Find Out Where To Mail Your Payment

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies, loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Who Is My Student Loan Servicer Heres How To Find Out

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

You May Like: Usaa Used Auto Loan Rates

Recommended Reading: Usaa Rv Buying Service

Explore Different Student Loan Strategies

As you think through your loans, income and other financial factors, you can identify the plan of attack that best fits your situation.

The nice thing about the tools above is they take the focus off doing math and place it on creating a strategy that works for you.

With so much information out there and so many decisions to make, its easy to become overwhelmed. Dont let fear about your student loan situation paralyze you and prevent you from making decisions that will make your life easier in the long run.

With a little bit of ingenuity, hard work and help from Student Loan Hero, you can do more than manage your student loans you can conquer them.

Andrew Pentis and Honey Smith contributed to this report.

Ways To See All Your Student Loans

Many students take out a student loan or two each semester while theyre in school. That means you will likely have several student loans by the time you leave school.

However, transitioning from college to the real world can be a busy and chaotic process. Between applying for jobs, starting a career or moving to a new city, it can be all too easy to lose track of student loans.

Heres how you can locate your student loans and make sure youve found them all.

Also Check: Drb Student Loan Review

Log Into The Fsas Loan Simulator

Once youre logged into the Federal Student Aid website, you can do a lot more than just locate your loans. Among the new tools of Next Gen, the loan simulator is a great one to start with.

Unfortunately, theres no similar tool that plug into all banks and could collect all your private student loans. You can employ our student loan calculators, however, to explore different possibilities and compare outcomes.

If youre considering postponing your repayment to focus on finding a job, for example, you could figure the cost of accruing interest on your debt with this calculator:

William D Ford Federal Direct Student Loan

In the Direct Loan program, the U.S. Department of Education is the lender for your student loan. There are two types of student loans in the Direct Loan program subsidized and unsubsidized. These loans are not based on your credit rating/score and do not require a credit check.

- The Direct Subsidized Loan is based on need. Interest on the Direct Subsidized Loan does not accrue while you are in school and during your grace period.

- The Direct Unsubsidized Loan is not based on need. Interest on the Direct Unsubsidized Loan does accrue once the loan is disbursed.

Loan Request Process: If you were not initially awarded a Federal Direct Student Loan and are interested in requesting one, or if you were only awarded a Subsidized loan and would like to request an Unsubsidized loan, you must complete and submit the online Federal Direct Loan Request Form.

| Students who will be offered aSubsidized loan automatically: | Students who need to submita loan request form: |

|---|---|

|

|

Also Check: Does The Capital One Pre Approval Car Loan Work

Reservist Status In The Canadian Forces

If you are a reservist in the Canadian Forces on a designated operation you can delay repayment and interest on your student loan.

Complete the Confirmation of Posting Assignment for Full-Time Students form and submit it with your loan application to maintain your interest-free status. Make sure you attach a copy of your notification of posting instructions that you received from the Department of National Defence.

If you need help with this, contact your provincial or territorial student aid office.

If You Don’t Repay Your Loans

If you don’t make your loan payments, you will be in default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further OSAP until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and HST rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

Also Check: Fafsa Entrance Counseling Quiz Answers

Repayment Assistance Plan Stages

The plan has two stages: interest relief and debt reduction.

1. Interest relief

The interest relief stage is available for up to 60 months, or until you are out of school for 10 years, whichever comes first.

During the interest relief stage

- your monthly affordable payment will first go toward paying down your loan principal

- if your payment is large enough, the remainder will go toward monthly interest

- the governments of Canada and Ontario cover all monthly interest that is not covered by your payment

If you are not required to make any payments at all during this stage, the governments of Canada and Ontario will cover your entire monthly interest charges and your loan principal would stay frozen.

Visit the National Student Loans Service Centre website to get more information.

2. Debt reduction

The debt reduction stage occurs after the interest relief stage, which is after you have received interest relief for a minimum of 60 months or you have been out of school for 10 years, whichever comes first.

During the debt reduction stage:

- you will make either no payments or a monthly affordable payment, depending on your income and family size

- your monthly affordable payment, if any, will go first toward paying down your loan principal

- if your payment is large enough, the remainder will go toward paying monthly interest

Visit the National Student Loans Service Centre website to get more information.

Student Loan Stats At A Glance

Do you know what is the best way to bog yourself down in a quagmire of debt?

Get yourself a college degree.

The second highest consumer debt category is student loan debt, preceded by mortgages.

Student loan debt in the United States is higher than both auto loans and credit card debt as well.

The average student loan borrower owes $33,000. About 3 million students owe over $100,000. To put that in context, an average new car costs $36,700. You can get a small starter house in most small or mid-sized cities for $100,000.

When its time to start making repayments, shortly after graduation, the average monthly repayment is $300.

Imagine making monthly $300 payments for 6, 10, 15, or 20 years.

Over 45 million Americans dont have to imagine it. Its their everyday reality.

A student loan is a lifelong investment for many. Its as vital a bill payment as rent, a mortgage, or car loans.

If youre embarking on a decades-long journey of monthly student loan repayments, you must know how to find the student loan account information.

Also Check: Usaa Auto Loan Reviews

Which Teachers Qualify For The Teacher Loan Forgiveness Program

If you teach full time for five consecutive, complete academic years at certain schools and educational service agencies serving low-income families, the Teacher Loan Forgiveness Program may forgive as much as $17,500 of your federal student loan principal and interest. Qualifying loans include subsidized and unsubsidized Federal Family Education Loan Program and Direct Loans. Portions of consolidation loans may qualify. Visit StudentAid.gov for more information and to see which schools and agencies qualify.

Also Check: Fha Maximum Loan Amount Texas

Your Student Loan Servicer

We’re here to process your loan payments and help you find lower monthly payment options if you need them. Learn what we do.

Upload Documents Without Logging in to Your Account

Do you need to upload a document? There’s no need to log in. Fill out our form with the requested information and attach your document.

Read Also: Sss Loan Requirements

Who Took Over Sallie Mae Loans

Navient CorporationOn April 30, 2014, Sallie Mae spun off its loan servicing operation and most of its loan portfolio into a separate, publicly traded entity called Navient Corporation. Navient is the largest servicer of federal student loans and acts as a collector on behalf of the Department of Education.

Also Check: Capital One Pre Approved Car Loan

William D Ford Federal Direct Parent Plus Loan

Your browser does not support this video.In the Direct Loan program, the U.S. Department of Education is the lender for your student loan. The Direct PLUS loan program is available to parents of a dependent undergraduate student who is eligible for financial aid. Unlike the Direct Loans for students, though, parents applying for a Direct PLUS Loan must meet certain credit criteria.

Application Process: To apply for a Direct PLUS Loan,

Borrowing Limits: The amount a parent can borrow is based on the students enrollment, grade level and other financial aid received. Based on these factors, the Financial Aid Office will determine the maximum amount you can borrow.

Interest Rates and Fees: for information on interest rates and fees associated with the Direct Loan program.

Read Also: Usaa Car Loan Calculator

We Protect Your Online Account

Account Access is only intended for our borrowers. To protect personal information, we will block or delete an online account if we suspect a third party has accessed it or if we suspect fraudulent activity is taking place on the online account. If you are not the borrower and need assistance or have questions about their account, for assistance. We’ll do everything we can to help.

How Can I Find Out How Much Interest Was Paid On My Loans Last Year

The number will be on your 1098-E Student Loan Interest Statement, which you can access by logging in to mygreatlakes.org and selecting My Accounts »Tax Filing Statements. Your 2021 statement will be online starting January 13, 2022.

- If we have your current email address, we’ll send you an email reminder when your 1098-E is available online.

- If we don’t have your email address, we’ll send you a letterunless the interest you paid during 2021 is less than $600. If it’s less than $600, you can still access your 1098-E online, but we won’t send you a paper copy.

Please note: Because loan payments were not required and interest rates were at 0% during 2021, your interest paid was likely lower than in previous years.

If you definitely want to know when your 1098-E statement is available, check your profile to make sure we have your email address and you’re signed up to receive email communication from us. You can verify all your other contact information at the same time, too.

Is there a deadline for interest payments to be included on my 2021 1098-E?

Yesthe interest on payments received by 5:00 p.m. Central time on December 31, 2021 will be included on your 2021 1098-E. Interest on payments received or scheduled after that time will appear on next year’s statement.

Recommended Reading: Prosper Credit Requirements

More Frequently Asked Questions

What are the benefits of getting correspondence through this platform?

- Never worry about a misplaced statement and have statements automatically filed electronically for you.

- Access information easily while logged into your account.

- GSM& R statements and account information is available in real-time.

- Information will be stored with the confidence of knowing it is password-protected and confidential.

- Online statements are quick and easy to access and good for the environment as the need for paper statements is eliminated.

- Note: Please add this to receive emails related to your online student loan account.

I currently receive electronic statements, will I continue to?

If you currently receive electronic statements, you will need to log on to your account and create a profile. If you have not already done so, you will be prompted to choose whether to receive electronic statements. If you accept this then you will continue to receive electronic statements, if you choose not to you will start receiving paper statements.

Why am I not receiving notifications in my email after I have signed up for electronic correspondence?

Sometimes automated replies are auto-directed to a junk or spam folder within your mailbox. Please be sure to check all of your email folders. You should add this to ensure these emails reach your Inbox.

How do I apply for cosigner release?

Where Can I Find My Loan Information : :

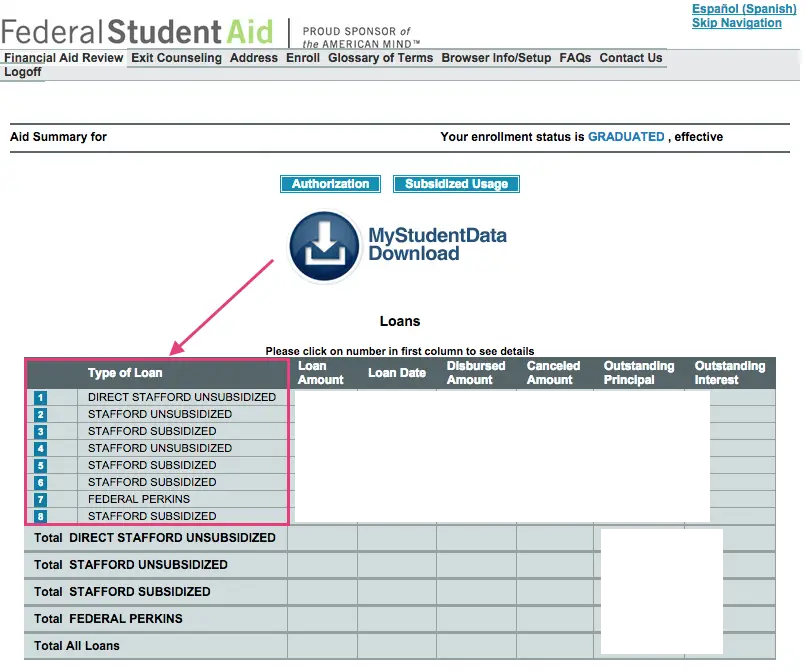

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

Read Also: Usaa Prequalify Mortgage