How Many Units Can I Buy With An Fha Multifamily Loan

An FHA multifamily mortgage loan allows homebuyers to purchase a house with two, three, or four units. Anything with 5+ units is considered commercial property, which are subject to completely different lending rules.

The FHA does not directly loan money to consumers. Instead, it insures mortgages offered by FHA-approved lenders. The government insurance means less risk for lenders and more leeway on credit scores and other requirements for borrowers.

Thatâs why it can be easier to qualify for an FHA loan than a conventional mortgage.

Although conventional loans often have a 3% down payment allowance, the credit score and debt-to-income requirements can be tougher.

Find Out Whether You Qualify For Buying A Multifamily Home

Are you ready to start considering adding multifamily properties to your real estate investment portfolio? Wondering how to go about buying multifamily rental unit options?

Before you jump into the buying process, youll want to find out if you qualify for a mortgage on a multiunit property.

For a two to four-unit multifamily property of the type that you can get from many residential lenders, including Rocket Mortgage®, you need to take the following into consideration:

How To Start Investing In Multifamily Real Estate

If youre wondering how to buy multifamily homes, it pays to have a good idea of where to start, how to choose a loan type and whats involved with making a strong offer.

Below, we take a closer look at the multifamily real estate investing process and how you can maximize your odds of successfully identifying and capitalizing on new opportunities.

Also Check: Can You Build With An Fha Loan

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

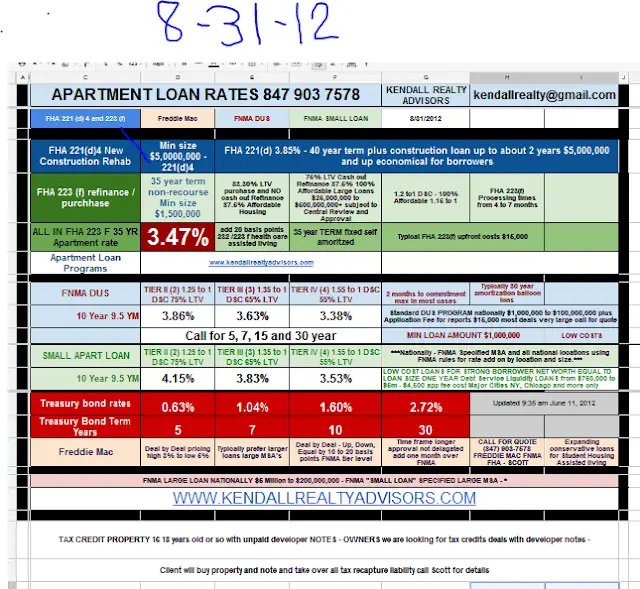

Fha Multifamily Lending Programs

The Federal Housing Administration provides mortgage insurance to approved lenders to make loans to borrowers for multifamily properties. As an approved FHA Multifamily Lender, EagleBank provides access to the flexibility of the FHA multifamily loan programs on an expedited basis and financing can be secured for acquisitions, refinancing, moderate rehabilitation, substantial rehabilitation or new construction. These loans facilitate non-recourse, long-term, fixed-rate, fully-amortizing financing, and allow financing through the issuance of tax-exempt bonds and mortgage-backed securities. We help determine the FHA-Insured program that best suits your specific needs to provide you the ideal solution with the lowest cost of financing.

You May Like: How Does The Veteran Home Loan Work

Can I Get An Fha 203k For A Multi

Some home buyers in today’s housing market want to buy a duplex in order to have the renters pay part of the mortgage. But the problem buyers are running into right now, is that many of these multi-family buildings have been left vacant and need work, or simply need upgrades and remodeling. This is the scenario that prompted one borrower to ask us “Can I get an FHA 203k for a multi-family building?”

Yes, multi-family housing that needs work can be financed with the FHA 203k. The key to this is that the owner of the home must also live there. It must also be the owners primary residence. So a duplex is fine. You can have up to 4 units – 3 of which could be rented out.

So if you’re looking at this, you probably know what the 203k loan already is. Let’s dive into required and eligible home improvements for the Full 203k.

Can You Use An Fha Loan To Buy A Multi

The FHA loan program is for buyers purchasing a primary residence. So, if a buyer is planning on living in one unit, they might qualify for an FHA loan.

Here are some requirements for purchasing a multi-family property with an FHA loan:

- Borrower must live in the property for a minimum of one year as a primary residence.

- Must take occupancy of the primary residence within a set amount of time set by the lender.

- Multi-family unit can have up to four living units.

- Property must meet FHA standards.

The bank might also have other factors they consider when looking at a loan for a multi-family property, including what the debt-to-income ratio will be after bringing in rent and if the borrower has been a landlord in the past.

Other factors to consider not related to the loan are local ordinances for landlords, the time and money commitment of renting out a property, and other due diligence to make sure it is the right fit for you.

Another Way To Own Investment Properties

Read Also: Current Home Loan Interest Rates

To 4 Units Are Required To Pass The Self

- Rental income from the 3 to 4 unit is calculated by using the appraisers fair market rent from all units, including the unit the borrower chooses to occupy, and subtracting the greater of 25 percent of the fair market rent or appraisers estimate for vacancies and maintenance.

- Principal, interest, taxes, and insurance divided by the monthly net-self sufficiency income cannot exceed 100 percent for 3 to 4 unit properties.

Hurdles When Financing A Duplex Or Multifamily Home

When learning how to buy a duplex or other multifamily unit, there are unique characteristics you will not encounter with a conventional mortgage. Appraisals might be rare to come by since there might not be as many comparable units in the area. So, if you use a multifamily conventional loan, you could end up having to shell out a higher down payment, upward of 15 percent for duplexes and 20 percent for multifamily homes .

Don’t Miss: How Do I Find Out Student Loan Balance

Lender Overlays Versus Hud Two To Four Unit Multi

Lender overlays can get in the way when purchasing a home with FHA financing. Many banks have credit score overlays where they require a 620 or even a 640 credit score to move forward. When purchasing a multi-family home, many banks also have extra reserve requirement overlays. We will detail reserves later in this blog, but we do not have any lender overlays when it comes to FHA mortgage financing. This is why we are able to help more families than most lending institutions. If you feel like you have been given incorrect mortgage advice, please reach out to our expert team today. We have stayed on top of all FHA guideline changes and will take the time to explain the entire mortgage process to you and your family!

Build Equity Thanks To Multifamily Units Financed With Fha Loan

Investment properties produce a lot of equity rapidly. The down payment for a multifamily property may be significant, and the monthly rental income adds to the homes equity. You can tap into your home equity with a cash-out refinance to renovate the property, make necessary repairs, or even purchase additional investment properties. For individuals new to real estate investing, multiunit properties may be a fantastic way to get started.

Don’t Miss: How Do You Apply For Student Loans

How To Apply For A Multifamily Loan

If you’re looking to apply for an owner-occupied multifamily home loan up to 4 units through FHA, a lender will check your credit as well as evaluating your income and assets. Be prepared to share things like your W-2s, tax returns and 1099s. Additionally, you’ll want to provide statements from any bank and investment accounts you want to use to qualify for the mortgage.

In addition to your personal financial qualifications, your property will be evaluated to give an appraised value. Youll also receive a fair market rental value, which is used to help qualify you for the mortgage payment with rental income.

The fair market rent evaluation particularly important with 3- to 4-unit properties where the income you make from the property has to be equal to or greater than the mortgage payment after applying a 25% vacancy factor.

Disadvantages Of Fha 223 Loans

- Only available to existing HUD-insured: One of the most limiting features is that the refinancing opportunity is only available to those with an existing HUD-insured loan. It only applies to health care and multifamily properties.

- No cash out: There is no availability to cash out the loan, which could limit the use of these loans for some borrowers. The amount borrowed cannot exceed the original mortgage loan amount either.

- Some exclusions apply: This includes risk share mortgages, Section 202 loans, co-insured properties, and some other types of HUD-insured mortgages.

Recommended Reading: What Is Loan Lease Payoff Coverage

The Benefits Of Buying A Duplex Or Multifamily Home

A multifamily property is a residential building with multiple units, in which two to four families or tenants can live separately. The owner can either live in one of the units and rent out the others, or live off site and collect rent remotely. Owning a duplex or a multifamily home has multiple benefits: It generates cash flow for the owner, improves your credit score and allows you to take advantage of attractive loan options.

Depending on the terms of your multifamily mortgage, you can buy a duplex, triplex or four-unit apartment building, but you dont need to look at it as your long-term home. Provided you live onsite long enough to meet the terms of your mortgage, you can explore other options, such as becoming a remote landlord. If youre willing to put in the time and money required to maintain the property and communicate with your tenants, multifamily homeownership is a largely hands-off income generator.

Fha Supports Fair Housing And Equal Opportunity

HUD is committed to enforcing the Fair Housing Act and to ensuring that people are not discriminated against when they seek housing or housing-related services. If you need assistance in determining your rights under the Fair Housing Act or applicable laws, or believe you have been a victim of housing discrimination and need assistance, we encourage you to review the information on HUD’s Office of Fair Housing and Equal Opportunity webpage.

Don’t Miss: Which Bank Is Good For Business Loan

Building Equity By Buying Two To Four Unit Multi

If you are a young first-time home buyer, a multi-family home could be a great tool to start building wealth and investing in other real estate down the road. As long as you are comfortable being a landlord and living next to other tenants, this is a great investment tool. You can ask your realtor to only show you multi-family homes in your area.

Multifamily Forecast: Investors Moving To Secondary Markets

The apartment sector has remained the darling of the commercial real estate for the past six years. This doesnt appear to be changing anytime soon, as 2016 is expected to set a new record for multifamily mortgage origination volume. While multifamilys position as top dog remains uncontested, savvy investors are altering their strategy for sourcing Read the full article

Theres no shortage of options when it comes to multifamily financing. Heres five factors to consider when deciding on a commercial lender.

Also Check: Are Tax Returns Required For Mortgage Loan

Multifamily Requirements For All Loan Programs

| Type Of Mortgage | |

|---|---|

| Below 45% | Below 45% |

These are hard guidelines that can change based on case scenarios. The minimum FHA credit score to finance a multifamily unit is 500 however you have to put down 10%. With a 580 or higher credit score, FHA only requires a 3,5% down payment based on a multifamily purchase price. Some people based on extenuating circumstances can qualify if they dont pass certain FHA Multifamily requirements. Please fill up the form below and we will answer all your questions within an hour.

The Top 4 Reasons To Buy A Multifamily Home

Buying a multifamily property can be a great investment with enviable returns, and multifamily financing isnt much different from a standard mortgage. Here are our top four incentives:

Recommended Reading: Why Should I Refinance My Car Loan

How Assets America Can Help

Assets America® is a high-end commercial brokerage focused on debt placement starting from $20 million with no upper limit. We can finance multifamily properties through many programs, although we specialize in Fannie Mae financing and large, ground-up construction projects. Whatever your funding needs, call us at for a free, no-obligation consultation to see how we beat the competition, or simply fill out the below form for a prompt response!

Finance A Multiunit Property With An Fha Loan

One way to use an FHA loan to buy an income property is to purchase a multiunit dwelling. The FHA allows homeowners to buy a property with up to four units, provided that one is occupied by the owner. There is no upper limit to the size of the lot. In this way, an owner is able to live in one unit, making it an owner-occupied property and FHA-eligible. The owner can rent out the other unit for income.

A savvy investor in a hot rental market sometimes earns enough income using this method to live in the home for free. As noted above, the FHA lends up to 96.5% of the appraised value, meaning the purchaser can put down as little as 3.5%.

You May Like: How To Apply For Federal Direct Subsidized Loan

Local Laws For Owning An Operating A Multi

Remember that although there are specific guidelines outlined here for qualifying for an FHA loan for a multi-family building, as a landlord you still need to obey local laws.

Every community may have unique laws and rules tied to owning and operating rental properties. Before moving ahead with your purchase, it would be a good idea to visit with the local office governing these rules to fully understand what is required of you as a landlord in that town.

You also will need to know if there are or have been any building violations or issues of any kind. It is smart to check to see whether any permits were taken out on the building. Then, see if the permits align with all the repairs that the seller claims to have done over the years.

Investors Typically Need Higher Down Payments Than Owner

Traditional mortgages require a 20 percent down payment. Buyers can sometimes get mortgages with lower down payments, though theyll have to pay for PMI.

If youre buying property as an investment and dont plan to live there, youll have to meet different criteria to get a mortgage. Investment properties dont qualify for PMI, so youll have to put down at least 20 percent, and possibly more, to get traditional financing. Lenders generally assume more risk with investment properties, so they might require 25 or 30 percent down, depending on the interest rates on offer.

Also Check: Fifth Third Bank Auto Loan Login

Types Of Fha Multifamily Loans You Can Qualify:

Fha Loans For Investment Properties

If you can find such a property, using an FHA loan to purchase the property can be a great way to break into real estate investing and start making passive income from a rental property. If you find yourself in this situation, be sure to hire a property management company to handle the rentals and purchase a home warranty to reduce your risk as a landlord.

Don’t Miss: How To Obtain Home Improvement Loan

Are There Commercial Fha Loans

The FHA doesnt offer commercial loans. What they do offer is the possibility for mixed-use property as long as 51% of the property is still devoted to living space for you and your tenants. This is true whether dealing with single-family projects or what the FHA considers multifamily residential properties.