Who Should Get Gap Insurance

Not every driver is eligible for gap insurance, and not every driver who is eligible should get it.

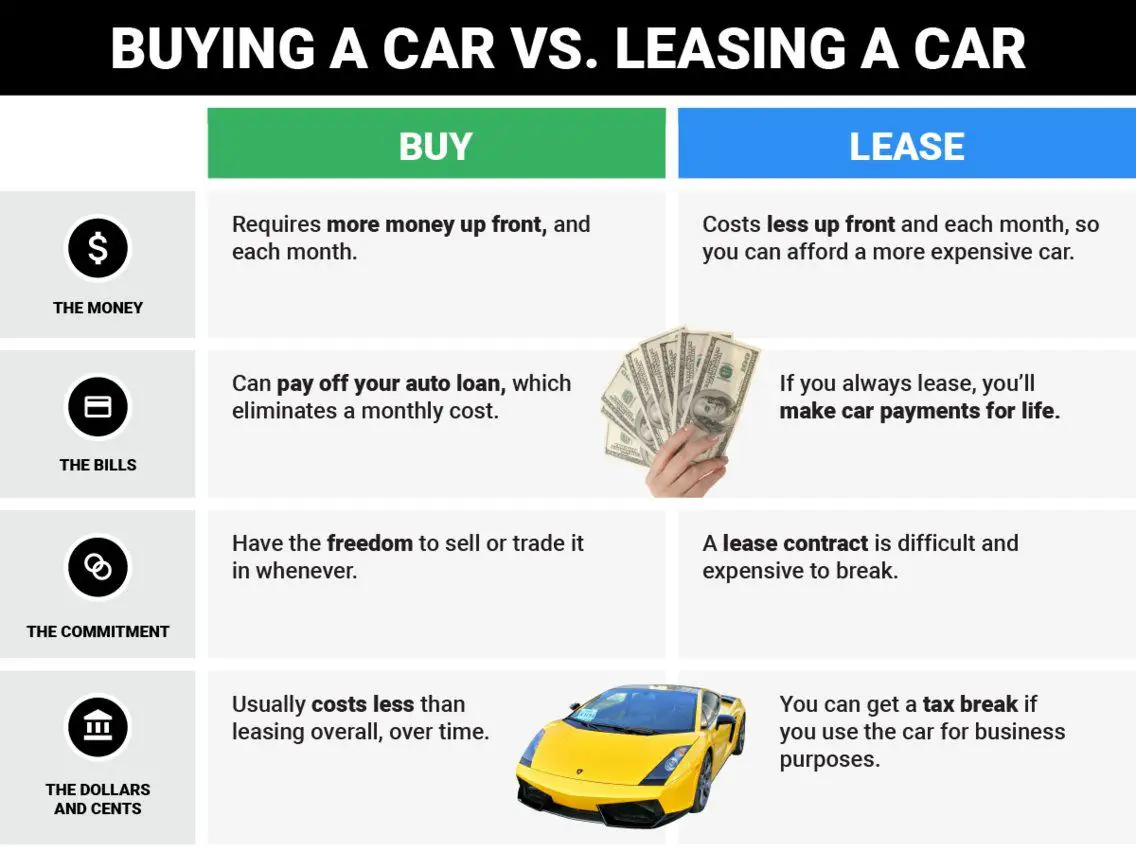

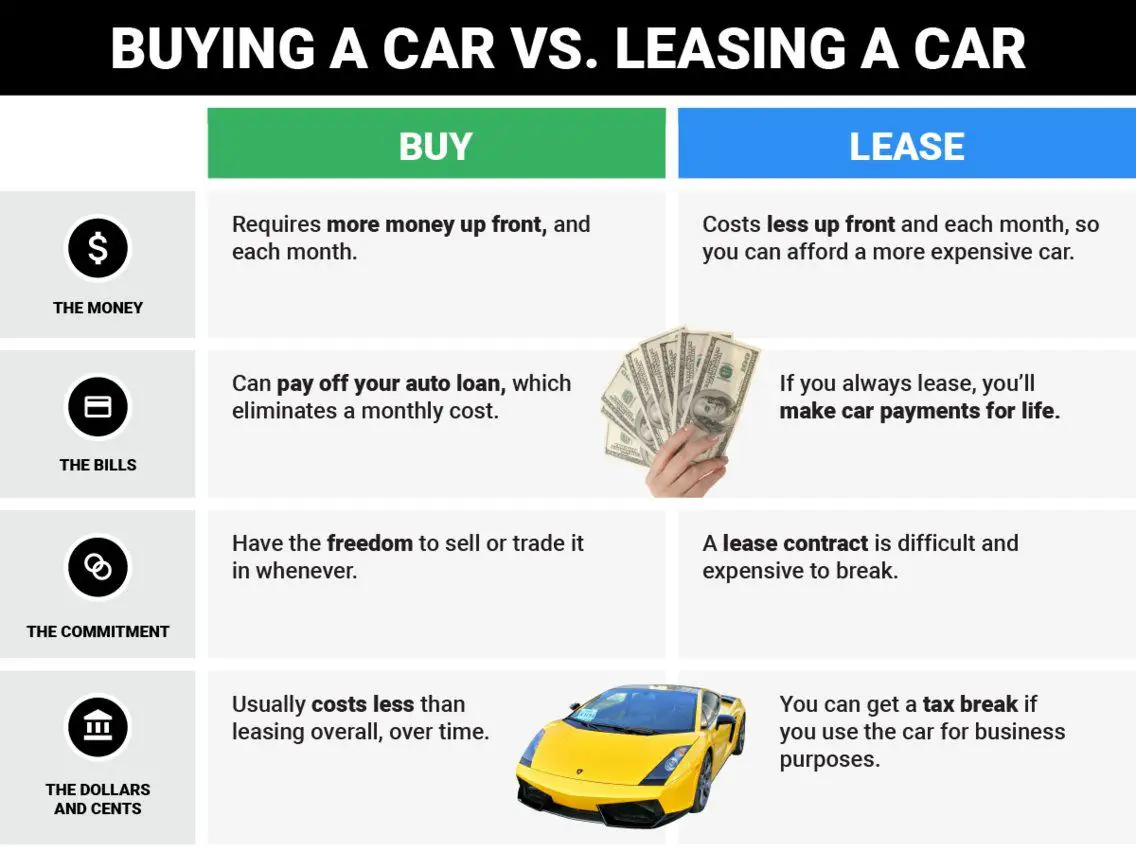

Gap insurance is only available if you bought your car with a loan or if you lease your vehicle. If you own your vehicle outright, you don’t need to consider getting gap coverage.

Even if you financed your car, you only need gap coverage if the amount you owe is more than the car’s value. The best way to determine whether you need gap coverage is to find the cash value of your car and subtract it from how much you owe.

You won’t be able to find the exact amount your insurance company uses for your vehicle’s actual cash value, but you can approximate your car’s value by visiting a local appraiser or looking it up in Kelley Blue Book.

For example, we found that the Kelley Blue Book value of a 2017 Mini Cooper is around $13,000. If you owe $15,000 on that car, you’re underwater and would benefit from gap coverage.

Calculating the gap between your car’s value and what you owe is the best way to know if you need it. You may also be more likely to need gap coverage if any of the following situations apply to you:

You probably don’t need to carry gap insurance forever. Once you pay down the loan to the point where it’s worth more than you owe, you should remove gap coverage, as long as the terms of your lease allow it. In the event your car experiences a total loss, having gap insurance would not result in any extra payment.

> > LEARN MORE: How Much Car Insurance Do I Need?

Do You Need Gap Insurance

If your vehicle is not financed, there is no reason to purchase gap coverage. If you do finance your vehicle, gap coverage can be a good idea, but it depends on how much you drive and how quickly your car depreciates.

Keep in mind that cars can depreciate rapidly. According to the Insurance Information Institute, many vehicles depreciate 20% or more within the first year of ownership. If you dont make a large down payment on your car, the amount you owe in car payments can quickly exceed your cars value.

You should consider gap insurance coverage if:

- You made a small down payment

- You have a long finance period

- You drive a lot

- You purchased a vehicle that depreciates quickly

To calculate the potential value of gap insurance for yourself:

One last thing to keep in mind is that you will typically need to purchase gap coverage while your vehicle is less than three model years old.

Can I Buy Gap Insurance If My Loan Is From An Individual

Gap policy providers wont offer coverage if your loan is through a private individual.

When dealing with a bank or finance company, the gap insurance carrier knows the terms, sees the paperwork, etc. With a private party loan, it is hard for the gap carrier to be assured that the loan is only for the vehicle, payments were made properly, etc. all things that an insurer requires.

Also Check: When Does Pmi Fall Off Fha Loan

Car Gap Insurance May Make Sense If

According to the Insurance Information Institute, it may be a good idea to consider buying gap insurance for your new car or truck purchase if you:

- Made less than a 20 percent down payment

- Financed for 60 months or longer

- Leased the vehicle

- Purchased a vehicle that depreciates faster than the average

- Rolled over negative equity from an old car loan into the new loan

In these instances, gap insurance could protect you against potentially negative financial consequences if the vehicle were to be declared a total loss.

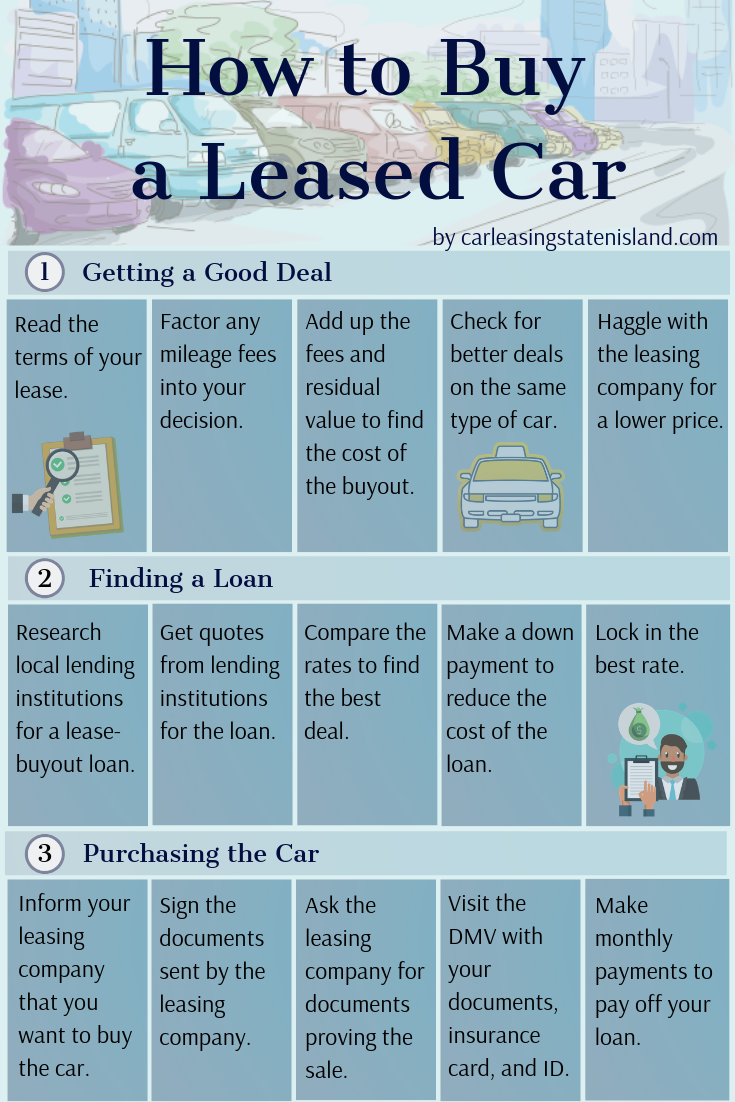

If you’ve purchased gap insurance, check your loan balance from time to time and cancel the insurance once you owe less than the book value of your vehicle.

Key Things To Know About Gap Insurance

- Gap insurance pays for the difference between what a totaled car is worth and what the driver still owes on their auto loan or lease.

- Drivers should consider getting gap insurance if they made a small loan down payment, lease their car, or have a car that depreciates quickly.

- You can get gap insurance from your car insurance company, loan provider, or dealership. The largest auto insurance companies in the US that you can get gap insurance from are State Farm, Progressive, and Allstate.

- Gap insurance costs between $400 and $700 when purchased from a dealership and between $20 and $40 per year when added to a car insurance policy.

Don’t Miss: Capital One Auto Loan Private Seller

What Isn’t Covered By Gap Auto Insurance

Gap insurance usually wont pay for:

- Overdue lease/loan payments

- Costs for extended warranties, credit life insurance or other insurance purchased with the loan or lease

- Carry-over balances from previous loans or leases

- Financial penalties imposed under a lease for excessive use

- Security deposits not refunded by the lessor

- Amounts deducted by the primary insurer for wear and tear, prior damage, towing and storage

- Equipment added to the car by the buyer, meaning that only factory-installed equipment is covered

- Mechanical issues, such as engine or transmission failures, or any other car problems that are not losses covered by your car insurance policy

How Do I Get Gap Insurance

The easiest way, and probably the cheapest way, is to ask your auto insurance company if they can add it to your existing policy. You can compare prices online to make sure you’re getting the best deal.

The car dealership will probably offer you a gap policy but the price will almost certainly be higher than a major insurer will offer. In any case, check to make sure you don’t already have gap insurance on your vehicle. Auto lease deals often build gap coverage into their pricing.

Don’t Miss: Upstart Loan Calculator

Why Did My Extra Or Over

Any overpayments made on an account are automatically applied and will appear as a credit to your monthly payment. Please be advised, if there are fees due on your account, the amount overpaid is first applied to fees and then all remaining amounts towards the principal balance of the account.

We calculate simple interest on retail accounts on a daily basis based on the current principal balance, the interest rate, and the number of days since your last payment.

What Is Not Covered By Gap Insurance

Gap insurance should not be confused with coverage for anything above what your standard car insurance will cover. There are things gap insurance does not cover:

- Medical bills

- Damage to your car that isnt a total loss

- Car problems, like mechanical issues that are not covered by our car insurance policy

- Past due lease or loan payments

- Excessive use penalties imposed by a lessor

- Non-refunded security deposits by the lessor

- Non-factory installed equipment

- Depreciation deducted by the primary insurer

- Extended warranties

- Carry-over balances from other loans or leases

Read Also: What Credit Bureau Does Usaa Use

Example Of How Gap Insurance Works

Imagine you buy a $50,000 car with a down payment of $10,000. Three years later, the car is worth $20,000, but you still owe $24,000 on the loan. If the car is totaled in an accident or stolen and declared a total loss, your normal insurance policy will pay $20,000, or the cars actual cash value, minus your deductible.

If you dont have gap insurance, youll still owe $4,000, and youll still have to pay off the car even though you cant drive it. But if you do have gap insurance, it will pay the $4,000.

| New car price | |

| Gap insurance payment | $4,000 |

A gap forms as a result of a car depreciating faster than the loan or lease amount can be paid off. A new car loses about 10% of its value the moment you drive it off the lot, and it depreciates by about 20% within the first year.

Learn more about how gap insurance works.

What Is A Fico Score

A FICO® Score is a three-digit number that is used by lenders to evaluate your credit risk based on your credit history at a particular point in time. It influences the credit that is available to you, as well as the terms that can be offered when a credit decision is made.

It is also commonly referred to as simply a “credit score” or”credit rating.”

View our available Frequently Asked Questions About the FICO® Score publications for more detailed information about the FICO® Score, credit, and how they affect your financial health.

Recommended Reading: Do Mortgage Loan Officers Get Commission

What Is The Cost To Buy Gap Car Insurance Coverage

Wondering how much is gap insurance? The average cost of gap insurance is not that high as compared to other types of car insurance coverage. A driver has to pay $400 to $700 one time and $25 every year to the car insurance company for the renewal of the policy.

There are a lot of factors that affect any type of car insurance coverage. The same goes for gap insurance. No two drivers can get similar costs for gap insurance in some cases the cost can vary by a couple of dollars and in some cases, it can be in hundreds.

Below are some factors that affect the cost of car gap insurance:

- The age of the driver

- The age of the car

- Value of the car during purchase time

- Condition of the car

How Does Gap Insurance Work If Your Car Is Totaled

If your vehicle is totaled, your insurance provider will pay out a maximum of your cars actual cash value. ACV is an estimate of the cars retail value on the open market. If your vehicle is financed, you may owe more in payments than the total value of your car. If this happens, gap insurance coverage will make up the difference.

Don’t Miss: Usaa Auto Loan Rates And Terms

Do We Really Need Gap Insurance Coverage

The most common question asked about this insurance is if gap insurance is worth it or not. We need gap insurance for the following scenarios:

- If the down payment of your loan is less than 20%.

- If the loan on your car has a high interest rate. In such cases, the principal amount takes more time to pay off.

- The loan term is more than 5 years.

- If you want protection from depreciation.

Please note that the gap amount fluctuates with time as your loan will pay off the amount will decrease. Hence it is also important to keep in mind the time period when you actually need gap insurance.

It is not mandatory for every driver to buy this insurance type there are also some situations where gap insurance is useless. Below are some cases where gap insurance is not required:

What Does Kia Motors Finance Do With My Personal Information

All financial companies need to share customers personal information to run their everyday business. The types of personal information we collect and share depends on the product or service you have with us. Federal law gives consumers the right to limit some but not all sharing.

To learn more about what we can share, why we might share it, and how you can limit this sharing, please read the Kia Motors Finance Consumer Privacy Notice.

Our Online Privacy Policy explains how we protect your privacy while using our website.

Also Check: How Far Back Do Underwriters Look At Bank Statements

Why You Need To Rethink Your Budget

Whether youve been able to reduce your auto insurance costs or not, youre still newly car-payment-free! That means all the money you were spending on your car payment each month can now be used elsewhere. But where?

The next step after notifying your insurance company and reassessing coverage is to rethink your budget. If you dont have a budget, now is a perfect time to create one. Whether you use a spreadsheet or a budgeting app, a budget is a critical tool for financial health. If you already have one, now is an important time to update it.

One of the leading principles of budgeting is to give every dollar you earn a job. Are we saying you should spend every dollar you make? No, definitely not. The job you give to each dollar may be to go into your savings account, to pay on a high-interest credit card, or to save for a wedding. The car payment you are now saving is no exception. What can you do with that money each month now to strengthen your financial position?

If you have other debts, we recommend using your former car payment to pay those debts down faster starting with the debts with the highest interest rates. Then focus on building up an emergency fund and putting money toward something youve been saving for. This is a great choice to have! Whatever you decide, be sure you are putting these new savings each month to good use.

When To Consider Keeping Full Coverage

But there are other things to consider, too. Your financial situation is an important factor in deciding what kind of auto insurance coverage you need. The above rule only works if you have enough emergency savings or other assets to cover your costs if something were to happen. If you do not have the money readily available to pay for things like accident repairs, it may be worth it to pay a bit more premium for full coverage than to end up with coverage that is inadequate.

If you decide not to drop full coverage, consider speaking with your insurance agent about the possibility of reducing coverage limits. If it makes sense to drop coverage limits, you may be able to save some money after all. And dont forget, even if you cannot reduce your auto insurance cost now that youve paid off your loan, you still have the monthly car loan savings to look forward to.

Don’t Miss: Should I Choose Fixed Or Variable Student Loan

When Should You Get Gap Insurance

If youre not leasing or financing a vehicle, then you likely dont need gap coverage. If you are financing a vehicle, gap insurance coverage could be worth the investment depending on how much you drive, how much you owe, and the stability of your cars value.

Here are a few situations where you should or should not consider gap insurance:

| You Should Consider Gap Insurance If… | You Should Skip Gap Insurance If… |

|---|---|

| Youre leasing a car for more than 48 months | You purchased your car outright |

| Your car has a fast depreciation rate | Your car depreciates slowly |

| You dont drive too much,keeping your cars value higher for longer | |

| You made a low or $0 down payment on a car loan | You made a large down paymentand will pay off your loan quickly |

Its worth noting the value of a car can depreciate quickly. The Insurance Information Institute estimates most vehicles lose 20 percent of their value within a year. This means the balance on a car loan can eventually outpace the value of your car, especially if you choose not to make a large down payment.

When financing a car, car dealers will typically give you the chance to buy gap coverage on the spot. Depending on your standard car insurance provider, you may also be able to add gap coverage to your full coverage auto insurance policy. However, this typically must be done while your vehicle is less than three model years old.

So, is gap insurance worth the money? Here are a few steps to take that’ll help you decide:

When You Might Need Gap Insurance

Gap insurance is not required by state law, but it may be required by lenders and lessors. Purchasing gap insurance may also be a good idea even if its not required, depending on your financial situation.

Specifically, you should look into purchasing gap insurance coverage if any of the following applies to you:

Read Also: Fha Mortgages Refinance

When Its Time To Buy

A little knowledge is nice, but theres no replacement for expertise. So, when you are ready to upgrade your current policy or buy a new one, talk to your independent insurance agent, who can help you choose the ideal options for your auto. Except for the moonroof that ones your call.

LC June 2018-291

Will My Recurring Payment Automatically Stop At The End Of My Contract Or When I Pay Off My Vehicle

No. After setup, the recurring payment schedule will continue to draft the payment amount selected until the scheduled end date unless it is cancelled by you. It is recommended to set up recurring payments for the original term of your contract. Additionally, it is your responsibility to stop any recurring payments set up through a dealership, third party bill-pay service or your financial institution.

Don’t Miss: Fha Limits In Texas