How To Calculate Apr

Now that we have the fees for each loan type, the next step to finding the APR is to estimate the monthly payment amount. Rather than breaking out the calculator or pen and paper, open excel or google sheets and type the following formula:

=PMT

Where:

- rate is the interest rate divided by 12

- nper is the number of payment periods, or months, you will make payments on the loan to repay it

- pv is the present value, or principal, of the loan

Now you can use that payment figure to calculate the APR in excel using the following:

=RATE

- nper is the same number of payment periods you used before

- pmt is sht monthly payment figure you calculated above

- pv is the principal amount

Length Of The Loan & Repayments

Borrowers should also review the length of the loan. Federal loans offer a standard 10-year repayment. Online loan information can give you an idea of your monthly repayment amounts. Other options can also be exercised when you go into repayment.

Always recognize that the longer the loan repayment, the more you will repay in interest. While a longer loan can present lower monthly repayments, it can also result in a much higher amount to be repaid.

On the flip side, you can reduce your loan costs whenever you have a personal budget surplus. Think about increasing your payment beyond the minimum monthly amount whenever you can. But if you do, contact to servicer to ask to have any excess payment applied to accumulated interest first. This will reduce additional interest being charged on already accumulated interest.

Next, federal loans typically do not have any penalties for early repayment. If you can add to your monthly payment or make multiple payments when you get more financially on your feet, you can pay off the loan in a shorter period of time and reduce interest accumulation.

NOTES:

GRAD STUDENT SUBSIDIZED LOANS: Graduate and professional students are no longer eligible for Subsidized Loans as of July 1, 2012.

Don’t judge a loan simply by the interest rate numbers. Look into the frequency of interest calculation and the length of the loan to better know the full repayment cost of borrowing for your education.

University of Cincinnati

How Is Student Loan Interest Calculated

Federal student loans and most private student loans use a simple interest formula to calculate student loan interest. This formula consists of multiplying your outstanding principal balance by the interest rate factor and multiplying that result by the number of days since you made your last payment.

Interest Amount = × Number of Days Since Last Payment

The interest rate factor is used to calculate the amount of interest that accrues on your loan. It is determined by dividing your loans interest rate by the number of days in the year.

Recommended Reading: Bayview Loan Servicing Charlotte Nc

Should You Take Out A Student Loan Now

With federal student loan rates at record lows, now might be the best time in history to take out a student loan. Always exhaust all your options for federal student loans first by using the Free Application for Federal Student Aid form, then research the best private student loans to fill in any gaps. Whether you choose federal or private loans, only take out what you need and can afford to repay.

Try to take out no more in student loans than what you expect to make in your first year out of school.

If you have private student loans, this may be a great time to refinance. All of the best student loan refinance companies are offering competitive rates and can cater to unique debt situations.

When Do I Pay Back These Loans

After you graduate, leave school, or drop below half-time enrollment, your lender will send you information about repayment and notification of the date it will begin. You have a six-month grace period before you must begin repayment.

During the grace period on a subsidized loan, you dont have to pay any principal and you wont be charged interest. In contrast, you will continue to accrue interest on your unsubsidized loan. You have the option to either pay the interest or it will be capitalized at the end of the 6 month grace period.

Failing to make payments on your loan is likely to have a negative effect on your credit rating.

Also Check: Capital One Pre Approval Auto

How Will My Interest Be Calculated

A daily interest formula determines the amount of interest that accrues on your loan between your monthly payments. Heres how the formula works: Outstanding Principal Balance x Interest Rate Factor x Number of Days Since Last Payment =Interest Amount In other words, the formula multiplies your loan balance by the number of days since you made your last payment, and it multiplies that result by the interest rate factor. The interest rate factor is determined by dividing your loans interest rate by the number of days in the year.

Federal Direct Unsubsidized Loans

Direct unsubsidized student loans are easier to qualify for than federal subsidized loans because you don’t need to prove financial need. That being said, while the interest rates are identical, the terms for direct unsubsidized student loans aren’t quite as good. You’ll be responsible for paying the interest accumulated on the loan during the period you are in school. If you don’t make these interest payments while in school, the aggregate amount of the interest payments will be tacked onto your total loan amount.

Undergraduate Direct Unsubsidized Student Loans

| Disbursement Date |

|---|

| 8.50% |

Recommended Reading: Usaa Car Financing Calculator

Interest On Subsidized And Unsubsidized Loans

Federal loans are known for having some of the lowest interest rates available, especially compared to private lenders that may charge borrowers a double-digit annual percentage rate :

- For loans disbursed on or after July 1, 2021, and before the July 1, 2022, school year, direct subsidized and unsubsidized loans carry a 3.73% APR for undergraduate students.

- The APR on unsubsidized loans for graduate and professional students is 5.28%. And unlike some private student loans, those rates are fixed, meaning they dont change over the life of the loan.

There’s also one other thing to note about the interest. While the federal government pays the interest on direct subsidized loans for the first six months after you leave school and during deferment periods, youre responsible for the interest if you defer an unsubsidized loan or if you put either type of loan into forbearance.

Income-driven repayment plans can mean lower monthly payments, but you might still be making them 25 years from now.

How Does An Unsubsidized Loan Work

If you are anundergraduate or graduate student, you can opt for an unsubsidized Staffordloan. Unlike subsidized loans, you do not have to submit a requirement thatdemonstrates your financial need.

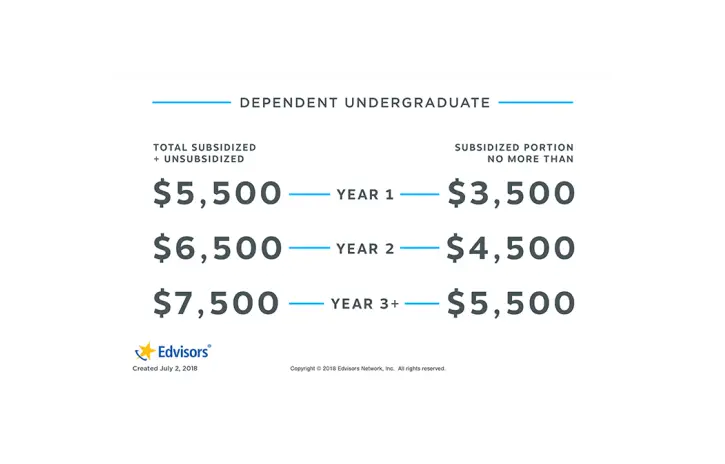

Additionally, your school will determine how much money you can receive as a loan for each academic year.

However, there are both annual loan limits and aggregates . These limits vary depending on the year of the school you are in and whether you are a dependent or independent student.

Once you receive the unsubsidized loan, and as we mentioned at the beginning, you are responsible for paying interest on each of the periods. In case you fail to pay the interest, the interest will accumulate, and which will be added to the principal amount of the loan.

In other words, you will end up paying more than you should.

Apart from interest,you must pay a fee to receive the unsubsidized Stafford loan. This loan rate isa percentage of the total amount that is deducted proportionally with eachdisbursement.

Also Check: Calculate Pmi On Fha Loan

Student Loan Interest Rates From 2006

Over the past 12 years, interest on federal student loans has ranged from 3.4% to 7.90%, depending on the type of loan. Although these student loan rates have fluctuated through the years, rates have been rising since 2016. To see a visual representation of how student loan interest rates have changed over time, we’ve provided a chart that illustrates the rate pattern for three types of student loans since 2006.

*Note that in the above chart we didn’t include the historical rates for Stafford Loans or Federal PLUS Loans. Both loans were part of the Federal Family Education Loan Program , which was terminated in 2010. However, we have included their historical rates from 2006 and on in our breakdown below.

How Interest Works For Unsubsidized Loans

Understanding how interest works for unsubsidized student loans is equally as straightforward:

The minute a loan is disbursed, the borrower is responsible for the accrued interest.

In other words, Uncle Sam isnt helping you out on this one.

This is why graduate student loans are subsidized students dont demonstrate financial hardship .

The problem with unsubsidized student loans is that a $20,000 loan could end up being $26,000 or more before a borrower can even start to make payments.

Unsubsidized Loans 101:

- Unsubsidized loans have $31,000 lending limits

- Interest accrues at the disbursement of the loan

- Do not have to demonstrate Financial need

- End up costing more than subsidized loans

You May Like: Can You Refinance With Fha Loan

Federal Student Loan Fees

When you are approved for a direct federal loan, you may be surprised to learn that you wont receive the full amount. The reason is that you must pay a loan fee of (1.057% for Direct Subsidized and Direct Unsubsidized, and 4.228% for Direct PLUS loans issued between Oct. 1, 2020, and Oct. 1, 2022, which is taken out of your loan principal. However, you still have to pay interest on the full principal even though you dont actually get that amount.

For example, someone with a $7,500 loan and a 1.057% loan origination fee would receive $7,420.73. But they are still responsible to pay the full $7,500 when it comes time for repayment.

Be aware that, in response to the COVID-19 pandemic, there is 0% interest and a suspension of payments from March 13, 2020, through Jan. 31, 2022.

Dont Miss: How Do I Find Out My Auto Loan Account Number

Who Qualifies For Federal Direct Loans

Federal subsidized and unsubsidized loan borrowers must meet the following requirements:

- Enrollment at least half-time at a school that participates in the Federal Direct Loan program

- A U.S. citizen or eligible non-citizen

- Possession of a high school diploma or the equivalent

- No default on any existing federal loans

Direct subsidized loans are only available to undergraduates who demonstrate a financial need. Both undergraduates and graduate students can apply for direct unsubsidized loans, and theres no financial need requirement.

If you qualify for a subsidized loan, the government pays your loan interest while you’re in school at least half-time and continues to pay it during a six-month grace period after you leave school. The government will also pay your loan during a period of deferment.

To apply for either type of loan, you will need to fill out the Free Application for Federal Student Aid . This form asks for information about your income and assets and those of your parents. Your school uses your FAFSA to determine which types of loans you qualify for and how much youre eligible to borrow.

Read Also: Becu Fha Loan

Student Loan Interest Rates 201: Your Guide To Understanding The Numbers

The 2019-2020 federal student loan interest rates are currently 4.53% for undergraduate loans, 6.08% for unsubsidized graduate loans and 7.08% for direct PLUS loans. With roughly 70% of students taking out student loans to attend collegein a rising-interest-rate environmentit’s important to understand how these loans can impact your finances. Read more to find out how federal student loan rates have changed over time and how they compare to private student lenders.

Subsidized Vs Unsubsidized Stafford Loans

Federal Stafford Loans are the cornerstone of many financial aid packages. While they always have to be paid back, they offer low interest rates, deferment of payment while enrolled in school, and flexible repayment plans once you graduate.

Stafford Loans are available in both subsidized and unsubsidized incarnations.

If youre wondering about the difference between subsidized and unsubsidized Stafford Loans, the table below should answer many of your questions.

As you can see, the main differences between subsidized and unsubsidized Stafford Loans are how the award is determined, how much a student can borrow, the interest rate, and whether or not the interest is paid by the government or the student while in school. While lower interest rates and subsidized interest payments are a great thing for those who qualify, in any subsidized vs unsubsidized Stafford Loans situation, every student will come out a winner.

You May Like: Usaa Apply For Auto Loan

How Do You Apply For Unsubsidized Student Loans

To apply for an unsubsidized student loan, you may need to fill out a Free Application for Federal Student Aid. Once its submitted, schools use the information from the FAFSA to make any financial aid package that they send you. To be eligible to fill out the FAFSA, you must be a U.S. citizen or eligible non citizen with a valid Social Security number. You also must meet other requirements:

- Registered with the Selective Service if youre a male student

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program

- For Direct Loan Program funds, be enrolled at least half time

- Maintain satisfactory academic progress

Current Unsubsidized Loan Interest Rates

If you receive a federal student loan, you will be required to repay that loan with interest. Interest rates are fixed for the life of the loan.

- For undergraduates, the current interest rate for direct unsubsidized loans is 3.73% .

- For graduate or professional students, the current interest rate for direct unsubsidized loans is 5.28% .

If the borrower does not pay the interest as it accrues, it is capitalized .

You May Like: Do Loan Officers Get Commission

What Is The Difference Between Stafford Subsidized And Unsubsidized Loans

There are 4 maindifferences between Stafford subsidized and unsubsidized loans:

However, the biggestdifference between subsidized and unsubsidized loans lies at the moment inwhich interest is charged. When unsubsidized loans are disbursed, interestbegins to accrue while in school and until the grace period ends.

What Is An Unsubsidized Loan

An unsubsidized loan, which is also referred to as a direct unsubsidized loan or unsubsidized Stafford loan, is a low-cost, fixed-rate federal government student loan that can benefit both undergraduate and graduate students. Financial need is not mandatory, which implies that students from wealthy families can still apply for the direct unsubsidized loans.

If you take an unsubsidized student loan, pay all interest accrued in the entire schooling period. It has no grace period and interest will accrue regardless of deferment periods. It differs from subsidized loans in different aspects. Subsidized loans are only meant for undergraduate college students still in school pursuing their courses and in need of help to pay for their tuition fees and related expenses. The loan is determined by the cost of the attendance minus the expected family contribution and other forms of financial aid the student is expected to receive, for example, scholarships and grants.

To qualify for an unsubsidized loan, you must first visit and complete the Free Application for Federal Student Aid . It is free to apply for FAFSA. If you qualify for the unsubsidized loan, your school notifies you.

To accurately know what is an unsubsidized loan, know what costs are covered. Unsubsidized loans cover for the cost of attendance, which includes:

- Room and board

Dont Miss: How Do I Find Out My Auto Loan Account Number

Recommended Reading: Usaa Auto Loan Apr

How Do You Apply For A Federal Direct Unsubsidized Loan

The first step to finding out what kind of financial aid you qualify for, including Federal Direct Unsubsidized Loans and Subsidized Loans, is to fill out the Free Application for Federal Student Aid .

Your school will then use your FAFSA to present you with a financial aid package, which may include Federal Direct Unsubsidized and Subsidized Loans and other forms of financial aid like scholarships, grants, or eligibility for the work-study program.

The financial aid and loans youre eligible for is determined by your financial need, the cost of school, and things like your year in school and if youre a dependent or not.

Do You Pay Back Unsubsidized Loans

When you graduate,drop out of school or sign up to study less than part-time, you will have sixmonths of grace before you start paying. During the grace period ,your loan administrator will provide you with all the necessary information andnotify you when you must make your first payment. Then, from that moment, youwill have to make a monthly payment.

Remember to make yourpayments, otherwise, you get penalty fees and more interest added on.

Dont forget to talkwith your loan provider about the different payment options that are availableto you. You can choose options that will give you 10 to 25 years to pay for theunsubsidized Stafford loan.

If you cannot meet anyof the payments of your unsubsidized loan, you should immediately contact yourloan provider. They can help you figure out a solution. For example, they may offerto change your payment plan, to request an indulgence or to request a deferral.

Also Check: Refinance Options For Fha Loans

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan at any time. Most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the “grace period” when the government continues to pay the interest due on the loans.

When your loan enters the repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicer’s website in most cases.