Credit Card Consolidation Loan

Pros:

-

Fixed interest rate means your monthly payment wont change.

-

Low APRs for good to excellent credit.

-

Direct payment to creditors offered by some lenders.

Cons:

-

Hard to get a low rate with bad credit.

-

Some loans carry an origination fee.

You can use an unsecured personal loan from a credit union, bank or online lender to consolidate credit card or other types of debt. Ideally, the loan will give you a lower APR on your debt.

are not-for-profit lenders that may offer their members more flexible loan terms and lower rates than online lenders, especially for borrowers with fair or bad credit . The maximum APR charged at federal credit unions is 18%.

Bank loans provide competitive APRs for good-credit borrowers, and benefits for existing bank customers may include larger loan amounts and rate discounts.

Most online lenders let you pre-qualify for a without affecting your credit score, though this feature is less common among banks and credit unions. Pre-qualifying gives you a preview of the rate, loan amount and term you may get once you formally apply.

Look for lenders that offer special features for debt consolidation. Some lenders, like Payoff, specialize in consolidating credit card debt. Others, like Discover, will send loan funds directly to your creditors, simplifying the process.

Not sure if a personal loan is the right choice? Use our debt consolidation calculator to enter all of your debts in one place, see typical rates from lenders and calculate savings.

Can Improve Credit Score

Applying for a new loan may result in a temporary dip in your credit score because of the hard credit inquiry. However, debt consolidation can also improve your score in a number of ways. For example, paying off revolving lines of credit, like credit cards, can reduce the credit utilization rate reflected in your credit report. Ideally, your utilization rate should be under 30%, and consolidating debt responsibly can help you accomplish that. Making consistent, on-time paymentsand, ultimately, paying off the loancan also improve your score over time.

Repaying Student Loan Debt

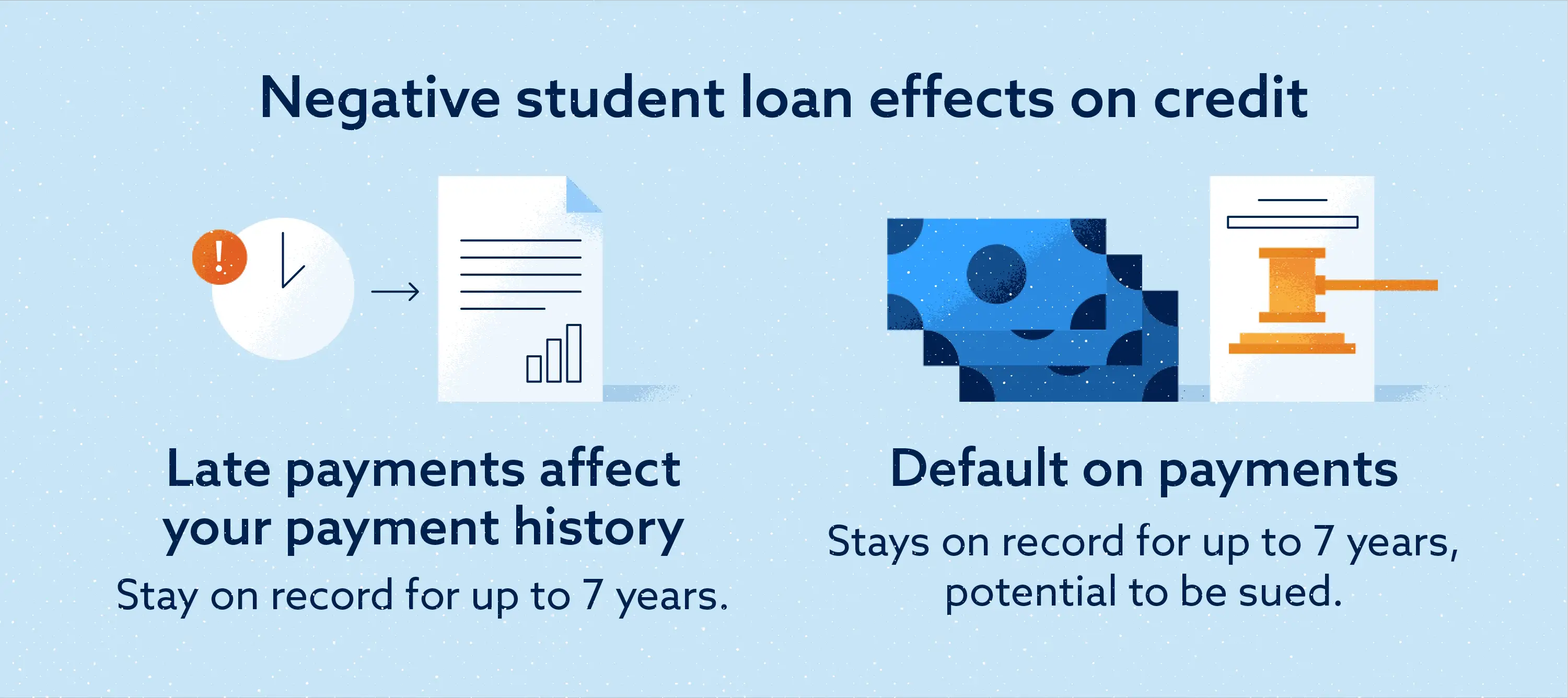

The single biggest factor that determines how student loans affect credit is whether you make your payments on time.

As soon as you miss a payment on a federal student loan, you’re classified as delinquent. If you have a federal student loan, your missed payment will be reported to the three major credit reporting agencies once you’re at least 90 days late. Private student loan lenders may report missed payments sooner.

A single payment that’s 30 days late could potentially reduce your credit score by more than 80 points, according to FICO. And the later you are in paying your monthly bill, the bigger the drop. Late student loan payments can stay on your credit report for seven years and have a long-term negative impact.

Defaulting on your loan can have even worse consequences. You’re considered to be in default on direct loans or FFEL loans one youve gone 270 days or more without making a payment. And if you have a Perkins loan or private student loan, your loan servicer could classify you as defaulting as soon as you miss a payment.

The U.S. Department of Education warns that defaulting can damage your credit in a way that may take years to recover from. And while you can rehabilitate defaulted federal student loans and have the record of the default removed from your credit history, all late payments leading up to it will still show on your credit report for seven years.

Also Check: Auto Refinance Calculator Usaa

You May Want To Consider Student Loan Consolidation If

- You want to simplify your life with a single monthly payment. If youre tired of juggling several loan payments at once, debt consolidation can make sense. Once you consolidate, youll have a single loan payment to make and keep track of each month.

- You can get a lower interest rate with a private lender. If your student loans are at high interest rates and you think you can get a better deal, you may save money by getting a new loan with a lower interest rate. Keep in mind, you can find out how much you can save by exploring student debt consolidation options on LendingTree.

- You want to lower your monthly payment. If the monthly payment on your current loans is too high, debt consolidation can help. Most of the time, you can lower your monthly payment by extending your repayment timeline. Keep in mind, however, that you may pay more interest the longer you extend your loans even if your interest rate is lower.

- You want to pay down your loans faster. While debt consolidation doesnt guarantee early repayment, it can make the process easier. With a single monthly payment to worry about, it might be simpler to focus on repayment and come up with extra funds to pay toward your loan principal each month. You may be able to pay down your loans especially fast if you get a lower interest rate, too.

Ways To Consolidate Credit Card Debt

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Consolidating your debt is ideal if the new debt has a lower annual percentage rate than your credit cards. This can reduce interest costs, make your payments more manageable or shorten the payoff period.

The best way to consolidate will depend on how much debt you have, your credit score and other factors.

Here are the five most effective ways to pay off credit card debt:

Refinance with a balance transfer credit card.

Consolidate with a personal loan.

Tap home equity.

Start a debt management plan.

Read Also: Maximum Fha Loan Amount In Texas

How Does Student Loan Consolidation Affect Credit

Student loan debt is one of the most-talked-about issues when we, as a society, discuss our economic future. One of the most important factors of someones personal financial situation is their credit score. So how we handle our student loans can directly impact our buying power, at least when it comes to things we might need to finance such as a car, house or home repairs. But how does student loan consolidation affect credit scores?

As you might know, student loans are listed on your credit report as an installment account. These types of accounts, along with revolving accounts like credit cards, are good for your credit mix. Paying revolving and installment accounts on time is one of the best ways to maintain a good credit score.

Although getting a consolidation loan doesnt raise your score on its ownyour outstanding debt amount will remain mostly the sameit can make it easier for you to manage your finances overall, thus helping you keep paying bills on time.

Its important to point out here that, like any credit check from a potential lender, applying for a consolidation loan will add a hard inquiry to your credit report. Inquiries have a lower impact on your overall credit history than, say, amount of debt and on-time payments, but having too many inquiries in a short period can cause your score to drop.

Can Debt Consolidation Hurt My Credit Score

Debt consolidation has the potential to hurt your credit score in several ways, depending on which method you use. For people using a debt management plan for consolidation, it is important to fully understand your agreement with your credit counselor. It is also important to know whether you are working with a credit counselor from a not-for-profit organization, or if you are working with a for-profit debt settlement/consolidation firm.

Don’t Miss: Usaa Car Loan Rate

Do I Need A Good Credit Score To Take Out A Student Loan

Whether or not you need a good credit score to borrow student loans depends on whether youre talking about federal or private student loans.

Most federal loans dont take credit scores into account, which is why nearly every borrower gets the same interest rate regardless of financial profile. However, federal PLUS loans for parents require that borrowers do not have an adverse credit history.

For private lenders, your credit score is usually a critical factor in determining student loan approval and the attached interest rate. In general, the better your score, the better your rate.

Can Debt Consolidation Help My Credit Score

While debt consolidation is mainly a method of lowering or eliminating mounting debt, it can also have a positive effect on your credit score. Beyond helping you reduce your number of monthly debt payments and save on interest over the life of your loans, debt consolidation can help you eliminate or drastically reduce your total debt over time.

When you consolidate revolving debtlike credit card accountsyou also will be working toward reducing your utilization ratioone of the most important factors in calculating your credit score. Your is calculated by comparing how much available credit you have and how much you use each month. Credit utilization accounts for 30% of your credit score.

Imagine if you have one credit card with a limit of $10,000. If the balance on that card is $5,000, your credit utilization ratio is 50%. It is commonly recommended to keep your credit utilization under 30%. As you roll revolving credit debt into a debt consolidation loan, and if you keep your balances on those accounts low, this can help to reduce your credit utilization and in time help boost your credit score.

Don’t Miss: Usaa Car Payment Calculator

How Much Could I Save

One of the ways consolidation can give you some extra financial wiggle room is by lengthening the term of your loan the longer the term, the lower your monthly payments. For example, if you have a $20,000 loan with a 3.90% APR and a 5-year term you would be making monthly payments of $367.43, making the total cost of the loan $22,046.

If you take that same $20,000 loan, with a 3.90% APR but with a 15-year term, you could be making payments of $146.94 to repay the loan. That gives you an extra $220.49 every month that you could put toward becoming a homeowner! Keep in mind, while that frees up come cash now, those low payments increase the total cost of the loan to $26,449 with interest.

Extending the length of your term is a good option if youre looking to put that extra money into savings for your financial goals, or make your monthly payments more manageable. But, if you can manage those higher payments, you could end up saving more money in the long run.

Does Consolidating Student Loans Hurt Your Credit

While consolidating student loan debt can sometimes improve ones credit, the opposite could also happen at least at first. Because debt consolidation requires a new loan, your loan servicer will complete a hard pull on your credit report. This hard pull allows them to assess your credit worthiness, but it can cause a temporary drop to your credit score.

The good news is, any temporary hit to your credit score caused by a hard inquiry will not last long. In normal circumstances, negative effects only last a few months. Most of the time, the benefits of consolidating student loans far outweigh the cons. As always, you should consider your unique situation and weigh the pros and cons before you decide.

You May Like: Interest Rate For Car Loan With 650 Credit Score

What If I Cannot Make Payments

You already know how student loans impact your . We discussed that the impact depends highly on the repayment ability. If you repay the debt on time, the impact will be positive, and your credit score will increase. In contrast, late, skipped, or non-payment will decrease the credit score, and you will face further challenges. Specifically, you need to avoid default status as its consequences last for years. You might be unable to request a new loan, get an apartment or even find a decent job.

If you face financial difficulties and you are unable to make accurate payments, you have to find alternative ways. As mentioned, payment history is the most influential factor for determining FICO credit score. Therefore, it is essential to maintain a good payment history.

Is Refinancing Your Student Loans Worth The Credit Score Hit

As important as it is to understand refinancing and how student loans affect credit scores, its even more important to remember why you wanted to refinance your student loans in the first place.

Ultimately, refinancing student loans can be about getting a lower interest rate so you may pay off your student loans faster or make lower monthly payments. Either way, paying less in interest can be more beneficial than losing a few points on your credit score.

Its easy to get caught up in the race for the best credit score possible. Just dont let it lead you to decisions that are bad for your bottom line. Learn to balance the two for your best financial outcome.

You May Like: Refinance Usaa Auto Loan

How Does My Credit Score Affect My Ability To Get A Student Loan

Home> Students & Debt> How Does My Credit Score Affect My Ability to Get a Student Loan?

The yearly cost for a college degree can total $50,000 or more, a price tag that requires most students to turn to student loans. Unfortunately, many students worry that their credit score could stand between them and the loans they need to get to graduation.

But theres good news: Having a negative credit score or a lack of credit history by no means prohibits you from receiving loan approval. Instead, credit may determine what types of loans and interest rates are available to you.

Here are options for students concerned about credit:

You Risk Missing Payments

Missing payments on a debt consolidation loanor any loancan cause major damage to your credit score it may also subject you to added fees. To avoid this, review your budget to ensure you can comfortably cover the new payment. Once you consolidate your debts, take advantage of autopay or any other tools that can help you avoid missed payments. And, if you think you may miss an upcoming payment, communicate that to your lender as soon as possible.

You May Like: Fha Loan Refinance

What Is A Credit Score

Lenders usually use the FICO credit scoring model. A credit score is a numerical determinant ranging from 300-850. It is the reflection of the borrowers creditworthiness and trustworthiness.

The score depends on many factors, but mainly on the individuals prior performance, such as the timely payments of debt, credit usage, credit history length, recent activities, etc. The higher the score, the more creditworthy the individual is.

Usually, a score above 700 is considered good, while between 800-850, it is excellent. People in the U.S in 2020 had an average score of 710.

Many entities check credit scores for different purposes. You can observe its impact on daily life when:

- you want to get a new loan

- an employer makes a decision regarding hiring or promoting

- insurance company use a credit score to determine insurance costs

Which Should I Choose

| You should consolidate directly if: | You should refinance if: |

|---|---|

| You do not have a steady income currently. | You do have a steady income or full-time job offer in hand. |

| You will be using an income-based repayment program. | You will not be using an income-based repayment program. |

| You are satisfied with your current loans. | You want to customize the term of your repayment according to your budget and save money through lower interest rates. |

You May Like: How To Get Mortgage License In California

Build Credit Before You Refinance

If you end up deciding to refinance your private student loans or at least a portion of your federal student loans, it’s important to make sure your credit is ready. Again, the best rates are reserved for people with high credit scores and incomes.

Check your credit score to see where it stands. If it needs some work before you apply, review your credit report to pinpoint areas you can address. That can include paying down credit card balances and taking other actions that can help improve your credit score.

This process can take time, but if it helps you score even a slightly lower interest rate, it could save you hundreds or even thousands of dollars, depending on how much you owe. As you make an effort to improve your scores, closely monitor it for changes to see how effective your actions have been.

Will Consolidating My Student Loans Help My Credit

First things first. Because of the way your credit score is determined, theres a chance debt consolidation could actually improve your credit score.

When you consolidate several loans into a new loan product with a lower interest rate and better terms, you are often able to secure a lower monthly payment. Not only will a lower monthly payment make it easier to pay your loan bills on time each month, but it will lower your debt-to-income ratio, too. When your debts make up a smaller percentage of your income every month, you become a more attractive prospect to creditors and may see a boost in your score as a result.

Lastly, student loans are often seen as good debt. They are also considered installment loans whereas credit cards entail a revolving line of credit. Since your credit score is determined by considering factors such as your credit mix, diversifying your credit with different types of loans can lead to a better credit score over time.

You May Like: Credit Score Usaa