How Do I Get A Startup Business Loan With Bad Credit

Without at least two years time in business and strong revenues, lenders will have to rely on your credit scores to help determine their level of risk. A business owner with bad credit will find it tough to qualify for almost any loan. However, many of the microloans and crowdfunding options are worth exploring, as they may be available to business owners with poor credit or no credit, and there are a few startup business loans with bad credit you may qualify for.

Determine How Much Funding You Need

Start the process by asking yourself, What do I need the money for?

Lets call the answer your loan purpose. Calculate what it will cost to meet your loan purpose and that is the amount to look for. If you can clearly articulate your loan purpose to a lender, your crowdfunding campaign, the SBA, or your uncle Fred, you are more likely to get the money you need as opposed to simply looking for, As much as I can get. Whats more, youll avoid the financial stress and repercussions of borrowing more than you really need.

Startup Business Loans By Banks

| Name of the lender |

| 17% p.a. to 21% p.a. |

HDFC Bank

- Loans of up to Rs.40 lakh. Rs.50 lakh in select location.

- A processing fee of 0.99% of the loan amount will be charged by the bank.

- Repayment tenures of up to 4 years.

TATA Capital

- Repayment tenures of up to 3 years

- Loans ranging between Rs.50,000 and Rs.75 lakh.

- Processing fee of 2.50% of the loan amount plus GST will be charged by the lender

Kotak Mahindra

Key highlights

- Loans of up to Rs.75 lakh.

- Interest rate charged by the bank will depend on factors such as the loan amount availed by you, the repayment tenure, etc.

- 2% of the loan amount plus GST will be charged as the processing fee.

- Repayment tenures of up to 5 years

Fullerton India

- Loans of up to Rs.50 lakh.

- Repayment tenures of up to 5 years.

- The processing fee charged can go up to 6.5% of the loan amount plus GST.

Startup business loans are of two types –

- Line of Credit

- Equipment Financing.

Line of Credit

A startup business loan in the form of a line of credit works in a similar manner to a . However, the card is tied to the individuals business instead of their personal credit. One of the best benefits of a small business line of credit is that customers will have no obligation to pay interest on the borrowed sum for the first nine to 15 months, thereby making it easier to cover expenses whilst getting their business to a good start.

Equipment Financing

Don’t Miss: Can You Get Fha Loan For Mobile Home

Where Can You Get A Business Startup Loan With Bad Credit

Fundbox

FundBox is an invoice factoring company that services individuals and B2C entities. This fintech company can deliver fast funds up to $100,000.

| Loan Amounts | |

| No minimum personal credit score required | |

| Time to Funding | A few minutes to several days |

- Finances invoices for individuals and small businesses

- Transparent terms

- Minimum requirement 6 months in business and 6 months billed in your accounting software

- No collection services

- Transactions are full recourse

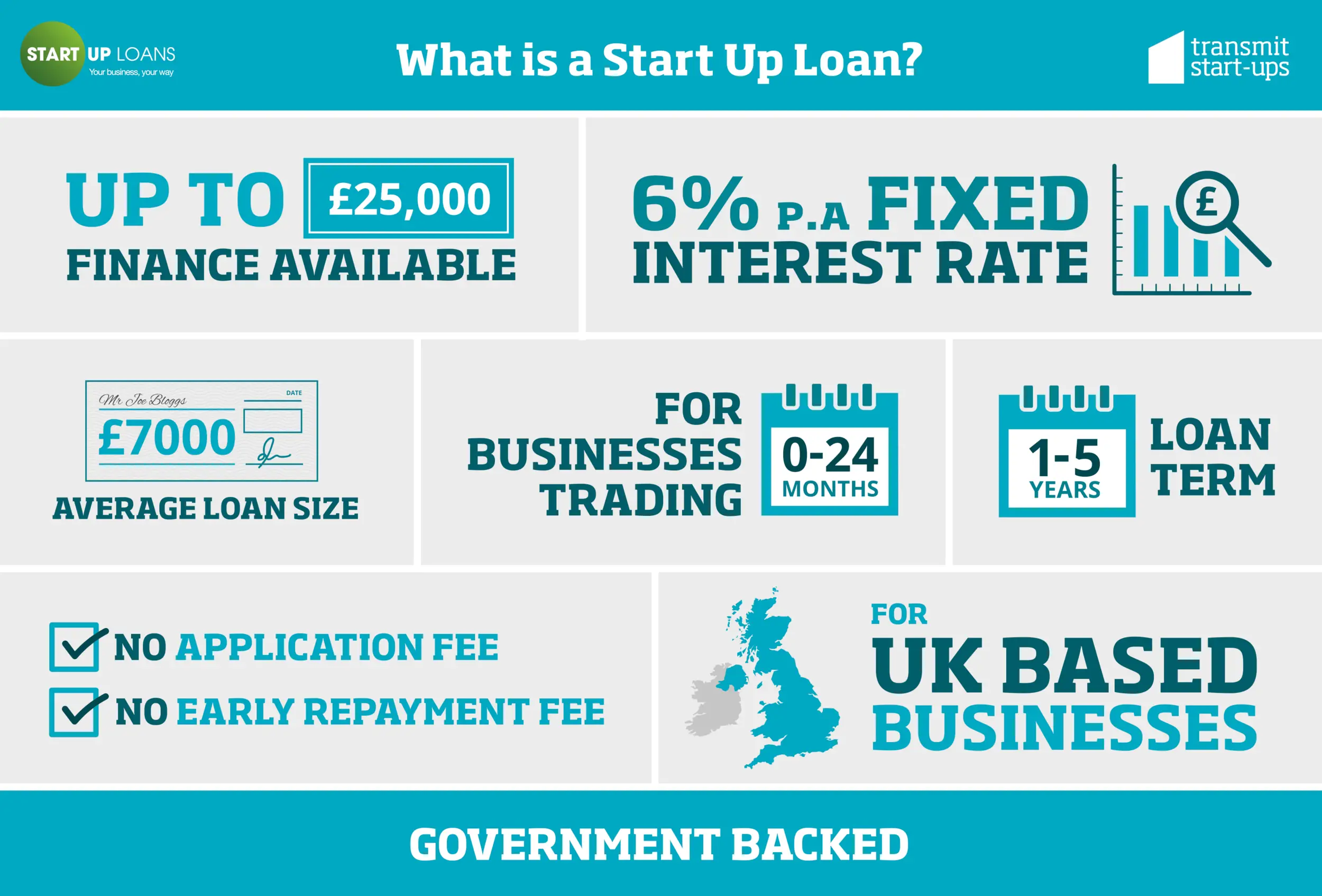

What Is A Start Up Loan

A start up loan is a type of finance designed to help new businesses that have been trading for less than 24 months. Start up business loans enable budding entrepreneurs to pay for key requirements, such as funding the launch or early stages of their new company.

Startup business loans are usually unsecured so there is no need to provide valuable business assets as security. With a start up finance:

Receive between £1,000 £500,000

Repay over a period of 1 3 years

Benefit from competitive interest rates

Recommended Reading: What’s The Best Online Loan Lenders

Different Payment Methods For Start

Top of the list of any start-up businesss to do list should be ensuring you get paid.

There are lots of ways customers can pay for your goods and services from cash to digital wallets but not all are suitable for every situation, and some come with additional costs for using them.

Customer payments are the lifeblood of any business.

Poor payments can lead to cash flow issues which may risk the viability of your business, so its crucial to find payment methods that are suitable and efficient.

Different businesses such as e-commerce stores or high street shops may use different payment methods but each one should be as simple as possible for customers to use.

The same goes for business-to-business transactions.

Frictionless payment systems can encourage timely payments, which means less time spent chasing late or missing payments.

For many small businesses, such as cafés or pop-up retailers, the choice used to be limited to cash.

But advances in payment systems that use mobile broadband have made it easier for small businesses to take credit card payments quickly and cheaply with minimal fuss, too.

Online stores can use a wide range of new payment systems, including payment gateways such as PayPal, that provide tracking, invoicing, and reporting.

With several different ways of taking money, how do you know which is best for you?

Want to learn more about launching a business that has a positive environmental impact?

Revenue And Time In Business

In the eyes of a small business lender, the more time you have in business, the better.

Many online lenders also require a minimum annual or monthly revenue to qualify for any type of loan. They want to make sure youre bringing enough money in on a regular basis to cover your loan payments.

When it comes to startup loans, you might have limited options at first because you havent been in business long enough to start making any money.

If you struggle to find a startup loan and you can wait to apply for financing, consider doing so. Youll have more options available to you if you have a year or even six months in business.

Also Check: How Do Loan Modification Programs Work

Use Freelancers Or Contract Workers

As of 2020, there were 2.2 million freelancers opens in new window working in the UK, according to not-for-profit self-employed organisation IPSE.

Freelancers can be cost-effective and deployed on tasks as needed without ongoing overheads.

Freelancers can bring expertise to a project.

However, availability can be challenging, and they may be less invested in your businesss culture and success.

Employment agencies can help overcome a lack of experience and resources when hiring.

Agencies typically charge a fee payable only when you employ someone they have recommended.

They often write the job ad, screen candidates, set up interviews, and provide feedback.

They can also ensure your hiring practices are fair and inclusive.

However, fees can be expensive typically 15% to 20% of the employees annual salary.

Check to see if they offer a clawback facility, where your fee is returned if the new employee doesnt complete a probation period, for example.

You may not need to hire anyone at all to solve your staffing issues.

Consider upskilling existing employees as an alternative to hiring.

There are free online training resources that can help with this, and many are divided into smaller sections that can be completed either in the employees own time or at work.

Offering training can also be an enticing benefit when posting job ads.

Courses cover subjects such as accounting, management, and business sustainability.

Do Start Up Loans Require Personal Guarantees

After making an application, its important to be aware that some lenders will require a personal guarantee as part of their agreement terms. Because there is nothing to secure the money against, a lender might want reassurance that they will have a way of getting their money back, if your small business defaults on repayments.

What is a personal guarantee? A personal guarantee is a signed agreement making the business director personally liable for paying back the money to the lender.

How risky are personal guarantees? You shouldnt be considering a start up loan if you are not confident with your business plans or financial forecasting. Provided you will be able to pay back repayments on time, there is little need to worry about signing a guarantee.

Recommended Reading: What Does 85 Loan To Value Mean

How To Start Up

New start-ups come from all walks of life but they’re all inspired by a great idea or a passion. NAB doesnât like to see good ideas go to waste, so weâve developed a solution to make sure your great ideas get to market. Thatâs why weâve teamed up with EasyCompanies, a company that knows just what official documentation and registration you need. We can then submit the documents for you whilst updating you along the way with your progress.

Here are some of the main administration tasks weâll help you with so you can launch your business.

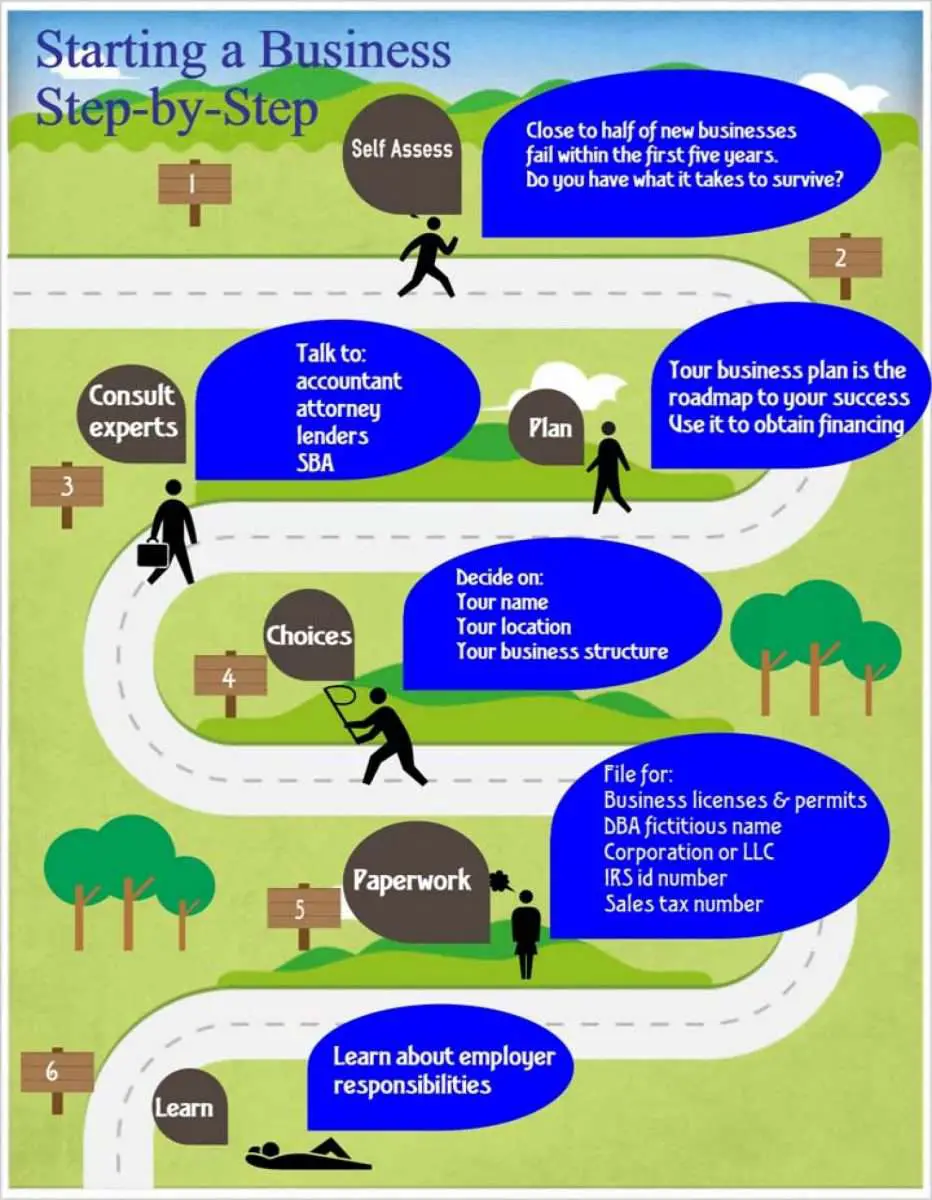

How To Get A Startup Business Loan

The process of getting a startup business loan varies by financial institution and financing type, but most banks and online lenders impose similar requirements. Even so, you may face some additional challenges as a startup with limited financial records and credit history. Follow these steps to get a business loan as a startup:

1. Evaluate what kind of loan you need. Available loan amounts and repayment terms vary by loan type and lender, so first consider how much you need to borrow and what type of financing you prefer. If youre a brand new startup, consider whether alternative types of startup financing may be appropriate, or if youre likely to qualify for a business loan based on your personal credit.

2. Check your personal and business credit scores. Before you apply for a startup business loan, check all your credit scores. This can help you gauge your approval odds for traditional financing. If necessary, take time to improve your credit score before applying for a startup loan. Likewise, if your startup has been in business for at least a year, it may have a credit score through Experian, Equifax or Dun & Bradstreet . But it usually takes up to three years for a business to establish credit.

You May Like: Can You Use Mortgage Loan For Down Payment

Broaden The Talent Pool

It can be easy to target traditional recruitment pools when seeking employees, such as advertising on general recruitment platforms or seeking employees willing to work full time.

Yet this approach may limit who can apply for a vacancy.

Instead, consider accessing hidden talent pools such as part-time and flexible workers or workers that other businesses overlook.

For example, older job seekers may have valuable experiences to draw on, while return-to-work parents or carers can bring much-needed expertise on a part-time basis.

Consider adopting a hybrid/flexible working model.

This can help employees reduce commuting costs and enjoy a better work/life balance.

It may result in quicker work with fewer distractions, according to the ONS opens in new window.

Flexible working hours, such as allowing time for school runs or after school childcare may also attract a wider pool of potential workers.

Eligibility Criteria For Startup Business Loan

The eligibility criteria to avail startup business loans may vary from lender to lender but the generic ones have been listed below:

- Age of the applicant should not be less than 21 years while the maximum age should not exceed 65 years.

- The applicant must be a citizen of India.

- Applicants should have a business plan.

Read Also: How To Shop For Home Mortgage Loan

Do New Businesses Qualify For Sba Loans

New businesses can qualify for SBA loans, but they may not be eligible for all of the SBAs programs. Because new businesses dont have established financial records and cash flow history, the application process can be more difficult.

Applicants may need to provide additional materials, including a business plan that demonstrates the likely future success of the business. Startup founders should also have evidence of their prior experience in the industry and general business management experience.

How To Choose The Best Startup Business Loans

The right lender and type of loan can make all the difference for your business. Here are tips for choosing the best startup business loans:

- Length of repayment time: The longer the monthly payments then the easier it will be on your cash flow as the payments will be stretched out. However, youll pay more interest. Take into consideration if you want your cash flow stronger or a higher interest payment overall.

- Compare interest rates: The interest rate will determine how much you will have to pay back over time. The lower the interest rate, the less you have to pay back overall.

- Amount of capital: How much money do you need? If you have a business plan, look at the forecast and determine how much youll need to cover expenses in the first year. You may also want to figure out how much capital youll need to reach profitability and start turning a profit.

- Lender reputation: The most important thing to consider when choosing a lender is its reputation. Reputable banks and credit unions offer better interest rates than non-bank lenders. If a lender has a good reputation, its more likely that they can be trusted and be around if something goes wrong.

Read Also: How Much Do Loan Signing Agents Make

Work On Your Application

Once youve made sure you meet all the qualifications for a grant, you can start on your application.

Depending on the grant youre applying for, the application can range from answering a few basic questions about your business to very involved essays, videos, and budget proposals. In other words, you should plan on investing some time in your grant application.

That said, you should consider how involved the grant application is and compare that to the grant award amount. It may be worth pouring hours and days into an application for a $60,000 grantbut you might not want to invest that much time in a $1,000 grant.

What Is Required To Get A Small Business Loan

Requirements vary significantly by lender, but you should be prepared with the following:

- Personal credit reports and scores from all three major credit bureaus.

- Business forecast with details on future cash flow and costs.

- Tax returns and supporting IRS documents for both your business and personal tax accounts .

- Any applicable licenses and registrations for doing business in your state.

- All financial documents that would be deemed relevant .

- Any legal contracts that would be relevant .

- Bank account to deposit the loan proceeds into.

As a startup business, you probably wont have business credit reports or business tax returns. In that case, the lender may rely on your personal credit, tax returns and/or a personal financial statement. If, however, you are purchasing an existing business, the lender will likely require information about that business.

Once youve submitted the application, you may have to be patient. Some financing options can be approved in minutes some may take weeks or even months. Be sure that youre aware of the wait time before you begin the application process. You dont want your urgent business needs to be on hold or miss an obligation waiting for a loan to be approved.

Also Check: Do Pawn Shops Loan Money

Make Sure You Qualify

Most grants require applicants to meet certain eligibility requirements.

For example, the grant-giving organization might require you to have a for-profit business. The requirements can get much more specific than that though. Take the Asian Women Giving Circle Grant. Applicants must be Asian American women with a nonprofit in New York City.

So before you start an application, make sure you and your business meet all the relevant requirements for your grant of choice. Otherwise, you could waste time on a grant youll never get.

Now, the good news is that most grants stick to demographic qualifications or industry qualificationsthings about you or the area you work in. They dont, however, usually care about things like your personal credit score. Likewise, you wont find too many grants that have strict revenue or time in business qualifications.

That means you can often qualify for grants even if you cant qualify for business loansmaking grants great for startup funding.

When youre sure you qualify for the grant you want, youre ready to begin your application. After all, grants dont get handed out willy-nilly to anyone who wants themyou have to win them.

Types Of Business Startup Loans In Canada

Unsecured business loans

An unsecured business loan is a business loan that doesnt require any collateral. Unsecured loans are issued based on how good your credit score is. Youll usually need a personal score of at least 650 to qualify for these types of startup business loans.

Secured business loans

A secured business loan is a loan backed by collateral, whether its a business or personal asset. These loans can be easier to come by as a startup than unsecured loans, since you lower the lenders risk by using an asset such as your home or equipment to secure your payments. The downside is that your lender can seize this asset to repay your loan if you run into financial trouble.

Merchant cash advances

A merchant cash advance is money you receive in advance from the lender in exchange for a percentage of your daily credit card and debit sales in the future. Merchant cash advance loans can be a suitable option for startups since they get repaid based on a percentage of your sales, which means that youll repay more in months where you net a higher revenue and less in months where your business is less busy.

Lines of credit

Revolving lines of credit give you more flexibility in terms of how you can access money. You can dip into these loans whenever you need cash and pay them back whenever you have a surplus of revenue. The best part is youll only pay interest on the amount you withdraw. Minimum time in business is around 6 to 12 months.

You May Like: What Is An Sba 504 Loan