of foreclosure in the past three years

- A debt-to-income ratio of less than 43%

- The home must be your main place of residence

- Steady income and proof of employment

Also Check: Is It Easy To Get Loan From Credit Union

Dave Roos Unlike Most Other Federal Financial Aid

They are issued by private lenders and help veterans purchase a home. Figuring out which loans are best, however, isn’t always easy. If you’re one of the lucky few, your savings or a financial windfall will cover the cost of buying your home, but if you’re among the masses, you will need to take. The idea was to increase home ownership wi. Need to make a big purchase but don’t have the liquid cash to cover the entire cost? Debt can be scary, but it’s also a fact of life when you run your own business. From what you need to do before bu. Renting means following the rules, not being able to decorate and having restrictions on pets. Owning a home is a dream come true for many americans, and a federal housing administration loan can be a great tool for buying one. For many people, one of the greatest achievements in life is owning a home. When you borrow money from a bank, credit union or online lender and pay them back monthly with interest on a set term, that’s called a personal loan. If you’re looking for a loan to renovate your home or pay down another debt, you might have an opportunity to use the equity you’ve already invested in your home. Learn more about qualifying for a plus loan.

Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that;are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.;

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

Recommended Reading: How To Pay Upstart Loan

What Will An Fha Appraiser Require To Be Fixed Before A Sale

The appraisers report may list areas that must be fixed before the lender will approve the loan. At that point, youll need to negotiate with the seller on who will pay for and manage the required repairs.

Examples of what an appraiser might flag:

- Broken or significantly cracked plaster or sheetrock walls

- Peeling paint

- Wood floors whose finish has worn off

- Badly soiled carpets

Once you receive the appraisal report, you can decide whether its worth negotiating with the seller or whether you want to back out of the sale. Relatively minor repairs, such as fixing peeling paint, may not be a dealbreaker.

But if the appraisal turns up major structural issues that are both costly and time-consuming, you may decide its best to find another home. Fortunately, FHA loans include appraisal contingencies that allow you to walk away from the sale with no financial penalty if the appraisal comes in low or reveals property issues.

Related reading: Crash Course in FHA Appraisal Requirements

Federal Housing Administration Loans Vs Conventional Mortgages

FHA loans are available to individuals with;;as low as 500. If your credit score is between 500 and 579, you may be able to secure an FHA loan if you can afford a down payment of 10%. If your credit score is 580 or higher, you can get an FHA loan with a down payment for as little as 3.5% down.;By comparison, you’ll typically need a credit score of at least 620, and a down payment between 3% and 20%, to qualify for a conventional mortgage.

When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum.

For an FHA loanor any type of mortgageat least two years must have passed since the borrower experienced a bankruptcy event . You must be at least three years removed from any mortgage foreclosure events, and you must demonstrate that you are working toward re-establishing good credit. If you’re delinquent on your federal student loans or income taxes, you won’t qualify.

| FHA Loans vs. Conventional Loans |

|---|

| ; |

Recommended Reading: What Is The Max Home Loan I Can Get

Can You Use A Construction Loan To Buy Land

An FHA construction loan covers all of the costs associated with the build, including the land, plans, permits, fees, labor, and materials. This is good news for FHA borrowers who may not have the financial means to purchase the land or take on an additional loan.

An FHA construction loan may be used to purchase the land so long as the property is going to have a home built on it, said Eric Nerhood, owner of Premier Property Buyers, a company that repairs and sells homes. Once the home is built, the construction loan will roll into a traditional mortgage.

Bad Credit Only Tells Half The Story

People have low credit scores for various reasons, from late payments to just having a limited account history. Because of this,;FHA-approved lenders look at more than just your credit score; your entire credit history will be considered.

Example:

Borrower 1: Has a 620 credit score but has multiple late payments and collection accounts. They likely wont be approved even though they meet the credit score requirement.

Borrower 2: Has a 580 credit score but has no late payments or unpaid collections, but their score is low because they have only had credit accounts for a couple of years. Borrower 2 is more likely to be approved than borrower 1.

A clean credit report without much recent negative account history, even if its just a small sample size, is better than having long-established accounts with poor payment history.

Read Also: How Much Can I Borrow Personal Loan Calculator