What Is The Minimum Down Payment For Conventional Fha And Va Loans

Wells Fargo offers several low down payment options, including conventional loans .

- Conventional fixed-rate loans are available with a down payment as low as 3%.

- Keep in mind that with a low down payment mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment. We’ll explain the options available, so you can choose what works for you.

- Talk with a home mortgage consultant about loan amount, loan type, property type, income, first-time homebuyer, and homebuyer education requirements to ensure eligibility.

Close Your Dream Home With Personalized Lenders

Purchasing your first or second home doesnt have to be stressful: it can be an exciting adventure. Our experienced lending team is dedicated to helping you close on your dream home and walking you through the process every step of the way.

We help you get pre-qualified for the right type of loan that fits your budget and needs. Theres no need to fear taking the next step when our lending professionals are at your side.

Speak with Jimmy Vercellino and our Highly Motivated Vercellino team today by calling -800-8387.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Recommended Reading: Is Firstloan Com Legit

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Whats Included In My Mortgage Payment

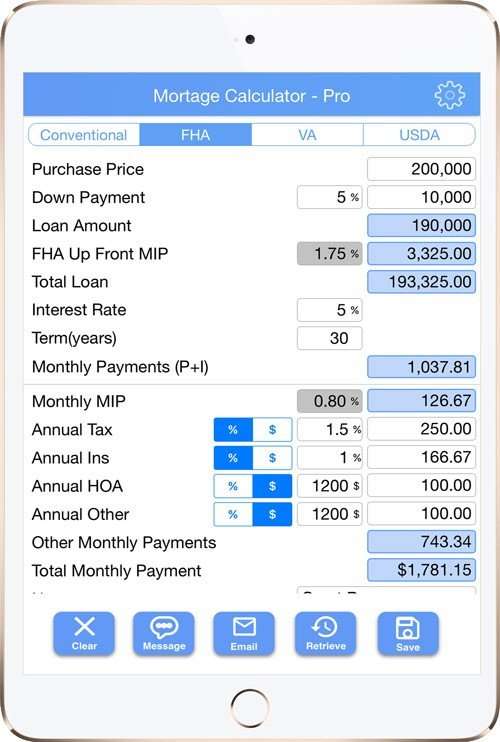

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Don’t Miss: Maximum Fha Loan Amount In Texas

How Much Mortgage Can I Get Approved For With A Poor Credit History +

Your credit score plays a crucial role in the type of mortgage that you will be eligible for. This is because that score is what is used to predict how likely you are to repay your new mortgage loan. Your chances of getting a good mortgage value hinges on how good a credit score you have, so it is important to request a copy of your credit report and credit score about a couple of months before you start making your maximum mortgage calculations.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Also Check: Penfed Credit Score Requirement Auto Loan

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

You May Like: How Long Until Sba Loan Approval Take

Mortgage Default Insurance 101

There are plenty of things in life that require insurance, and that includes mortgages in many cases. So, how do you know when and if you will need to contribute to a mortgage default insurance policy?

As mentioned earlier, borrowers who are unable to come up with a 20% down payment will be required to pay mortgage default insurance. Also referred to CMHC insurance, this type of policy is paid for by the borrower but is designed to protect the lender in case the borrower ever defaults.

With a smaller down payment comes a higher loan amount, or LTV. That means theres less equity in the home which also means that the borrower and the mortgage itself is riskier. To offset this risk, lenders charge mortgage default insurance premiums to cover them in the event of mortgage default.

In Canada, there are three major mortgage default insurers: CMHC (Canada Mortgage and Housing Corporation, Genworth Financial, and Canada Guaranty. The insurance provider involved will calculate the premium based as a percentage of the loan amount. This percentage is based on the LTV ratio of the mortgage and the premium is either paid upfront in one lump sum or rolled into the mortgage.

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

You May Like: How Much Car Can I Afford Based On Income Calculator

How Much House Can I Afford With An Fha Loan

With a FHA loan, yourdebt-to-income limitsare typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirementsare met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

You May Like: Texas Fha Loan Limits 2020

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

How Do Mortgage Lenders Determine Their Interest Rates

Mortgage lenders obviously are out to make money on mortgages. Its why theyre in the business and its how they make their money. In order to make a profit, they charge interest on the loan amount. But how exactly do they come up with the rates they charge?

It usually comes down to two things: the prime rate/bond market, and your level of risk as perceived by the lender.

Bond market Chartered banks use the bond market to determine their mortgage rates. Government of Canada bonds and mortgages are two investments that lenders use to make a profit. Essentially, lenders calculate the interest rates on the money they loan out through mortgages based on the interest rates that they are getting on the capital they have invested.

They then use any anticipated profits from bond investments in order to make sure theyre able to cover the costs or any losses they experience through loaning money through mortgages. If the bond market is more profitable, the mortgage interest rates will be lower, and vice versa.

Your risk level Your lender will assess your risk level before they even agree to loan you funds to buy a home. If you are approved, your risk level will play a key role in the interest rate youre offered. If youre low-risk, your rate will likely be lower. But your rate will be higher if youre considered higher risk.

So, how does your lender determine what risk level youre at? There are a couple of things:

Read Also: How Much Of A Loan Can I Get For A Car

Calculate The Number Of Payments

The most common terms for a fixed-rate mortgage are 30 years and 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

Also Check: Usaa Auto Lease Calculator

Life Insurance For Mortgage Holders

You could consider taking out life, or life and critical illness insurance alongside your mortgage. These covers are designed to offer some financial protection against the unexpected. Your loved ones would receive a lump-sum payment if you died and, depending on your cover, could receive a lump sum if you were diagnosed with a critical illness, which could help repay your mortgage.

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

You May Like: What Does Carmax Pre Approval Mean

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

Also Check: Usaa Vehicle Loan Calculator

Mortgage Term Vs Amortization Period

Its common for homebuyers to confuse the mortgage term and amortization. But in fact, theyre completely different.

Term The mortgage term is the amount of time that you are committed to your current mortgage contract with your lender. Youre also committed to the current interest rate and terms of the mortgage during that time period until the term ends. Typical mortgage term lengths are usually five years, though they can be shorter or longer depending on the deal you strike with your lender when you first take out your mortgage.

Once the mortgage term expires, you will either need to have paid off your entire loan amount in full, refinance your mortgage, or renew your mortgage, either with your current lender or a new one. Usually, your new term will have a different interest rate and conditions.

Amortization The mortgage amortization period is the entire length of time that you have to pay off your mortgage amount in full. In Canada, the maximum amortization period allowed is 25 years, though uninsured mortgages may go as long as 30 years. An uninsured mortgage simply means that at least a 20% down payment was put forth, allowing the borrower to avoid having to pay mortgage default insurance, which well discuss later.

It also means the total amount paid for the loan will be much less because less interest will have to be paid over the life of the loan. However, the monthly mortgage payments will be higher in order to pay off the loan faster.