Why Refinance Your Car Loan

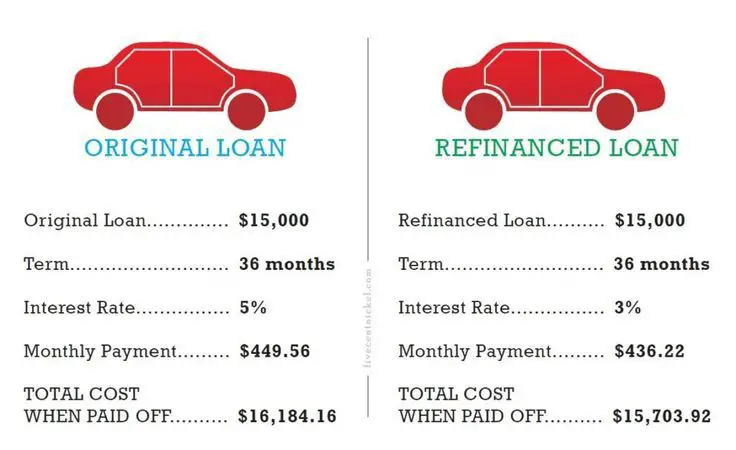

Most borrowers choose to refinance their car loan in order to pay less interest on a monthly basis. When you refinance an auto loan to a lower interest rate, you can save hundreds or even thousands in total interest over the life of the loan.

You may end up with a lower monthly payment, which will free up money you can use to pay off other loans. A lower payment will also reduce your debt-to-income ratio, which reflects your monthly debt payments divided by your monthly gross income. If youre planning to apply for a mortgage at some point, a low DTI could also help you qualify for a better interest rate.

Conversely, some borrowers choose to refinance their car loan to a shorter term so they can repay the loan faster. You can also refinance a car loan to a longer term, which can provide some wiggle room in your budget. Another reason to refinance could be if you first got the car loan with a co-signer and want to remove them from the loan.

What You’ll Learn: Everything You Need To Know When Refinancing A Car Loan

EXPECTED READ TIME: 7 MINUTES

Everything You Need to Know About Refinancing a Car Loan

There are times in life when the path to paying off your car can get a little bumpy. Refinancing your auto loan might help smooth the ride.

But before you decide to refinance, take note of the obstacles you may encounter. For starters, your new loan could have a higher interest rate than your old one. Or your lender may charge a penalty for paying off your original loan early. And if you extend your loan term, you may shell out more in interest over time.

Youll only enjoy the full benefits of refinancing if its the right option for you. Begin by asking yourself:

- Has my credit improved since taking out the original loan?

- Am I better off financially now than I was before?

- Are current interest rates lower?

A yes to any of these questions may mean the time is right to refinance. If you think refinancing is right for you, its time to get things rolling. Youll need your original loan info. That includes your current vehicle identification number, and the make, model, and mileage of your vehicle. You will also need personal documents, like proof of insurance and employment.

Next, youll want to shop for a lender. Credit unions are great choices because they typically offer lower rates and fewer fees than traditional banks.

Once your new loan begins, you can start making payments. Be sure to pay your bill on time every month to establish healthy money habits and boost your credit.

Factors To Consider Before Refinancing

Here are some factors to consider before you decide to refinance your vehicle:

- Requirements for refinancing: Every bank or lender has different requirements that determine whether or not youre eligible for refinancing. Some specific things to look for before deciding to refinance are a clean car title, whether youre upside-down on your loan and whether youve been current with payments.

- Prepayment penalties: A prepayment penalty is the fee that you must pay if you pay off your loan early. Not all lenders charge this, but it could affect your overall savings.

- Time remaining on the loan: If youre near the end of your current loan, it may make more sense to finish paying it off instead of sinking time and money into refinancing.

- Your financial state: Your debt-to-income ratio is one of the many factors considered by lenders. The more debt youre able to pay off before applying for a new loan, the better terms youll receive.

You May Like: Is Carmax Pre Approval A Hard Inquiry

You Hate Your Current Lender

Many people choose to refinance simply because they dont like the way their current lender does business. Rude customer service reps or poor record keeping can really sour a relationship with a lender. If you really cant stand your current lender, refinancing with a new lender may help alleviate some of your frustrations.

How To Refinance A Loan

If you’re looking to refinance a loan, you should first examine the specifications of your current agreement to see how much you’re actually paying. You should also check if there is a prepayment penalty on your current loan, as the value of refinancing could potentially be outweighed by the early termination cost. After finding the value of your current loan, you can comparison shop between a few lenders to find the terms that best fit your financial goals.

Whether you’re looking to change term lengths or lower your interest rate, a variety of loan options are available on the markets today. With new online lenders looking to compete with traditional banks, there are services and packages tailored towards all financial goals. For the most qualified borrowers, this competition can help cut the costs of a loan by hundreds or thousands.

Also Check: Drb Refinance Reviews

If I Shop Around For Rates Will That Hurt My Score More

A common misconception is if you shop around for rates and have your credit pulled multiple times, this will hurt your credit score beyond doing just a single application.

This is not true. The credit scoring agencies of both FICO and Vantage are aware this is happening, and they encourage borrowers to shop around. Making multiple hard inquiries within a few weeks span will behave as one single credit pull as far as your score is concerned.

Five Reasons To Consider Refinancing Your Auto Loan

As a car owner, you may have loved or hated the car-buying process, but either way, you are now the proud owner of a brand new car payment! As with most things in life, change is inevitable, and this goes for interest rates on car loans, too. That means you may want to consider refinancing to get more miles out of your dollars.

Not sure what refinancing means? No problem! Refinancing is taking out a new car loan to pay off an existing loan, typically to receive a lower interest rate and/or decrease your monthly payment. In other words, you are shopping around for an interest rate that is more appealing and one that best fits your current financial situation and needs.

Whether or not youve already thought about refinancing your car loan, here are a few reasons to consider it.

Don’t Miss: Does Usaa Do Car Loans

When Does It Make Sense To Refinance Your Auto Loan

When you refinance an auto loan you are essentially paying off your existing loan and replacing it with a new one, under different terms. Unless you opt for a cash-out refinance, the new loan amount will be equal to the outstanding loan balance, with the vehicle still serving as collateral. The main reason that people refinance their loans is to either shorten or lengthen the loan duration, or to obtain a lower interest rate so they can pay less over the life of the loan. However, a longer loan term could translate into higher cumulative interest charges because youll be paying for the loan for a longer period while accumulating interest. Conversely, a shorter loan term will usually mean a lower interest rate and overall cumulative charges.

After Youve Been Approved

Once youre approved with several different lenders, compare the various offers carefully. The most important factor is the annual percentage rate and total interest paid over the life of the loan. The APR includes the interest rates and any fees, including the lender and title fees. A lower APR means youll pay less in fees and interest.

You may be approved for several different interest rates and loan terms. Loans with longer repayment terms generally have higher interest rates and lower monthly payments. A loan with a shorter term means youll have higher monthly payments and a lower interest rate.

Look at your budget and decide how much you can comfortably afford each month. Remember, you can also make extra payments on the loan if you choose a lender that doesnt charge a prepayment penalty.

After you select the lender, youll have to finalize the car loan. The new lender is responsible for paying off the loan balance from the old lender, but its a good idea to double-check that this goes through correctly. Its also important not to fall behind on your car payments during this transfer process. Once the first lender is paid off by the new lender, they should return any extra payments you made during that window.

Once the loan is paid off, you can start making payments to your new lender. Consider setting up automatic payments so you dont have to worry about remembering your new due date.

Recommended Reading: Usaa Loan Approval

When Should I Refinance My Car Loan

The best time to refinance your car loan is when it can save you money in the long term, but it may also help if youre hoping to catch a break on your monthly payments. Here are a few situations where it may make sense to refinance:

- Refinance car loan rates have gone down: Most car loan interest rates fluctuate based on the prime rate and other considerations. If you purchased your car a while ago, its possible that car loan rates have decreased since then.

- Youve improved your credit score: Even if market rates havent changed, improving your credit score may be enough to get a lower rate. The better your credit, the more favorable loan terms youll receive. If youve improved your credit score since signing for your initial loan, you may qualify for better loan terms.

- You got your initial loan from the dealer: Dealers tend to charge higher rates than banks and credit unions. If you took out your initial loan through dealer-arranged financing, refinancing directly with a lender could get you a lower rate.

- You need lower monthly payments: In some cases, refinancing a car loan may be your ticket to a more affordable payment, with or without a lower interest rate. If your budget is tight and you need to reduce your car payment, you could refinance your loan to a longer term . Keep in mind, though, that while you will pay less per month with this strategy, you can expect to pay more over the life of the longer loan.

Youre Having Trouble Keeping Up With Bills Each Month

Even if youre not able to secure a lower interest rate, it may still be worth trying to find a loan with a longer repayment period in order to reduce your monthly car payments.

If you cant find a suitable loan, you may also be able to renegotiate the repayment period on your current loan. But keep in mind that more time spent paying back your loan is also more time spent paying interest. In general, youll pay more interest overall if you have a loan with a longer term.

You May Like: Refinance Options For Fha Loans

Right And Wrong Times To Refinance A Car Loan

Unfortunately, people with bad credit typically cant refinance a car loan right away there’s a right time to do it. Lenders like to see that around one or two years have passed, so there’s an established payment history on the loan and their credit scores have a chance to improve.

As time passes and these bad credit borrowers improve their credit scores with the help of their auto loans, they can look into refinancing. When they decide to refinance a car loan, they have two options to help them lower their monthly payment:

When Should I Avoid A Refinance For My Auto Loan

With any auto loan, the amount of interest paid decreases each month during the length of the loan and the amount of principal paid increases each month. A good way to think about it is the interest is paid on the front end of the loan and the principal is paid on the back end.

With that said, if you are towards the end of your loan, it may not make sense to refinance your auto loan since you have paid most of the interest up front. Sure, it may lower your monthly payment, but overall, the refinance could cost you more in the long run.

Read Also: What Percentage Do Loan Officers Make

What Happens When You Refinance A Car Loan

With a traditional refinance, you take out a new loan to pay off your current loan.

If your credit scores have improved or interest rates have dropped in the time since you got your original loan, you might be able to get a lower interest rate on a new loan, which could help you save money. You may also be able to save on your monthly payment if you extend your loan term. Just keep in mind that youll likely end up paying more in interest if you choose a longer loan term.

What Is Car Loan Refinancing

In simple terms, refinancing is the act of taking out a new loan either with the same lender or a new lender in order to replace an existing loan. There are many aspects of a loan that can be changed with a refinance: the interest rate being charged, the monthly payment amount, the repayment term, and even the parties responsible for that debt.

Essentially, refinancing allows you to swap out your car loan for a replacement loan. Youre still in debt, of course, but your loan has been revised in a way that benefits you.

Your new refinance loan will serve to pay off the original loan balance in full. From that point on, your debt will be held with the new lender, so thats where you will direct any questions or concerns and where you will send your monthly payments.

Each lender will have their own specific guidelines regarding auto refinance loans and eligible borrowers. In general, though, you can refinance an auto loan as early as youd like, and you can even refinance the same debt more than once.

Auto Refinance Calculator

Don’t Miss: Fha Loan Limits Harris County

Possible Outcomes When Refinancing Your Car

Not all car loan refinance deals are the same, but customers who choose to refinance often seek one of the following goals :

Lower Your Monthly Car Payments

Most of the time, people seek car loan refinancing to lower their monthly payments. This priority is understandable since monthly car loan payments can have an immediate impact on a households monthly finances. However, your monthly payment should not be the only consideration when refinancing

There are two ways to lower your car loan monthly paymentsyou can get a lower interest rate, you can extend your loan term, or both. Usually, the best way to lower your car loan payments dramatically is to extend the number of months over which you pay for your car. However, when you extend your loan term, you may end up paying more for your car in total than you would without extending it. Still, if your lender allows you to extend your loan term and gives you a lower interest rate, you may benefit by both lowering your monthly payments and paying less in total for your car. The example below will illustrate how this outcome can occur.

Change the Length of Your Car Loan Terms

Sometimes refinance customers seek refinancing to change the length of their loan terms. However, this goal usually has more to do with lowering monthly payments than changing how many months in which a customer pays for his/her car.

Remove or Add Someone as a Co-Signer to Your Loan

Pros And Cons Of Refinancing A Car Loan

Now that you know the potential savings, let’s hit the brakes and look at the advantages and disadvantages of refinancing your car loan.

| Pros of Refinancing | |

|---|---|

| You have the opportunity to lower your interest rate and monthly payment | Your refinanced loan could have a higher interest rate than your original loan |

| Lowering your monthly payments could increase your cash flow | Some lenders may issue a prepayment penalty for paying off your original loan early |

| You could save money on interest if you shorten your loan term | You could pay more over time if you extend your loan term |

Those are some of the basic pros and cons of refinancing a car loan. But one area that could be a pro or a con is your credit score.

Recommended Reading: Mlo Average Salary

Refinance A Car Meaning And Process

When you buy a property and finance its purchase, the lender usually takes a security interest in the property. That is, the property is the collateral for the loan. If you stop making your payments, the lender can take the property to satisfy the debt. Refinancing is the process by which you can get a new lender to loan you enough money to pay off the old loan. The old lender releases the lien on the title, and the new lender takes a security interest on the vehicle.