Can I Borrow A Mortgage That Is Worth Five Times My Salary +

This is rather very unlikely. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half times your annual gross income. Ultimately, your maximum mortgage eligibility is calculated by weighing your income against your debts, purchase price of the house, your down payment, the mortgages interest rate as well as property taxes and insurance.

What Other Factors Determine How Much House I Can Afford

Beyond the price you offer to pay and the amount you have for a down payment, there are other expenses involved in home-buying, as well, including:

- , which can include recording fees or transfer taxes in your location as well as fees charged by your lender and lawyer

- , which often have to be set aside in escrow and are added to your monthly mortgage payments

- Homeowners insurance, which also can be paid through escrow

How Much House Can I Afford

Your house will likely be your biggest purchase, so figuring out how much you can afford is a key step in the home-buying process. The good news is that coming up with a smart budget is pretty straightforward and not too time-consuming especially with the Bankrate Home Affordability Calculator.

Don’t Miss: Usaa Boat Loan Credit Score

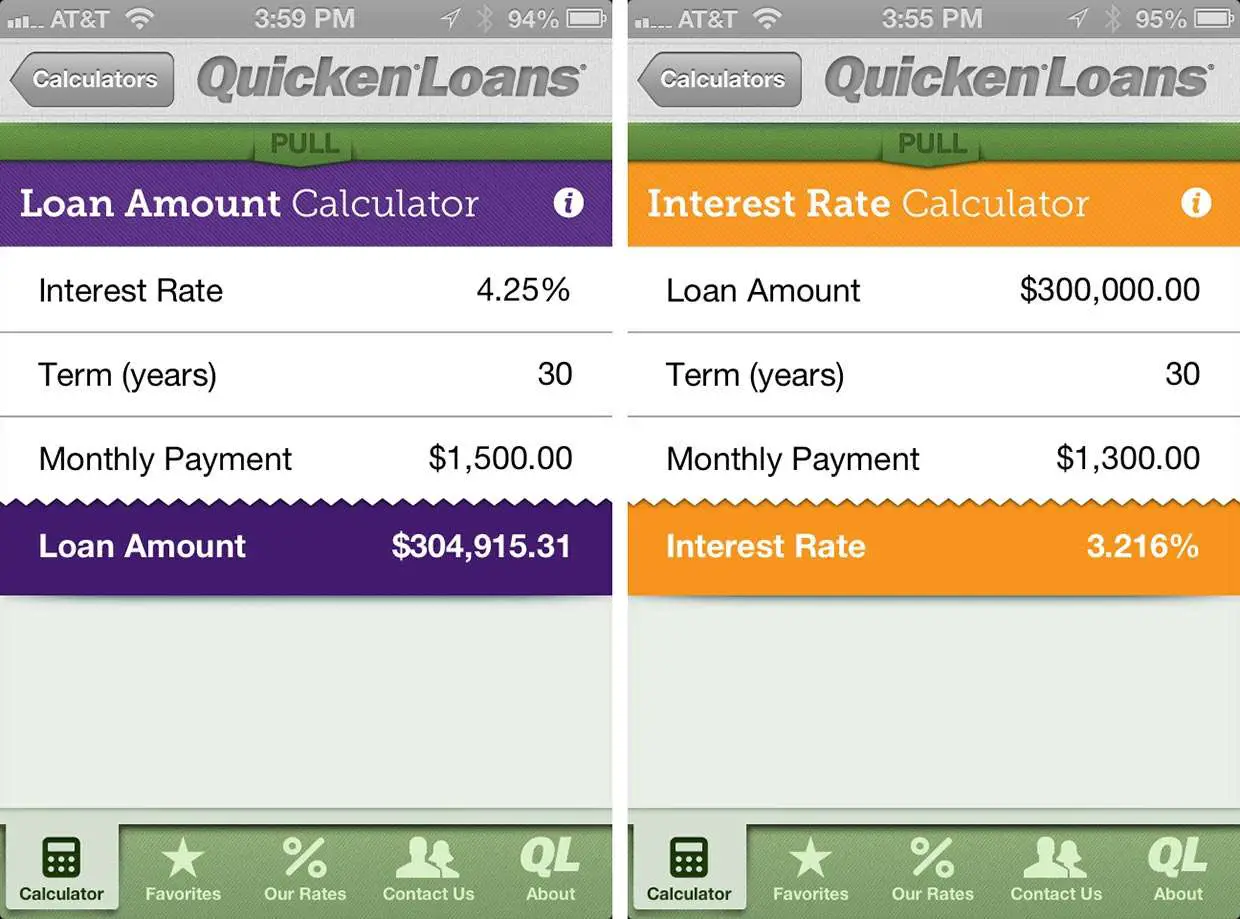

The Bottom Line: Mortgage Calculators Can Help You Decide How Much House You Can Afford

Mortgage calculators are great for giving you an estimate of what you might expect when purchasing or refinancing a home. While not an official qualification, the act of using a calculator is a nice starting point.

If youre ready to take the next step and get started, you can do so online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowners income and the typical local home value.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Also Check: Usaa Car Loans Bad Credit

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your interest payments:

- The mortgage interest rate. This is the rate at which the bank charges you interest on the loan. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The federal funds rate. The interest rate on your loan is loosely tied to the federal funds rate set by the Federal Reserve, which dictates the rate at which banks lend money to each other overnight. If you have a variable interest rate, paying attention to the federal funds rate can help you predict what your interest rate will do.

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.

You May Like: 650 Credit Score Interest Rate

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

You May Like: Carmax Loan Approval

My Result Came Out Higher Than The Amount I Wish To Borrow What Now

Now that you have ascertained that you are in a strong enough financial situation to sustain the purchase of your desired property, you need to set about getting in touch with some mortgage providers.

Fortunately, we have made this process very easy for you. Simply click the Get FREE Quote button and you will be taken through a very brief set of questions. We will then ask our carefully selected lenders to contact you directly with the very best quotations they can provide. By reaching out to lenders this way, you get the best deal possible and are saved the effort of contacting them yourself it couldnt be simpler!

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Also Check: Usaa Used Car Loan Calculator

What Credit Score Do I Need To Buy A House

Credit scores do not factor into the mortgage calculator directly, but they have a major influence on the interest rate charged on your loan. are designed to predict your likelihood of defaulting on a loan, or going 90 days without making a payment. People with lower credit scores are statistically more likely to default than those with higher credit scores. A widespread lending industry practice known as risk-based pricing typically assigns higher interest rates to loan applicants with lower credit scores and reserves the lowest rates for applicants with high credit scores.

Lenders make their own determinations, based on prevailing interest rates and their own lending strategies, when deciding which credit scores ranges they will assign which interest rates. Because each lenders approach is different, its prudent to apply to multiple lenders when seeking a mortgage, because some may offer you a lower interest rate than others.

How Much Income Is Needed For A 200k Mortgage +

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

You May Like: Reloc Line Of Credit

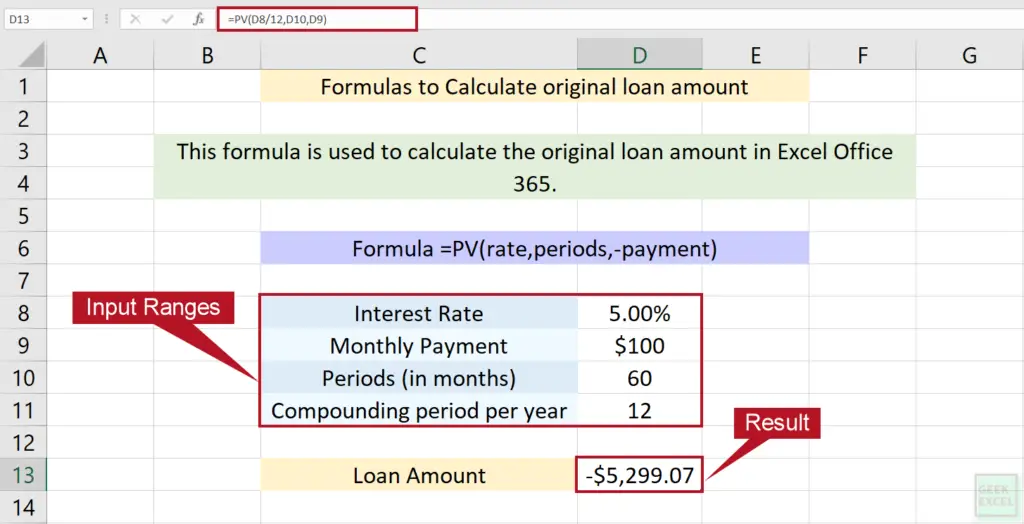

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

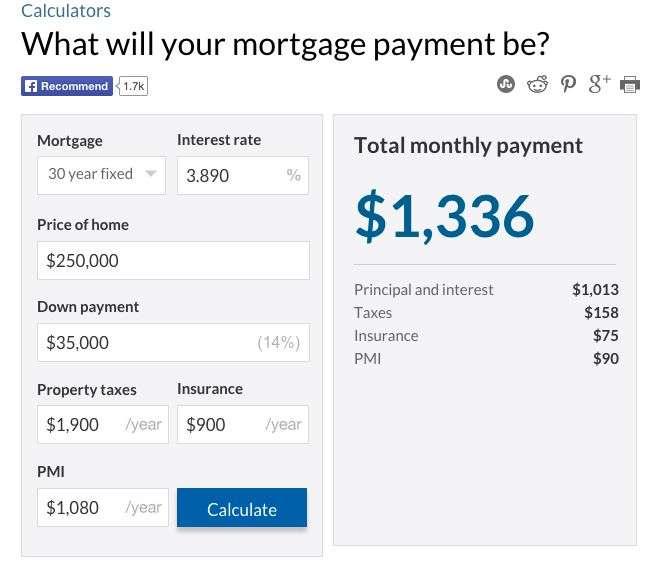

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Read Also: My Car Loan Is Not On My Credit Report

Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Also Check: How Does Usaa Auto Loan Work

How To Lower Your Monthly Mortgage Payment

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

How Much Will A Bank Lend On A Property

Generally, we can expect a lender to lend up to 80% of the value or price of a house .

Often, lower percentages are loaned on properties outside urban areas and on apartments. These figures are sometimes called the loan to value ratio, or LVR.

It is possible to borrow up to 95% of a propertys value in some cases. But thats a big risk for both the borrower and the lender.

You may face two extra costs when borrowing a high proportion of a propertys value:

Talking to one or more lenders or to a local mortgage broker can give a good idea of the lending limits for the types of property you want to buy and the area you want to buy in.

Dont Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Read Also: Current Usaa Car Loan Rates

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Don’t Miss: Leads For Loan Officers

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Mortgage Interest Compounding In Canada

Mortgage interest in Canada is compounded semi-annually. This means that while you might be making monthly mortgage payments, your mortgage interest will only be compounded twice a year. Semi-annual compounding saves you money compared to monthly compounding. Thats because interest will be charged on top of your interest less often, giving interest less room to grow.

To see how this works, lets first look at credit cards. Not all credit cards in Canada charge compound interest, but for those that do, they usually are compounded monthly. The unpaid interest is added to the credit card balance, which will then be charged interest if it continues to be unpaid. For example, you purchased an item for $1,000 and charged it to your credit card which has an interest rate of 20%. You decide not to pay it off and make no payments. To simplify, assume that there is no minimum required payment.

The same applies to mortgages, but instead of monthly compounding, the compounding period for mortgages in Canada is semi-annually. Instead of adding unpaid interest to your balance every month like a credit card, a mortgage lender is limited to adding unpaid interest to your mortgage balance twice a year. In other words, this affects your actual interest rate based on the interest being charged.

Read Also: How Many Aer Loans Can I Have