Chase Customer Reviews And Reputation

While JPMorgan Chase & Co. has an A+ BBB score, it is not accredited, and customer reviews are not very positive. The BBB customer score is at a very low 1.1 out of 5 stars. However, this is based on a relatively small number of reviews . Given that Chase customers number in the millions, this score represents only a tiny fraction of Chase users.

The customers who have complained on the BBB website mention declined payments and delays in mailing their vehicle title after their loan is paid off. Positive Chase reviews typically praise Chase banking services and fraud detection.

Chase Loans At A Glance

Chase does not publish specific rates for used or new auto loans. Instead, they offer an auto loan rate calculator where you can enter the following information:

- The year and make of the car

- Your state of residence

- Your estimated credit score

- The desired loan amount

The rate youll get on a Chase auto loan will vary based on your answers. Chase offers terms from 36 to 72 months, which is in line with the average loan term most buyers choose. For example, a consumer in North Carolina with a credit score in the 800s who wants to finance a new, $60,000 Honda for 72 months may receive a rate of 4.69%APR.

Ideally, you should get the shortest auto loan term possible. The less time you spend repaying a loan, the less money youll have to pay in interest charges.

Remember that you will need to use a dealer in their network, and Chase does not offer auto loan refinancing.

What Makes Them Different

The Chase Car Loans website offers a comprehensive financial education library to help you make an auto purchase.

The focus is on the entire auto purchase process, starting with multiple articles and worksheets to determine if you should purchase a new or used automobile.

You can jump around from section to section or go through the entire process to best prepare you for making your car purchase and obtaining Chase Car Financing.

Most of Chases auto loan competitors provide education more towards choosing the best auto loan and the factors that determine what you can afford.

Chases car loan education resources stand out as much more comprehensive than other lenders websites we have reviewed.

Of course, these resources are available to anyone whether you obtain a loan from Chase Auto Financing or not

Another nice feature Chase offers is a free credit score through Chase Credit Journey whether you are a customer or not.

You May Like: When Can You Use Your Va Loan

Chase Auto Loan Special Features

Navigating the car-buying process can be overwhelming, and thats where the Chase Car Buying Service can help. This concierge car buying service can guide you through the process, eliminating a lot of the legwork youd do when searching for cars and visiting dealerships on your own. Participation is open to anyone, even if you dont have a Chase bank account.

With Chase Auto Preferred, a concierge dealership employee will guide you through buying a car:

- Youll receive discounted pricing on cars.

- The concierge will facilitate a test drive and a trade-in vehicle evaluation, if needed.

- The concierge will also work with you to find appropriate auto financing, whether thats through Chase or through another loan provider.

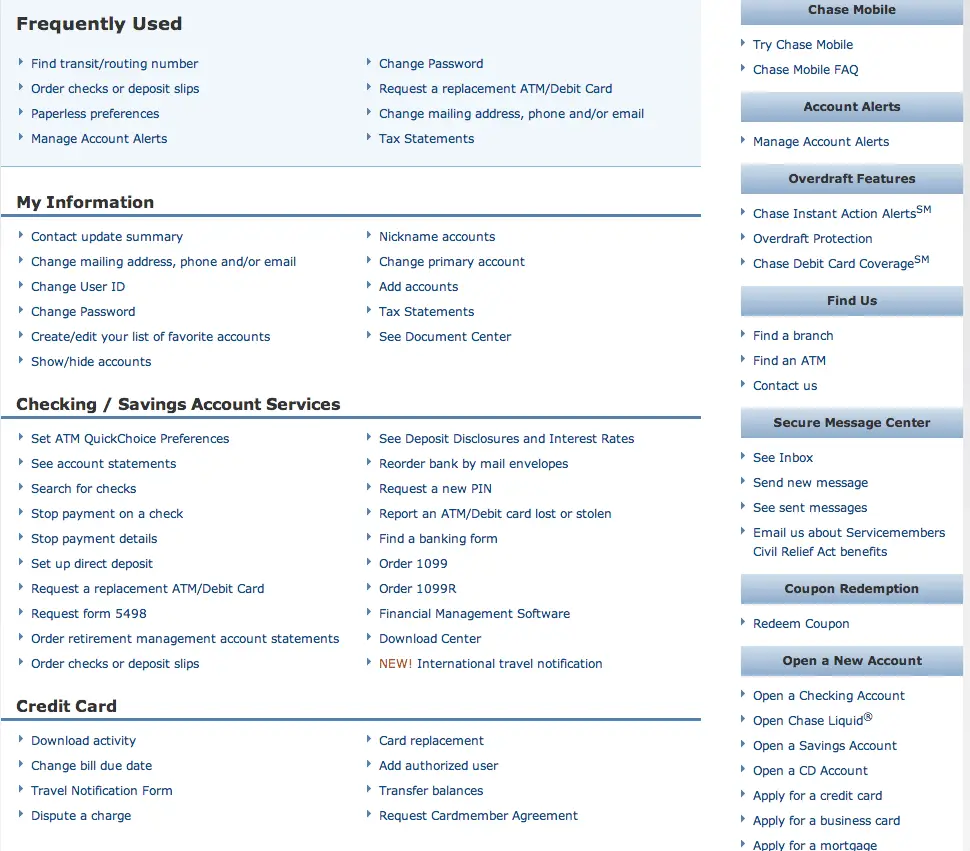

Chase also offers a MyCar platform that can help you manage your vehicle. The MyCar platform helps you track your maintenance schedule, provides details on your cars value, and checks for recalls to ensure your car is safe. This platform is available to any Chase customer with an online account. You dont have to have a Chase auto loan to use the platform.

Is A Chase Loan Right For You

If you know what kind of car you want to buy and you can find a good deal with a dealer in the Chase network, then a Chase auto loan may be a good option. Ultimately, however, since they dont disclose their offered APR range, its hard to know whether a Chase auto loan is the right choice for you. Remember that its a good idea to shop around with multiple lenders. Getting multiple auto loan offers will help you understand if a Chase loan is a good deal for your car purchase. You can fill out a form with LendingTree and receive up to five auto loan offers.

Also Check: Are Student Loan Forgiveness Programs Legitimate

Chase Auto Finance Customer Service Phone Number Knowing

Contacting chase customer service center chase is a part of the jp morgan chase company, which accounts for more than $2 trillion in customer money and investments. .auto finance support number get full information email id, fax , office location & customer service support phone number on isopentoday.

See Also: Phone Number Preview / Show details

Chase Auto Loan Pros And Cons

| Chase Auto Loan Pros | |

|---|---|

| No financing for commercial vehicles or vehicles more than 10 years old | |

| High loan amounts for customers with strong credit | No loans for motorcycles, boats, or recreational vehicles |

| Can complete your auto purchase entirely through Chase | No refinancing loans |

If you are looking to purchase a car, theres no harm in applying for prequalification with Chase. You can also compare auto loan offers from other top lenders.

Don’t Miss: How Much Income To Qualify For Home Loan

Chase Auto Finance Member Services Phone Number #:

877-242-7372

Chase Auto Finance has 2 phone numbers and 4 different ways to get customer help. We’ve compiled information about 877-242-7372 and ways to call or contact Chase Auto Finance with help from customers like yourself. Please help us continue to grow and improve this information and these tools by sharing with people you know who might find it useful.

See Also: Phone Number Preview / Show details

What Is The Contact Information For Chase Auto Financing

Chase may be contacted at 336-6675 for loans and 227-5151 for leases. You may also create an account online at

Used car loans have APRs of 2.89% and 2.39% if a Chase customer discount is placed. email address, social security number and phone number.

Chase Bank Auto Loan customer reviews and ratings are extremely troubling with complaints of slow loan approval, poor customer service, and 30+ minute hold

Pay by phone: Customers can pay your Chase Auto Finance bill by calling customer service at 1-800-336-6675. You will need your account details and acceptable

May 10, 2022 Chase Auto Loan Customer Support Phone is 1-800-336-6675. Live customer service representatives from Chase Auto Loan are available 24 hours a

Chase car buying service is provided by True car. Refinancing is subject to credit approval by JP Morgan Chase Bank, N.A. . Chase Auto Finance

Learn more about finding details and payment options of your loan. your social security number, phone number and residence and employment information.

Read Also: How To Find Out Student Loan Account Number

Chase Auto Loan Application Process

The first step to applying for a Chase auto loan is called prequalification. Many loan providers have a prequalification stage. To prequalify, you will need to provide Chase with your name, address, income, and the last four digits of your social security number. There is no fee for prequalification or application.

Chase does not mention a minimum required credit score, and prequalification does not require a hard credit check. This means that your credit score will not be affected just for applying. After completing prequalification, Chase can give you an idea of the loan amount for which you qualify and an expected interest rate.

How Chase Auto Loans Compare

While its hard to know whether Chase auto loans are the best choice since they dont disclose their rates, they do offer the highest maximum loan amount, at $600,000. They also lend to people with fair credit, though your interest rate will be higher than someone with better credit. Below, well compare Chase auto loans to the loans offered by Bank of America and BMO Harris.

| Chase |

|---|

| 640-650 |

Also Check: How To Pay Off Home Loan Quicker

Types Of Chase Auto Loans

Chase offers auto loans for both new and used cars purchased through a dealer within Chases network. Commercial vehicles, vehicles older than 10 years, and vehicles with more than 120,000 miles are not eligible. Chase also doesnt provide loans for motorcycles, RVs, or vehicles that will be used as taxis or for Uber or Lyft.

Loans start at a minimum of $4,000. The maximum loan amount tops out at $600,000, which is significantly higher than the maximum amounts offered by other auto loan providers.

You can also explore refinancing your current auto loan with Chase.

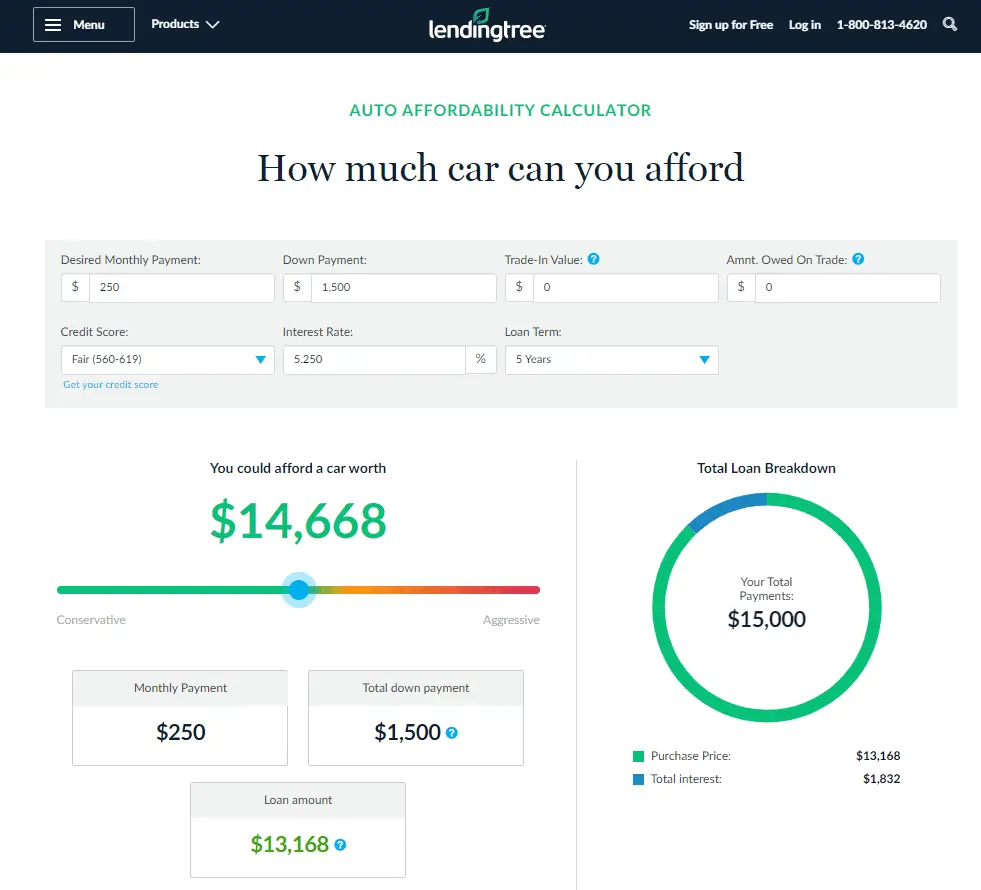

Chases auto loan rate calculator can help you to get a sense of what your monthly payments could be like. This calculator determines your monthly payment based on information about the vehicle youre buying and the total amount of your loan.

Chase also offers a payment calculator that can help you estimate your car payment and determine just how much interest youll pay during the life of your loan. This information is valuable when youre first shopping around for auto loans and can help you decide just how much you can afford to spend on a vehicle.

How To Print The Check Image On Chase Bank

Get prequalifiedopens in the same window. 1 To finance a new or used car with your dealer through JPMorgan Chase Bank, N.A. , you must purchase your car from a dealer in the Chase network. The dealer will be the original creditor and assign the financing to Chase. All applications are subject to credit approval by Chase. How financing withChase works. 1. Apply. Fill in a few details including car choice and dealer to get a credit decision. Don’t worry, you can update your car later, if needed. 2. Get financing. Once approved, we’ll send the details directly to you and your chosen dealer, saving you time and paperwork. 3. Chase Freedom Unlimited ®Credit Card. $200 bonus plus 5% gas station cash back offer. Earn 1.5% cash back on all other purchases. No Annual Fee. Sign in to apply faster Opens in a new window. Apply Now. Opens in a new window. Learn more.

Read Also: What’s The Best Car Loan Interest Rate

Chase Auto Loan Reviews

JPMorgan Chase & Co. is a multinational bank that offers a wide variety of financial services, including Chase auto loans for purchasing new and used vehicles. In this review, well take a close look at this company and explore loan details, the application process, and Chase auto loan reviews from customers.

If youre trying to purchase a vehicle, finding the right auto loan can save you thousands of dollars in the long run. Read our review of the best auto loans to learn more about all your vehicle financing options.

Up to 722.94%

- Low rates for good credit customers

- Strong industry reputation

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- A leading provider in refinance loans

Up to 72Varies

- Great for customers with limited/no credit

- Offers special military rates

- Average monthly savings of $145

- Online Application

Up to 72Varies

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

All APR figures last updated on 6/13/2022 – please check partner site for latest details. Rate may vary based on credit score, credit history and loan term.

Chase Auto Loan Customer Service Number

www.chase.com

Date Submitted: 06/15/2021 03:52 PM

Average star voting: 5

Summary: Find the best contact information: Chase Auto Loan Customer Service Number. You will find contact quickly with the information you need.

Match with the search results: If you miss the earlier cutoff time, you can make a same-day payment at 1-800-346-8915 until 10:30 PM ET on a business day.. read more

Read Also: How To Transfer Car Loan From One Bank To Another

Why Doesnt Chase Have Any Record Of A Car Loan That Jerry

Im a first-time car buyer. I went to purchase a vehicle with financing and the dealer said they were working with Chase. I was skeptical of the agreement

3 days ago ELT PO BOX 91326 / 6150 OMNI PK DR / MOBILE AL 36691 CHASE AUTO FINANCE.

Contact us | Auto Loans | Chase Loans: 1-800-336-6675. We accept operator relay calls. If youre deaf, hard of hearing, or have a speech disability, call 711

Lease Customer Service / Lease-End Department 1-844-868-2150. Please call us for loan payoff quotes or lease end of term payments.

Chase Auto Finance · Banking · About us · Locations · Employees at Chase Auto Finance · Similar pages · Browse jobs · Sign in to see who you already know at Chase Auto

Finance, which includes auto financing and the related account services Download Chase Mobile®: Get the free Chase Mobile app for your smartphone and.

It also has flexible loan amounts and a number of auto loan options for members. Chase Auto offers the security of a stable financial institution with

Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments.

Chase Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

JP Morgan Chase Bank, popularly known as Chase, is one of the nations largest lenders, and they offer competitive auto loans for both new and used cars. Chase auto loan rates vary by the make and year of the car, where you live and the loan amount. One catch about getting a Chase auto loan is that you have to buy your car from a dealer in the Chase network in order to finance through this lender. As one of the leading players in the automotive finance industry, Chase may be able to offer appealing terms to qualifying borrowers.

In this article, well explore

Recommended Reading: How To Get Loan At 18

Who Is Eligible For Chase Auto Loans

Anyone over the age of 18 can apply for a Chase auto loan. The company only provides financing for new and used vehicles less than 10 years old and with fewer than 120,000 miles. Chase auto finance doesnt cover the following:

- Commercial vehicles

- Salvaged or branded title vehicles

- Vehicles that arent titled or registered in one of the 50 states or Washington, D.C.

- Vehicles used as taxis or limousines or for rideshare services such as Uber or Lyft

- Motorcycles, RVs, boats or aircraft

- Certain exotic makes

Chase doesnt list any minimum income or credit score requirements on its website, so it may be easier for those with fair credit to be approved for an auto loan.

Current Auto Loan Interest Rates

| Dates | |

|---|---|

| 4.08% | 4.48% |

The above chart gives you an idea of the starting interest rate based on how long you need the loan for.

As you can see, the longer time you plan to take to pay the loan off, the higher the rates become.

While the monthly premiums will be lower if you select a longer payoff period, you are going to end up paying much more interest.

You May Like: Can I File Bankruptcy And Keep My Car Loan

Chase Auto Shop Finance Manage Chasecom

1 To finance a new or used car with JPMorgan Chase Bank, N.A. , you must purchase your car from a dealer in the Chase network. The dealer will be the original creditor and assign the financing to Chase. All applications are subject to credit approval by Chase. Additional terms and conditions apply, such as vehicle make, age and mileage.

See Also: Finance Preview / Show details

Getting A Chase Auto Loan

![[Warning Government Action] Chase Auto Loan Review (2020) [Warning Government Action] Chase Auto Loan Review (2020)](https://www.understandloans.net/wp-content/uploads/warning-government-action-chase-auto-loan-review-2020.png)

Chase Auto offers several key services. The primary option is Chase Auto Direct, which is car financing. You can go to the Chase website and enter some general information, such as the state youll be buying in, the loan amount youre seeking, and your general credit score, from excellent to fair.

Then, youll see a list of the Chase auto loan terms and a sample of what your APR and monthly payment might look like. Loan terms typically range from four to eight years, and they do advertise APRs of less than 3%. However, this is dependent on your creditworthiness.

Read More > > If you do not think you have a high enough credit score, there are bad credit auto loans from other lenders.

You May Like: How Does Student Loan Consolidation Affect Credit Score

Auto Loan Maturity Auto Loans Chase

For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Sports & Entertainment Chase gives you access to unique sports, entertainment and culinary events through Chase Experiences and our exclusive partnerships such as the US Open , Madison Square Garden and Chase Center .

See Also: Customer Service Preview / Show details

Taking Action On A Car Loan

Hopefully, you found this Chase Auto Loan Review helpful because getting an auto loan can be complicated and a time-suck if done incorrectly.

Now that you know there are dealerships ready and willing to work with you there is no reason to go without a car.

Getting a car loan is also part of establishing a different type of tradeline which overtime, will help increase your credit score.

Read Also: How To Become Commercial Loan Officer

Contact Us Subaru Motors Finance Chasecom

800-662-3325

Loan Customer Service 1-800-662-3325. Lease Customer Service 1-800-644-1941 or its affiliates and are licensed to JPMorgan Chase Bank, N.A. . Subaru is solely responsible for its products and services and for promotional statements about them, and is not affiliated with Chase or its affiliates. Auto finance accounts are owned by

See Also: Customer Service / Show details