What Is Freddie Macs Home Possible

SimpleMoneyLyfe »Mortgages » What Is Freddie Macs Home Possible®?

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Read our Disclaimer Policy for more information.

If youre looking for a mortgage on a budget, Freddie Macs Home Possible program may be your answer.

Home Possible works with low-income borrowers who can afford a small down payment and their monthly mortgage bill thanks to the programs looser lending requirements.

Recommended Reading: Nerdwallet Loans

Who Is Eligible For Refi Possible Financing

Eligible borrowers must have

- A Freddie Mac-backed mortgage secured by a 1-unit, principal residence

- A current income at or below 100% of the AMI

- Not missed a mortgage payment in the past six months, and no more than one missed mortgage payment in the past 12 months and

- A mortgage with a loan-to-value ratio up to 97%, a debt-to-income ratio of 65% or less, and a minimum 620 FICO score.

How Fannie Mae And Freddie Mac Affect Your Home Loan

While they may not affect your day-to-day as a homeowner, Fannie Mae and Freddie Mac do affect your ability to get a home loan in some fundamental ways. Fannie Mae and Freddie Mac have guidelines for the loans that they buy, including how much is borrowed, the amount of the down payment and the credit score of the buyers.

Because Fannie Mae and Freddie Mac set the standards for the conventional home loans they are willing to buy, its in the lenders best interest to ensure that some or all of the loans they grant conform to the standards set for by Fannie Mae and Freddie Mac. So even though Fannie Mae and Freddie Mac arent directly granting loans to consumers, they do have an impact on the terms of your loan by setting guidelines for lenders.

Your loan will also be affected if it is sold because youll submit your payments to a different company than the one who granted you the loan. The terms of your loan will remain the same.

Read Also: Who Can Use Fha Loan

Fannie Mae And Freddie Mac: Overview

In 1938, the government created Fannie Mae, or the Federal National Mortgage Association, amid the struggles of the Great Depression. The goal of Fannie Mae was to create a more reliable source of funding for homebuyers, opening doors for more Americans, figuratively and literally.

Freddie Mac, short for the Federal Home Loan Mortgage Corporation, came on the scene through an act of Congress in 1970, with a similar purpose. Both Fannie Mae and Freddie Mac now operate under the conservatorship of the Federal Housing Finance Agency .

Fannie Mae and Freddie Mac help facilitate access to long-term, fixed-rate mortgages with installment payments. They do this by buying mortgages from banks and other lenders, giving the lenders more capital to continue creating loans for more borrowers. Fannie Mae and Freddie Mac typically package the loans they buy into mortgage-backed securities in the secondary mortgage market.

Both GSEs played a role in the Great Recession. In the years leading up to the housing market collapse, they backed or owned numerous subprime mortgages. When the housing bubble burst, economic pressures and large losses led to the need for the government to step in with bail-out funding. As a result, Fannie Mae and Freddie Mac were able to help usher the housing market toward recovery.

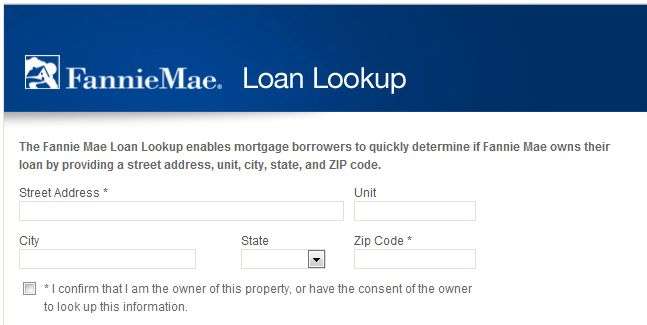

Freddie Mac Mortgage Loan Lookup

To understand the options available for getting help with your mortgage it’s important for you to know who owns your loan.

Using the secured look-up tool below, you can quickly find out if Freddie Mac owns your loan. Please enter your information carefully a spelling error or other small mistake could cause an inaccurate result. Abbreviations, typos, or including the “Street Type” in the “Street Name” field can also lead to inaccurate results.

Recommended Reading: What Loan Should I Get

Where Can You Find Freddie Mac Mortgage Rates

Freddie Mac publishes U.S. mortgage rates in its Primary Mortgage Market Survey . This weekly report averages the interest rates from participating lenders on 30-year fixed, 15-year fixed and 5/1 adjustable-rate mortgages. The survey reflects market trends and not specific Freddie Mac mortgage rates.

Freddie Mac Refi Possible Available This Summer To Help Lower

MCLEAN, Va., May 05, 2021 — Freddie Mac today announced that Refi Possible, a new refinancing option aimed at helping lower-income homeowners, will be available in August. The Freddie Mac Refi PossibleSM mortgage will help borrowers who make at or below 80% of the area median income refinance their mortgage. Eligible borrowers with a Freddie Mac-owned single-family mortgage will benefit from a reduced interest rate and lower monthly mortgage payment, helping save an estimated $100 to $250 a month.

Refi Possible will help reach those families who would benefit most from lowering their monthly mortgage payment, said Donna Corley, executive vice president and head of Single-Family at Freddie Mac. Just as we are committed to a product that makes a difference, we are focused on a seamless integration, so our clients and partners feel confident in promoting and originating Refi Possible when its available this summer.

With Refi Possible, homeowners will see their mortgage rate reduced by at least half of a percentage point and will save at least $50 on their monthly mortgage payment. Homeowners can also receive a $500 credit for an appraisal if one is obtained. And, theyll also be able to roll up to $5,000 in closing costs into their mortgage providing a solution for those with limited cash to close.

To qualify for a Refi Possible mortgage, eligible homeowners must have:

MEDIA CONTACT: Chad Wandler

Read Also: How Do I Apply For Sba Loan

Qualifying For Mortgage With Direct Lender With No Overlays

Home Buyers needing to qualify for government and/or conventional loans with no lender overlays can contact us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at Gustan Cho Associates is a mortgage company licensed in multiple states with no lender overlays on government and conventional loans and offer alternative financing programs. The team at GCA Mortgage Group also offers non-traditional mortgage loan programs such as NON-QM Loans, Bank Statement Loans for self-employed borrowers, and two-time perm construction loans. We also offer escrow advances on refinancing mortgages.

Recommended Reading: Usaa Vehicle Refinance

Is My Apartment Building Financed By Freddie Mac

Renters may use our property search tool to find out if they live in a property that has a mortgage loan purchased or securitized by Freddie Mac.

Tenants who live in a property with a mortgage loan purchased or securitized by Freddie Mac may be eligible for certain tenant protections.

These protections could include:

- Protection from eviction solely for nonpayment of rent

- Giving the tenant at least a 30-day notice to vacate

- Not charging the tenant late fees or penalties for nonpayment of rent

- Allowing the tenant flexibility to repay back rent over time and not in a lump sum

The protections that apply may include protections under the CARES Act, under state or local law, or if the property is in forbearance .

To better understand the protections and assistance that may be available, please visit .

In addition, certain Manufactured Housing Communities that received financing via Freddie Mac’s Manufactured Housing Community Loan offering may provide tenant protections above and beyond the minimum required by law. Renters can consult their leases and/or community rules and regulations to determine if these protections are currently active in their community.

Read Also: How To Get Pag Ibig Housing Loan

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Does Freddie Mac Work

But while Freddie Mac is similar to Fannie Mae, the difference is that Freddie Mac purchases home mortgage loans from smaller banks, also known as thrift banks. Fannie Mae purchases its mortgages from larger commercial banks.

After purchasing mortgages, Freddie Mac will sometimes keep a portion of these loans as its own investment. Other times, though, the organization bundles these loans into mortgage-backed securities and sells them to investors on the secondary market.

Freddie Mac guarantees or backs these loans. If a borrower stops paying their mortgage, Freddie Mac pays the investor.

You May Like: Should I Refinance My Va Home Loan

What Do Fannie Mae And Freddie Mac Do

Fannie Mae and Freddie Mac have similar charters, mandates, and regulatory structures. Each buys mortgages from lenders to either hold in their portfolios or repackage as MBSs that can be sold. In turn, lenders use the money they get from selling mortgages to originate more loans. This helps individuals, families, and investors access a continuous and stable supply of mortgage funding.

According to their charters, Fannie Mae and Freddie Mac “establish secondary market facilities for residential mortgages provide that the operations thereof shall be financed by private capital to the maximum extent feasible.” Both entities are mandated to do the following:

- Maintain stability in the secondary market for residential mortgages

- Respond appropriately to the private capital market

- Offer ongoing support to the secondary market for residential mortgages by increasing the liquidity of mortgage investments and making more money available for residential mortgage financing

- Promote access to mortgage credit by increasing the liquidity of mortgage investments and making more money available for residential mortgage financing

Fannie Mae has one additional responsibility according to its charter: to manage and liquidate federally-owned mortgage portfolios to minimize any adverse effects on the residential mortgage market and minimize losses to the federal government.

Who Is A Conventional Loan Best For

Conventional loans work best for people in the following circumstances:

- People with high credit scores: If your credit score is 640 or above, conventional loans are advantageous.

- People house-hunting for vacation or rental properties: Conventional loans can be used on secondary properties or homes the owner does not occupy.

- People with a 20 percent down payment: Generally, putting down at least 20 percent lets you avoid private mortgage insurance â and the thousands of dollars PMI can cost over the course of your loan.

Also Check: What’s The Longest Car Loan Term

Benefits Of Refinow & Refi Possible Programs

To ensure low-income homeowners benefit from these new offerings, lenders have some requirements they must meet when completing these refinances:

- The refinance must result in a savings of at least $50 per month on the borrowers mortgage payment.

- There must be a reduction of at least 0.50%to the borrowers interest rate.

Additionally, borrowers can benefit from an up to $500 appraisal credit if theyre not already eligible for an appraisal waiver.

What’s The Story Behind The Names

You may be wondering: Whats with these names? And trust me, youre not alone. Its all too often that we hear or refer to Fannie, Ginnie, and Freddie on a first-name basis without ever realizing the actual origin of the names, which were all derived from acronyms.So, to break down the acronyms:Fannie Mae, or the Federal National Mortgage Association, came from the acronym FNMA. Fannie for the letters FN and Mae for MA.Ginnie Mae, or Government National Mortgage Association, came from its acronym GNMA. Ginnie from GN and Mae from MA.As for Freddie Mac, that one is a little trickier. Similar to Fannie and Ginnie, Freddie Mac, or Federal Home Loan Mortgage Corporation, was derived from its acronym FHLMC. Freddie, from F and Mac from MC. It seems the jury is still out on as to why letters HL were left out. So much so that in 1997 the company abandoned the acronym FHLMC altogether to officially become just Freddie Mac.Mystery solved.

Don’t Miss: How Do You Take Over Someone’s Car Loan

Why Do Fannie Ginnie And Freddie Matter To Homeowners

Similar to any lender or financial institution, the financial health and stability of Fannie Mae, Freddie Mac and Ginnie Mae has a direct impact on homebuyers. When these organizations decline, homeownership becomes more costly and less accessible.

Fannie Mae and Freddie Mac are not only secondary market lenders, but these organizations also set regulations and guidelines for mortgages that depository and non-depository institutions have to abide by.

How Do Freddie Mac Loans Work

Freddie Mac, or the Federal Home Loan Mortgage Corporation, buys conventional loans from small banks. These are the guidelines that Freddie Mac establish for loans:

- Debt-to-income ratio up to 45%, although 33% to 36% is recommended

- Down payment as low as 3% of purchase price for HomeOne loans, geared toward first-time buyers, and as low as 3% for Home Possible loans, designed for people such as first-time buyers, low-income borrowers and retirees

- PMI typically required when the homebuyer puts down less than 20% of homes purchase price

You May Like: What Is Bridge Loan Financing

How Does Freddie Mac Affect The Mortgage Market

Freddie Mac has a generally positive effect on the real estate mortgage market. Without Freddie Mac, mortgage originators would be required to hold mortgage loans in-house.

As a result, these enterprises would assume all the risk and tie up their capital. This would increase the interest rates that banks would need to make a profit and therefore drive up the total cost of homeownership across the country.

The History Of Fannie Mae

Before Fannie Mae was created in 1938, home loans had to be repaid quickly and often included a balloon payment, meaning the entire balance was due and payable after a set time period. During the Great Depression, nearly a quarter of American homeowners lost their homes, leaving banks without enough money to offer mortgages.

Congress created Fannie Mae to address this housing crisis and increase banks capacity to lend to consumers. The housing market and economy improved as a result, and mortgage banks created the long-term, fixed-rate loan that is now the mortgage industry standard.

Fannie Mae initially bought and sold loans guaranteed by the government in 1954 Congress restructured it as a public-private, mixed-ownership corporation. By 1968, it was a completely private company and eventually began buying loans in the secondary market and offering mortgage-backed securities to investors.

Recommended Reading: How To Get Approved For Parent Plus Loan

Qualifications Homeowner Must Have:

- A Fannie Mae-backed mortgage secured by a 1-unit, principal residence.

- A current income at or below 80% of the AMI .

- No missed mortgage payments in the past six months, and no more than one missed mortgage payment in the past 12 months.

- A mortgage with a loan-to-value ratio up to 97%, a debt-to-income ratio of 65% or less, and a minimum 620 FICO score.

How Both Agencies Keep Mortgage Rates Low

Low interest rates. Lenders can offer interest rates that are lower than most other types of debt because they have access to funds from Fannie Mae and Freddie Mac to make loans and sell them in the secondary market. Mortgage companies must follow lending standards set by Fannie Mae and Freddie Mac, which protect homeowners from borrowing money they cant pay back. If theres less risk that mortgage loans will default, lenders can offer lower interest rates to current and future homeowners.

Read Also: How To Apply For Income Based Student Loan Repayment

More Flexible Lending And Appraisal Standards

The easing of lending and appraisal standards for homebuyers applying for a Fannie Mae- and Freddie Mac-backed mortgage during the pandemic was extended by the FHFA to July 31, 2021, as the final deadline. They allowed:

- Alternative appraisals on purchase and refinance loans

- Alternative methods for documenting income and verifying employment before loan closing

- Expanding the use of powers of attorney to assist with loan closings

Freddie Mac Loan Lookup Tool

Refinancing programs including the new Home Affordable Refinance Program may require that you determine who the investor for your mortgage is to see if your loan is eligible. You cannot assume that your investor is the mortgage servicer that collects your payments each month because there is a difference between servicer and investor. Your mortgage services collects your monthly mortgage payments and services your account while passing the payments to the investor that holds your loan. They receive a small compensation for completing these task on behalf of your mortgage investor.

Ready to get started on a Freddie Mac Open Access refinance? Apply now for our Unlimited LTV Freddie Mac HARP refinance.

Freddie Mac which is short for, Federal Home Loan Mortgage Corporation , is a government ran entity that purchases and packages mortgage backed securities and sells them on a secondary market. Freddie Mac holds only conventional or conforming mortgages therefore if you have a FHA loan, Rural Housing loan, VA loan or Jumbo loan then Freddie Mac is not your investor.

Also Check: Can I Get Out Of My Car Loan