Can A Parent Plus Loan Be Put In The Student’s Name When The Student Graduates

The parent who borrows the PLUS Loan is solely responsible for repayment, even though the loan is borrowed to pay the college costs of the student. The only way to officially transfer the responsibility for loan repayment from the parent to the student is to refinance the loan in the student’s name. The student will need to qualify for refinancing on his or her own, and will need to refinance with a lender who offers this option.

Need additional guidance on borrowing loans and paying for college? Visit our dedicated webpage for high school seniors and their families here. You’ll find videos, calculators, and articles to help you navigate your journey.

How Are Funds Paid Or Disbursed

PLUS loan funds are sent via to the University for application to the student’s campus account. Accepted loan funds are divided so half the funding is provided for the Fall semester and the other half is provided for the Spring semester.

Once the funding has been sent to the University, the Office of Financial Aid will again verify the student’s eligibility for payment. Then the funds are applied to the student’s remaining campus balances, this would include Campus Tuition and Fees, as well as CSUF On-Campus Housing Charges. Once the student’s account has been paid in full, Student Business Services will mail a check for the remainder of the funds to the parent borrower. If the student owes money to the University there will be a temporary hold placed on the disbursement until the balance on the student’s account is paid in full.

Learn About Repayment Options And Refinancing

If you receive a parent PLUS loan, repayment begins after funds are disbursed to your childs school. Repayment is not automatically deferred while your child is in school, but you can submit a separate application asking for a deferment while your child is enrolled at least half time at an eligible school and for six months afterward.

If you need to refinance your parent PLUS loan, you can apply for a private student loan. When you refinance, you can keep the loan in your name or, in some cases, transfer the loan to your child.

Read Also: Bayview Loan Servicing Tucson Az

Grad Plus Loan: 6 Things To Know Before You Apply

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Read Also: Usaa Used Car Refinance Rates

Can You Get A Better Interest Rate With Private Lenders

The current interest rate for Direct PLUS Loans is a fixed rate of 6.28 percent . If you have a good credit score, you may be able to qualify for a better interest rate with a private lender. Look into private loan options and determine where you can get the best rates before deciding to apply for a parent PLUS loan.

Read Also: Usaa Auto Loan Rates Used Cars

When Do I Begin Repaying My Plus Loan

Repayment of the Parent loan begins within 60 days of the full disbursement of the loan. For a full year loan repayment will generally begin sometime in February. Information about repayment terms and timing will be provided to you by your federal loan servicer. Repayments are made directly to the loan servicer. Borrowers generally have from 10 to 25 years to repay the Parent PLUS Loan. To calculate estimated loan payments, use the Direct Loan Repayment Calculator. Additional information is also available on the Federal Student Aid website under Repayment.

Will President Biden Forgive Parent Plus Loans

So much for the low, slow payoff methods toward forgiveness of Parent PLUS Loans. How about a more unconditional form of forgiveness being hinted at by President Biden and other government leaders?

Theres been a lot of talk recently from lawmakers and consumer advocate groups pushing to have federal student loans forgivenincluding Parent PLUS Loans. But the legal details of how that would work are far from clear. And even President Biden himself hasnt stated for sure how he wants to address the issue.

Heres what we know right now about forgiveness proposals, including how theyd affect Parent PLUS borrowers:

- Democratic leaders in the House and Senate in February reintroduced a resolution calling on President Biden to use an executive order to forgive $50,000 in student loan debt for every borrower.

- Also in February, the White House said the administration is open to the idea of forgiveness and is looking into whether an executive action could work legally.

- Theres been a lot of debate about whether the forgiveness should apply for all borrowers, or whether it should be limited only to borrowers who fall below a defined maximum income.

- The Biden administration has said Parent PLUS Loan borrowers might be included in a possible forgiveness order.

- On the other hand, in his presidential campaign, Bidens talk about loan forgiveness was focused primarily on helping undergraduates.6

Also Check: How Long Does Sba Take To Approve

Why You Have To Apply For The Parent Plus Loan Every Year

Just like other types of federal financial aid, you must apply for the parent PLUS loan on an annual basis, or at least every year you need the loan.

Financial aid is distributed annually for a few reasons. First, its based on the information you provide on the FAFSA, such as your familys income and number of children in college. If your circumstances change, your eligibility for aid will be adjusted.

Second, the amount you can borrow is based on the schools cost of attendance, which is also subject to change from year to year. For instance, tuition rates could increase, or your child might be eligible for more aid if theyre receiving fewer scholarship awards in later years.

And third, a parent PLUS loan involves a credit check. If you have adverse credit, you wont get approved, unless you apply with an endorser. Federal Student Aid checks your credit each year before giving you a loan.

For these reasons, you can borrow a parent PLUS loan one year at a time, just as your child can borrow federal direct loans one year at a time. All that said, filing a renewal FAFSA for your students sophomore, junior or senior year is usually easy.

As long as your circumstances havent changed much, you can simply transfer the information you provided from the previous year into the new FAFSA, make any necessary updates and hit submit.

Can I Use Parent Plus Loan Funds For Non

Yes, you can use the Parent Loan to cover charges that are not billed by the college However, it is important to account for the timing of the loan disbursement, any outside scholarships, and unearned work study when you are calculating how much you must borrow in order to generate the refund you need. The Office of Financial Aid is happy to help you weigh the amount you plan to borrow against your expected charges to make sure that you borrow enough. Keep in mind the expenses that the refund will cover when you are applying for your loan because you will declare how your refund should be issued within the application. We strongly suggest that you complete an ACH Authorization Form so your refund can be issued by direct deposit. This can be especially important if you are borrowing to cover book costs at the beginning of the semester. The other choice is for the Coe Student Accounts Office to cut a paper check and mail it to the refund recipient.

Read Also: Fha Maximum Loan Amount Texas

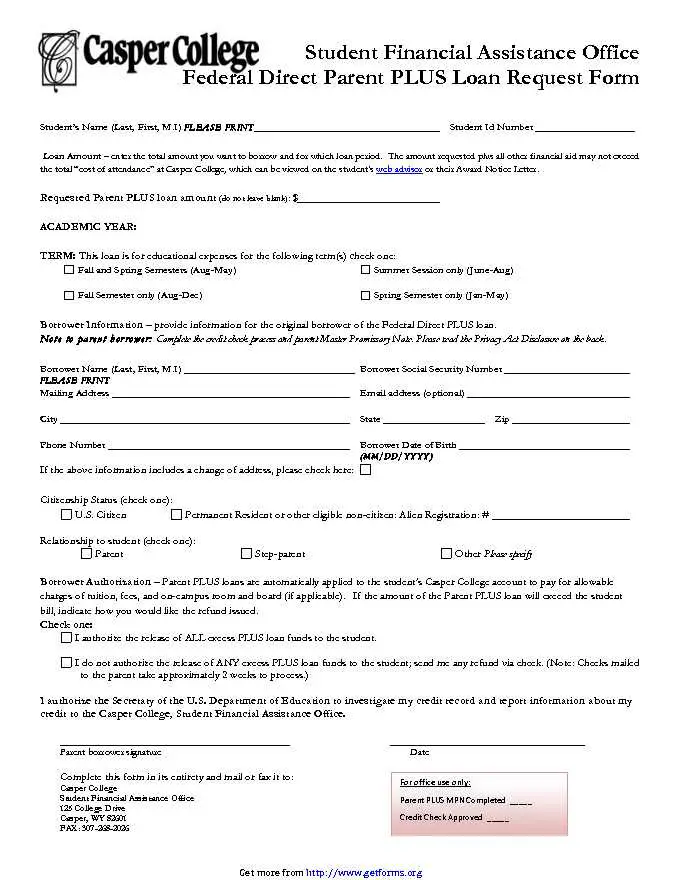

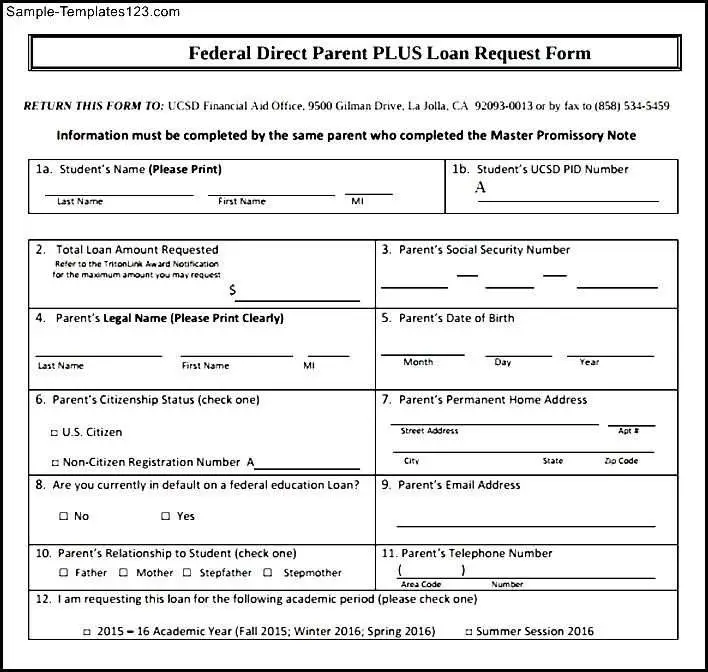

How To Apply For A Plus Loan

While PLUS loans are available for both graduate students and parents of undergrads, there are two separate applications. If youre a graduate or professional student, youll need to apply using a Direct PLUS application for graduate or professional students. Before you apply, youll need:

- Student information

- Personal information

- Employers information

To receive funds for both the graduate/professional or parent PLUS loans, youll need to complete a Master Promissory Note. The federal government will disburse funds directly to the school for tuition and fees with any extra funds directed to you. If youre the parent, you can determine if the excess funds go to you or your student.

Benefits Of A Plus Loan

You may be wondering about why you should consider a PLUS loan to help pay for school. Some reasons include:

- You need financial help. Instead of working a job outside of school and having to juggle responsibilities, a loan can be used to supplement school costs.

- The interest rate won’t change. Some loans from private lenders will feature variable interest rates, which may go up and force you to pay more. With a PLUS loan, there are no surprises. The interest rate stays the same throughout the lifetime of the loan, which means predictable payments.

- Loan fees may be lower. You may discover that the loan fee for a PLUS loan is lower than options available from private lenders.

Again, if you have questions about which loan option is best for you to attend UTI, talk with our Financial Aid office so we can help.

Also Check: What Kind Of Loan For Land

What Is A Direct Plus Loan

Direct PLUS loans are federal loans that graduate or professional degree students or parents of dependent undergraduate students can use to help pay for education expenses.

Direct PLUS loans have a fixed interest rate and are not subsidized, which means that interest accrues while the student is enrolled in school. You will be charged a fee to process a Direct PLUS Loan, called an origination fee. An origination fee is deducted from the loan disbursement before you or the school receives the funds. A credit check is performed on applicants to qualify for a Direct PLUS Loan.

There are two types of Direct PLUS loans: the Grad PLUS loan and the Parent PLUS loan.

Grad PLUS loans allow graduate and professional students to borrow money to pay for their own education. Graduate students can borrow Grad PLUS loans to cover any costs not already covered by other financial aid or grants, up to the full cost of attendance.

To qualify for a Grad PLUS loan you must meet three criteria:

Parent PLUS loans allow parents of dependent students to borrow money to cover any costs not already covered by the students financial aid package, up to the full cost of attendance. The program does not set a cumulative limit to how much parents may borrow. Parent PLUS loans are the financial responsibility of the parents, not the student and cannot be transferred to the student upon the students completion of school.

To qualify for a Parent PLUS loan, you must meet three criteria:

Parent Plus Loans: Rates Terms And Repayment Plans

The parent PLUS loan can be a useful way to cover college costs, as it comes with a reasonable interest rate and flexible repayment terms.

PLUS loans have fixed interest rates, meaning the rate at which you borrowed the loan will remain the same while youre paying it back. As mentioned, you can also choose whether to make payments on your PLUS loan immediately or defer payments while your child is in school and for six months after they graduate or drop below half-time enrollment.

If your PLUS loan payments are burdensome, you might be able to adjust them on a graduated, extended or income-contingent repayment plan. Finally, parent PLUS loans are eligible for certain federal forgiveness programs.

All that said, PLUS loans do have a couple of downsides. For one, they come with an origination fee, which adds to your total cost of borrowing.

Second, federal loans like PLUS loans have no statute of limitations. If you default on your student loans, collectors can pursue you for repayment, and the government can garnish your wages, tax refund or even Social Security benefits.

Also Check: Usaa Car Refinance Rates

These Loans Can Help Pay For Collegewhile Also Leading To Debt Troubles

Imagine this scenario: Your son or daughter has been out of college for over a decade and moved on to a successful career. Your own career is coming to a close and retirement is only a few years away. And yet, you still owe thousands of dollars for your childs college bills. This scenario is a reality for many parents who take out federal Direct PLUS Loans. While these loans might seem like an easy way for parents to help their child with education costs, in far too many cases, they put the parents financial security and retirement at risk.

Your Parents Could Pay More In Interest

Although PLUS loans do require your parents to pass a credit check in order to be approved for the loan, the interest rate is the same for everyone, regardless of how good their credit is. This is because interest rates for federal loans are set by Congress.

If you are a borrower or cosigner with an excellent credit score, you may be able to get aprivate student loan at a much lower interest rate than what the PLUS loan program offers, which can save thousands in interest paid at the end of the loans life, Walter says.

So, if your parents have excellent credit, it wouldnt hurt to compare rates from a private lender or two, to ensure theyre getting the best deal possible.

Also Check: Usaa Car Loan Bad Credit

Why You Should Plan Carefully When Borrowing A Parent Loan

Once youve carefully researched loan options and learned when and how to apply for a parent PLUS loan, you can make an informed decision about how best to fund your childs education.

Remember to consider how student loan debt will affect your future. You dont want to jeopardize your retirement security, so find the most affordable loan you can and consider creating a plan for early repayment.

Christy Rakoczy and Andrew Pentis contributed to this report.

Alternatives To A Grad Plus Loan

If the yearly cost of your graduate or professional program is within the annual limit of a Direct Unsubsidized Loan from the federal government , that can be another option. Interest rates are lower on those loans than with the grad PLUS loanonly 4.30% for loans disbursed from July 2020 to July 2021. In addition, there’s no credit check required, and your eligibility isn’t based on financial need.

However, if you have excellent credit and can qualify for a private student loan, that might make an equally good choice, as you may be able to get a lower interest rate if youre a well-qualified borrower. With private loans, you wont have access to income-driven repayment options or loan forgiveness or discharge. But the higher earnings of some professionals and graduates might render such benefits unnecessary.

In some cases, you might be able to reduce your loan amount or altogether avoid the need for a grad PLUS loan by getting part or all of your tuition paid for by teaching classes or receiving a research fellowship.

Read Also: Can I Refinance My Upstart Loan

You Can Borrow Up To The Full Amount Of Cost Of Attendance

The maximum amount that you can borrow under the federal Direct Unsubsidized Loan program for graduate school is $20,500 a year, with a maximum lifetime limit of $138,500. But a graduate PLUS loan allows you to borrow up to the cost of attendance, minus any other financial aid received.

Its possible to pay for graduate school in its entirety by exclusively taking out federal loans assuming you qualify . If youre leery of the private student loan market, this is a definite advantage.

However, remember that anything you borrow via grad PLUS loans has to be paid back. You can always decline all or part of the loan prior to disbursement if you determine that its unnecessary.

Danger : You Can Easily Borrow More Than You Need

When you apply for a Direct PLUS Loan for your child, the government will check your , but not your income or debt-to-income ratio. In fact, it does not even consider what other debts you have. The only negative thing it looks for is an adverse . Once you’re approved for the loan, the school sets the loan amount based on its cost of attendance. However, a schools cost of attendance is usually more than most students actually pay. This can lead to parents borrowing more than their child needs for college.

If you have other outstanding debt, such as a mortgage, you may find yourself in over your head when it comes time to repay the PLUS loan.

Recommended Reading: Mlo Endorsement To A License Is A Requirement Of