How Will My Forbearance Impact My Year End 1098 Tax Statement

Since every situation is unique, we encourage you to reach out to a trusted tax professional for advice before the end of the tax year.

- If you missed any regular mortgage paymentsor paid less than the regular amountbecause you were on a forbearance plan, the mortgage interest, real-estate taxes, and/or mortgage insurance paid as reported on your 1098 statement may be impacted.

- If you did not make payments while on a forbearance, then the amount of mortgage interest received from payer/borrowers and mortgage insurance premiums paid may be different from prior years.

What Happens At The End Of The Forbearance Period

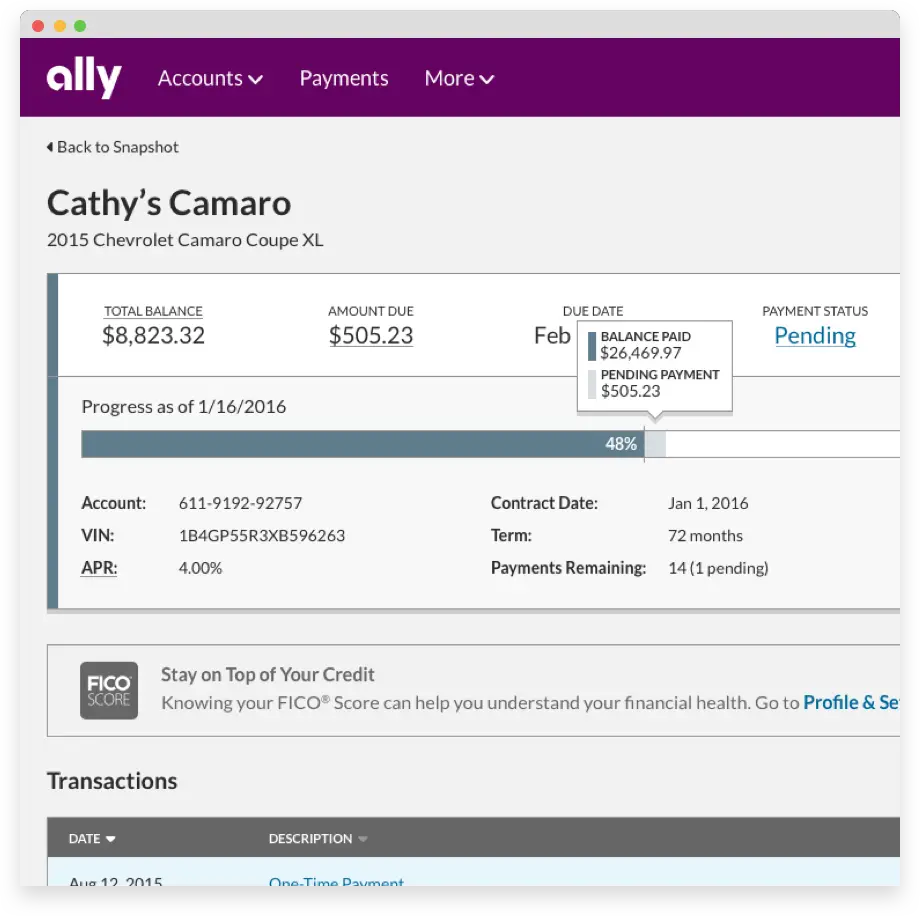

You can access and explore your repayment options via Mortgage assistance from your mortgage account within online banking and the mobile app. The best solution will depend on your financial situation. Our top priority is to keep you in your home with affordable monthly payments.

We offer programs which will not require you to repay all the suspended payments at the end of the forbearance. Instead, long-term solutions will include adding the suspended payments to the back of the loan or adding the suspended payments into the loan and extending the loan term.

If after reviewing your long-term options you still have questions, you can reach out to your Relationship Manager to discuss your situation and available options.

Us Bank Mobile App Steps:

For the best mobile banking experience, we recommend logging in or .

If you’d like to pay more than one bill, repeat the above steps. There’s not a limit to how many individual payments you can make. However, the option to pay multiple bills at once isn’t available on mobile banking.

Recommended Reading: How Do You Calculate Loan To Value Ratio

Useful Links For Us Bank

US Bank has helpful links both on its website and within its US Bank App. Customers who want to access accounts, make payments, and purchase products may do so through various links.

Any US Bank customer can access their personal or business account information by signing in, which can be done through the websites menu or mobile app. Signing in takes customers to their accounts, and they can also access US Bank customer service chat. Customers can also make payments once signed in.

More US Bank Website Links:

Safety Precautions In Our Branches

To help keep our employees and customers safe:

- Weve reduced our hours and operations at some branches. Get real-time updates on our branch locator page.

- Were requiring our employees and customers to wear a mask, even if not required by law in that location.

- Were limiting the number of customers permitted in our branches at a time.

- Please maintain physical distancing by staying at least six feet away from other individuals.

- Do not enter a branch if youre experiencing symptoms of COVID-19, including fever, cough or shortness of breath.

You May Like: How Do I Find Who Has My Student Loan

How Do I Apply For A Checking Or Savings Account With Us Bank

Review our Checking Accounts or Savings Accounts pages to find the one that’s right for you. When ready, log into digital banking and follow these steps to start your application.

Online banking steps:

U.S. Bank Mobile App steps:

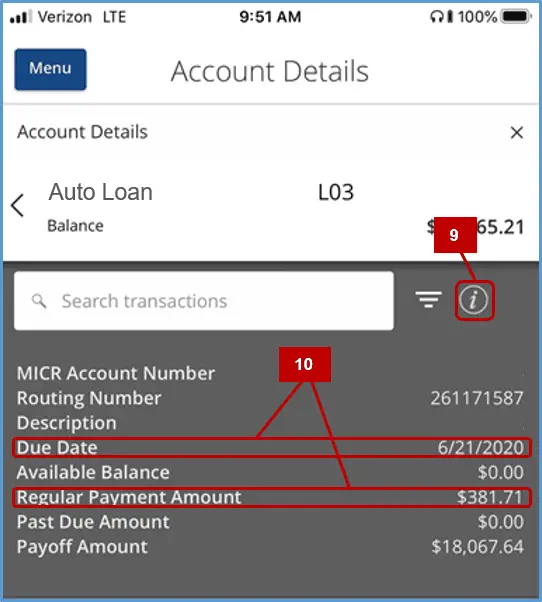

How Do I See My Transaction History

We make viewing the last 18 months’ worth of transactions easy and convenient. Right below the account’s details you’ll find:

- Pending and completed transactions, with descriptions and amounts.

- Account balance after deducting transactions.

Online banking steps:

To get started, log in to online banking and follow the below steps:

From the dashboard select My accounts then Choose an account. Select the desired account and your transaction history will appear. Use the directional arrows to move the pages forward and backward.

U.S. Bank Mobile App steps:

For the best mobile banking experience, we recommend logging in or downloading the U.S. Bank Mobile App. From the main page, choose the account you wish to see transactions for. Use the directional arrows to move the pages forward and backward.

Additional information

To obtain transaction history older than 18 months:

- Use the Advanced search to enter a date range that encompasses the transaction you’d like to view.

- View your monthly statements.

If you have any questions or need assistance, call us at 800-USBANKS . We accept relay calls.

Don’t Miss: How Long To Get Pre Approved For Car Loan

Contact An Sba Banker

Thank you for your interest in U.S. Bank SBA Loan programs. The form below is for contact purposes only and does not directly relate to our Paycheck Protection Program.

Equal Housing Lender

An email address is required for all requests. We use email to communicate information about your request. Confidential, personal or financial information will never be sent or requested in an email from U.S. Bank.

Subject to credit approval and program guidelines. SBA loans are subject to SBA eligibility guidelines. Certain restrictions apply to refinancing options and are subject to program terms. Refinances of existing SBA loans are excluded.

Financing maximums and terms are determined by borrower qualifications and use of funds.

U.S. Bank and its representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

Can I Make A Payment Toward My Escrow While On A Forbearance Plan

Yes, you can choose to pay only the escrow portion of your monthly payments while on a forbearance plan.These options allow you to indicate you want your payment to go to escrow.

- Payments can be made via usbank.com or the U.S. Bank Mobile App.

- You can also send your escrow payment through the mail by including the coupon attached to your monthly billing statement.

Paying toward your escrow will not end your forbearance protection. All long-term solutions presented to you at the end of your forbearance period will account for the required escrow balance, while also ensuring that your monthly payment remains affordable.

Recommended Reading: Rates For Refinancing Student Loans

What Specific Programs Will Be Available For Me So I Do Not Have To Pay All Suspended Payments At Once

We have a variety of optionsonceyou reach the end of your forbearance. Depending on your situation, they may include:

- Deferment:A deferment moves the past due paymentsinto a non-interest-bearing account. It may also includeany advances made on your behalf, like taxes. You will be responsible for paying thedefermentamount upon the maturity date of your existing mortgage, or earlier upon the sale or transfer of the property, refinance of the mortgage loan or payoff of the loan.

- Modification: A modification refers to changing the existing terms of your loan, including extending the term or adjusting the interest rate.

- Repayment plan: A repayment plan allows customers to pay their past due amount in several months, along with their existing mortgage payments.

Let Us Partner With You

Fill out the form below and a business banker will be happy to assist you. Have existing account questions or prefer to contact us directly? Call us at .

Equal Housing Lender

Deposit products are offered by U.S. Bank National Association. Member FDIC.

An email address is required for all requests. We use email to communicate information about your request. Confidential, personal or financial information will never be sent or requested in an email from U.S. Bank.

You May Like: Low Credit Score Personal Loan

How Do I Request A Balance Transfer On My Credit Card

Managing your money is important and we want to help. If you’ve decided to transfer the balance from an external account to your credit card, follow the steps below. If the option to transfer a balance isn’t available through digital banking, please call us at 800-285-8585 and any banker can assist. We accept relay calls.

How Do I Order Checks Or Deposit Slips

Ordering checks using our digital banking services is easy and convenient. Checks are customizable, and we have many designs to choose from, ranging from the professional look to fun and outdoors. Choose the font style, the check design, add a monogram or symbol next to your name, or add an additional signature line.

Also Check: What Kind Of Auto Loan Can I Get

Deed In Lieu Of Foreclosure

This option allows you to deed your home back to your lender or investor instead of facing foreclosure.

This option may work for you if:

- You cant afford your regular monthly payment or a slight increase in your payment, plus other monthly expenses.

- You dont have substantial funds left at the end of the month.

What Methods Are Available To Pay My Loan And Line Of Credit In Full

If you’d like a payoff quote first or have any questions, please contact us. We accept relay calls.

- 800-USBANKS for your Home Equity Line of Credit , Auto Loan/Lease or Personal Loan

- 800-365-7772 for your Mortgage

MailSend a check or money order via regular mail or overnight delivery.Online/Mobile bankingMake your payment electronically by setting up autopay or making a one-time payment.See Also: How can I set up automatic payments for my credit card, loan, lease or line of credit? or How do I make a one-time payment to my credit card, loan, lease or line of credit?Pay by phoneCall us at 800-USBANKS to pay using your U.S. Bank checking or savings account. You can use our automated phone system to make your payment or speak to an agent to assist you. We accept relay calls.

Recommended Reading: What Is The Best Loan Company

How Do I Place A Stop Payment On A Check

There are a few things to consider before you place a stop payment on a check:

- Payments already in process or completed can’t be stopped.

- To stop a scheduled payment, you’ll need to submit your request at least three business days before the scheduled payment date.

- You can reach us anytime at 800-872-2657.

If you’d like to proceed with placing the stop payment, follow these steps to get started:

If Ive Had A Recent Loan Modification Am I Still Eligible For Another Loan Modification

Any previous customer assistance program, such as a deferment or a modification, wont disqualify you from current or future eligibility for a loan modification. When youre ready to discuss your options, reach out to us via Mortgage assistance from your mortgage account within online banking and the mobile app. You can also call us at 855-698-7627. Well help you with the solutions specific to your financial situation to bring your account to current.

Don’t Miss: What Bank Has The Best Car Loan Rates

How Do I Review And Redeem My Credit Card Rewards

How you redeem rewards depends on the type of account you have. Thereâre a couple ways to locate that information. You can find it in the rewards section of your billing statement or log in to digital banking.If your rewards program is with U.S. Bank , follow the steps below to review and redeem your rewards.

How Do I Get A Payoff On My Loan Or Line Of Credit

Getting a payoff for a loan or line of credit is easier than ever. You can log into digital banking anytime to use our Smart Assistant and get a quote whenever it’s convenient for you.

Online banking and U.S. Bank Mobile App steps:

If the account you need doesn’t appear, visit your local U.S. Bank branch or reach us at the applicable number below. We accept relay calls.

- Home loans : 800-365-7772.

- All other loans: 800-USBANKS .

To visit with a branch banker, consider scheduling an appointment to allow time for questions and processing. We can meet by phone, virtually, or in person. See also:How can I schedule an appointment at a U.S. Bank branch?

Don’t Miss: First Federal Saving And Loan

Home Equity Line Of Credit***

| NY Prime + .50% | NY Prime + 0.0% |

These rates are based on a credit review and your rate may be higher based on your credit score, property type, loan to value and mortgage product. If the loan exceeds $250,000, title insurance is required.

The example mortgage Annual Percentage Rates shown above are based on loans secured by a single-family primary residence and are calculated using a $100,000 loan amount at 80% loan-to-value .

*Relationship Rate: Available to customer who has four or more unique services with the bank, including the new loan/line. Services include Consumer Checking, Business Checking, Savings, Smart Savers Account, Money Market, Holiday Club, Certificate of Deposit, Credit Card Merchant Service, Mortgage Loan, Personal Line/Loan, VISA® Credit Card, Commercial Line/Loan, Trust/Estate, Brokerage, Safe Deposit Box.

** First Time Home Buyer Program: 0% Origination Fee and $0.00 Document Preparation fee.

****Variable rate on the Line of Credit based on NY Prime rate and has a floor rate of 2.50% and the maximum rate is 18%.

All of the above rates are subject to change and are provided for informational purposes only. Rate is available with a minimum F.I.C.O. credit score of 700 to qualify. Rates and terms are subject to borrower qualifications. Other terms and rates are available. The term APR represents Annual Percentage Rate.

Member FDIC NMLS #407554

How Do I Change Or Update Insurance Information For My Home Mortgage

We want to make the process of updating your homeowner’s insurance as simple as we can. If you have questions about your mortgage account, please call us at 800-365-7772. We accept relay calls. We suggest reviewing the document for the following information:

- Your first and last name

- Property address

If everything is in order, follow these steps to electronically submit your information.

Recommended Reading: What Type Of Loan Can Be Used For Debt Consolidation

Us Bank Business Banking Toll Free Number

US Bank offers its business customers financial services like business checking accounts, credit cards, loans, and even merchant accounts.

Reach US Bank Business Banking customer service to discuss your business needs. US Banks business banking toll free number is:

Recommended: Use our How to Get a Toll-Free Number guide to get your own business phone number or create your own business phone number using our Vanity Phone Number Generator.

How Can I Change The Pin On My Credit Card

There’s a few options available to reset your credit card PIN. Choose the one that works for you.

Representative: If you’re not sure what your PIN is, call us us at the phone number on the back of your card or at 800-285-8585 and request a PIN mailer to be sent to you. We accept relay calls.

Automated phone system: You must have your PIN mailer or the pre-selected PIN to use this option. Call 800-673-3555, listen to the menu options and enter the pre-selected PIN when prompted. We accept relay calls.

Branch/ATM: Visit us at any U.S. Bank branch or ATM. At the terminal, from the main menu, start by selecting Customize ATM, then select Change PIN.

When selecting a PIN, be aware of the following restrictions:

- It can’t begin with a zero , be all nines , or all zeros

- You can’t select 1234

A PIN mailer is a system generated number. Representatives can’t set a specific PIN for you. Once you receive the mailer, follow the above steps to reset your PIN to a new number.

You May Like: What Does Loan Forgiveness Mean

Options Regarding Selling Your Home

If you face the possibility of selling your home, ask yourself the following before starting the process:

- Are you prepared to sell your home?

- Are you unable to recover from a situation that caused you to fall behind on your mortgage payments?

- Are you unable to afford your regular monthly payment and have no means to catch up on delinquent payments?

If you decide to sell your home, consider the following options.

How Do I Report My Debit Card As Lost Or Stolen

If your card is lost or stolen, here’s what you can do:

- Digitally report the card as lost or stolen. If the card is no longer in your possession, follow the numbered steps below to cancel the card number and replace it with a new one. There’s no need to wait for a banker, and we’ll send it to the address on file.

- Temporarily lock the card. You can lock it through digital banking so you can keep searching, while your account is secure. If you find the card, the lock can easily be removed, all without waiting on the phone. See also: How do I lock or unlock my debit card?

- We’ll cancel the card number and replace it with a new one. Just let the banker know if you want the card sent to the address on file, or if it should be sent to an alternate address.

- We can be reached at 800-USBANKS . We accept relay calls.

- To protect you from potential fraud, shipping to an alternate address cannot be completed through digital banking.

Also Check: Where Do I Get An Fha Loan