Wells Fargo Auto Loans Features And Benefits

There are some perks to consider when financing with Wells Fargo. If you find yourself without the funds for a down payment, Wells Fargo allows those who qualify to completely finance your vehicle without any initial cost or down payment.

Additionally, Wells Fargo helps people with lower credit scores finance their vehicles.

What Sets It Apart

Wells Fargo used to offer a wider range of financing than most banks. In addition to dealership financing, you could also get a loan for a private party purchase or even refinance a current Wells Fargo auto loan for a better rate.

But this bank appears to be phasing out its car loan program in response to COVID-19. Many banks consider personal financing to be too risky. Its possible Wells Fargo will offer even fewer auto financing options in the future or none at all.

Compare our top picks for car loan providers for more options.

What People Are Saying About Wells Fargo

As of Sept. 12, 2022, Wells Fargo has a 1.08-star rating based on 622 customer reviews through the Better Business Bureau and a 1.3-star rating on Trustpilot based on 793 reviews. Reviews are overwhelmingly negative and generally focus on the companyâs poor customer service. Note, however, that online reviews of Wells Fargo are primarily related to the bankâs other financial productsânot auto loans since those are offered indirectly.

Some reviews mention that, since Wells Fargo customer service can only be reached via phone, this limited availability makes it difficult to contact a representative. That said, the lender has a frequently asked questions page on their website that includes answers to a number of topics about online account enrollment, fees, interest calculations, payments and other auto loan information.

Related:Auto Loan Payment Calculator

Recommended Reading: Va Loan With 500 Credit Score

Wells Fargo Auto Loans: Conclusion

Wells Fargo auto loan was rated 2.5 out of 5.0 stars by our review team due to its poor reputation and lack of a streamlined application process. Overall, sentiment around the companys car loan services is not good and we recommend searching elsewhere. When searching for the best auto loan for you we recommend getting together companies in a list and comparing your options before committing.

Below you can start comparing auto loan rates from multiple top lenders.

Who Has The Best Auto Loan Rates Credit Unions Banks Or Online Lenders

Trying to figure out who has the best auto loan rates can feel like an impossible task.

It is natural to want to use your local Credit Union or Bank because you feel loyalty to the financial institution that you trust with your monthly banking needs.

In some instances, going directly through your Credit Union or Bank can be your best bet. Your bank or credit union knows your finances and may consider information other than your credit score when they make an offer.

However, local Credit Unions and Banks may be limited in the loan programs they can offer. They may not be able to compete with the lowest online auto loan rates.

You also have to consider the time it takes to go to your local financial institution to obtain a quote for an auto loan. Online lenders may give you a quote in seconds.

Be Careful!Be careful if you get an auto loan from a Credit Union or Bank that you have a checking, savings, or CD account with. Some financial institutions require you to sign a document allowing them to take payment without your permission if you do not pay.

In comparison, you can obtain four loan offers within two minutes of filling out a short, one-page application with Auto Credit Express®.

Even if you decide to see what your bank or credit union has to offer, getting an online lender quote is free and takes next to no time.

Purchasing a car can be a stressful endeavor because of all the decisions you must make with that helpful high-pressure car salesman stuck to your hip.

Recommended Reading: Can You Give Your Va Loan To Your Child

What We Love About Wells Fargo Auto Loans

Wells Fargo offers flexible auto loans, giving you the option to buy a new or used car from a dealer or in a private transaction. This lack of restrictions makes it very easy for you to shop around to find the best deal on a car. Keep in mind that if you make a private transaction, you have to finalize the loan in-branch.

The banks loans are also flexible. You can choose a term up to 72 months and may not need to provide any down payment to secure the loan. Wells Fargo banking customers can also enjoy an interest rate discount that will save them money over the life of their loan.

Dont Miss: How Much Will The Va Home Loan Give Me

Wells Fargo Auto Loan Review

Auto loans for new and used vehicles are not available directly through Wells Fargo Bank. They have a Wells Fargo dealer services program that provides auto loan financing to over 11,000 dealerships across the United States. An ongoing problem for Wells Fargo Bank has been the seemingly endless embarrassing settlements of government lawsuits for shady business practices. One of these recent settlements involved customers being charged fees that were not in their auto loan contracts. Customer reviews complain of poor customer service, long hold times, and high-interest rate auto loans. Based on these issues and many more, wed recommend you consider a different company for your car financing needs.

Recommended Reading: Navy Federal Home Loan Credit Score

How Do Wells Fargo Auto Loans Work

Wells Fargo Offers new and used car loans with up to 100% financing, but there is a catch.

You can only apply for a Wells Fargo auto loan through an Affiliated car dealership instead of online or in person.

When you are shopping for a new car, ask the dealer if they are affiliated with Wells Fargo to ensure that you have access to the Wells Fargo auto loan program.

Otherwise, you will not be able to finance your new vehicle through Wells Fargo.

My Vehicle Was Damaged In An Accident Do I Still Need To Pay My Auto Loan Payment

Yes. You are responsible for making your regular monthly payments until the loan is paid off. You should contact your insurance company to begin the claims process.

If you have Guaranteed Asset Protection coverage on your loan, and your vehicle is a total loss, some or all of the balance after the insurance settlement is applied may be covered. If there is a remaining balance on the loan after the GAP payout is determined, you are responsible for making regular monthly payments until the loan is paid off. You can also make a one-time payment, if you prefer.

Read Also: What Is An In House Mortgage Loan

Is A Wells Fargo Auto Loan Right For You

Its hard to tell if Wells Fargo auto loans are a good fit until you apply. Currently, you wont be able to get an estimate of rates available until youre at the dealership. But it could be a good choice if youve already compared offers from other providers and found that Wells Fargo is a better deal than the competition when youre purchasing your car.

But you cant use Wells Fargo refinance your current car loan or buy a used car outside of a dealership.

How To Apply For An Auto Loan By Wells Fargo

Applying for a Wells Fargo auto loan is a simple process that can be completed in very little time. Wells Fargo has put in place an efficient online mechanism for auto loan applications and approvals.

All you have to do is to go online and apply for the auto loan and wait for a decision on your loan.

Read Also: What Do I Need To Apply For Personal Loan

Myautoloan: Most Popular Marketplace

An online marketplace, myAutoloan lets you compare offers from lenders in one place. The marketplace can help borrowers looking to refinance find rates as low as 1.99%. Those with bad or poor credit can refinance their vehicle loans through the site as long as they have credit scores of 575 or better.

Customer service ratings for myAutoloan are strong. The auto loan marketplace has an A+ rating from the BBB and is accredited by the organization. In addition, the company has a solid 4.3-star average rating from more than 800 customers on Trustpilot.

What To Do If You Get Turned Down

If you get turned down for a Wells Fargo auto loan, consider contacting the lender to determine the reason for denial. Sometimes loan applications are rejected because of inaccurate information or incomplete documentation. If this is the case, ask whether you can correct the error and resubmit your application. You can also ask about other financing options while at the dealership.

On the other hand, if your application was rejected due to a low credit score or insufficient income, take steps to increase your approval odds. This may involve paying down current loans or credit accounts to improve your credit score.

Ultimately, it may be necessary to choose a less expensive car that requires a lower loan amount. Alternatively, choose a lender that offers a prequalification process or imposes more transparent eligibility requirements. Keep in mind, however, that lenders with less rigorous qualifications typically impose higher auto loan interest rates.

Recommended Reading: What Credit Union Has The Best Auto Loan Rates

Best Personal Loan: Wells Fargo

Wells Fargo

For those who want an unsecured loan option, Wells Fargo is our pick for the best personal loan lender due to its available loan amounts, competitive rates, and rapid funding.

-

Borrow $3,000 to $100,000 without collateral

-

No origination fees

-

Loan terms between one and seven years

-

You must be an existing Wells Fargo customer to qualify for lowest-advertised rates

-

You may have to apply in person

-

Good to excellent credit required

Wells Fargo allows you to borrow up to $100,000 without any form of collateral. Wells Fargo loans have no origination fees, and there is no prepayment penalty.

If you are a Wells Fargo customer and have a checking or savings account with the bank, you can qualify for its lowest rates. Rates range from 5.74% to 20.99% with the relationship discount, and Wells Fargo has loan terms ranging from one to seven years.

You need to have good to excellent credit and proof of income to qualify for a loan. With Wells Fargo, you can apply for a loan online or over the phone if you have an existing Wells Fargo bank account. If you arent currently a Wells Fargo customer, you can still apply for a loan, but youll have to apply in person at a Wells Fargo branch. If approved, your loan will be disbursed in as little as one business day.

How Do I File A Claim Or Use My Aftermarket Product

Contact the coverage provider for information on how to file a claim or how to use the product their contact information is listed on the aftermarket product contract. Your coverage provider will let you know if they will reimburse you for expenses or if they will pay the expenses at the time a covered service is performed. They will also explain other conditions, such as requiring that the maintenance be performed at the dealership where you purchased the vehicle.

Read Also: What Is The Jumbo Loan Limit In Massachusetts

Best Car Loan Rates: Conclusion

You can find the best auto loan rates for you through banks, credit unions, online lenders, and dealers. There are also a variety of factors that affect your interest rates and many methods for you to get the lowest rates possible. We encourage you to look around and compare your options to find the best auto loan for you.

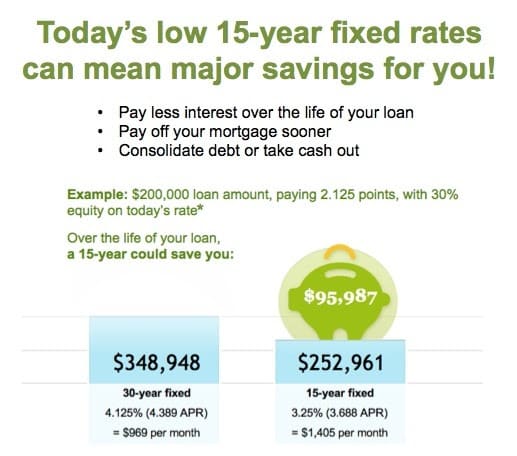

Raise Your Credit Score

You can do a few things to get a lower interest rate. For example, you can raise your credit score over a few months to a year if you work hard at it. Even 20 or 30 points can move you up a bracket and make a big difference in your auto loan options. You can also make a larger down payment to reduce your APR.

You May Like: Where Can I Get Personal Loan With No Credit

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. They function as a grade for your borrowing history ranging from 300 to 850, and include your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be.

A lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.40% | $656 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $656 a month, while a person with a score in the lowest category would pay $831 a month, or $175 more for per month for the same car.

I Don’t Remember Buying An Aftermarket Product What Should I Do

Ask the dealer for a signed copy of the aftermarket product contract. All purchased products require a signature. If the dealer is unable to provide a signed copy, you may be able to request a refund for the price of the product.

If you purchased Guaranteed Asset Protection , Credit Life Insurance, and/or Accident & Health Insurance, and would like to cancel the product, you may call us at 1-800-289-8004 to begin the cancellation process. If you would like to cancel any other products, contact the dealer or coverage provider.

You May Like: What Kind Of Auto Loan Can I Get

Wells Fargo Car Loans Reviews

This is one of the worst banks! It has been a nightmare for me. I pay my car note every month on time via bill pay and even after uploading documents as proof of payment… I have had to call and email multiple messages and every time I get an email that it has been forwarded to âthe right department â and will be resolved but nothing happens and I keep getting notifications of late payment. The most pathetic bank ever!! Today I had to upload proof of payment since January and still nothing has been done!! This bank is rotten to the core!!!!

What Could Wells Fargo Auto Loans Do Better

Wells Fargo has had some controversy in the past, including a situation where many people had accounts opened without their consent. This has given the company a reputation for poor customer service and left some consumers wary about dealing with the company.

The auto loans themselves are relatively good, giving borrowers lots of options to customize their loans, but these past controversies are something that Wells Fargo has to work to overcome.

Don’t Miss: Can I Get An Equity Loan

Penfed Credit Union: Best New Car Loan Rates

- New Car Loan Starting APR: 2.09%

- Used Car Loan Starting APR: 3.29%

PenFed Credit Union has one of the lowest annual percentage rates of any bank, credit union, or loan company at this time. The advertised starting rate for new cars is 2.09%, but not just anyone can get rates that low. This rate applies to people who use PenFeds car buying service to purchase a new vehicle with a 36-month loan term. PenFed Credit Union works with TrueCar to show you vehicles in your area, and the low APR is an incentive to use this shopping process.

If you purchase a vehicle without using this buying service, loan rates start at 2.89%. Used car loans start at 3.29% with the buying service and 3.69% otherwise. These are still some of the best auto loan rates compared to other lenders rates for new and used vehicle purchases.

PenFed Credit Union requires membership and a $5 deposit. You can become a member through a variety of organizations or simply by expressing interest in joining.

PenFed Credit Union Pros and Cons

Even the best auto loans from PenFed Credit Union come with the benefits and drawbacks below:

| PenFed Credit Union Pros | |

|---|---|

| Some of the lowest APRs on the market | Requires membership to become eligible |

| Offers loans as small as $500 | |

| 4.6-star customer service score on Trustpilot | Medium or strong credit needed for approval |

For more details on PenFed Credit Union, head to the companys website.

Where Do I Find My Account Number

Your 10-digit auto loan account number can be found in the following places:

Welcome Letter

Your account number is provided with the loan details in the welcome letter that you receive in the mail after your new loan is funded.

Account Statement

Your account number is at the top of your monthly statement and on the payment coupon at the bottom of the statement.

Online

To view your complete account number, sign on, select your auto loan from Account Summary, and then select Account1234.

Phone

If you are unable to find your auto loan account number, please call us at 1-800-289-8004.

You May Like: How To Apply For Fha Loan Ohio