The Steps To Take And What To Expect

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

False Certification Of Ability To Benefit

You may qualify for discharge if your school falsely certified your ability to benefit from the education. A school is required to certify that students who lack a high school diploma or a high school equivalency diploma have the ability to benefit from the education provided by the school. The school may have failed to test or conducted testing in an improper manner.

Federal Loans And Hardship

Your student loan holder may choose not to oppose your petition to have your loans discharged in bankruptcy court if it believes your circumstances constitute undue hardship. Even if your loan holder doesn’t, it may still choose not to oppose your petition after evaluating the cost of undue hardship litigation.

For federal loans, the Department of Education allows a loan holder to accept an undue hardship claim if the costs to pursue the litigation exceed one-third of the total amount owed on the loan . Private student lenders are likely to apply similar logic.

Read Also: Fafsa Entrance Counseling Quiz Answers

Total And Permanent Disability

You can apply for a Total and Permanent Disability Discharge or TPD through the Office of Federal Student Aid or the U.S. Department of Education if you cant work because of a long-term disability. Your doctor must determine that your disability has lasted at least 60 months and will be present for another 60 months.

If youre a veteran with a service-related disability, youll need documents from the Department of Veterans Affairs. If you get Supplemental Security Income or Social Security Disability Insurance benefits, you must have a disability review scheduled in the next seven years.

You can also get a student loan discharge because of identity theft or death. Ask FRANK if you have any more questions about applying for loans, scholarships, grants, and other forms of financial aid.

Sidelined By Disability And Saddled With Student Loans

Within months of receiving his diploma from Vanguard University near Los Angeles in May 2012, Edgar Zakata started having multiple seizures. He had suffered from epilepsy for most of his life, but medication had always kept the convulsions at bay. Not anymore.

Before he could put his psychology degree to use, Zakata began experiencing up to seven seizures a day. There were visits to the emergency room. There were CAT scans and cocktails of medications to get his condition under control. Nothing worked.

A series of tests suggested it was likely that nothing could be done to prevent the seizures from disrupting his life. He wouldnt be able to hold down a steady job. And with no source of income, there was no way he could repay the $33,000 he owed in federal and private student loans.

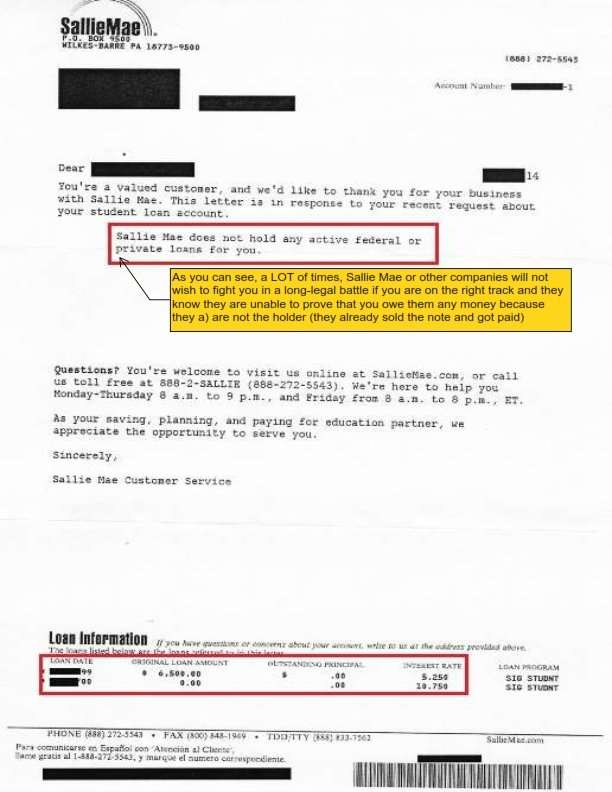

Zakatas prospects were bad enough for the Department of Education to discharge the $25,000 he owed the government, but not for Sallie Mae to grant a similar disability waiver for the $8,000 it was due.

Instead, the private lender demanded more medical records, more doctors letters, more proof. Two years later, the battle is emblematic of the disparities between federal and private student debt collection.

Whereas the federal government has rules for income-based repayment, forbearance and waivers for severe disability, there are no industry-wide equivalents governing private lenders. Instead, each bank or financial firm decides whether to institute those policies, and not all do.

Also Check: Can You Buy An Auction Home With A Fha Loan

Your School Lied To You

Over the years, government officials have shut down many for-profit institutions that defrauded students. The borrower defense loan discharge program allows you to file a claim to have your debt forgiven if you believe your school misled you and broke state fraud laws.

The relief program has not worked smoothly since first being used under the Obama administration to help people who attended Corinthian Colleges. When President Trumpâs education secretary, Betsy DeVos, took office, the process for approving applications slowed to a crawl. The Education Department focused its efforts on defending litigation rather than finding ways to quicken the process and grant borrowers the relief they were entitled to under the law.

The new education secretary, Miguel Cardona, has announced the department was scrapping his predecessorâs policy and replacing it with a simplified, fair path to relief when a schoolâs misconduct has harmed them.

In June 2021, the department announced it would wipe out $500 million for 18 thousand borrowers who attended ITT Technical Institute.

- Whose eligible: Youâre eligible if you attended a school that misled you or engaged in other misconduct, or you can show the school violated state law related to your loan or the educational services provided.

- How to apply: You can apply online anytime or submit a paper application to the Department of Education.

- When to apply: You can apply anytime after your schoolâs misconduct.

- Application:.

Federal Employee Student Loan Repayment Program

The Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency.

This plan allows Federal agencies to make payments to the loan holder of up to a maximum of $10,000 for an employee in a calendar year and a total of not more than $60,000 for any one employee.

It’s important to note that an employee receiving this benefit must sign a service agreement to remain in the service of the paying agency for a period of at least 3 years.

An employee must reimburse the paying agency for all benefits received if he or she is separated voluntarily or separated involuntarily for misconduct, unacceptable performance, or a negative suitability determination under 5 CFR part 731. In addition, an employee must maintain an acceptable level of performance in order to continue to receive repayment benefits.

Furthermore, you must sign up for this program when you’re hired. You can’t go back to your HR department after you’re already employed and ask for it.

You can learn more about this program here.

You May Like: Is Carmax Pre Approval A Hard Inquiry

Death Doesn’t Necessarily Wipe Out Consolidated Loans

If spouses have consolidated their federal student loans together, one spouse’s death wipes out only that spouse’s portion. In the past, spouses could consolidate their federal student loans. Now, though, married couples aren’t allowed to combine their student loans into a single, shared Direct Consolidation Loan.

Biden Administration Cancels $1.5 Billion of Student Debt for Borrowers

In 2021, the U.S. Department of Education announced that:

- 72,000 student loan borrowers who previously had part of their federal student loans canceled under a “borrower defense to repayment” claim will now get full student loan relief

- about 41,000 borrowers whose federal student loans were discharged due to total and permanent disability and then reinstated will get a discharge

- more than 323,000 borrowers with total and permanent disabilities will get automatic student loan discharges, and

- $1.1 billion in federal student loans for around 115,000 borrowers who attended ITT Technical Institute will be automatically discharged.

Also, the American Rescue Plan Act exempts student debt forgiveness from federal taxation until January 1, 2026.

Leaves And Change In Employment

Loan forgiveness is not pro-rated. If you leave government in the middle of the year, youre not entitled to any portion of the loan forgiveness for that year and you must start making payments on the B.C. portion of your Canada-B.C. integrated student loan.

If you return to full-time studies, youre not eligible as your loans will be in non-payment status during that time. You can re-apply when you return to work.

- For less than 3 months during the 12 month service period being reviewed, youre eligible for loan forgiveness

- For 3 months or more during the 12 month service period being reviewed, youre ineligible to receive loan forgiveness and will be removed from the program

Employees on general leave cant apply while on leave, but are invited to apply or reapply to the program once they return to work.

Don’t Miss: How To Apply For Sss Loan

Discharge Due To Death

In the unfortunate circumstance where the student loan borrower or student for whom the loan was taken out dies, the loan can be discharged.

All federal loans are eligible. With parent loans, including Parent PLUS loans, the loan is discharged if the parent borrower dies or if the student on whose behalf the parent obtained the loan dies.

To apply, a family member or other representative must submit proof of death, such as a death certificate, to the loan servicer.

Loan Forgiveness For Lawyers

There are about a million jokes about lawyers being bloodsuckers on society, but the federal loan program begs to differ. There is a financial incentive for lawyers to practice in public service or government offices in order to have some portion of their law school loan forgiven.

For example, the Department of Justice provides up to $60,000 in loan forgiveness for lawyers who work there for at least three years. The Air Force Judge Advocate program offers up to $65,000 in loan forgiveness.

The best place to start looking might be your own law school, since several colleges forgive some or all of the student loans for students who make less than $60,000 a year.

That amount varies, so check with your school to get actual requirements and amount forgiven. If you cant qualify for a forgiveness program, look into refinancing your law school debt.

You May Like: Usaa Personal Loan Credit Requirements

The Additional Step: Filing An Adversary Proceeding

Here’s where things get more complicated. As stated earlier, just filing for bankruptcy under either Chapter 7 or Chapter 13 is not enough to have your student loans discharged. You must take the additional step of filing an adversary proceeding.

Under the U.S. bankruptcy code, an adversary proceeding is a proceeding to determine the dischargeability of a debt. In other words, it’s a lawsuit within a bankruptcy case. Included in the adversary proceeding paperwork is “a complaint.” The complaint includes administrative details, such as your bankruptcy case number, along with the reasons you are seeking to discharge your student loans in bankruptcythe circumstances of your undue hardship.

Thisadditional step is necessary because student loans and a few other types of debt have stricter requirements for discharge than credit card debt, for example. These requirements are described in section 523 of the U.S. bankruptcy code. The keywording that relates to the discharge of student loans is: A discharge under…this title does not discharge an individual debtor from any debt…unless excepting such debt from discharge under this paragraph would impose an undue hardship on the debtor and the debtors dependents.” Note the words “undue hardship,” which is discussed below.

Requirements For Federal Student Loans

Disabled borrowers of federal education loans made in the William D. Ford Federal Direct Loan program, the Federal Family Education Loan program, and the Federal Perkins Loan may be eligible for discharge of their federal loans. The total and permanent disability discharge will also cancel the requirement to complete TEACH Grant service obligations.

Note that the disabled person must have borrowed the student loans. Although the Federal Parent PLUS loan may be discharged upon the death of the student on whose behalf the loan was borrowed or the parent borrower, Federal Parent PLUS loans can be discharged only upon the disability of the parent borrower, not the disability of the student.

There are three different ways of demonstrating a disability that is severe enough to qualify for the total and permanent disability discharge. These involve veterans with a VA determination of unemployability due to disability, people with certain Social Security disability statuses and people who obtain a doctors certification.

Also Check: Refinancing With Usaa

Air Force College Loan Repayment Program

The main Air Force College Loan Repayment program is paused in 2018 . This program allowed you to get up to $10,000 in student loan debt paid off in 3 years.

However, the Air Force JAG student loan repayment program is still active. You can receive up to $65,000 in student loan forgiveness if you go into JAG in the Air Force.

You can learn more about this program here.

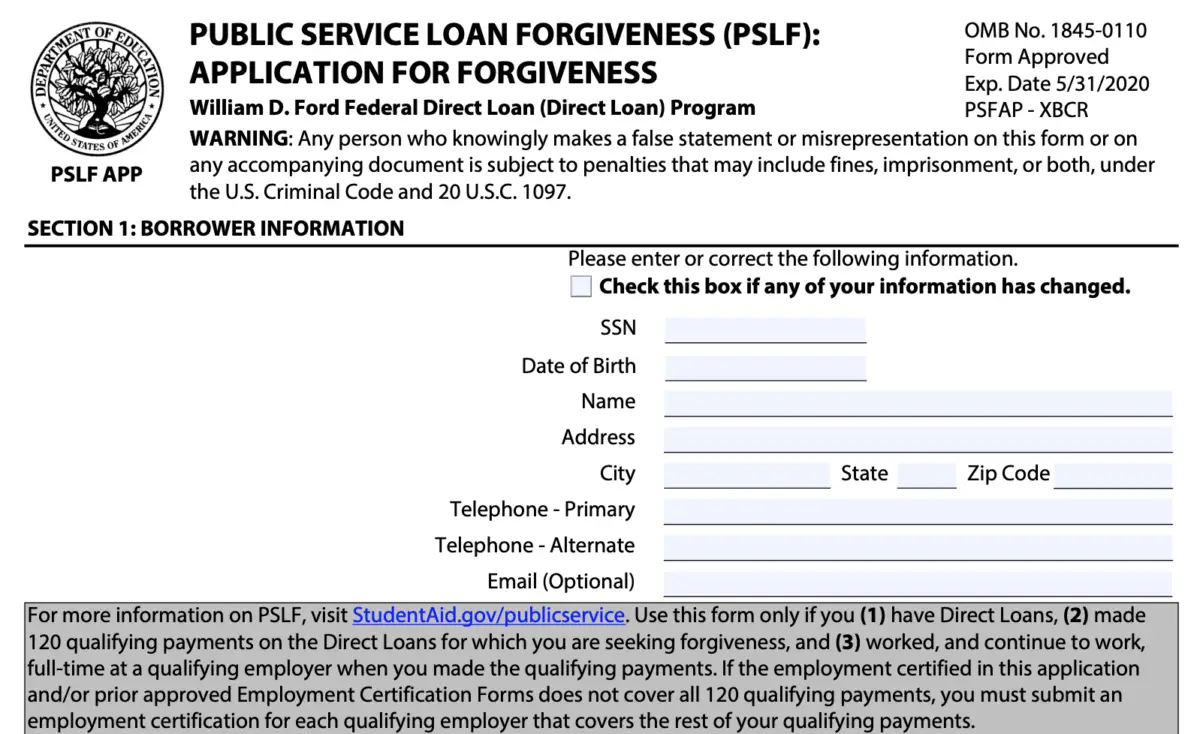

Who May Need To Consolidate Their Loans

If you have Federal Family Education Loan Program loans, Federal Perkins Loans or other types of federal student loans that arent direct loans, you must consolidate them into the direct loan program by Oct. 31, 2022, according to Federal Student Aid.

This is important for borrowers because you can’t receive credit for payments if you consolidate after that date. Once the consolidation process is complete, you must then submit a PSLF form to your loan servicer.

The help tool on the Federal Student Aid website will be updated in the coming months to process applications for borrowers in the Federal Family Education Loan Program and those with Perkins loans.

Right now, employment can still be verified for them in Step 1 of the help tool, and loan consolidation can still be requested, Federal Student Aid said on its website. But an application for the Public Service Loan Forgiveness program through the tool may not be available in the near term for those borrowers.

Recommended Reading: Can You Refinance With A Fha Loan

Borrower Defense To Repayment Discharge

Borrowers may be eligible for discharge of their federal education loans if their college engaged in fraudulent, deceptive or illegal practices concerning their student loans or education under federal or state law. Examples include providing false information about college costs, accreditation, job placement statistics or the ability to transfer credits.

Borrowers who qualify for the borrower defense to repayment discharge may also qualify for a refund of some or all of the payments they made on the loans.

To apply for a borrower defense to repayment discharge, submit an application on the U.S. Department of Educations website.

What Happens After Tpd Discharge

If your application is approved based on a physicianâs certification, youâll be put under a three-year post-discharge review where the Education Department will check your earnings.

For the three years after this review begins, youâll need to file paperwork showing your income for the past tax year. If your income exceeds the Poverty Guideline amount for a family size of two for your state â no matter your actual family size â your balance can be reinstated. The easiest way to prove your income during the 3-year monitoring period is to provide a copy of your tax return, W-2, or Social Security benefits award letter. You can get that letter at ssa.gov.

You can escape this monitoring period if your discharge was granted based on SSA or VA documentation, following policy changes made under the Trump and Biden administrations.

Read Also: Fha Title 1 Loan Lender

Can You Get A Real Car Loan With Bad Credit

- Check your creditworthiness. Check your credit score before you start shopping for a car loan.

- Save for the deposit. Building up a deposit can have several advantages.

- Think about how much you can afford. Donât just think about your monthly loan payment, but how much you can afford.

- Buy from different lenders.

What Loans Qualify For Tpd Discharge

All federal student loans are eligible for discharge due to disability, including:

- Direct Loans.

- Federal Parent PLUS Loans â discharged only if the parent becomes disabled.

- Federal Family Education Loans .

- Federal Perkins Loans.

- Joint Spousal Consolidation Loans â the non-disabled spouse will still be responsible for the loan.

For private student loan debt, contact your lender to learn if theyâll forgive your loans due to disability. Read more about private student loan forgiveness programs.

Read Also: Can I Use A Va Loan For A Second House

Student Loan Discharge Options

There are also ways to get your student loans discharged in some circumstances. We consider student loan discharged to be a little bit different than forgiveness, both due to the nature of the way the loan is eliminated and the potential taxability surrounding it.

There are various discharge options you may qualify for.

Us Military Student Loan Forgiveness Options

Serving our country can be a great career. And there are good incentives to sign up and serve. Student loan forgiveness has been one of these programs.

If you’re considering a career in the military, find out if they will help pay down or eliminate your student loan debt. You can also look at our full guide to military and veteran education benefits.

Recommended Reading: Car Loan Through Usaa

Loan Forgiveness For Volunteering

Volunteers with AmeriCorps may earn Segal AmeriCorps Education Awards which can be used to repay their federal student loans and state student loans. The education awards are worth up to the maximum Federal Pell Grant amount. There is a seven-year limit on using the education awards. Volunteers age 55 and older may transfer their education awards to their children or grandchildren.

Volunteers with the Peace Corps may receive a transition payment of more than $10,000 after completion of two years of service.

Both the education awards and transition payments may be used to repay federal student loans. These lump sum payments count toward up to 12 qualifying monthly payments for Public Service Loan Forgiveness.

However, some borrowers may be better off making payments under an income-driven repayment plan. These payments can be as low as $0 and still count toward Public Service Loan Forgiveness. Volunteering full-time with AmeriCorps or Peace Corps qualifies as full-time employment in an eligible public service job.

The U.S. Department of Education publishes a guide to repaying federal student loans for Peace Corps volunteers.

Recipients of the Segal AmeriCorps Education Award may apply the award to their student loans through the My AmeriCorps portal. Choose Create Education Award Payment Request and then specify Loan Payment as the Payment Type.