If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

What Does Student Loan Interest Mean To Me

Putting off payments or just making the minimum each month will leave you with a big interest cost over the life of your loan.

Use your new knowledge of how to calculate student loan interest on a loan and how compound interest works to pay off your loans early.

You work hard for each paycheck. Pay more today so you can save even more later.

Andrew Pentis, Eric Rosenberg and Christy Rakoczy contributed to this report.

Current Interest Rates For Private Student Loans

Private student loans offer fixed interest rates and variable interest rates. Variable loans have a fluctuating rate which can go up or down based on market conditions.

Current interest rates on private student loans are at historic lows. Fixed rates are as low as 3.49%, and variable rates are as low as 1.05%.

Fixed rates on private student loan refinance have decreased to as low as 2.97%, and variable rates have dropped to 1.61%.

The government does not set the interest rate on private student loans. Instead, private lenders set their rates, which can vary depending on the loan you take out. Thats why its important to compare private lenders before you borrow a private student loan.

Interest rates on private student loans are all credit underwritten. That means borrowers will need to have a good credit score to qualify for the best interest rates. Unfortunately, many students have very little credit history, which means they could end up paying more in interest. Private student loans may also require a cosigner if you dont have steady income and solid credit.

Want to see how much you will pay for a student loan next year? Use our student loan calculator.

Don’t Miss: Bayview Loan Servicing Class Action Lawsuit

When Do Student Loan Rates Increase

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Student loan rate increases are a daunting possibility for students planning on borrowing federal student loans each year. But unfortunately, student loan interest increases can be par for the course.

Federal student loan interest rates for the 2021-2022 school year have increased slightly from the 2020-2021 rates. If youre worried about an upcoming student loan rate increase, and wondering if the federal government might be raising student loan interest rates in the coming years, read on for more information.

Theres no way to know for sure what will happen with federal student loan interest rates in the long term, but it could help to know the landscape, understand how the rates have gone up in the past, and look at whats being proposed for the future.

The more you know, the more prepared you can be if you need to borrow another student loan.

Key Terms In This Story

Fixed interest: An interest rate that does not change during the life of a loan. All federal student loans have fixed interest rates, but private loans can offer fixed or variable interest rates. Fixed interest is the safer option because you dont have to worry about your rate and payment increasing.

Refinance: The process of swapping out your current student loans for a new private loan with more favorable terms, like a lower interest rate. Refinancing can help save you money on your loan and can be right for people with stable finances.

A student loan is money you borrow from the federal government or a private lender to help pay for college costs, like tuition, supplies, books and living expenses. Federal student loans typically have lower interest rates and more flexible repayment options than private loans. Borrowers should exhaust student loans from the federal government before applying with private lenders.

Variable interest:Variable interest rates can change monthly or quarterly depending on the loan contract and come with rates caps as high as 25%. Variable interest loans are riskier than fixed interest loans, but can save you money if the timing is right.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

You May Like: Becu Auto Loan Payoff

Will Overpaying Actually Make Any Difference

For overpaying to have any impact you need to repay enough that it’d lower the amount you repay within the 30 years. Here’s an example to explain the concept .

Let’s imagine you’ve built up £10,000 in savings and after a few years you use that to reduce your outstanding student loan balance, because you’re worried about the ‘interest building up’.

As you can see in this case, overpaying £10,000 makes absolutely no difference to your repayments over 30 years, so paying it has no gain for you whatsoever.

In fact, someone recently contacted me who’d done just this on receiving an inheritance. A year after she lost her job, had read this article and realised it was a futile act, and she won’t gain at all from overpaying. She contacted me to ask if she could reclaim her cash. Sadly, I had to say no.

Thus overpaying is just throwing money away as it won’t reduce what you pay. And that’s likely to be the case UNLESS you’re…

a) A high earner, likely to clear the loan and interest in less than 30 years. Use the MSE student loan calculator to get an idea of whether you’re likely to be in this category.

b) Someone overpaying a very large lump sum, which’ll radically reduce the amount owed, so you can clear it within the 30 years or even clear it entirely straightaway.

If these don’t apply, overpaying the loan won’t save you any money. So don’t do it .

From here on I’ll assume overpaying is likely to reduce your actual payments over 30 years.

Do These Interest Rates Apply To Private Student Loans

No, these student loan interest rates only apply to federal student loans. Private loans have separate interest rates, which are set by the lender from which you borrow. Importantly, you should check if your private loans have a variable interest rate. If so, your student loan interest rate on your existing student loans could change as interest rates change.

Read Also: How To Reclassify A Manufactured Home

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

Federal Student Loan Interest Rates

Federal loan borrowers who took out the same type of loan in a given year have the same interest rate. The federal student loan interest rate for loans disbursed between July 1, 2020, and July 1, 2021, are as follows:

| Loan Type |

Disclaimer: The College Finance Company works hard to keep information listed on our site accurate and up to date. The information provided on CollegeFinance.com may be different than what you encounter when you go to the website of a financial institution, bank, loan servicer or a specific product page on a different site. When evaluating any offers, please review the legal pages on the other partys site. Product name, logo, brands, and other trademarks featured or referred to within CollegeFinance.com are the property of their respective trademark holders. Information obtained via CollegeFinance.com is for educational purposes only. Always consult a licensed financial expert before committing to any financial decision.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Should You Take Out A Student Loan Now

With federal student loan rates at record lows, now might be the best time in history to take out a student loan. Always exhaust all your options for federal student loans first by using the Free Application for Federal Student Aid form, then research the best private student loans to fill in any gaps. Whether you choose federal or private loans, only take out what you need and can afford to repay.

Try to take out no more in student loans than what you expect to make in your first year out of school.

If you have private student loans, this may be a great time to refinance. All of the best student loan refinance companies are offering competitive rates and can cater to unique debt situations.

Other Ways To Make Money

Its tempting to think that a part-time job is the only way to actually earn extra money while at uni. But that couldnt be further from the truth.

There are hundreds of weird and wonderful ways to make money at uni , including setting up your own business, using paid online survey sites and even selling your old stuff.

In fact, there are even a fair few ways to earn free money too. Thats the dream, right?

The moral of the story is: if you have a brainwave and think youve found an ingenious way to make money, go for it! As long as its within the confines of the law, of course

Recommended Reading: Does Va Loan Work For Manufactured Homes

How Interest Accrues On Student Loans

The interest on your student loan begins to accrue on the first day we disburse your loans funds to you or your school. It continues to accrue until youve paid off your loan. The interest rate for your loan is listed in your disclosure documents and billing statement. This is the same for both Federal Direct Loans and private student loans.

Youre Looking For Lower Initial Payments

Another benefit of a variable rate student loan is that with a lower initial rate, you also have lower monthly payments.

With the typical savings of 1.25% on a variable rate student loan, monthly payments will be about $10 to $12 less per month for each $10,000 of the loan.

There are plenty of recent college graduates who have entry-level pay now. However, they may expect big increases in pay in the years to come.

On average, workers see big wage growth in their 20s. Most 30-year-olds are earning 60% more than their entry-level pay, according to a PayScale survey.

If this sounds like you, a variable rate student loan can help you get lower monthly payments now. This is great if you need low monthly bills ASAP.

Just make sure youre staying on track to earn pay increases. This will help offset the risk of monthly student loan payments becoming unaffordable if your variable rate increases.

Don’t Miss: Fha Loan Limits Texas

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

How To Compare Loans For Students

To decide on which loan is the right fit for you, it can help to look into some of the following factors:

- Lowest rates. Low interest rates are the number one factor you should look for with your student loan. Government loans usually charge around 6.59% while private loans can fluctuate depending on the lender.

- Best repayment terms. Look for a lender that has measures in place to help you if you cant make repayments on time for some reason. For example, government loans will often offer repayment assistance plans to reduce your payments if you make below a certain income.

- No fees. If your lender asks you to pay fees on your loan, chances are you should keep looking for a better offer.

- Good customer service. If you opt for a private loan, then make sure the lender you settle on has a good reputation and solid online reviews.

Don’t Miss: Becu Auto Smart

How Are Student Loan Interest Rates Calculated

Federal student loan interest rates for the fall are determined by the 10-year Treasury note auction every May, plus a fixed increase with a cap.

- Direct Unsubsidized Loans for undergraduates 10-year Treasury + 2.05%, capped at 8.25%

- Direct Unsubsidized Loans for graduates 10-year Treasury + 3.60%, capped at 9.50%

- Direct PLUS Loans 10-year Treasury + 4.60%, capped at 10.50%

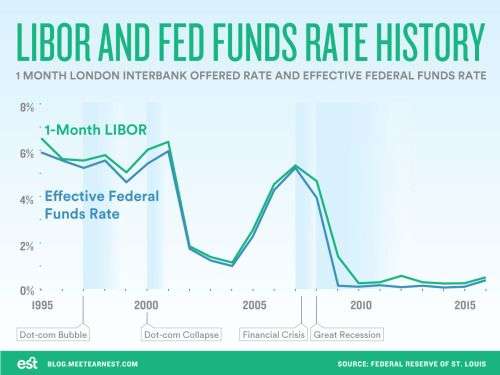

Private student loan interest rates are determined by each lender based on market factors and the borrowers and cosigners creditworthiness. Most private lenders also offer a variable interest rate, which typically fluctuates monthly or quarterly with the London Interbank Offered Rate .

While federal student loans dont take into account and income, these factors play a big role in private lenders decisions. Students who dont meet lenders credit requirements will need a cosigner. The 2017 Annual Report of the Consumer Financial Protection Bureau Student Loan Ombudsman noted that more than 90% of private student loans are made with a cosigner. However, even if you dont have a good credit score or cosigner, there are lenders who offer student loans for bad credit and student loans without a cosigner.

How Does A Variable

Lenders cant just change a student loan interest rate whenever they want. Rates can only go up or down if an index rate moves.

When it comes to student loan interest rates, there are two basic options: Option one is a fixed-rate loan, where the interest rate does not change over the life of the loan. Option two is a variable-rate loan.

The advantage with variable-rate loans is that the interest rates start much lower than they do on a fixed-rate loan. The risk with the variable-rate loan is that it can go up. Generally speaking, the longer the loan repayment length, the more dangerous it is to go with a variable-rate loan.

Don’t Miss: How To Calculate Amortization Schedule For Car Loan

What If I Cant Afford Repayments

When life happens and unexpected circumstance hurt your ability to pay back your loans, you have options especially if you have government student loans. Making payments on time and in full is key to maintaining a good credit score, which helps you in many areas of life like getting a car, buying a home, supporting a family and travelling.

1. Negotiate a better repayment plan with your lender

One surprisingly effective but easily overlooked solution to managing debt is to contact your lender, explain that youre struggling financially and ask if theyll agree to a new payment arrangement thatll help you meet your obligations. Be sure to explain any specific factors or circumstances affecting your ability to pay .

Lenders would rather work with you than risk losing money, so you may be offered an extended term with lower monthly payments, a different interest rate, permission to make a late payment without penalty, deferred payments or some other solution. By doing this, you could protect both your wallet and your credit score.

2. Refinance your student loans

One drawback is that student loans already tend to come with lower interest rates than most credit products, so it may be difficult to find a loan that lets you save money. However, if you have non-student debt such as credit cards, car loans, personal loans or mortgages, refinancing those could save you money on interest, which can then be applied to your student loans.

3. Government repayment assistance plans

Faq: How Many Times Can You Refinance Student Loans

Jul 10, 2021 Further, student loan refinancing typically does not cost much, if anything. Many lenders do not charge application or origination fees. Note

Jun 2, 2021 There is no limit to the number of times you can refinance your student loans. As long as you are eligible, you can choose to refinance again

Apr 6, 2020 When it comes to refinancing student loans, theres no rule that says you can only refinance once. In fact, you can refinance student loans

Don’t Miss: How Do I Find Out My Auto Loan Account Number