Money You Will Spend Beyond The Mortgage

When figuring out how much of a payment one can afford, there are other expenses that must be considered aside from the mortgage. These addition financial obligations can be:

- Home Maintenance: There will be some maintenance during ownership of the home. Appliances break down, carpet needs replaced, and roofing goes bad. Being overextended due to the mortgage can make repairs more of a burden.

- Utilities: These expenses keep the home heated, lit up, water running, and other items such as sewer, phone, and cable T.V. going.

- HOA Fees: If the community in which the borrower moves in has amenities, there may be Homeowners Association Fees that must be paid. The fees can vary based on what amenities the community is offering. Sometimes the price can be $100 per month or $100 per year.

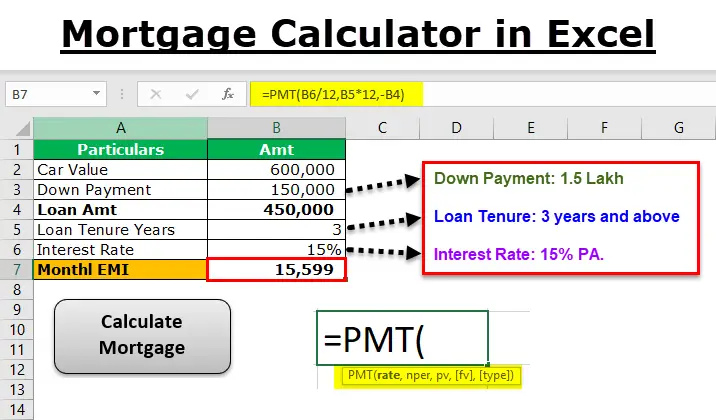

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, youll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Loan To Value And The Size Of Your Deposit

All mortgages require some form of deposit, but they are not directly linked to how much you could borrow. The loan to value or LTV of your mortgage, means how much the mortgage is in relation to the value of the property. So, if you have a £50,000 deposit for a £200,000 property, the mortgage you need would be £150,000 75% of the property’s worth, or 75% loan-to-value.

Also Check: Credit Score Needed For Usaa Auto Loan

Cherry Creek Mortgage Best For First

Cherry Creek Mortgage, which also does business as Blue Spot Home Loans and under a few other names, lends mortgages in 33 states.

Strengths: Cherry Creek Mortgage offers several low-down payment loan programs, including Conventional 97 and HomeReady loans and FHA, VA and USDA loans. The lenders website includes educational resources for first-time homebuyers, including a free downloadable guide to homeownership.

Weaknesses: Cherry Creek Mortgage isnt available in every state, and for FHA loans, it requires a minimum 620 credit score, which is higher than what some other lenders will accept.

Seven Factors That Determine Your Mortgage Interest Rate

Your lender knows how your interest rate getsdetermined, and we think you should, too. Learn more about the factors thataffect your interest rate.

If youre like most people, you want to get the lowest interest rate that you can find for your mortgage loan. But how is your interest rate determined? That can be difficult to figure out for even the savviest of mortgage shoppers. Knowing what factors determine your mortgage interest rate can help you better prepare for the homebuying process and for negotiating your mortgage loan.

How much will you pay in interest on your mortgage loan?

Your lender knows how your interest rate gets determined, and we think you should, too. Our Explore Interest Rates tool lets you plug in some of the factors that affect your interest rate. You can see what rates you might expectand how changes in these factors may affect interest rates for different types of loans in your area.

Even saving a fraction of a percent on your interest rate can save you thousands of dollars over the life of your mortgage loan, so it definitely pays to prepare, shop around, and compare offers.

You May Like: Usaa Car Calculator

The Mortgage Repayment Calculator Can Help You Find A Mortgage Product To Suit Your Requirements And Calculate What Your Monthly Repayments Could Be

When using the repayments calculator, bear in mind that the property price, minus the deposit amount, shouldnt be any more than the borrowing amount. And remember, when youre thinking about what youll have to pay back every month, take into consideration all your other monthly outgoings to make sure you have enough left over for the month.

Is There Anything Else That Lenders See As Risk

There is one more risk that the lenders end up facing. The risk of you prepaying the loan.

What? Why is that a risk? As a lender, wouldnt I be happy if the money is paid back in full and before time? In full, yes. All lenders love that. But before time, not really.

Banks and other lenders are in the business of making loans. The original principal is what they owe to depositors. Their revenue solely comes from the interest you pay them. If you pay back early, they will not be earning interest from you any more.

One would ask, well they can make a new loan and start earning interest again. A very fair point.

Unfortunately, people prepay and refinance their loan only when interest rates go down. For a bank to be paid the loan amount in full is bad because the new loan the bank will make will be at a lower rate than what you were paying him so far.

This type of risk is called reinvestment risk. Because most mortgages in the US dont have a prepayment penalty associated with them, people can refinance whenever rates fall. So lenders face that risk. Unfortunately, no one refinances when rates go up to make it even for the lenders.

That risk is not with specific borrowers only. Its a risk they face with all borrowers in general. If borrowers were prohibited from early payment, all of us would have had slightly lower mortgage rates. But most borrowers are fine to have the option to prepay for a small cost in the form of a slightly higher mortgage rate.

Don’t Miss: How Long Does An Sba Loan Take To Get Approved

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

How Lenders Assess Your Borrowing Capacity Differently

Most lenders will add an interest rate buffer to your estimated interest rate when calculating your borrowing power. This is to ensure you can still afford your repayments in times of financial hardship. Some lenders may calculate your borrowing power based on your credit limit instead of using the amount you owe. In addition, lenders may decrease your borrowing capacity depending on the location of your property and how risky they consider it to be.

At Mortgage House, we understand how complicated the home loan application process can be, which is why we work with you every step of the way. We can also help you improve your borrowing power, helping you get the most out of your income so you can purchase the home of your dreams.

Also Check: Usaa Car Loan Bad Credit

Income Is A Significant Part Of Deciding How Much You Could Borrow

Income is crucial for determining how big a mortgage you can have. Traditionally, mortgage lenders applied a multiple of your income to decide how much you could borrow. So, if you earn £30,000 per year and the lender will lend four times this, they may be willing to lend £120,000.

When it comes to households with two incomes, some lenders offer a choice:

The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second person’s income is £15,000 a lender might offer 4x the first income, plus the second income or

A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they are willing to lend. This is something that has become particularly strict following mortgage regulations introduced in 2014.

If part of your income is comprised of a bonus or overtime, you may not be able to use this, or if you can, you may only be able to use 50% of the money towards what the lender deems as your income. All income you declare in your mortgage application will need to be proven usually through you providing your latest pay slips, pensions and benefits statements.

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Also Check: Usaa Auto Loan Credit Score Requirements

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Don’t Miss: Transferring Auto Loan To Another Bank

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

You May Like: Usaa Pre Qualify Auto Loan

How Do Lenders Assess My Affordability

When deciding how much of a mortgage to offer, lenders will spend some time assessing your financial situation, looking at how long youve been in a job, lived at your current address and had a bank account.

Essentially, they want to be sure of your ability to make the monthly mortgage repayments and will therefore look at how reliably you have paid back any borrowings in the past which will involve reviewing your in depth.

Most Agreement in Principle only require a soft search on your credit file, which means other lenders will not see this search on your file.

A real mortgage application, however, will leave a mark on your credit file that all other lenders will be able to see.

Each lender has its own scoring system . In general, having more marks can count against you because it could suggest you are desperate for credit. Being turned down for a loan product will also have a negative impact on your credit file.

It is therefore important to apply to each of the 3 main credit agencies: Experian, Equifax and TransUnion for your credit file before submitting any mortgage applications. This will enable you to check the information held and correct any errors.

Try to avoid applying for anything that will require a credit search while applying for a mortgage, as it can make you look desperate for credit.

How Many Times My Salary Can I Borrow For A Mortgage

Lenders will typically use an income multiple of 4-4.5 times salary per person.

For example, if you earn £30,000 a year, you may be able to borrow anywhere between £120,000 and £135,000.

However, lenders will sometimes offer a mortgage that is 5 times your salary. So if you earn £40,000, you may be able to borrow up to £200,000.

Meanwhile Nationwide Building Society, the biggest mortgage lender in the UK, recently announced that it would lend up to 5.5 times income to first-time buyers with a 5% deposit.

Other lenders may also be willing to advance money at this salary multiple to higher earners. Barclays, for example, will lend up to 5.5 times income to applicants with a salary of at least £75,000 a year.

If part of your income is made up of bonuses, commission or overtime, this will make it more difficult to know exactly how much you can borrow. The decision on whether additional earnings on top of a basic salary will be counted depends on individual lenders.

NatWest, for example, will take the average of the past two years of a guaranteed bonus. If your bonus is discretionary , NatWest will calculate the average but only include 50% of that when adding it to your regular income.

Mortgage borrowing calculator

How much you can borrow will vary between different lenders, and it is not always clear why some are willing to lend more than others.

To search for the best mortgage deals, try our free mortgage comparison tool below.

You May Like: Drb Vs Sofi

How To Calculate Mortgage Payments

Zillows mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The principal is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowners insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowners association dues , these premiums may also be included in your total mortgage payment.

How Are All These Forms Of Additional Income Treated By Mortgage Lenders When Assessing Affordability

Most lenders will happily include all of these forms of income when assessing how much mortgage you can afford. However, unlike your basic salary not all lenders will necessarily accept the total amount. Some lenders will look at using all of the income, others might use a percentage of it.

How do I evidence my additional income?

For additional income sources such as regular bonuses, overtime and commission payments most lenders will accept 50%, some will accept 75% and a few will accept 100% upon receipt of documentary evidence or a letter from your employer.

Some lenders may also want to see evidence of a regular track record of payments before taking any additional income into account. This evidence can be provided through payslips, bank statements and employment contract, were often asked how many payslips you need for a mortgage and its usually the last 3 months but some lenders may ask for longer.

Most lenders will also accept allowances written into your employment contract and include 100% of the amount when conducting their affordability assessment.

A lender will likely want to see a copy of your contract in order to clarify the amounts which have been declared. In the case of a housing allowance, some lenders may want to see that the allowance is permanent rather than for a specific term.

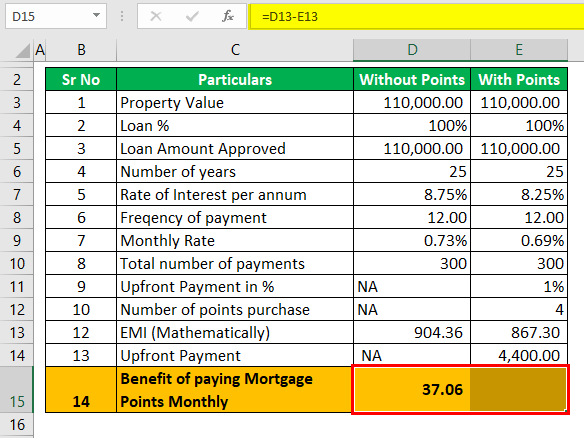

The table below illustrates the effect additional forms of income can have on the mortgage you receive.

| Basic Salary |

|---|

| £200,000 |

* = Bonus/Overtime/Commission capped at 50%

Read Also: Can You Use A Va Loan For Investment Property