How Do I Apply For A Usda Loan

The process for getting a USDA loan will differ depending on whether youre getting a guaranteed or direct loan. Since most USDA borrowers have guaranteed loans, well offer directions for that process here. If you have low income and are considering a loan directly through the USDA, we recommend checking your eligibility and contacting your local USDA office, which will have an application available to you.

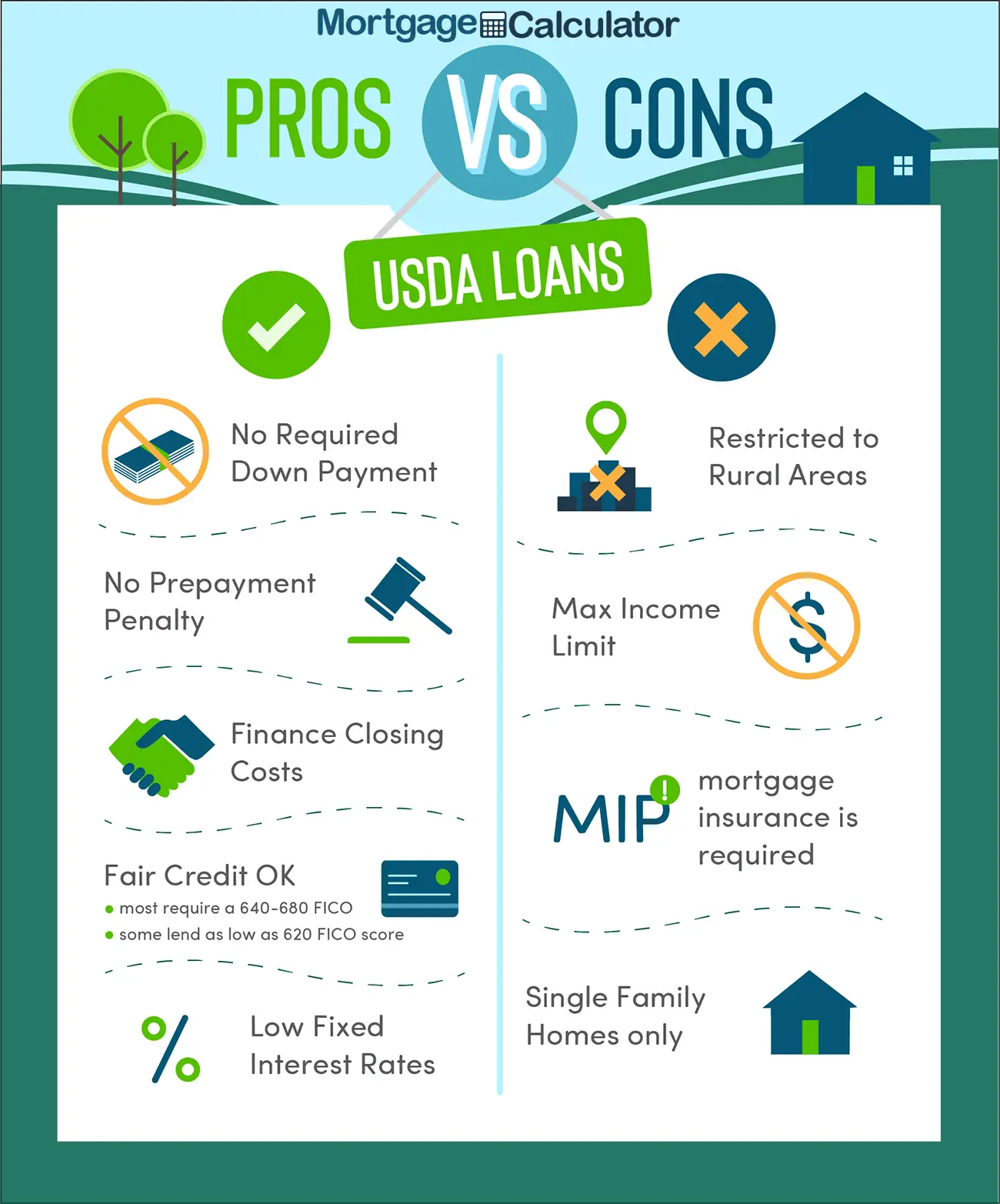

Disadvantages Of Usda Loans

There are certain drawbacks to USDA loans that borrowers may not encounter with conventional mortgages or mortgages through other government programs such as FHA and VA. These include:

- Geographical requirements: Homes must be located in an eligible rural area with a population of 35,000 or less. Also, the home cannot be designed for income-producing activities, which could rule out certain rural properties.

- Second property/vacation homes not allowed: The property must be used as the borrowers primary residence.

- Income limits: Borrowers must meet specific income requirements based on where they live. If you exceed the income limits, you will not qualify for a USDA loan.

- USDA up-front fee: Borrowers must pay an up-front fee for a USDA guaranteed loan or have that fee rolled into the mortgage loan amount. Depending on that loan amount, this could be several thousand dollars.

- Streamlined refinancing limitations: To qualify for a refinance, you must have a record of 12 consecutive, on-time mortgage payments, and the home must be your primary residence. This program only applies to mortgages with 30-year terms and is not available in all states.

We Specialize In Va Loans

Our mortgage company is called Patriot Home Mortgage for a reason we specialize in helping veterans and their loved ones find the house of their dreams. We know that finding the right home loan can be challenging, but were here to help. If you think you may qualify for a VA home loan or would like to better understand your options, contact our mortgage company in St. George, Utah or Mesquite, Nevada to schedule a free consultation.

Also Check: Refinance Fha Loan To Conventional Calculator

Do You Qualify For A Usda Loan

The U.S. Department of Agriculture has its own mortgage program, but its likely one of the least-known about.

The mortgage assistance program is a zero-down payment option for eligible homebuyers in rural locations. A USDA loan is issued through the USDA Rural Development Guaranteed Housing Loan Program by the U.S. Department of Agriculture.

The loan program is intended to help improve the quality of life and economy in rural America. Interest rates are relatively low, along with the no-down-payment component of the loan product. There are a couple of other USDA programs available as well.

What Is A Usda Loan And How Does It Work

A USDA loan is a mortgage loan that helps low- to moderate-income families purchase a home in an eligible rural area. The loan is backed by the USDA, which allows lenders to offer lower rates and no down payment. By making homeownership more affordable for many families, USDA loans, in turn, help these communities flourish and provide a better quality of life for rural residents.

There are a few different USDA loan programs. The two most common are:

- Single Family Housing Guaranteed Loan Program, which is offered by private lenders.

- Single Family Housing Direct Home Loans, which is offered by the USDA

Also Check: Can I Buy A Second House With My Va Loan

Who Qualifies For A Usda Loan

To get a USDA loan, the home you want to buy or repair must be in an eligible area. Homes usually need to be located in an area where the population is below 20,000, though in some cases homes in areas with a population as high as 35,000 are eligible.

There are other requirements that vary depending on the type of loan youre applying for.

- Section 502 direct loans Applicants need to have income no higher than the USDAs low-income limit for the county where theyre buying or building a home. They also have to be able to show that they can pay back the loan. They must plan to use the property as their primary residence, and they cant already have other housing lined up or have the option to take out a reasonably good loan from a different source.

- USDA-guaranteed loans Applicants need to have household income that isnt more than 115% of the median income. They have to show that they can repay a loan, but its OK if they have alternative proof of credit history in place of conventional credit reports and scores. They need to plan to use the property as their primary residence, and they must be unable to get a no-PMI conventional loan.

- USDA housing repair loans Applicants need to own the home and be living in it. Their income has to be less than 50% of the median income for their county, and they must not be able to find a loan they can afford from another source.

Who Should Get A Usda Loan

When youre buying a house, you have a lot of decisions to make, such as the location of your new home, its size and its amenities. You also need to choose the type of mortgage you get. Whether a USDA loan is right for you or not depends on a few factors.

The loans are designed to encourage people to buy homes in rural areas. But the USDAs definition of a rural area, at least for its guaranteed loan program, might be much broader than you think it is. Often, homes in suburban areas qualify for USDA loans. The only areas that are fully excluded are metropolitan or urban ones, so if you know you definitely want to buy in a city, the USDA loan program may be off the table for you.

Your income can also determine whether or not the USDA loan program is right for you. Buyers need to meet income limits, so as long as you qualify as a very low to moderate-income earner in your area, you may be eligible.

It can also be worth determining what other loans you qualify for, if any. Usually, USDA loan borrowers cant get financing through other means, such as a conventional mortgage or FHA loan. If that describes you, it may be worthwhile to seriously consider a USDA loan.

Don’t Miss: Usaa Credit Score For Mortgage

Rural Repair And Rehabilitation Loan

Purpose: The Very Low-Income Housing Repair program provides loans and grants to very low-income homeowners to repair, improve, or modernize their dwellings or to remove health and safety hazards.

Eligibility: To obtain a loan, homeowner-occupants must be unable to obtain affordable credit elsewhere and must have very low incomes, defined as below 50 percent of the area median income. They must need to make repairs and improvements to make the dwelling more safe and sanitary or to remove health and safety hazards. Grants are only available to homeowners who are 62 years old or older and cannot repay a Section 504 loan.

How Do I Apply For A Guaranteed Usda Loan

Before you apply for any type of USDA loan, you should gather the following documents.

- Proof of U.S. citizenship or permanent residency

- Proof of non-citizen national or qualified alien status

- Last two years of pay stubs and tax returns

- Documentation of bills and other financial obligations

- Records of alternate credit like rental and utility payments .

To apply for a USDA guaranteed loan, you need to reach out to a USDA-approved lender in the area you want to live in. The lender will process your mortgage application through the USDA. You can find one through a real-estate agent or by visiting the USDA Rural Development website. Each state also houses its own guaranteed loan coordinator.

You May Like: Should I Do Fixed Or Variable Student Loan

How To Use Usda Loan Eligibility Maps In Your Area

Using a USDA loan eligibility map is a breeze. First, go to the USDAs interactive map. Then, enter the address of a property youre thinking about buying.

Youll see a thumbtack appear on the screen to mark the location and receive an instant answer on whether the property is in an eligible area. Ineligible areas will be shaded in red. Depending on where youre searching, you may see eligible areas nearby. If the parcel seems to be on the line between an eligible and ineligible area, you may want to contact the USDA Rural Development office for clarification.

Please note: The USDA property eligibility map is an informational tool only and doesnt guarantee accuracy. To ensure that your desired property qualifies for the loan program, youll have to apply for the mortgage officially.

What Are Usda Eligibility Maps

USDA eligibility maps are maps that show you which areas have properties that may qualify for a USDA loan. Also known as USDA home loan maps, USDA property eligibility maps, USDA mortgage maps, or USDA loan maps, these geographic charts let you check desired parcels for eligibility before getting too deep into the research process. These maps are primarily created based on area population and may get updated on an annual basis.

Also Check: Usaa Auto Refinance Reviews

Property Condition And Quality

The USDA limits the properties that you can buy based on their condition and quality. The property has to have adequate mechanical systems and be termite-free. It also has to meet the USDA’s standards for being “decent, safe and sanitary.” To qualify for a USDA loan, a home must have a hard or all-weather road leading to it as well.

Does This House Qualify For A Usda Loan

5 Factors That Determine if Youll Be Approved for a Mortgage If you owe too much, youll have to either buy a cheaper home with a smaller mortgage or work on getting your debt paid off before you try to borrow for a house. different lenders do have different.

usda home loans: Rural Development Loan & Property Mortgage. When you apply for your USDA Home Loan, your lender will check your credit rating, income, and your employment history. However, there are several other.

What is a USDA Loan? Can I Qualify. NC Mortgage Experts In fact, a home with this sized back yard would be considered commercial property, and wouldnt qualify for a USDA loan. but you could live next door!. Thats the total debt ratio meaning we take your new house payment, including the Homeowners Insurance, taxes, USDA PMI, and any homeowner association fees.

USDA Loans: Everything You Need to Know Contour Mortgage A USDA loan is a government-backed home loan offered by the United States Department of Agriculture. The point of this type of loan is to make it possible for low-income buyers to purchase a house they can afford, since USDA loans come with low interest rates, a zero-down payment and relaxed income and credit requirements.

USDA Loan Requirements 2019 USDA Rural Development Loan. What attracts many to the USDA guaranteed loan is that there is no down. The first step in finding a home for sale that is eligible for USDA financing, is to.

Read Also: How Much Car Can I Afford Based On Income Calculator

Usda Loan Property Requirements 2022

If you wish to purchase a home with a USDA loan, there are property requirements that must be met in order for the home to qualify for financing. These include property eligibility based upon the location of the home, as well as certain property types, and appraisal and inspection requirements.

USDA Property Location Eligibility

The first step in determining if a home is eligible to be financed with a USDA loan is to check if it is located in an eligible zone. The USDA guaranteed loan, which is also known as the USDA rural development loan, is only available to finance rural properties. What is technically considered rural is any town, city, place, or village outside of a major urban/metropolitan area, and that has a population that does not exceed 20,000 inhabitants. You can use the USDA eligibility search to check the eligibility of an exact address, or otherwise view by region, which will highlight ineligible areas. We can walk you through how to find USDA eligible homes for sale.

Types of Properties Allowed

USDA loans are strictly for non-income producing properties. This means that agricultural, farm, or other types of income producing properties are ineligible for a USDA guaranteed loan. The program was created to assist families and individuals purchase a primary residence . This means no investment or rental properties of any kind are allowed.

USDA Loan Property Condition Requirements

USDA Loan for Existing Dwelling

USDA Loan for New Construction

How Usda Loans Work

Using a USDA loan, buyers canfinance 100 percent of a homes purchase price whilegetting access to better-than-average mortgage rates. This is because USDAmortgage rates are discounted as compared to other low-down paymentloans.

Beyond that, USDA loans arent allthat unusual.

The repayment schedule doesntfeature a balloon or anything non-standard the closing costs are ordinary and, prepayment penalties never apply.

The two areas where USDA loans are different is with respect to the loantype and down payment amount.

- With a USDA loan, you dont have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available via the USDA rural loan program

Rural loans can be used byfirst-time home buyers and repeat home buyers alike.Homeowner counseling is not requiredto use the USDA program.

Don’t Miss: Can You Refinance With An Fha Loan

What Is A Usda Loan Am I Eligible For One

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Perhaps you feel more at home surrounded by pastures than pavement. If so, buying a home might be well within reach, thanks to the U.S. Department of Agriculture mortgage program. In fact, the USDA might have one of the governments least-known mortgage assistance programs.

A USDA home loan is a zero down payment mortgage for eligible rural homebuyers. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program, by the United States Department of Agriculture.

» MORE: Best USDA lenders

In 2017, as a part of its Rural Development program, the USDA helped some 127,000 families buy and upgrade their homes. The program is designed to improve the economy and quality of life in rural America. It offers low interest rates and no down payments, and you may be surprised to find just how accessible it is.

With all types of mortgage loans to choose from, how do you know whether a USDA loan is right for you? Heres an overview of how it works and who qualifies:

Usda Home Loan Property Requirements

- Must be a single-family residence, an approved condominium or a PUD a townhome

- The property must be non-farm, non-income providing

- Maximum acreage is 40 acres

- The value of the site should not exceed 30% of the total value of the property

- The property must be in marketable condition at the time of closing, meaning it can be sold in its current condition if necessary.

Because this is a loan program designed to help low to moderate income families, you cannot own any other homes at the time of the USDA loan closing. If you do own other property, it has to be sold prior to, or concurrently with your USDA loan closing.

An exception can be granted if you are relocating, and your other home is either:

- not in the same commuting area

- functionally inadequate (USDA regards a mobile home not on a permanent foundation as functionally inadequate

Don’t Miss: How Long Does The Sba Loan Take To Process

Usda Loans Require Mortgage Insurance

USDA guarantees its mortgage loans meaning it offers protection to mortgage lenders in case USDA borrowersdefault. But the program is partially self-funded.

To keep this loan programrunning, the USDA charges homeowner-paid mortgage insurancepremiums.

As of October 1, 2016, USDA has lowered its mortgage insurance costs for both the upfront and monthly fees.

The current USDA mortgage insurance rates are:

- For purchases 1.00% upfront fee, based on the loan amount

- For refinancing 1.00% upfront fee, based on the loan amount

- For all loans 0.35% annual fee, based on the remaining principal balance each year

As a real-life example: A homebuyer with a $100,000 loan size would be have a$1,000 upfront mortgage insurance cost, plus a monthly payment of $29.17 for the annual mortgageinsurance.

USDA upfront mortgage insurance isnot paid as cash. Its added to your loan balance for you, so you pay it over time.

USDA mortgage insurance rates are lower than those for conventional or FHA loans.

- FHA mortgage insurance premiums include a 1.75% upfront mortgage insurance premium, and 0.85% in MIP annually

- Conventional loan private mortgage insurance premiums vary, but can often be above 1% annually

With USDA-guaranteed loans, mortgage insurancepremiums are just a fraction of what youd typically pay. Even better, USDAmortgage rates are low.

For a buyer with an averagecredit score, USDA mortgage rates can be 100basis points or more below the rates of a comparable conventional loan.

The 2 Types Of Usda Home Loans

The USDA Guaranteed and Direct loan programs are very different, although both provide housing in rural areas and offer no-down-payment financing. Here’s what you need to know about how each program works and how to qualify.

To be eligible for a USDA Guaranteed or Direct loan, you cannot be delinquent on any federal debt and must be a U.S. citizen or legal nonresident alien.

Recommended Reading: Usaa Loans For Bad Credit