Loan Against The Insurance Schemes:

If your insurance scheme is eligible for a loan, you can avail the loan amount from your insurer. You may also use the investment for insurance as collateral. Generally, loans cannot be availed right from the commencement of the insurance policy. After 3 years into the scheme, you can apply for a loan against insurance.

Cons Of Conventional Loans

- Minimum FICO score of 620 or higher often required

- Higher down payment than some government loans

- Must have a debt-to-income ratio of no more than 43 percent

- Likely need to pay PMI if your down payment is less than 20 percent of the sales price

- Significant documentation required to verify income, assets, down payment and employment

Fixed Vs Variable Rates

Whether your loan is unsecured or secured, theres the matter of interest, which is your primary cost to borrow the money. A fixed interest rate means the rate remains the same for the life of the loan.In contrast, a variable interest rate means the rate will change over the life of the loan in response to the ups and downs of a financial benchmark determined by the bank typically the London Interbank Offered Rate or the Prime Rate. , and could be replaced by the Secured Overnight Financing Rate or SOFR.)

Most types of loans come with fixed interest rates, but the rate you receive for either will be based on your credit score. Again, the higher your credit score and stronger your finances, the lower the interest rate you can expect.

Fixed interest rates allow you to know just how much the loan will cost you in its entirety and allow you to budget accordingly. Variable interest rate loans may save you money if interest rates go down, but if they go up, they could end up costing you more. While they do have ceilings to protect borrowers from astronomical jumps in the market, those ceilings are generally set quite high.

| Fixed |

Don’t Miss: Car Loan Interest Rate With 600 Credit Score

Important Factors Lenders Look At To Approve Your Application

Since a credit score represents the credit history of the borrower, the lender analyses the repayment history of the borrower and concludes whether the borrower can repay on time or will he default on payments. The loan approval is based on the lenders judgement after the necessary analysis.

- Income and Employment History

Your monthly or annual income and employment history plays a crucial role in loan approval as well. Based on your income and income stability in the form of consistent and stable work history, the lender may or may not get convinced that you will be able to repay the loan.

Even if you are self-employed, the lender assumes that your business is running well for the past few years and your businesss turnover is satisfactory.

- Debt-to-Income Ratio

Not just having a good income, your debt-to-income ratio is also important. In case you have an income of Rs.1 lakh per month and if your debt repayment commitments exceed Rs.75,000 already, a new loan will not be provided to you as you will need the remaining income to take care of your domestic expenses.

Therefore, irrespective of your income, you must have a low debt-to-income ratio so the lenders can think that you have enough cash at hand every month to make the repayments as well as handle the family expenses.

- Collateral

- Down Payment

Based On The Security Provided

Secured Loans

These loans require the borrower to pledge collateral for the money being borrowed. In case the borrower is unable to repay the loan, the bank reserves the right to utilise the pledged collateral to recover the pending payment. The interest rate for such loans is much lower as compared to unsecured loans.

Unsecured Loans

Unsecured loans are those that do not require any collateral for loan disbursement. The bank analyses the past relationship with the borrower, the credit score, and other factors to determine whether the loan should be given or not. The interest rate for such loans can be higher as there is no way to recover the loan amount if the borrower defaults.

Read Also: Fha Loan To Buy Land And Build Home

The Different Types Of Bank Loans

This site is dedicated to the investment strategy known as Value Investing. There are over 600 articles on this site about business tenets, principles and standards. During 2020, this sites Value Investment Fund earned a 35% return during 2021 it has earned almost 45%. All of it is documented in the Value Investing Section. If you want to learn about value investing, click on the Value Investing tab in the header above.

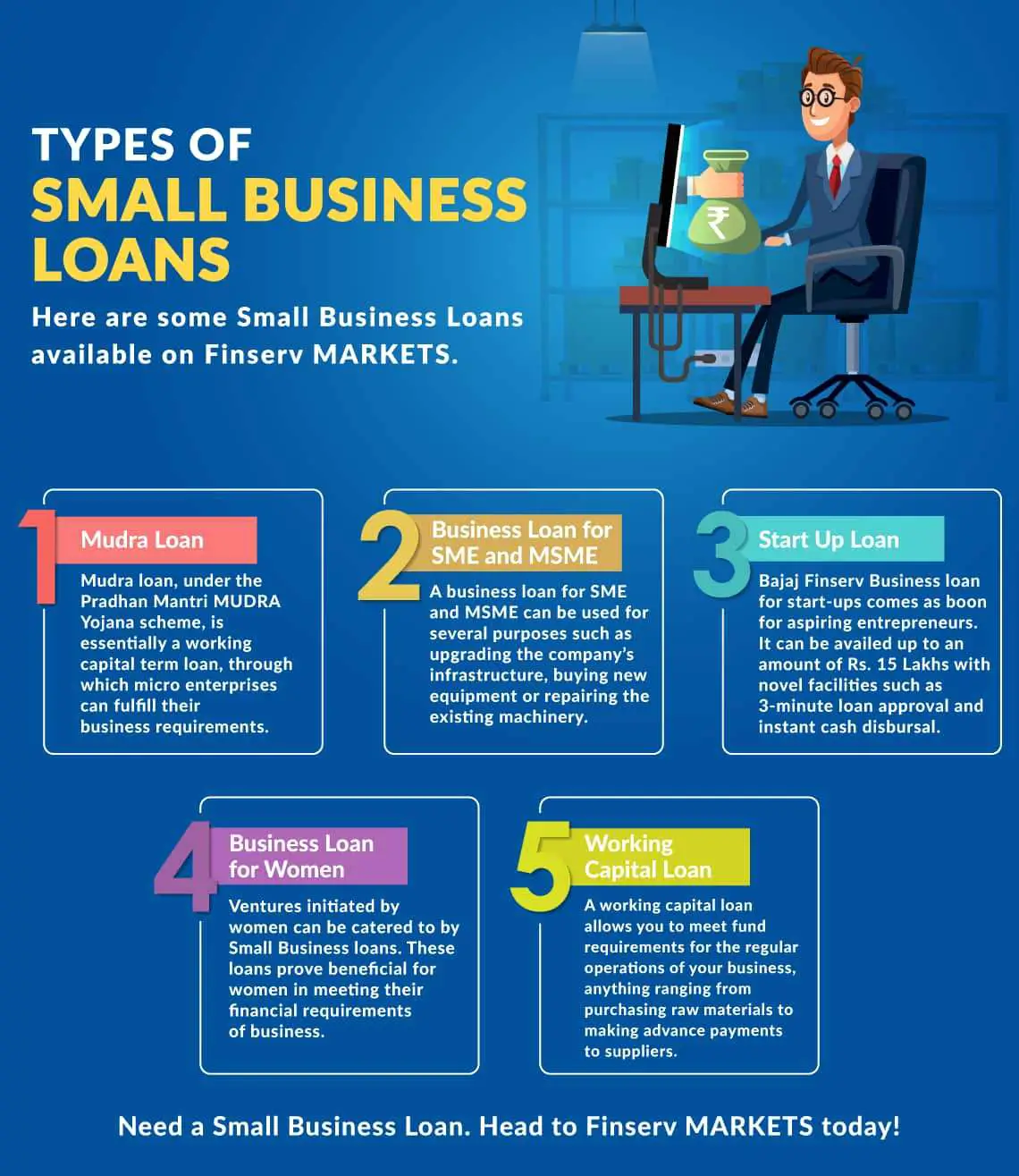

There are many different types of bank loans, each having their own respective purpose. All bank loans are categorized into two distinct groupings secured and unsecured loans. Within in each category of loans there are several different sub-types of bank notes used to make a loan. Both categories require the owner of the small business to provide a personal guarantee to ensure the loan is paid back.

The following categories identify and explain the different types of bank loans used in the small business world.

Loans Against Mutual Funds And Shares

Mutual funds can also be pledged as collateral for a loan, an ideal vehicle for long-term wealth creation. You can pledge equity or hybrid funds to the financial institution for availing of a loan. For doing so, you need to write to your financier and execute a loan agreement.

Your financier then will write to the mutual fund registrar and put a lien on the specific number of units to be pledged. Typically, you can get 60-70% of the value of units pledged as a loan.

Similarly, financial institutions create a lien against shares for which the loan is taken, and the loan value is equivalent to a percentage of the value of the shares.

You May Like: Usaa Rv Loan Rates Calculator

Watch Out For Credit Requirements And Interest Rates

Since unsecured personal loans dont require collateral, lenders usually turn to your credit reports and credit scores to help determine if youre a good candidate for a loan. In general, people with higher credit scores will be eligible for better loan terms.

You may be eligible for an unsecured personal loan even if you have fair or bad credit. But you may want to shop around to make sure the interest rate and monthly payment is affordable for your budget.

Your Down Payment Amount Affects Your Loan Choices And Your Costs

Watch our short video to learn what to consider when choosing how much to put down. Many homebuyers choose to put less than 20 percent down. When you put less than 20 percent down, you will likely need to pay for mortgage insurance. Mortgage insurance adds to your loan costs, but it helps you get a loan you might otherwise be unable to get. Mortgage insurance protects the lender if you fall behind on your payments, which means lenders are more willing to lend to you. Mortgage insurance doesnt protect you or pay your mortgage for you. Learn more about mortgage insurance and how it works.

Recommended Reading: How To Get Approved For Capital One Auto Loan

Interest Only Home Loan

When borrowing money from a lender or bank, you can choose to pay just the interest on the loan or both the interest and the principal . If you choose to pay only the interest on the loan, your repayments will be much lower freeing up cash for things like renovations and other expenses. However, a lender or bank will always assess your ability to pay back both interest and principle in order to qualify for the loan as interest-only loans have a limited life span of up to 5 years.

Different Types Of Loan And What They Entail

If you are looking for a loan to finance your business, then you need to understand the different types of loans available to you. Loans are given to people, corporations, and governments for various purposes. Their main purpose is to increase the money supply and serve as a source of revenue for the lenders. There are three main types of loans available to you secured, unsecured, and conventional.

You May Like: Prosper Loan Approval Time

Best For Debt Consolidation And Major Purchases

If you have high-interest credit card debt, a personal loan may help you pay off that debt sooner. To consolidate your debt with a personal loan, youd apply for a loan in the amount you owe on your credit cards. Then, if youre approved for the full amount, youd use the loan funds to pay your credit cards off, instead making monthly payments on your personal loan.

Depending on your credit, a personal loan may offer a lower interest rate than your credit card and a lower interest rate could mean big savings. It may help to get an idea of what the average debt consolidation rate is.

A personal loan may also be a good choice if you want to finance a major purchase, like a home improvement project, or you have other big costs like medical bills or moving expenses.

Recreation Vehicle And Boat Loans

Whether youre seeking a motor home or a motor boat, you might need help financing it. Personal loan lenders typically allow you to borrow for this purpose. Just be sure to compare apples-to-apples APRs as you shop around among lenders and RV and boat sellers that may have their own in-house loan options.

Also, keep in mind that buying used RVs and boats on credit could be difficult or expensive. Lenders typically award lower interest rates on RV and boat loans when the vehicle being purchased is less than five years old.

Like with other personal loans, if your credit or cash-flow is suspect, consider budgeting yourself into a stronger borrowing position. The right RV loan will be available once your finances are ready.

Recommended Reading: How To Transfer Car Loan To Another Bank

What Is A Loan

A loan is a sum of money that one or more individuals or companies borrow from banksTop Banks in the USAAccording to the US Federal Deposit Insurance Corporation, there were 6,799 FDIC-insured commercial banks in the USA as of February 2014. or other financial institutions so as to financially manage planned or unplanned events. In doing so, the borrower incurs a debt, which he has to pay back with interest and within a given period of time.

The recipient and the lender must agree on the terms of the loan before any money changes hands. In some cases, the lender requires the borrower to offer an asset up for collateral, which will be outlined in the loan document. A common loan for American households is a mortgageMortgageA mortgage is a loan provided by a mortgage lender or a bank that enables an individual to purchase a home. While its possible to take out loans to cover the entire cost of a home, its more common to secure a loan for about 80% of the homes value., which is taken for the purchase of a property.

Loans can be given to individuals, corporations, and governments. The main idea behind taking out one is to get funds to grow ones overall money supply. The interest and fees serve as sources of revenue for the lender.

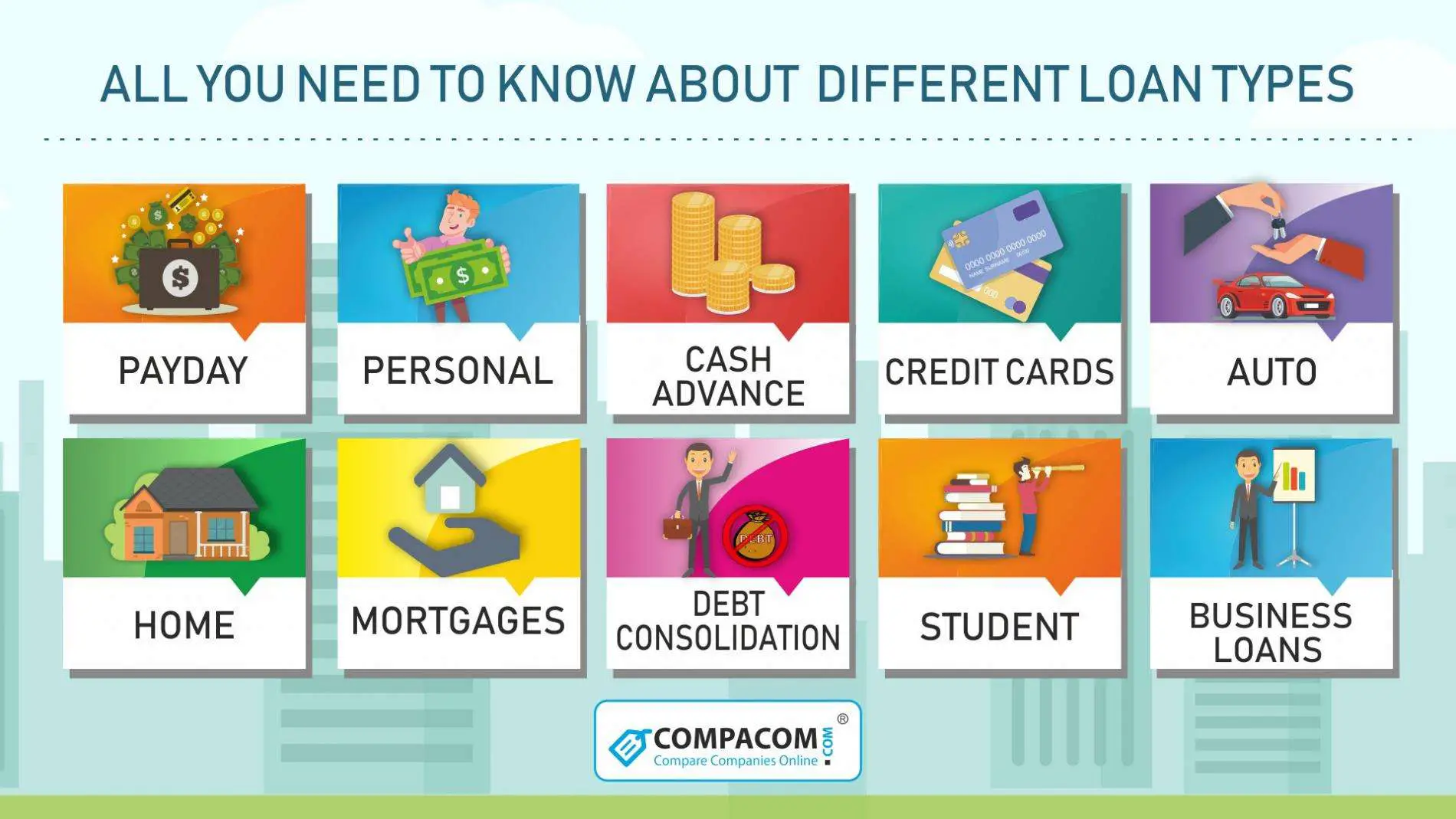

Loans can be classified further into secured and unsecured, open-end and closed-end, and conventional types.

1. Secured and Unsecured Loans

2. Open-End and Closed-End Loans

Loan Against Insurance Policies:

If you have an insurance policy, you can apply for a loan against it. Only those insurance policies that are aged over 3 years are eligible for such loans. The insurer can themselves offer a loan amount on your insurance policy. Approaching the bank for the same is optional. You need to submit all the documents related to the insurance policy to the bank.

Recommended Reading: Max Fha Loan Amount Texas 2021

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Income From Discharge Of Indebtedness

Although a loan does not start out as income to the borrower, it becomes income to the borrower if the borrower is discharged of indebtedness.:111 Thus, if a debt is discharged, then the borrower essentially has received income equal to the amount of the indebtedness. The Internal Revenue Code lists “Income from Discharge of Indebtedness” in Section 61 as a source of gross income.

Example: X owes Y $50,000. If Y discharges the indebtedness, then X no longer owes Y $50,000. For purposes of calculating income, this is treated the same way as if Y gave X $50,000.

You May Like: Usaa Car Loan Rates

Based On The Pledged Assets

Gold Loan

Many financiers and lenders offer cash when the borrower pledges physical gold, may it be jewellery or gold bars/coins. The lender weighs the gold and calculates the amount offered based on several checks of purity and other things. The money can be utilised for any purpose.

The loan must be repaid in monthly instalments so the loan can be cleared by the end of the tenure and the gold can be taken back to custody by the borrower. If the borrower fails to make the repayments on time, the lender reserves the right to take over the gold to recover the losses.

Loan Against Assets

Similar to pledging gold, individuals and businesses pledge property, insurance policies, FD certificates, mutual funds, shares, bonds, and other assets in order to borrow money. Based on the value of the pledged assets, the lender will offer a loan with some margin at hand.

The borrower needs to make repayments on time so that he/she can get custody of the pledged assets at the end of the tenure. Failing to do so, the lender can sell the assets to recover the defaulted money.

Borrowing From Friends And Family

Borrowing money from friends and relatives is an informal type of personal loan. It can result is considerably less interest and administrative fees for the borrower, but it isnt always a good option. A few missed payments may strain a relationship. To protect both parties, its a good idea to sign a basic promissory note.

Learn more about borrowing from friends and family.

Recommended Reading: Drb Vs Sofi

The Different Types Of Loans In Canada: Explained

Interest rates can be a very complicated matter to understand, especially for first-time home buyers who are unfamiliar with the rules and regulations surrounding loans in Canada. However, understanding interest rates is not something you have to master all by yourself, so here is an explanation of different types of loans.

Loan Programs And Mortgages For Different Property Types

Many people think of an existing single-family home when they think about homeownership or buying residential real estate. Purchases of this type of property are common, after all. But there are other residential real estate purchases that might be perfect for your lifestyle and/or financial situation.

One of the biggest differences between purchasing a single-family home and a different type of property comes down to the financing. Existing, habitable homes are generally financed with a conventional mortgage, jumbo loan, VA loan, or FHA loan .

Thankfully, there are other mortgages for different property types. Lets break down some of the most common property types and what those mortgage loans might look like.

Read Also: Credit Needed To Refinance Home

How Much Money Should I Put Down

If you have a large chunk of cash just sitting around, then putting 20% down will save you any mortgage insurance premiums and will make you a more qualified buyer, getting you the best rates. With current mortgage rates as low as they are, any cash over 20% down could most likely perform better in a retirement savings vehicle like an IRA, 401, or HSA and give you immediate tax savings.

Who Should Get A Government

If you cannot qualify for a conventional loan due to a lower credit score or limited savings for a down payment, FHA-backed and USDA-backed loans are a great option. For military service members, veterans and eligible spouses, VA-backed loans can be a good option often better than a conventional loan.

Also Check: Credit Score Usaa

Loans Vs Other Types Of Borrowing Options

Loans arent the only way to borrow. There are several other ways to finance a purchase, or otherwise afford it, such as a credit card, line of credit or gifted funds.

Loan vs. credit card: With a credit card, the cardholder is never obligated to borrow money and only pays interest on balances they carry from month to month. Plus, the card remains open indefinitely.

Loan vs. line of credit: A line of credit is like a credit card without the physical card. The person who opens a line of credit only has to pay interest on what they borrow, and they arent obligated to borrow. However, some lines of credit may have a set draw period during which the borrower can take out money.

Loan vs. gift: Loans require repayment, while gifts do not. Gifts are taxable, but its the person giving the gift who pays the tax. Gift givers only need to report gifts on their taxes if they give more than $15,000 to any individual person/place in a year . And they likely wont have to actually pay tax on gifts of $15,000+ because everyone has a lifetime tax exemption on $11.4 million worth of gifts.