Are There Any Additional Fees I Should Consider

Make sure you understand any additional fees you could pay when evaluating the total cost of a loan, especially any prepayment penalties when paying off your loan early. At LendingClub, there are no prepayment penalties. You can pay off your loan, or make an additional payment, at anytime and get rid of future interest payments.

The monthly payment amount you entered is too low to pay off the total debt amount you entered. Please confirm your monthly payment amount and re-enter the information.

You left some information blank or entered a zero in one of the fields. Please re-enter the missing information.

Prosper: Best For Fast Loan Funding

| 640 |

What to know

With a straightforward check your rate option, Prosper is worth consideration among borrowers without excellent credit who might be better off roping in a co-applicant. Read our full Prosper review.

Prosper is among lenders that promises next day funding but be aware that this means your loan wont be disbursed until one business day after youve signed your loan agreement.

What Could Be Improved

Unless your credit score is strong enough to ensure an interest rate on the low side of the scale, you could pay a hefty price to borrow the money.

Origination fees

Any time you are required to pay origination fees you pay more for the loan. Let’s say you borrow $10,000 with an origination fee of 4%. That’s $400 taken off the top of the loan and $9,600 is deposited into your bank account. Still, you must repay the entire $10,000, plus interest. The best personal loans do not charge an origination fee.

Hard credit checks

As part of the pre-approval process, some LendingTree partners run a hard credit check before letting you know if you qualify for a loan. Keep in mind that a hard credit check will ding your credit score a bit.

Prepayment penalties

While LendingTree does not charge prepayment penalties, some of its lender partners do. It’s important to check the fine print.

Funding time is on the slow side

If you need the funds to cover an emergency situation, waiting seven business days for the funds to hit your bank might be difficult.

Read Also: How Long Home Equity Loan Take

Can You Get A $50000 Personal Loan With Bad Credit

Getting financing with bad credit isnt easy or cheap. But, is it possible? In some cases, it may be possible. The first thing you need to know before applying for a $50,000 loan is your credit score. The credit score lenders usually use is the FICO score. It is a number that is calculated by taking several factors into account. Your score is based on things like how much debt you have, how recently your account or accounts have been opened, if you are at your maximum limit or close to it, and if you have made payments on time. Late payments, being in default, or having a bankruptcy will hurt your credit rating and generate a lower score.

Two credit scores can be used-the VantageScore and the FICO score. Since 90% of lenders use the FICO score, lets look at their numbers to see what is considered a bad credit score.If your FICO score is between 300-579, its considered poor. This can mean that you have not paid back your borrowings either on time or in full in the past. Lenders will look at your current situation carefully to see if you will pay them back on time going forward.

Understand too that if your credit is bad, your loan rate will probably be much higher than it could be if you had good credit. This will add significant costs to your loan and make it really expensive to borrow.

Types Of Personal Loans

When shopping for a personal loan, you may come across two types of offers: secured or unsecured. Each type comes with its own pros and cons, and which is best for you will depend on your goals and situation.

Secured loans require collateral, or an asset of value the lender has the right to seize if you dont fulfill your loan agreements terms. These loans generally offer lower interest rates because they present less risk to the lender.

Unsecured loans, however, are backed only by your promise to repay the debt. Therefore, lenders rely entirely on your creditworthiness, income level and amount of current debts when deciding whether youre a good candidate. Because the risk is higher for the lender, APRs are also typically higher on unsecured loans.

Here are some key differences between the two types:

| Unsecured personal loan | |

|---|---|

|

No collateral often results in higher interest rates May be more difficult to get approved based on your credit, income and outstanding debt |

Must have collateral to put up for the loan Collateral can be repossessed |

You May Like: How To Pay Off Home Loan Faster Calculator

Freedomplus: Best For Applicants With Excellent Credit

| 0 |

What to know

FreedomPlus is known for a no-nonsense approach: You can expect to avoid fees while receiving relatively fast credit and funding decisions. Read our full FreedomPlus review.

Always compare APRs, not base interest rates, when looking at multiple lenders: You might be attracted to FreedomPlus rates without realizing a potentially large origination fee is tacked on.

Who Lendingtree Isnt Right For

LendingTree might not be a right fit if you:

- Prefer to apply for a personal loan in person. As an online marketplace, LendingTreeâs application process is typically completed through its website or mobile app. However, you may be able to apply over the phone with LendingTreeâs customer service.

- Want a personal loan over $50,000. LendingTreeâs personal loans max out at $50,000, but you might be able to find a larger loan by applying elsewhere.

- Donât want to share your contact information with its network of lenders. After providing your phone number and email with LendingTree, you might get calls, texts or prerecorded messages from its network partners.

You May Like: Does Spouse Have To Be On Va Loan

What Is Loan Interest

When you take out a personal loan, you will have to repay more money than you borrowed. This additional money you must pay is called interest. As a lender, it would not be worth it to simply give out money without any incentive. Therefore, lenders will charge you to borrow their money at a predetermined interest rate. The amount of interest you will end up paying can depend on factors like the type of loan and your credit score. Luckily, there are many tools online that can help you calculate how much interest you can expect to pay. This can save you the time of doing it manually on your own and let you focus on more important matters.

How Do I Know If I Will Qualify For A Loan

Each lender has their own personal loan eligibility requirements youll need to fulfill. Just because you dont qualify with one lender doesnt mean others wont be willing to work with you. Lenders typically list their basic personal loan requirements on their websites, so you can sometimes find out whether youre likely to qualify without ever having to apply. Here are a few of the criteria youll need to look out for:

- Minimum credit score

Recommended Reading: How To Switch Loan Servicers

Upstart: Best For Borrowers With Thin Credit Histories

| 600 |

What to know

Upstart is a worthwhile option for applicants with thin or not-great credit files, noting that it sometimes stamps approval for borrowers that dont have a long enough credit history to have a credit score.

Like with other loan companies, your lender might not be who you think it is: Upstart farms its lending operations out to banks but will still service your repayment.

Personal Loans And Creditworthiness

The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan. Good or excellent credit scores are important, especially when seeking personal loans at good rates. People with lower credit scores will find few options when seeking a loan, and loans they may secure usually come with unfavorable rates. Like credit cards or any other loan signed with a lender, defaulting on personal loans can damage a person’s credit score. Lenders that look beyond credit scores do exist they use other factors such as debt-to-income ratios, stable employment history, etc.

Don’t Miss: How To Pay Student Loan Interest

Shopping For A Personal Loan

Traditional banks, credit unions, online-only lenders and peer-to-peer lenders offer personal loans,. If your credit is not great or you are trying to establish credit, it might be easier to qualify for a loan at a credit union, but online lenders also offer a lot of flexibility. The application and approval process for personal loans is often only one or two business days, and you get the money right away.

Personal loans are unsecured, so your credit score carries a lot of weight in lending decisions. Borrowers with good to excellent credit get the best rates and terms. Before you start applying, get a copy of your credit report and check it for incorrect or outdated information. You can get your for free on Bankrate. If your credit score is less than stellar, some credible lenders do offer bad credit loans that you may qualify for.

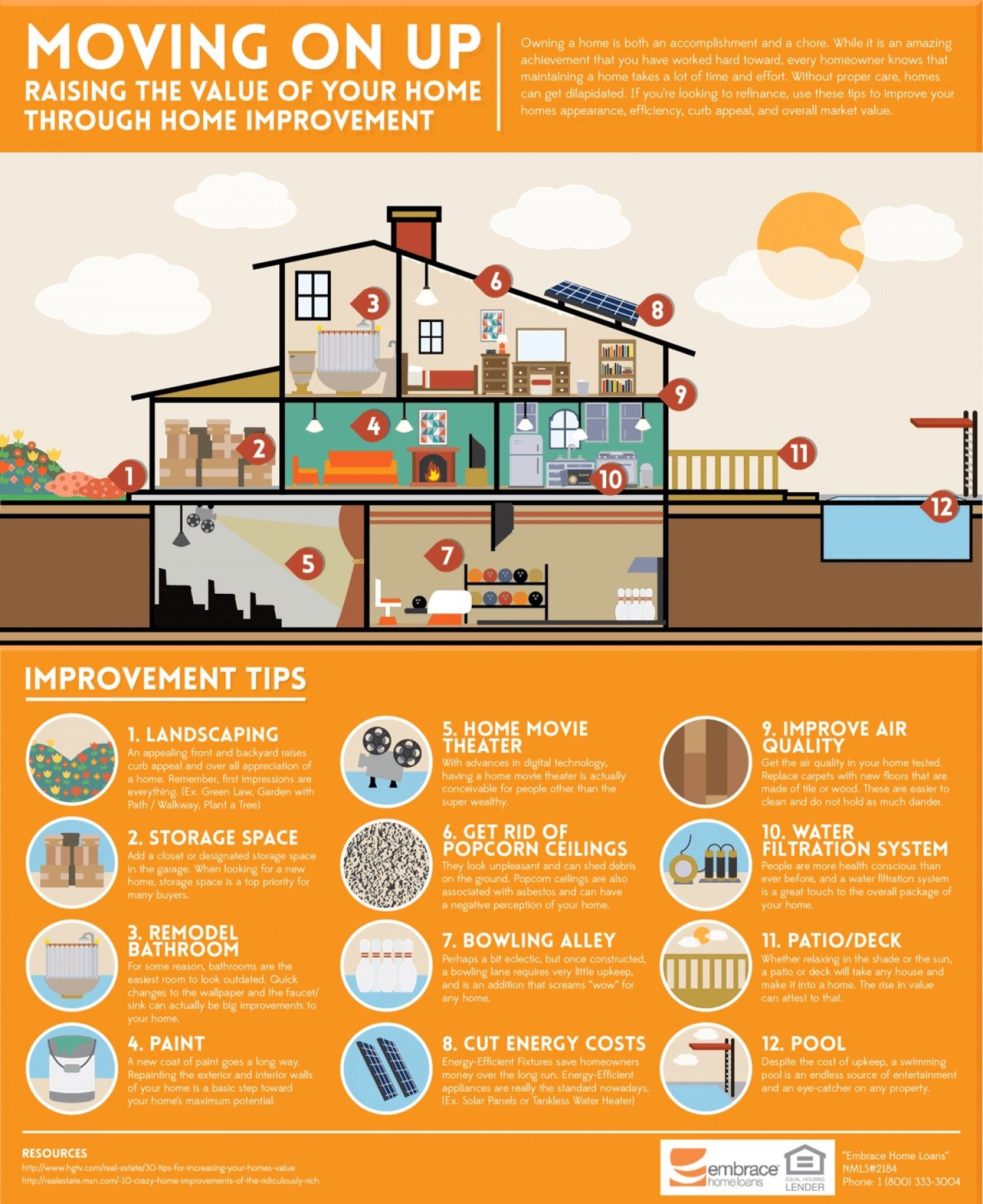

Consider the purpose of your loan before choosing a lender. If you are taking out a loan for home improvement, for example, the best lenders will be different than if you are looking for a debt consolidation loan. While you can use personal loans for almost any purpose, some lenders will offer better rates and terms for some situations than others.

Best Personal Loans For Fair Credit

If youre struggling to get approved for a personal loan with fair credit, consider applying with a cosigner to improve your chances.

Edited byAshley HarrisonUpdated September 7, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Youll typically need good to excellent credit to qualify for a personal loan. If you have fair credit usually considered to be a credit score between 640 and 699 you might have a harder time getting approved. However, there are several lenders that offer personal loans for fair credit.

Keep in mind that the best personal loans for fair credit provide competitive interest rates, a wide selection of loan terms, and inclusive eligibility requirements.

Heres what you should know about fair credit personal loans and where to find them:

Also Check: How To Pay Off Car Loan Early

How To Choose A Fair Credit Lender

While personal loan lenders might appear similar on the surface, its important to do your research and compare your options from as many lenders as possible. This way, you can find a loan that best suits your needs.

Here are some important points to keep in mind as you weigh your options:

- Interest rate: Your interest rate will play a major role in determining your overall loan cost. Several factors will influence the rates youre offered, including your credit score and repayment term. In general, the higher your credit score, the better your rate will be. Applying with a cosigner might also help you get a lower interest rate.

- Loan amount: You can typically borrow $600 up to $100,000 with a personal loan. Be sure to borrow only what you need to keep your repayment costs manageable.

- Repayment term: Personal loan repayment terms usually range from one to seven years, depending on the lender. While choosing a longer term might get you a lower monthly payment, its usually best to choose the shortest term you can afford to keep your interest costs as low as possible. Additionally, many lenders offer better rates to borrowers who opt for shorter terms.

- Fees: Some lenders charge fees on personal loans , which could increase your overall loan cost. Note that if you take out a loan with one of Credibles partner lenders, you wont have to worry about prepayment penalties.

Keep in mind:

Learn More: Where to Get a Personal Loan

Lending Tree Interest Rates

The required minimum score is 580. You can find personal loan providers on Lending Tree who offer loans ranging from $1,000 to $50,000. Lending Tree claims that its partners provide excellent credit to borrowers with interest rates as low as 2.49 %. Interest rates, however, can also be very high. Before you submit your loan application, Lending Tree and the lenders will not request information about your bank account.

Read Also: When Do I Start Repaying My Student Loan

What Is An Unsecured Personal Loan

Most personal loan lenders offer unsecured loans. Unsecured loans don’t require collateral that is, the borrower doesn’t have to put up valuable assets as a guarantee of payment. However, this also means that unsecured loans usually have higher interest rates as they present more of a risk for lenders.

Unlike with a secured loan you won’t lose any assets if you were to default on an unsecured loan however, your credit will take a hit, hindering your ability to get another loan in the future.

How Your Loan Term And Apr Affect Personal Loan Payments

When you take out a personal loan, two notable factors that will impact your loan payment include the loan term and APR. When you begin to compare loans from different lenders, a personal loan calculator will show different amounts for your monthly loan payment should the APR and loan terms differ.

Using a personal loan APR of 7.63% as an example, heres a simple breakdown of what the personal loan payment calculator can show you for a $5,000 loan and $10,000 loan.

| Your payments on a $5,000 personal loan | |

|---|---|

| Loan balance | |

| $5,610 | $6,030 |

In another scenario, the $10,000 loan balance and five-year loan term stay the same, but the APR is adjusted, resulting in a change in the monthly loan payment amount.

| Your payments on a $10,000 personal loan |

|---|

| Loan balance |

| $22,712 |

You May Like: Can I Get Business Loan With No Money

What Is Lending Tree Personal Loan

Based in Charlotte, North Carolina, Lending Tree connects prospective borrowers to multiple loan providers and helps them determine the best rates on loans,, insurance, etc. A reliable company founded in 1996, Lending Tree makes financial services simple and offers the best bargains for borrowers.

What Is Considered Bad Credit When Looking For A $50000 Personal Loan

The requirements to qualify for credit tend to get a bit stricter as you increase the amount you want to borrow. Higher amounts can put the lender at greater risk of not getting their money back because the payments have a big impact on the borrowers finances. So, while lenders may consider a credit rating of 580 or even 550 for a small loan, they usually want a higher credit rating for a larger loan. As we already discussed, a FICO score between 300-579 is considered poor. For a loan of 50k, lenders usually want the borrower to have a minimum but will sometimes consider a credit score of 600 or a bit lower. For a loan of 50k or more, a poor and you might find it difficult to get an unsecured personal loan.

This doesnt mean that you cant borrow the money. You may be able to get a secured loan, use the equity in your house as security for a cash-out refinance or home equity line of credit or add a cosigner to the loan.

Recommended Reading: What Is Good Auto Loan Interest Rate

Understand The Application Process

The application process of getting a personal loan will vary from lender to lender, but heres what you can generally expect when applying for a loan.

How To Calculate Personal Loan Interest

Regardless of what you are planning to purchase with your loan money, it is important to calculate how much interest you are expected to pay. Doing so will allow you to visualize how much you will have to fork out for each month to cover your interest payment.

Nowadays, you can simply find a loan interest calculator online with a quick google search. Within the calculator, you can input the loan amount, loan term, interest rate, and even how often your interest compounds. There are many different loan types and multiple different formulas to calculate interest payments, so these calculators can make your life very easy compared to doing the math yourself. However, if you are interested in the math behind it, we can look at how it breaks down. Most loans are amortized which means the payments made go towards both the principal and interest. Using the following formula, A is going to be your monthly payment including interest. P is your principal which is just the amount of money borrowed. The variable r is the interest rate per period, and n is the number of payments.

A = P /

10,000

= 10,000 *

According to our math above our monthly loan payment including interest will be $179.69.

Read Also: How Much Business Loan I Can Get