Good Debt Income Ratio For Car Loan

This post may contain affiliate links. Which means we may earn a commission if you decide to make a purchase through our links. Please read our disclosure for more info.

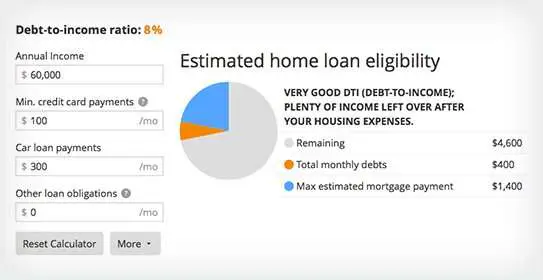

Your debt-to-income ratio is one of the things lenders use to measure your capacity to repay the amount of auto loan you wish to borrow. Its a percentage of your income thats allocated for paying off your debt. So you may be wondering if you can get a car loan if you have a high DTI ratio.

Yes, you may still qualify for a car loan even if you have a high debt-to-income ratio. Theres no rule or a maximum ratio set for auto loans. It varies among lenders. But according to a study conducted by RateGenuis, 90% of the approved auto loans generally had a ratio of 48% or less.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100.In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Is 47 A Good Debt

Debt to income ratio is the amount of monthly debt payments you have to make compared to your overall monthly income. Generally, a DTI below 36 percent is best. For a conventional home loan, the acceptable DTI is usually between 41-45 percent. For an FHA mortgage, the DTI is usually capped between 47% to 50%.

You May Like: What Do Mortgage Loan Officers Do

How To Improve Dti Ratio For A Better Chance Of Car Loan Approval

If you have a high debt-to-income ratio, its better to improve it first to increase your chances of getting approved for a car loan. Here are some tips:

- Review Your Expenses

Check your expenses first. Create a list of all your monthly debt payments. For example, your rent or mortgage, credit card debt, student loans, and property taxes. Evaluate all your monthly expenses including your gym memberships, groceries, Netflix subscription, internet, and cable bills those that have automatic deductions are worth your careful review. Decide which ones you can do without and be disciplined enough to take the corrective action required. .

- Lower Your Debt

There are different ways to pay down your debts. You can use the snowball method wherein you concentrate your payment efforts toward your smallest debt first or the avalanche method where you make minimum payments on all your debts, including your mortgage, except the one that has the highest interest rate.

- Increase Your Gross Monthly Income

You can increase your gross monthly salary by finding a job that pays more or asking for a raise if you think you deserve it. But if these options are not possible, you can also get a part-time job.

- Create A Budget And Stick To It

Budgeting helps you avoid overspending and making unnecessary purchases. It will also allow you to set aside money for debt repayments.

- Consider Refinancing Your Loans

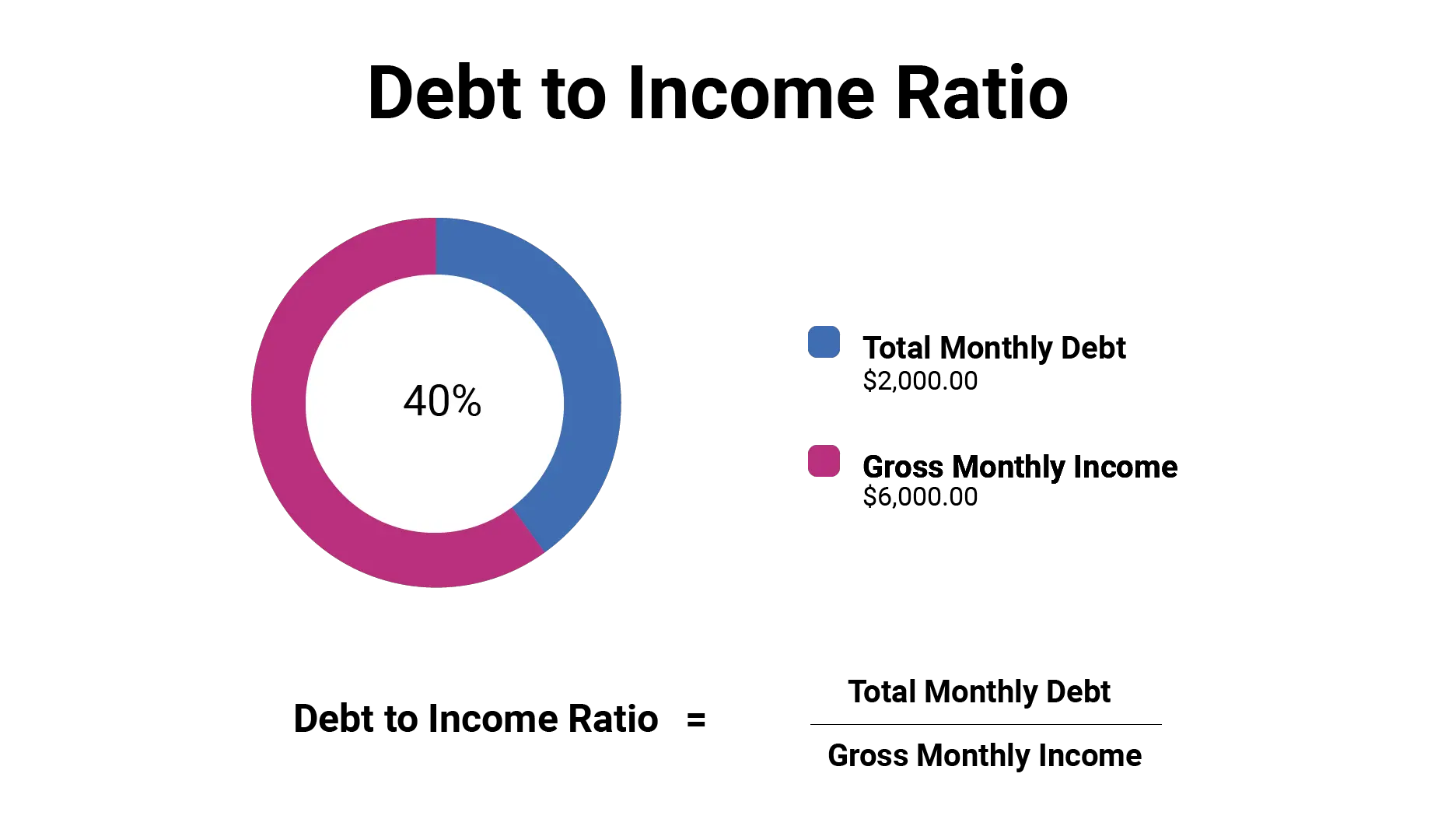

How Do I Calculate My Debt

Heres the simple formula you can use to calculate your DTI ratio.

Recommended Reading: How Do Mortgage Loan Officers Make Money

Other Factors For Qualification

Once you’ve determined that you have a qualifying debt to income ratio, you can breathe a sigh of relief on the income aspect of getting an auto loan. Even though income is a big part of qualifying, it’s just one of the items lenders look at with credit-challenged consumers.

In addition to having a qualifying income, you also need to meet the employment requirement, make a down payment, provide a list of personal references, and provide proof of residence, identification, and a working landline or contract cell phone in your name.

When a borrower is struggling with credit, these factors help a lender get the whole picture and determine their ability, stability, and willingness to successfully complete a car loan.

If you’re on the fence in terms of DTI, minimum income amount, or credit score, a lender may require you to make a higher down payment or ask that you add a cosigner or co-borrower to your loan.

When You Apply For A Loan Like A Mortgage Auto Loan Or Personal Loan Lenders Often Want To Know How Much Debt You Have Compared To How Much Money You Earn In Other Words They Want To Know Your Debt

Your debt-to-income ratio, or DTI, is a calculation of your monthly debt payments divided by your gross monthly income.

Lets take a look at how to calculate your debt-to-income ratio, learn why your DTI matters, understand what a good debt-to-income ratio looks like and how to lower your DTI ratio.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What Is The Ideal Debt

The lower the debt-to-income ratio, the better. A lower ratio suggests that you have enough earnings to cover your debt. Typically, a percentage of 36% or lower is ideal, but you may have a higher ratio and still get approved. For example, CashUSA.com can connect you to a lender that offers personal loans for applicants with a high ratio.

Theres no official law that determines what is a bad or good ratio for car loans. But lenders follow some general rules of thumb when evaluating the DTIs of applicants.

- 35% and below Applicants with this DTI reflect healthy finances and a manageable level of debt. They most likely have enough money left for spending and saving after paying off their current debt.

- 36% 43% Applicants with DTIs that fall between these ranges can still manage their debt but may come up short in case unexpected changes happen to their financial situation.

- 44% 50% Applicants with a DTI ratio of more than 43% will find it difficult to get approved for financial assistance. If your DTI ratio is within this range, consider getting a debt management program to improve your number and creditworthiness.

- Above 50% A DTI above 50% is considered a red flag. You will struggle to find a lender that will accommodate your loan application. Not only that, youll be at risk of suffering a financial crisis. It may be prudent to seek some financial advice or budgeting services if you are in this category.

Looking For Help To Manage Your Debt Compare Debt Relief Companies

My personal loan application was rejected because of my DTI. What do I do?

If you dont need the loan right away, consider holding off on reapplying until youve taken steps to improve your DTI. Showing that you can repay your loan is one of the most important factors to a reputable lender.

If its an emergency, consider applying for a short-term loan, which often comes with more lenient eligibility requirements. Keep in mind theres no guarantee youll be approved for a short-term loan either. Even if you are approved, you could end up with astronomical interest rates that can send you into a debt spiral if youre unable to make your repayments on time.

Also Check: Does Va Loan Work For Manufactured Homes

How Does Dti Ratio Differ From Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month.Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, to the calculation.Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Recommended Reading: Mlo Endorsement To A License Is A Requirement Of

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

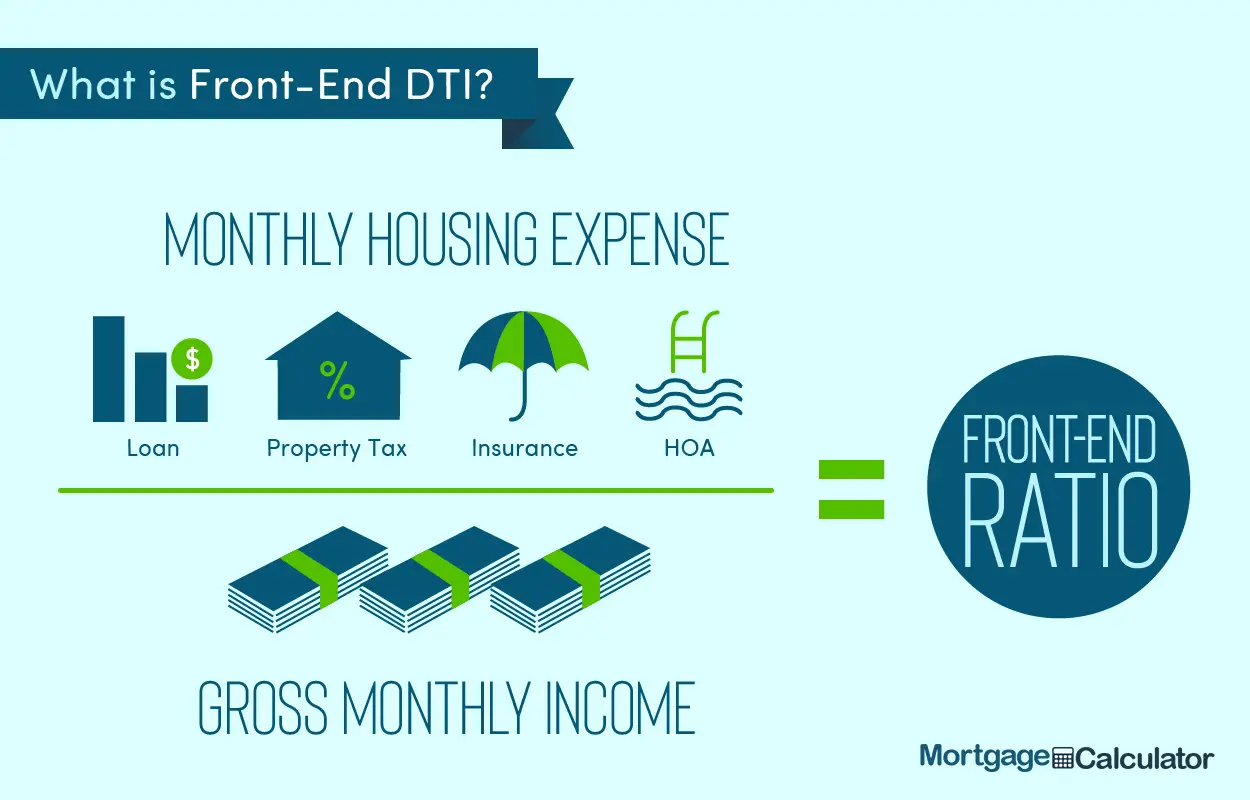

What Is The 28 36 Rule

A critical number for homebuyers. . One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldnt be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income ratio.

You May Like: Credit Score Needed For Usaa Personal Loan

How Can I Improve My Dti Ratio

OK, so you now know what a DTI ratio is, but how do you calculate and improve it? Determining your DTI ratio is easy. All you have to do is add up all your regular monthly bills plus an estimated auto loan and insurance payment, and divide the total by your pre-tax monthly income.

So, for example, if you make $1,900 a month before taxes, and your monthly bills plus an estimated car and insurance payment all add up to $750, your DTI ratio would be 40%.

If you calculate your DTI ratio, and the percentage is closer to or above 50%, the best way to improve your DTI ratio is to pay down as much debt as you can. Amounts owed makes up 30% of your FICO credit score , and although you may be paying your bills on time each month, the debt remaining could be bringing your credit score down and affecting your DTI ratio.

A common issue consumers are faced with is credit card debt. Its easy to fall into, and it can greatly affect your DTI ratio and credit score. If you have high credit card balances, you should work to pay off these or reduce the debt owed as best you can. The less you owe, the lower your DTI ratio is going to be, and the better your chances are of getting approved for a bad credit auto loan.

Is Car Insurance Included In Debt

Lenders consider as debt any mortgages you have or are applying for, rent payments, car loans, student loans, any other loans you may have and credit card debt. For the purposes of calculating your debt-to-income ratio, insurance premiums for life insurance, health insurance and car insurance are not included.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Debt To Income Ratio: What Is It

Your debt to income ratio helps a lender determine if you have enough available income to afford a bad credit auto loan. Shown as a percentage, this is a calculation you can do yourself. Having a DTI ratio that falls within the lenders range is important when applying for a car loan if your DTI ratio is too high, you may not qualify.

Ideal Dti For Auto Loans

Your DTI represents your monthly income that goes toward paying the debt you owe, expressed as a percentage. Auto lenders routinely use the DTI to figure out the amount of loan you can handle after all your other monthly debts are paid. Typically, lenders want your DTI to be no more than 36 percent, inclusive of your monthly obligation for the auto loan you are seeking.

Don’t Miss: Usaa Car Financing Calculator

How Do You Calculate Your Debt

Now that you know what a debt-to-income ratio is, how do you go about calculating it? Thankfully, it is a fairly simple process and shouldnt take you that long at all to figure out. It is calculated by dividing the debt payments you make each month by how much money you make each month, the number is normally presented as a percentage.

For example, if you make $4,000 a month and have debt that includes a $1,000 mortgage payment and a $500 car loan payment, you will have a debt-to-income ratio of 37.5%. So, the calculation we made for that was $1,500 divided by $4,000 . We got .375, and then we turn that number into a percentage and get 37.5%!

But the question you are probably asking is what does that number mean? If you have a low DTI ratio, you have a good balance between debt and income and are in no real danger of not being able to keep up with your debt, even if an emergency comes up. However, if you have one that is high, it can sometimes signal that you are carrying too much debt for how much money you are making. Also, having a high DTI ratio can simply make it hard for you to pay bills every month with so much of your income going to your debt payments.

Is your car loan payment worth more than your car? Heres what to do.

What is a Good Debt-to-Income Ratio?

Interested in getting serious about paying down your debt? Check out this infographic.

Why Is The Debt To Income Ratio Important

Before we get into how to improve your DTI ratio, you should know why its important. Lenders debt you out to make sure you can comfortably afford an auto loan, and set limits on how much debt youre allowed to have.

Believe it or not, lenders want to see you successfully complete a car loan, and calculating your DTI ratio helps the lender feel confident in your ability to pay it off. Plus, it helps you determine your budget, so you should calculate it at home beforehand to be more prepared.

Just how much debt youre allowed to have varies by lender. However, most bad credit lenders generally cap the maximum allowed DTI ratio at 45% to 50%. The lower the percentage, the better off you are.

Read Also: How To Get Loan Originator License