Interest Rates On Federal Loans

Federal student loans borrowed on or after July 1, 2006, have fixed interest rates. That means the interest rate does not change over the life of the loan. Interest rates for federal student loans depend on the type of loan and year the loan is disbursed. Federal student loan rates are set on an annual basis by federal law.

To view current interest rates for federal student loans as well as previous years interest rates visit the U.S. Department of Educations website.

How Are Student Loan Interest Rates Calculated

Federal student loan interest rates for the fall are determined by the 10-year Treasury note auction every May, plus a fixed increase with a cap.

- Direct unsubsidized loans for undergraduates: 10-year Treasury + 2.05%, capped at 8.25%

- Direct unsubsidized loans for graduates: 10-year Treasury + 3.60%, capped at 9.50%

- Direct PLUS loans: 10-year Treasury + 4.60%, capped at 10.50%

Private student loan interest rates are determined by each lender based on market factors and the borrowers and cosigners creditworthiness. Most private lenders also offer a variable interest rate, which typically fluctuates monthly or quarterly with overnight lending rates such as the Secured Overnight Financing Rate .

While federal student loans dont take into account and income, these factors play a big role in private lenders decisions. Students who dont meet lenders credit requirements will need a cosigner. The 2017 Annual Report of the Consumer Financial Protection Bureau Student Loan Ombudsman noted that more than 90% of private student loans were made with a cosigner. However, even if you dont have a good credit score or cosigner, there are lenders that offer student loans for bad credit and student loans without a cosigner.

Best Student Loan Refinance Lenders

- Variable rates starting at 2.49% APR *

- Fixed rates starting at 3.74% APR *

- Choose your own monthly payment

- No fees of any kind and exceptional customer service for the life of your loan

- Check your rate in under 2 minutes

To qualify, you must be a U.S. citizen or possess a 10-year Permanent Resident Card, reside in a state Earnest lends in, and satisfy our minimum eligibility criteria. You may find more information on loan eligibility here: https://www.earnest.com/eligibility. Not all applicants will be approved for a loan, and not all applicants qualify for the lowest rate. Approval and interest rate depend on the review of a complete application.

*Auto Pay Discount: If you make monthly principal and interest payments by an automatic, monthly deduction from a savings or checking account, your rate will be reduced by one quarter of one percent for so long as you continue to make automatic, electronic monthly payments. This benefit is suspended during periods of deferment and forbearance. Not all borrowers will qualify for our lowest rates, and your rate will be based on creditworthiness at time of application.

The information provided on this page is updated as of 8/25/2022. Earnest reserves the right to change, pause, or terminate product offerings at any time without notice.

Read Also: How Much Can I Borrow In Student Loans

Who Sets Federal And Private Interest Rates

Congress sets federal student loan interest rates each year. These fixed interest rates depend on the type of federal loan you take out, your dependency status and your year in school.

Private student loan interest rates can be fixed or variable and depend on your credit, repayment term and other factors. As a general rule, the better your credit score, the lower your interest rate is likely to be.

Alternatives To Direct Unsubsidized Loans

All college students qualify for Direct Unsubsidized Loans, regardless of their financial situation. If these loans will not cover all of your college expenses for the year, you do have other options to consider. You may, for example, be able to borrow private student loans, though these will typically be more expensive.

The parents of dependent undergraduate students may qualify to borrow Direct Parent PLUS Loans to cover any gaps that still exist. Additionally, graduate students for whom Direct Unsubsidized Loans do not cover all of their college expenses may qualify to borrow Direct Graduate PLUS Loans.

Also Check: Quick Loan For Bad Credit

Private Student Loan Interest Rates

Private student loans are funded by banks, credit unions and online lenders, so interest rates vary from lender to lender. Many private student loan lenders offer both fixed and variable rates, so your interest rate could fluctuate over the life of the loan if you choose a variable-rate option.

Most student loan lenders set rates based on the Libor or the Secured Overnight Financing Rate . However, while rates are tied to this benchmark, private lenders also typically evaluate your credit score, income and financial history to determine your interest rate. Generally, the better your financial health and credit score, the lower your interest rates will be. In order to access this information, many lenders will run a hard credit inquiry, which can knock your credit score down a few points although you can usually get a preview of your rates and terms with only a soft credit check.

Historical Average Federal Student Loan Rates

Some borrowers may not just be interested in the current average rates, but may be curious about the answer to the question, what is the average student loan rate over time? Again, this depends on the type of loan you’re taking out. Here are the historical rates for Direct Subsidized Loans and Subsidized Federal Stafford Loans. If you take a look at this chart, you can see, for example, that the average rate for this type of loan over the past five years was 4.108%.

You can do this type of calculation with each of the different kinds of loans for which the Department of Education has made historical data available.

Also Check: Signature Loans For Bad Credit

Federal Direct Subsidized/unsubsidized Loan

The terms of the need based Federal Direct Loan Program require that the student borrower repay, with interest, this source of financial assistance. Additional terms, subject to revision by federal regulation, include:

- Maximum annual limit varies by year in school

- 3.73% fixed interest rate for undergraduate students during repayment for loans first disbursed from July 1, 2021 through June 30, 2022

- 4.99% fixed interest rate for undergraduate students during repayment for loans first disbursed from July 1, 2022 through June 30, 2023

- 5.28% fixed interest rate for graduate students during repayment for loans first disbursed from July 1, 2021 through June 30, 2022

- 6.54% fixed interest rate for graduate students during repayment for loans first disbursed from July 1, 2022 through June 30, 2023

- 1.057% origination fee for student loans with a first disbursement date from October 1, 2020 through September 30, 2022

- Repayment on both principal and interest begins six months after the student ceases to be enrolled in school on at least a half-time basis, generally extending over a 10-year period

- $23,000 maximum base aggregate undergraduate borrowing limit for Subsidized loans. $31,000 maximum aggregate undergraduate borrowing limit for combined subsidized and unsubsidized loans for dependent students

- $138,000 maximum aggregate graduate borrowing limit for Unsubsidized loans.

| $0 |

You May Like: How To Give Loan Online

Average Student Loan Interest Rates

The average student loan interest rate depends on the type of student loan you get. Federal loans tend to charge lower interest rates for undergraduates, especially considering theres no credit check as with private student loans.

But graduates and parents may find it worthwhile to compare federal loan rates with rates from private lenders.

Also Check: How To Find Out Student Loan Account Number

Federal Direct Graduate Plus Loan Limits And Terms

You may borrow up to the full student budget less total financial aid from all sources. The interest rate is fixed at 7.543% for 2022-2023 loans. There is a 4.228% loan origination fee deducted from the loan by the U.S. Department of Education for loans with a first disbursement date prior to October 1, 2023 . The Grad PLUS Loan is credit-based and requires credit approval by the U.S. Department of Education.

Refer to the Federal Student Aid website for additional information regarding Direct Grad PLUS Loans.

Interest Rates For Federal Student Loans

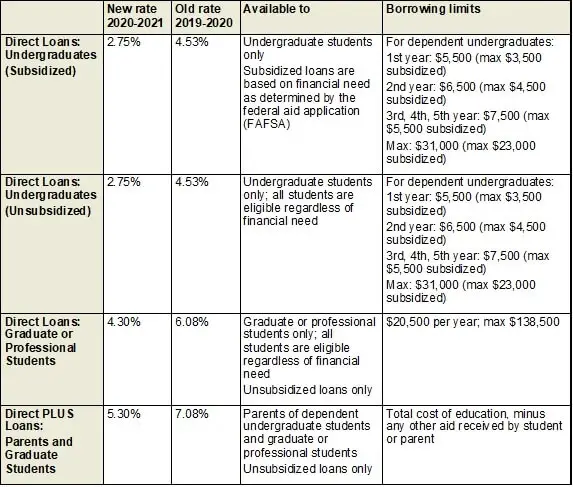

Federal student loans interest rates for the 2019-2020 school year range from 4.53% to 7.08%. As of July, 2006, all federal student loans have fixed interest for the life of the loan. Although rates are reevaluated by Congress every year, the interest rates on existing loans will not be affected.

Stafford loans for undergraduates in 2019-2020 came with interest rates of 4.53%. The Stafford loan rate for graduate students is 6.08%. Stafford Loans are the most common type of federal student loan. If your Stafford loan is subsidized rather than unsubsidized, it does not begin accruing interest until after you leave school.

Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At 7.08%, these have the highest interest rate of any federal student loan.

It should be noted that there is an aggregate limit to how much money students may borrow on federal loans. Undergraduates can only borrow $57,500 in total and no more than $23,000 of that can be a subsidized loan. Graduate students may borrow $138,500 and no more than $65,500 can be subsidized.

The graduate loan amounts include any money borrowed to obtain an undergraduate degree.

You May Like: Is Personal Loan Installment Or Revolving

Why Are Student Loan Interest Rates Rising So Fast

The big jump in rates on the 10-year Treasury note is thanks to the recent actions of the Federal Reserve, which raised its benchmark interest rate by half a percentage point last week to combat soaring inflation. The hike was the second so far this year.

The jump in rates also comes amid a heated national debate about student loan forgiveness. Some 40 million Americans cumulatively owe $1.59 trillion in student loans, according to data released this week by the Federal Reserve Bank of New York.

Payments on federal student loans have been paused, and interest rates set to 0%, since the beginning of the pandemic , but many Americans and progressive lawmakers are pushing for President Biden to cancel a portion of student debt via an executive order. Its not yet clear what Biden plans to do, but heres everything we know so far.

Compare Student Loan Rates

If youre borrowing loans to pay for college, it is always a good idea to compare current interest rates in the federal student loan program against private student loans. This is particularly true when it comes to the PLUS Loan program. Whether you are a graduate/professional student, or a parent looking to borrow on behalf of your son or daughter, interest rates for a Direct PLUS Loan are typically higher than other loan types. And they come with an origination fee.

In comparison, private student loans can be highly competitive with lower rates and zero origination fees. Since both loans do require a credit check, if you are eligible for a loan with a lower rate and better terms, it may be worth taking the time to shop around.

Also Check: How Can I Get 20000 Loan

How To Calculate How Much Interest You Will Owe

Every month, the interest amount you owe on your loan is recalculated using a daily interest formula based on your total outstanding loan amount:

Interest amount = Outstanding principal balance x Number of days since last payment x Interest rate factor

The interest rate factor is your annual interest rate divided by the number of days in the year. Your loan servicer is responsible for billing you monthly and explaining how your payments are applied to the principal balance.

You can use our student loan payment calculator to see how much your loan will cost in the long run.

If you apply for forbearance or deferment or sign up for an income-driven repayment plan, your loans will accrue more interest over time, increasing the total interest paid.

> > Read More:How Student Loan Interest Works

Interest Rates On New Federal Student Loans Going Up For 2022

- NerdWallet | Special to cleveland.com

Two years ago, federal student loan borrowers enjoyed the lowest interest rates ever on their loans. This fall, rates for undergraduate borrowers will be nearly double what they were in 2020-21.

The interest rates for new undergraduate direct federal student loans are set to increase to 4.99% for the 2022-23 academic year, up from 3.73% last year and 2.75% in 2020-21. The interest rates on graduate direct loans are also set to increase to 6.54% parent and grad PLUS loans will rise to 7.54%.

Since the new interest rates go into effect beginning July 1, any new loans taken out before then will carry the interest rates from the 2021-22 academic year.

2021-22 interest rates

7.54%.

Rising rates make college more expensive

Higher interest rates mean paying off loans will be more costly. For a dependent first-year undergraduate student, a $5,500 loan the maximum this student could borrow will cost $6,997 over the standard 10-year repayment term with an interest rate of 4.99%. At the 2020-21 rate of 2.75%, this loan would cost $6,297.

Those taking on graduate direct and PLUS loans will see the cost of borrowing swell even more. On top of higher interest rates, PLUS loans carry an origination fee of 4.23% and dont have any borrowing limits.

For undergraduate direct loans, 2.05 percentage points are added to the interest rate graduate student loans have 3.6 points added and 4.6 points for PLUS loans.

More From NerdWallet

Also Check: Usda Loan Forgiveness Update 2022

Is It Possible To Lock In The Lower Rate

If youre looking for student loans to cover your Fall 2022 term, its too early for you to borrow your federal student loans and therefore unable to lock in the lower rate. There are strict rules colleges must follow, and they essentially must wait until almost the start of your term to disburse your federal student loans.If your college term starts on or after July 1, 2022, your loans will likely have the 2022-2023 award year rates.

The Benefits Of Refinancing Student Loans

refinancing student loans can be a great way to get a lower interest rate and potentially save money over the life of the loan.

refinancing student loans can also improve your credit score, since the loan is now considered more responsibly managed.

there are a few things to keep in mind when refinancing student loans:

Make sure you understand the terms of the loan refinance, including what interest rate you are getting and how long it will be for. Before refinancing, make sure you have saved enough money to cover any potential cost of the refinance, such as closing costs or fees. If youre planning to refinance your federal student loans, be aware that you may need to provide additional documentation such as your income tax returns or pay stubs.

You May Like: Where Do I Get An Fha Loan

Student Loan Refinance Rates

If you already have student loans and are looking for better rates, refinancing could be a good option for you. However, if you plan to refinance your federal student loans, first consider the benefits you would be giving up, including income-driven repayment plans and student loan forgiveness. Still, you can explore student loan refinance lenders to see what would make the most sense for your student loans.

Keep in mind that interest rates are largely determined by your credit score, which indicates your ability to pay back the loan. If your credit score is not very high, you won’t qualify for the lowest rates available and should consider working to improve your credit score before applying or using a cosigner. Below, we’ve listed some of the best student loan refinance lenders and their rates.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

How The Feds Latest Interest Rate Hike Could Affect Your Student Loans

While federal student loan borrowers likely wont notice any changes to their loans, those with variable-rate private student loans could see increased loan costs.

Edited byAshley HarrisonUpdated August 16, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

The Federal Reserve again raised its benchmark rate by 75-basis points on July 27, 2022. The last increase, also 75-basis points, was on June 15. The rate will now range from 2.25% to 2.50%. The last time the Fed made a 75-basis point hike was 1994. The increase is the Feds answer to calm the market and curb inflation.

With federal student loan payments set to resume on Dec. 31, 2022, and the Fed expected to raise the rate again multiple times this year, you might be wondering how the rate hikes will affect your student loans.

Heres what you should know about how these higher interest rates affect student loans :

Don’t Miss: What Interest Rate For Used Car Loan

Should You Borrow Private Student Loans

There are cases where private student loans can be beneficial. For example, private loans typically come with higher borrowing limits, so if you max out your federal loan options you can still secure money for college by applying for private student loans.

Highly qualified borrowers may also find better deals on the private market. Graduate students and parents of undergrads face the highest interest rates and origination fees on federal loans. If you have a healthy financial history, you could potentially qualify for lower rates and fees with private student loans.

But be sure to weigh any savings with the loss of federal student loan perks. If you later have trouble repaying your loans, a private lender may not do as much to help you.