How To Refinance A Personal Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you refinance a personal loan, you replace an existing loan with a new one. This strategy can save you money if you qualify for a lower interest rate on the new loan.

Heres how to refinance a personal loan, plus when its a good idea and what to consider before you refinance.

Does Upstart Charge Any Fees

Before you accept a loan from Upstart, review the terms carefully to see if you’ll have to pay an origination fee. The fee can range from 0% to 8% depending on your creditworthiness and will be deducted from your loan disbursement. It’s important to account for these fees when borrowing because if, for example, you borrow $10,000 with an 8% fee, the amount you’ll actually receive is cut down to $9,200.

The origination fee is the only potential mandatory fee, but Upstart does charge a late payment fee if your payment is more than 10 days late. There’s also an ACH or check return fee if you don’t have enough money in your account to cover your payment and a fee for requested paper copies of your records.

Upstart does not charge a prepayment fee, and you can save money by paying off your loan early. However, you won’t receive any of your origination fee back.

Good For Applicants With Average Credit

If you have average credit, or no credit at all, it’s worth going through the quick rate-check process with Upstart to see if you’re offered a loan. Particularly if you have trouble getting approved elsewhere, you may be able to get a loan or a lower rate from Upstart. However, Upstart’s higher origination fees and interest rates may mean it’s worth checking your rate with other lenders first, especially if you have good to excellent credit.

Upstart offers are not currently available through Experian. All information regarding Upstart offers has been collected independently by Experian and has not been reviewed or provided by the provider.

Recommended Reading: Nslds.ed.gov Legit

How To Qualify For An Upstart Loan

-

Minimum credit score: None.

-

Minimum credit history: None borrowers with credit histories too limited to produce a FICO score may be accepted.

-

Minimum gross income: $12,000.

-

Employment: Full-time job, full-time job offer starting in six months, a regular part-time job or another source of regular income.

-

Must have a U.S. address where the borrower resides .

-

Must be at least 18 years old.

-

Valid email account required.

-

Personal bank account with U.S. routing number required.

Loan example: A three-year, $12,000 loan with a 20.5% APR would cost $449 in monthly payments. A borrower would pay $4,164 in total interest on that loan.

Exercise #: Hit The Big Red Button

Another one is a way to handle the stress of when things boil over, and problems are popping up. This was happening to me at Google all the time and probably less so now at Upstart, but when things pile up and your coping skills are almost at their wits end, I have this mental model of a reset button, says Girouard.

And its literally just this red button in my head, and I press reset. I tell myself, Im starting over. No problem is unsolvable. And were not building nuclear plants, so nobodys going to die. Im going to think about these problems one by one and realize that none of them are going to kill us, and each of them are solvable. A mental reset button just clears everything, and thats one trick that Ive strangely relied on for many, many years.

Sometimes you just need little mental models in your head to manage your own psychology as CEO.

Read Also: Loan License California

Also Check: Which Of These Loan Options Is Strongly Recommended For First-time Buyers

Student Loans For Bad Credit

While not a type of personal loan, a student loan may meet your needs if youre trying to pay for education costs like tuition, textbooks and room and board. Many personal loan lenders do not allow you to use funds for education, so youll have to start your search with dedicated student loan lenders for bad credit.

Pros: Student loans are sometimes the only way to get funding if you need to pay for your college tuition or related expenses.

Cons: Student loans are not offered by many personal loan lenders, and if you have bad credit, youll almost certainly need a co-signer to qualify.

Takeaway: Unlike the other options on this list, student loans can only be used for one purpose, but almost all student loan lenders accept co-signers if you have poor credit.

Statements Regarding Our Outlook For The Second Quarter And Full Year Of 2022

You can check your rates with no affect to your credit score via a soft credit check. Upstart and sofi are both good lenders, but they excel in different situations. Have no more than $50,000 of outstanding principal at the time the loan originates.

You May Like: Can You Refinance An Fha Loan

Can I Pay Off My Loan Early

Yes. You can pay off your full loan balance at any time with no extra fees or prepayment penalties.

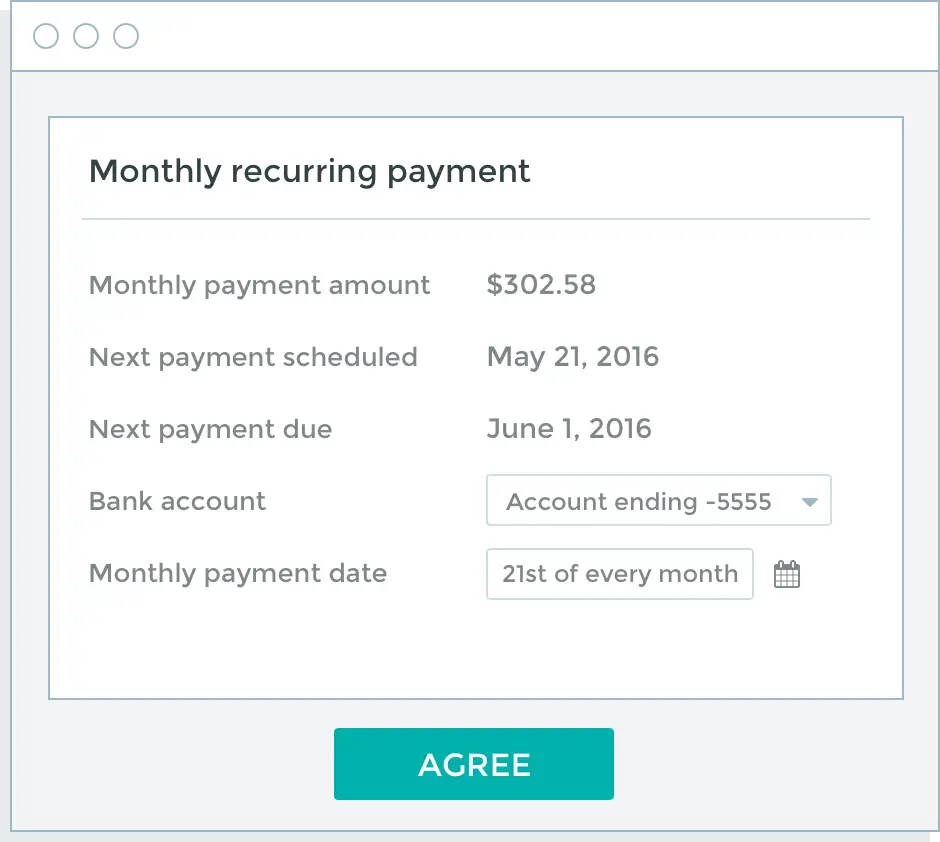

To pay off your loan or to check what your payoff amount is, please sign in and visit the Manage Payments section of your account. Click the Payoff Quote link and select the date when youd like to pay off your loan. Youll see your full payoff amount for the selected date. To pay off your loan, click continue and submit your payment request.

Youll have the option to select your payment form . Please note that 10 days of interest will be added to check payoffs to account for mailing and processing time. Any overpayment regardless of payment form will be returned to your bank account on file via ACH.

If youd like to schedule an extra payment for less than the full payoff amount, please click the Make a payment link in your account.

If youd like to make a principal-only payment, please call our Account Servicing team at 899-9931, Monday-Friday 6am-6pm, and Saturday-Sunday 6am-5pm PT.

How To Get A Loan With Upstart

Because Upstart is an online lender, you wont have to visit a branch in order to apply for a personal loan. Heres the steps youll need to follow in order to get a loan with Upstart.

Check if you prequalify

Upstart allows borrowers to prequalify for a personal loan, meaning you can see what kind of APR you may be eligible for without impacting your credit score. This can allow you to shop around and compare rates without your credit score taking a hit.

To see if you prequalify, youll need to provide Upstart the following information:

- Your loan purpose

- Details regarding your highest level of education

- Details regarding your occupation and income

- How much you have in savings and investments

- Whether youve taken out a personal loan in the last three months

One youve filled out that information, youll create an Upstart account to move onto the next step in the process.

Select your rates

If you qualify, youll then be able to select some of the details of your personal loan that best fit your financial situation, including the amount of your monthly payment. After youve settled on a specific personal loan plan, youll need to confirm your information with Upstart in order to move forward.

Verify your information

At this stage, Upstart will run a hard-credit check, which may cause your credit score to drop a few points.

Sign for your loan

Don’t Miss: Bayview Loan Servicing Tucson Az

Fast Rate Checks And Funding

In addition to distinguishing itself from other lenders with its unique underwriting, Upstart uses automation to verify applicant information.

While some companies may take a few business days to review your information, Upstart approves about 70% of applications with a fully automated processâmeaning no human involvement is required.

If you accept your loan offer before 5 p.m. Eastern time during a business day, Upstart will initiate the loan disbursement the next business day. Upstart says about 99% of its personal loans get sent to applicants the next business day. If you plan on using the money for educational expenses, however, there’s an additional three-day waiting period.

How Upstart Compares To Other Personal Loan Companies

Compared to other lending platforms, Upstart is innovative in its use of AI and alternative data. The company is also focused on providing access to credit for people who might be traditionally denied, including those with no credit history. Some other lending platforms and lenders, on the other hand, focus on serving creditworthy borrowers.

Upstart vs. LendingPoint Personal Loans Review

Both Upstart and LendingPoint offer fixed-rate personal loans for virtually every purpose. Both offer fast funding as soon as one business day, and neither allows co-signers. These lending platforms are similar in that theyre focused on serving borrowers with fair credit, but there are some key differences between them:

- LendingPoint may approve borrowers with credit scores as low as 580. Upstart only requires a minimum credit score of 300.

- LendingPoint offers repayment terms from 24 to 60 months, while Upstart offers three and five-year terms only.

- LendingPoint offers loans ranging from $2,000 to $35,600, while Upstart offers loans ranging from $1,000 to $50,000.

- LendingPoint has higher starting and average APRs than Upstart.

Upstart wins here due to its lower minimum credit score requirements and its broader range of loan amounts. But if you cant qualify for a personal loan through Upstart, LendingPoint could be another option to consider. Its also possible that your individual rate could be lower at LendingPoint even though starting and average APRs are higher than they are at Upstart.

You May Like: How Much Of A Car Loan Can I Qualify For

Dos And Donts Of Repaying Your Personal Loan Early

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

When youre nearing the end of a long personal loan road, its tempting to wrap your payments up a few months early. Who doesnt yearn to see that balance zero out?

But before you dip into your savings or use an unexpected influx of cash to pay off your personal loan, its important to check that your other financial bases are covered.

Understanding your financial goals and where paying off that loan falls among them will make managing your loan easier.

Here are three dos and two donts to keep in mind if youre tempted to pay off your personal loan early.

Dont Miss: When Should I Refinance My Fha Mortgage

Other Key Things To Know About Refinancing & Credit

Since refinancing a personal loan will hurt your credit temporarily, it’s best to avoid doing it right before you’re going to make a big financial commitment that requires a credit pull, like buying a car or a house. But if you’re not in that situation, refinancing can be a huge help not only to your credit, but also to your finances overall.

When you refinance a personal loan, you move the debt to another lender with a lower interest rate. That helps you pay off the loan sooner and thus get debt-free faster, which is fantastic for your credit. In addition, having a lower interest rate makes it easier to ensure that your payments are on time, which is vital for improving your credit score. Plus, if you use a single loan or credit card to refinance multiple personal loans, the fact that you’ll have fewer open accounts with balances can give your score a boost.

Don’t Miss: Fha Limits In Texas

How Upstarts Debt Consolidation Loan Works

Upstart offers loans ranging from $1,000 to $50,000. It offers 3-to-5 year repayment terms, but you dont get to choose. Your loan term and rate are non-negotiable. Theyre generated by Upstarts AI lending model, based on the information that you entered on your application and a soft credit pull. Once Upstart reveals your rate, you can either take it or leave it. Fortunately, you can check your rates without doing any damage to your credit score and it wont take more than a few minutes.

Who Qualifies For An Upstart Personal Loan

Although Upstart’s unique underwriting may improve your chances of getting a loan, make sure you meet the following borrower and credit eligibility requirements.

Minimum borrower requirements:

- Be a U.S. citizen or permanent resident living in the U.S. with a verifiable Social Security number

- Be at least 18 years old, or at least 19 if you live in Alabama or Nebraska

- Have a valid email account and personal U.S. bank account

- Have a regular source of income, such as a part- or full-time job have an offer to start a job within six months or have been accepted to one of the partner coding bootcamps

If you are a current or previous Upstart borrower, you may qualify for a second loan if you’ve made at least six consecutive payments on time and don’t have more than $50,000 in outstanding debt.

In addition to the borrower requirements, you need to meet some credit requirements, including:

- Have a FICO® Score or VantageScore® that meets lender requirements

- No bankruptcies on your credit report

- No currently past-due accounts on your credit report

- No more than six hard inquiries on your credit report

Even if you get preapproved for a loan offer, Upstart will check your credit before sending your loan and may revoke the offer if it finds your credit score drops by more than 25 points or you no longer meet the requirements.

Read Also: Can You Refinance An Fha Loan

Upstart Personal Loan Review

Upstart is an online lending platform founded by former Google employees, Anna Counselman, David Girouard, and Paul Gu. It offers debt consolidation loans with a unique way of determining a borrowers risk.

Home> Debt Consolidation> Companies> Upstart

Upstart has radically changed the market for personal loan by taking the loan process out of any personal hands. Upstart instead uses artificial intelligence to look at over 1600 data points, which include education level, area of study, and employment history along with more standard qualifications like and income.

These loans can be used for consolidating debt, specifically credit card debt.

Upstart claims its model can approve more borrowers at lower rates than traditional lenders like banks and . It operates off the notion that traditional lenders are too strict and cut off a lot of borrowers who actually would repay a loan.

According to a 2019 Upstart study, four in five Americans have never defaulted on a credit product, but less than half have access to prime credit.

Below, well go over the specifics of an Upstart debt consolidation loan and help you figure out if you qualify.

Snapshot:

- Funds by next business day

- Users can choose a custom payment date

Upstart Vs Avant Personal Loans

Both Avant and Upstart allow borrowers with poor credit to get approved. For borrowers who meet Upstarts minimum credit score requirement of 600, this lender could have an advantage with a wider range of interest rates and higher loan amounts.

Upstart offers loans of up to $50,000, while Avants loans top out at $35,000. Interest rates start lower at Upstart, ranging from 7.86% to 35.99% APR, as opposed to Avants interest rates ranging from 9.95% to 35.99%.

However, Avants maximum origination fee is lower than Upstarts, topping out at 4.75% as opposed to Upstarts maximum of 8%.

You May Like: How To Get Loan Signing Jobs

Recommended Reading: Usaa Auto Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Consolidate Debt Make A Large Purchase And More With A Personal Loan

Paying off credit cards? Planning a wedding? Perhaps a big home renovation? Borrowers can get the funds they need quickly, easily, and securely with a personal loan through Upstart. Take control of your finances and find out how Upstart goes beyond your credit score to arrange a fixed-payment installment loan with no prepayment penalty.

Don’t Miss: Is The Student Loan Forgiveness Program Legit

What Do You Need To Qualify For Upstart Auto Refinance

Upstart Auto Refinance does not have or does not disclose a minimum annual income eligibility requirement. Upstart Auto Refinance only considers borrowers who are employed.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members and their covered dependents are eligible to apply for a loan via Upstart Auto Refinance. Their rates fall within the limits of The Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by Upstart Auto Refinance. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Proof of insurance

- Proof of citizenship or residence permit