How Do I Calculate A Monthly Car Payment

Using the car payment calculator, fill in information like car price, interest rate and loan terms. The calculator also provides a place to add the sales tax rate for your local area. To get closer to seeing the actual payment, be sure to insert your down payment information plus your cars trade-in value, including any amount you owe. Thats how you calculate monthly car payments. Need help determining the trade-in value of your vehicle? Easy! Use our car valuation tool to get an estimate.

Planning Your Next Vehicle Purchase

A reliable car, truck, or minivan can make life so much more convenient, whether thats cutting back on your commute time, running weekend errands, or chauffeuring your kids to and from school. Then again, most vehicles, particularly new or lightly used models can get quite pricey when you factor in all the different costs involved.

If youre planning to finance your next vehicle purchase using a loan, its important to have a good understanding of what your payments will be. This way youll be able to create a monthly budget that works for your lifestyle. Our car loan calculator can help you determine what payments you can expect to pay based on a variety of factors.

How To Apply For An Auto Refinance Loan

The process of refinancing your auto loan is fairly similar to the process that came with applying for your initial vehicle loan. Follow these five steps before signing off on a new refinanced auto loan.

Also Check: How Much Interest On 10000 Loan

Auto Financing Advice For People With Poor Credit

There is no shortage of reasons why modern adults might find themselves in a weak financial position these days. Of course, the most current reasons are the economic downturn, the resultant job loss, and ongoing unemployment. But even before the Great Recession, plenty of people succumbed to the mindset of keeping up with the Joneses, living well beyond their means and landing in a situation where living paycheck to paycheck became the norm. It’s not all that surprising when you consider the tenets of capitalism – we have all embraced the idea of private ownership. But unfortunately, most of us continue to spend more than we actually earn.

And it’s made all the easier by the growing use of credit, which allows us to make purchases based on anticipated earnings and then pay them back later. The problem is that many adults treat credit as cash rather than the loan it is. In turn, they end up in an endless cycle of repayment, thanks to the addition of interest charges. At the same time, they continue to spend instead of paying off existing debts in full. So where does this leave you when you find yourself in need of a car? In a terrible position, that’s where.

Temper your budget

Expect higher interest rates

Get a copy of your credit report

Prepare to shop around

Watch for red flags

Collect some cash

Consider a home refinance

Clean up your credit

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Read Also: How To Find Out Old Loan Account Numbers

Protect Your Credit When Auto Loan Shopping

Every time a lender checks your credit or requests your credit score, that fact will be noted on one or more of your credit reports as an “inquiry.” Your credit score can drop as a result. The good news is that most credit scoring models will ignore recent auto-related inquiries, and will count multiple inquiries from auto loan applications in a short period of time as one. To protect your credit, it’s best to shop for an auto loan in a focused period of time: two weeks or less is best to be safe.

You can check your credit score for free using Credit.com’s free Credit Report Card. Requesting your own credit score through this service will not affect your credit score.

What Is A Car Loan

At its most basic, a car loan breaks the large expense of a car into monthly instalments. Your lender buys the car and you pay them back in instalments over a set period.

When you decide to purchase a car, your car dealer generally provides you with car loan offers from their partnered financial institutions. Alternatively, you can contact a bank before shopping to get a preapproved car loan.

Recommended Reading: Why Is My Car Loan Not On My Credit Report

How To Use The Car Payment Calculator

The main purpose of this calculator is to help you compare estimated payments for loans with different term lengths and interest rates. When you apply for a loan, youll get to choose a term length, which is the number of months youll make payments. Your interest rate may change based on which term length you choose, and your rate will also change based on your credit score.

As you use this tool, youll find that the interest rate and loan amounts have already been filled in. These pre-filled values are national averages, so if you aren’t sure what to enter, you can leave these values in place. However, providing specific information will give you a more accurate result for your situation.

Once you enter all the information below, click Calculate and youll be shown a breakdown of your monthly payment, along with information about how much youll pay in interest and sales tax. If you click Add another option to compare payment, you can enter a different term and rate to see how the payment changes. Comparing these payment estimates could help you choose the term and interest rate that fits better within your budget.

Here is an overview of each field:

Can I Get A Loan With A Credit Score Of 600

Recommended Reading: How Long Does It Take For Sba Disaster Loan Approval

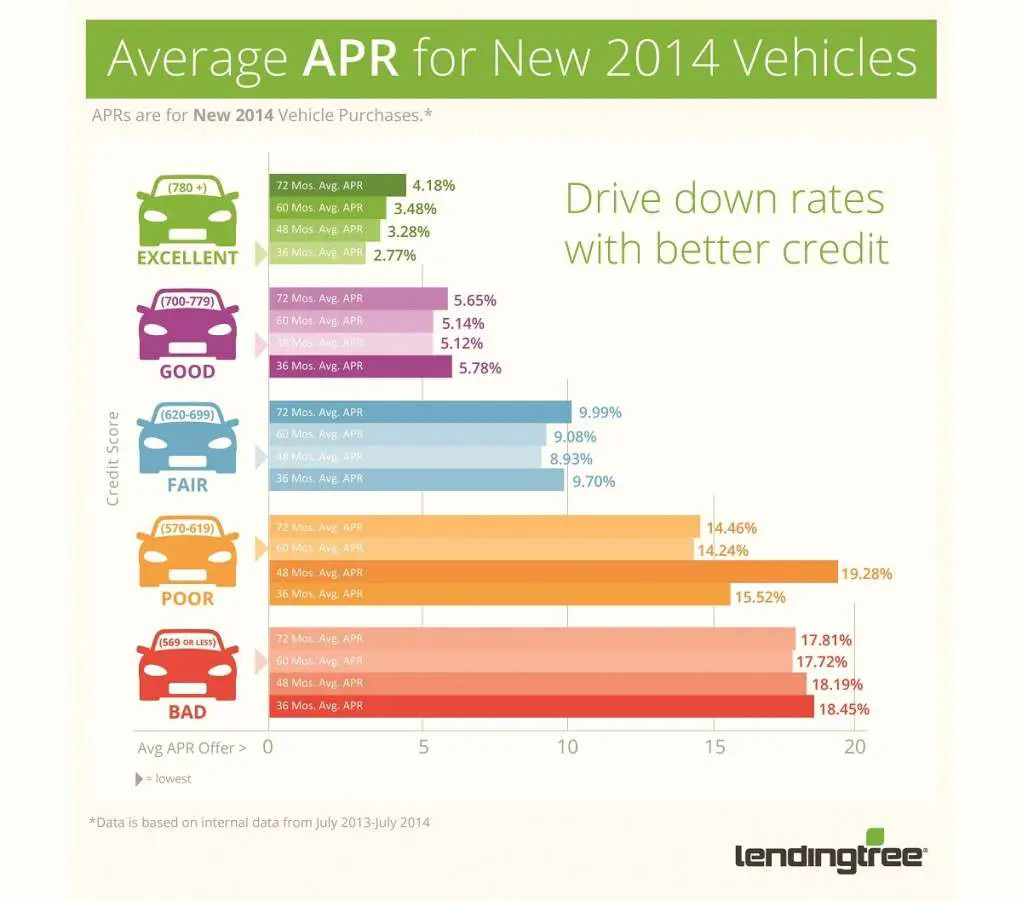

Average Auto Loan Rates By Credit Score In 2022

Average auto loan rates are always in flux depending on market conditions. In 2021, new car loan rates range from 2.34 percent to 14.59 percent. The difference between a low and high annual percentage rate is based largely on your credit score.

This article will explain the factors that determine how lenders set APRs and offer tips for finding the lowest auto loan rates. Also read our review of the best auto loan providers to learn about and compare the top lenders in the industry.

Up to 722.25%

- Low rates for good credit customers

- Strong industry reputation

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- A+ BBB Rating

- A leading provider in refinance loans

- A+ BBB rating

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

- Average monthly savings of $145

- Online Application

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

What Determines My Auto Loan Apr

Your APR is based in large part on your , and the higher your credit score, the more likely youll be to receive the most competitive rates. In the fourth quarter of 2019, borrowers with the lowest credit scores received an average APR of 14.25% on new car loans, while those with the highest credit scores received an average APR of 3.82%, according to Experian.

You May Like: Can I Pay Off My Child’s Student Loan

Why Using A Car Loan Calculator Is Important

Buying a car can be an expensive endeavor, and most people cant afford to pay cash outright. Luckily, consumers who need cars can obtain auto loans through car dealerships, banks, credit unions, and even online lenders.

Auto loans are secured personal loans, with the car acting as collateral. This means if you fail to make payments, your lender can repossess the vehicle and sell it to make its money back. Because the loans are secured, the interest rate is often lower than what youd find with other types of consumer debt, such as credit cards and personal loans.

Your interest rate will be affected by various factors, however, such as whether youre buying a new or used car if you have a trade-in the amount of your down payment your credit score and income and the length of your repayment loan term. Comparison shopping among lenders is also important for finding the best deal and an auto loan calculator can help by estimating your monthly payments and total costs of borrowing.

Is It Smart To Do A 72

72-month car loans are becoming more common, but keep in mind that taking out a long-term car loan can mean you end up paying more money than the car is worth . A 72-month car loan may allow you low monthly payments, but extending the loan term will increase the amount of interest you pay. A loan term that is 60 months or fewer may be better.

Read Also: How Much Home Loan Approval

Use The Auto Loan Refinance Calculator To Find Potential Savings

Bankrates auto refinance calculator will help you determine how much you can potentially save on interest, monthly payments or both. Simply input the details of your current loan: your monthly payment, remaining balance, interest rate and the remaining loan term.

Next, explore how a new loan could potentially save you money. After figuring out what adjusted term and interest rate work best for you and your wallet, it is wise to apply for loan prequalification which ensures you walk away with a good deal. Check out current offers to compare different auto loan rates and terms after calculating what you want your new loan to look like.

Why Is An Auto Loan Calculator Important

A car loan calculator is a tool you can use to analyze your car loan options before making a purchase. With a calculator, you can determine how large a loan you can afford to take on and, as a result, how much car you can afford. It can also be used to ensure the dealership or lender you finance your new or used car with isnt trying to inflate your monthly payment.

Most auto loan calculators ask for standard information, such as:

- Price of the car you wish to purchase

- Down payment

- Current market rates

- Current dealership promotions

Note that new cars typically have lower rates than used cars because they are less risky for lenders. Making a larger down payment may also get you a lower auto loan rate.

You May Like: Can You Add Onto An Existing Loan

Where To Find The Best Auto Loan Rates

The table below shows the lenders that offer the lowest auto loan rates. However, just because a loan provider offers low APRs does not mean everyone is eligible for that rate. Loan terms vary by individual, and there is no single best lender for all drivers.

Some lenders, like PenFed, offer car buying services. This means you can shop for a car and finance it in one place. Also, some lenders offer both purchase and refinancing loans, while others will offer either one or the other.

Will Trading In My Car Affect An Auto Loan

If you plan to trade in your current car before purchasing a new one, it could lower the total cost of your car loan. The credit or cash you receive from the trade-in can be put to use as a down payment, thus reducing the amount you need to borrow from a lender. Before trading in, just make sure you know whether the total amount you still owe on your car is less than what its worth. Carrying an old auto loan onto a new auto loan may raise your interest rates and limit your options for the best deals.

Also Check: How To Figure Out Student Loan Interest

How To Use Credit Karmas Simple Loan Calculator

Whether youre thinking of taking out a personal loan for debt consolidation or a student loan for college costs, you probably want a sense of how much your loan will cost over time.

Our loan calculator can help you understand the costs of borrowing money and how loan payments may fit into your budget. It takes into account your desired loan amount, repayment term and potential interest rate. Youll be able to view an estimated monthly payment, as well as the amortization schedule, which provides a breakdown of the principal and interest you may pay each month.

Keep in mind that this loan payment calculator only gives you an estimate, based on the information you provide. Loan fees like prepayment penalty or origination fee could increase your costs or reduce the loan funds you receive. This loan payment calculator also doesnt account for additional mortgage-related costs, like homeowners insurance or property taxes, that could affect your monthly mortgage payment.

Here are more details on the information youll need to estimate your monthly loan payment.

Use The Edmunds Auto Loan Calculator To Determine Or Verify Your Payment

You’re gearing up to buy your next car but aren’t sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but the good news is that the Edmunds auto loan calculator will do the heavy lifting for you.

Let’s say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle’s price into the auto loan calculator. It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the compound interest, estimate tax and title fees, and display the monthly payment.

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some time to experiment with different values to find an auto loan setup that works best for your budget.

You May Like: How Many Loans Can You Have At Once

Explore Your Auto Loan Options

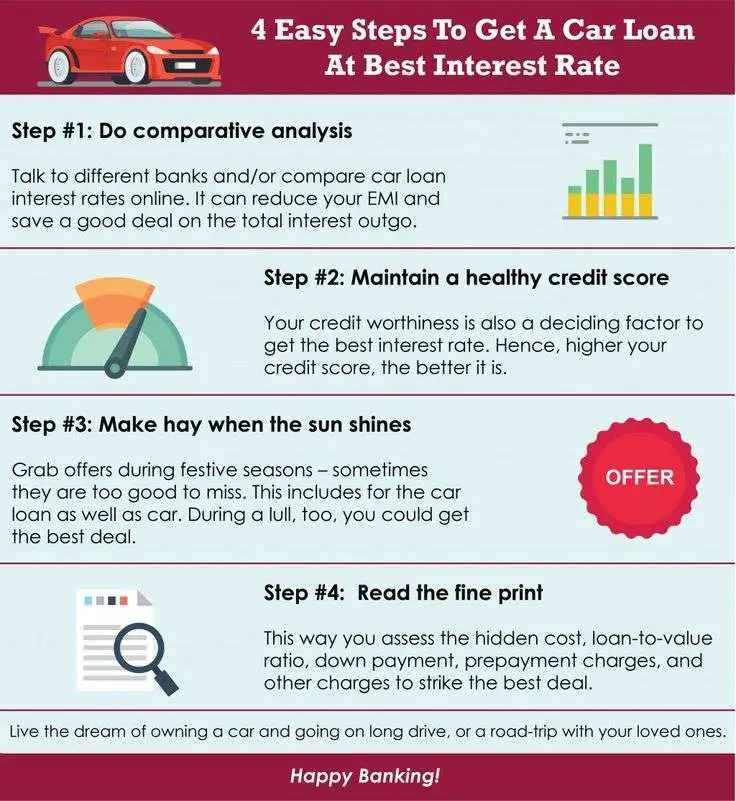

There are two main ways to get a car loan: direct lending and dealership financing. After picking out the car you want to buy, consider which option makes the most sense for you.

Direct Lending

Direct lending entails receiving a loan from a bank, credit union, or online lender. Youll agree on the amount of the loan and the finance charge, or interest rate, that youll pay on the loan. Some things to note about receiving direct lending:

- Banks often offer competitive interest rates but are more exclusive about who they offer a loan to. It is more likely you will need to have a good or excellent credit score to obtain a desirable loan from a bank. You dont usually have to be a member at the bank to apply for an auto loan or get pre-approval.

- Credit unions may have an easier loan application process and lower interest rates. However, you must be a member to apply for a loan.

- Online lending websites often contact several lenders at the same time so you can easily obtain and compare competing loan offers. Just like a bank or credit union, you will determine the terms of the loan with the lender. Make sure to always do background research on each lender to ensure they arent predatory.

Dealership Financing

Some dealerships offer on-site financing, which means you agree on the loan amount and interest rate with the dealer. Here are some things to keep in mind:

How Does My Credit Score Affect My Auto Loan

Your credit score is a major factor in calculating your auto loan rate. A higher credit score means you present lower risk as a borrower and are more likely to be approved for a loan with a low interest rate. If your score is on the lower end, youll be assigned a higher rate or could even be denied for a car loan.

If your credit score improves, it may be possible for you to refinance your auto loan with a lower rate. Depending on where youre at in your repayment term, this could save you money as you pay your remaining loan balance. Youll likely get better terms when its time to buy your next car, too.

Recommended Reading: How Do I Get My Student Loan