Which Is Cheaper: Home Equity Or Refinance

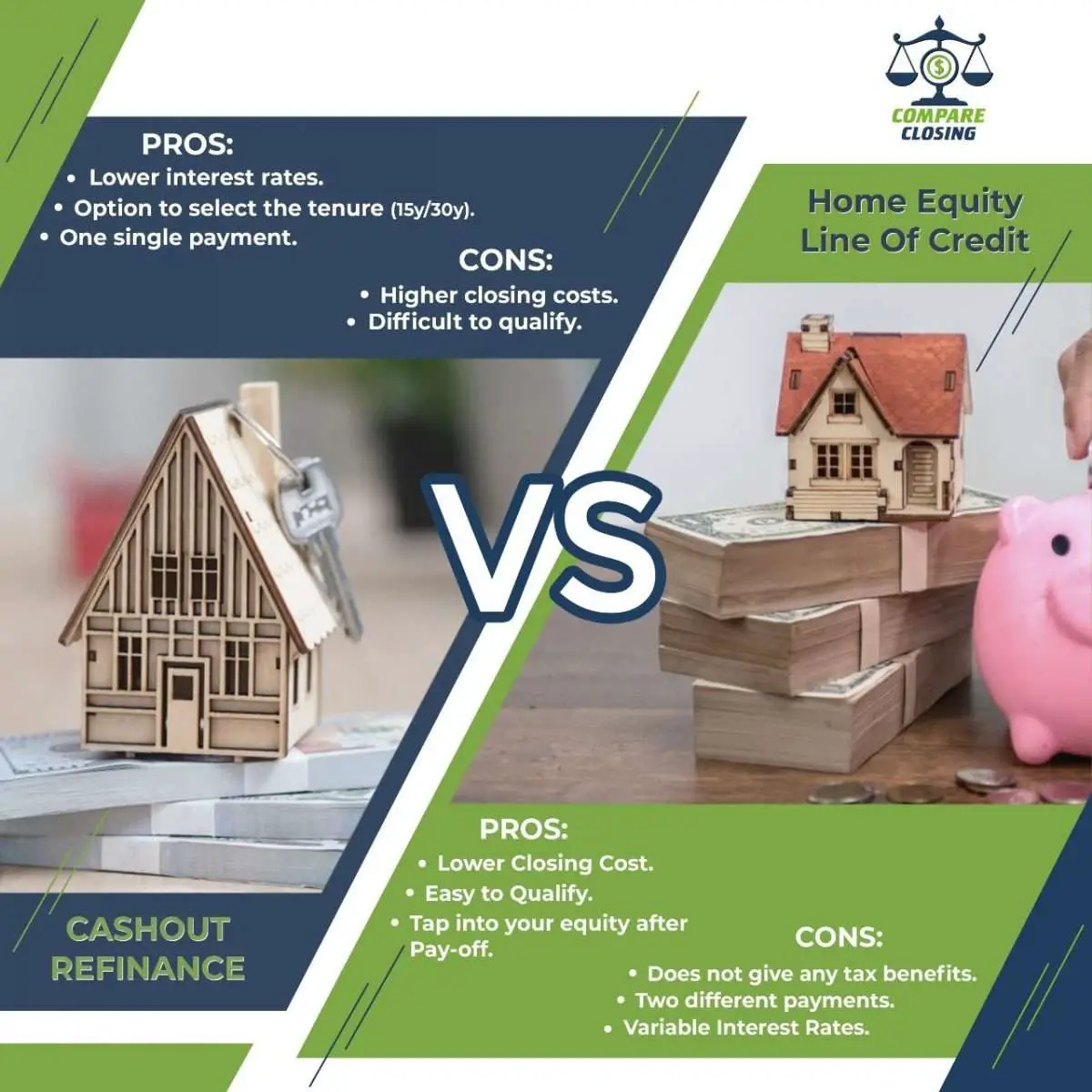

Home equity lines of credit and loans typically come with significantly lower closing costs than cash-out refinances. Sometimes the lender will even absorb these costs, too.

So while a HELOC or home equity loan carries higher interest rates, if those rates are comparable to your current mortgage rate, your best choice may be a home equity loan, especially if youre only borrowing a small amount of money.

What Is A Cash

A cash-out refinance is a mortgage refinancing option in which an old mortgage is replaced with a new one with a larger amount than was owed on the previously existing loan, helping borrowers use their home mortgage to get some cash. You usually pay a higher interest rate or more points on a cash-out refinance mortgage, compared to a rate-and-term refinance, in which a mortgage amount stays the same.

A lender will determine how much cash you can receive with a cash-out refinance, based on bank standards, your propertys loan-to-value ratio, and your credit profile. A lender will also assess the previous loan terms, the balance needed to pay off the previous loan, and your credit profile. The lender will then make an offer based on an underwriting analysis. The borrower gets a new loan that pays off their previous one and locks them into a new monthly installment plan for the future.

When You May Not Qualify For A Cash

Generally, home equity loans are easier to qualify for than refinances or HELOCs. However, its important to make sure you can cover both your monthly mortgage payment and the monthly loan payment. If youre facing financial trouble, the practice of moving debt from one place to another can be risky, especially since your home is collateral.

Recommended Reading: How To Get Teacher Loan Forgiveness

Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

- appraisal fees

Your lender may have to change the terms of your original mortgage agreement.

Start By Checking Your Home Equity

Your home equity comes from paying down your home loan and can also increase from property appreciation. Selling your house is, of course, one way to convert that equity into cash. But if you’re looking to tap into those funds without selling, you have to borrow against the equity with a home equity loan, line of credit or cash-out refinance.

Of course, you need to have an ample amount of home equity first.

To figure out how much home equity you have, estimate your home’s value and find out how much you still owe on the mortgage. If the difference between the two is a positive number, thats the equity you have in the home. But if you owe more than your home is worth, you’re not a candidate for a cash-out refinance, home equity loan or HELOC.

Also Check: What Is The Best Debt Consolidation Loan Company

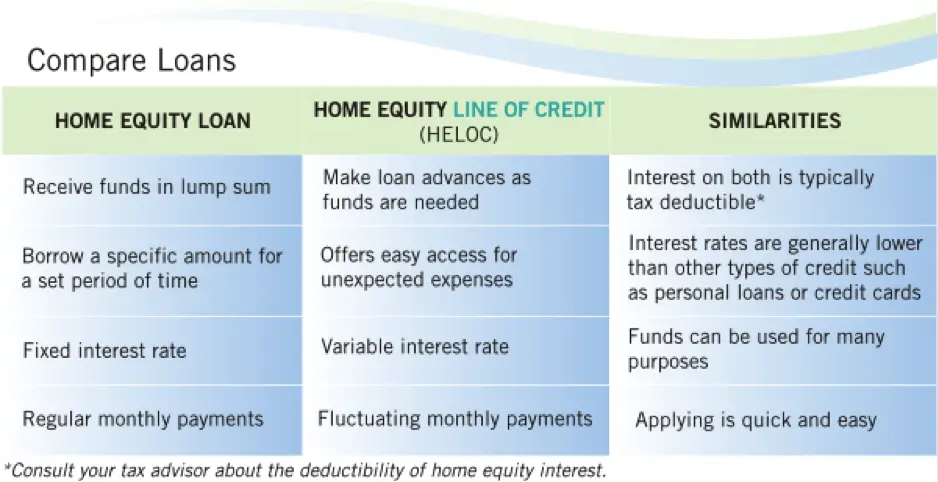

Helocs Vs Home Equity Loans

HELOCs are known as revolving credit. You can draw what you need against the line of credit, pay interest only on what youve used and then pay it back. HELOCs typically have terms that allow you to repeat that process over a 10-year period.

In contrast, a home equity loan is a lump-sum fixed amount that you borrow and pay it back in set installments.

The other major difference between HELOCs and home equity loans is that HELOCs have variable interest rates while home equity loans have fixed rates. That may make a home equity loan a better option for someone who has a particularly large project where they need one-time funding. A line of credit, however, may offer more flexibility because you can draw funds as needed however, it could come at a higher interest cost down the road due to its variable interest rates.

Keep in mind that while HELOC rates may be lower than those on home equity loans now, the Fed is likely to raise interest rates several times over the next year or two, meaning repaying a HELOC will likely be more expensive in the future.

What Can I Use A Heloc For

Money you borrow with a HELOC can be used for all kinds of things, not just home improvements. Many homeowners use the proceeds for other big purchases, education costs and more. Its important to remember that the funds borrowed with a HELOC are subject to variable interest rates, which could rise over time. That may mean other, more fixed-rate forms of financing for things like education are a better bet.

Don’t Miss: Can I Refinance Sallie Mae Student Loan

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

What Are Alternatives To A Heloc Or Cash

If youre considering refinancing but you only need a little liquidity for a small project or to pay off a little debt, you may instead consider either a small personal loan or a credit card with low interest rates. Either option would allow you to avoid the closing costs associated with refinances, home equity loans and HELOCs.

Recommended Reading: How Much Student Loan Should I Borrow

Determining Which One Is The Right Choice

If youâre choosing between a HELOC and a cash-out refinance, the right choice depends on your particular needs and your timeline. Generally, itâs important to consider when you plan to use the cashânow, later or in incrementsâand how long you plan to stay in your home.

For instance, if you donât need all the money at once, but just want to have it available on demand, a HELOC is probably your best option. With a HELOC, you are granted access to the agreed-upon amount of cash, but you withdraw only what you need when you need it. So you might withdraw $10,000 now to remodel your kitchen and another $10,000 next year to remodel your bathrooms. Or you may not withdraw any cash at all, simply keeping the account open in case of a layoff or furlough. Each month, you pay interest only on the amount youâve withdrawnâor pay nothing if you havenât withdrawn any money.

On the other hand, if you need the full amount youâre borrowing right now, a cash-out refinance may be ideal. You can access the cash you need and take advantage of historically low interest rates on your mortgage. By accessing cash through a mortgage refinance, you lock in a low interest rate over the life of your loan.

However, when mortgage rates start rising, âpeople will want to access capital with a HELOC rather than a refinance, because they wonât want to lose their low mortgage rate,â predicts Frank DiMaio, senior vice president and director of sales at Univest Bank and Trust Co.

Home Equity Loans Vs Helocs

A home equity loan and a HELOC are alike in that they are secured by your home, the money can be used however you want and the amount you can borrow may be limited to 80% to 85% of your home equity. But there are also distinct differences.

- Have a fixed interest rate and monthly payment, with a repayment schedule of five to 30 years.

- Provide the borrower a lump sum amount.

- Allow you to withdraw money as needed up to your credit limit, similar to a credit card.

- Charge a variable interest rate, meaning your monthly loan payments can fluctuate.

- Provide a borrowing period, or draw period, for you to reuse and repay the credit line. The draw period can last 10 years, though it depends on your loan.

- Require at least interest payments during the draw period.

- Can offer repayment plans after the draw period, or you may be able to renew or refinance the HELOC. Repayment plans typically let you repay the loan balance over 20 years, according to Experian.

Depending on your loan, you may owe a balloon payment at the end of the repayment period on a HELOC, or you may have to pay your entire balance at the end of the draw period, according to the Consumer Financial Protection Bureau. Make sure you ask about conditions for renewing or refinancing if necessary.

You will want to look at HELOCs and home equity loans and work with your lender to make the right choice. Both have pros and cons, including the risk of foreclosure if you fail to pay.

Also Check: Can I Rent Out My Va Loan House

How Does A Heloc Work

A HELOC is a line of credit guaranteed by the equity you have in your home. Most lenders allow qualifying homeowners to borrow up to 80% or 90% of the equity in their homes.

HELOCs are interest-only loans for a specific term, such as 10 years. Because the payments during that term are strictly interestâno principalâthey will likely be lower than regular mortgage payments, which include principal and interest.

The first part of a HELOC term is the draw period. This means youâre able to withdraw whatever you need from the loan, when you need it, up to the total approved limit. Each month, you only pay interest on the amount of the loan youâve used, so you may not be paying interest on the full amount for which you qualify. However, HELOCs typically are adjustable-rate loans based on the prime rate, which means your interest rate could potentially rise over time.

After the draw-down term ends, the repayment period begins, in which youâll pay a combined interest-and-principal payment every month until the loan is paid off.

One other thing to consider: Because mortgage interest rates are historically low, HELOCs may be difficult to come by. âSome banks are not even taking applications for HELOCs because they have so much demand for purchasing and refinancing mortgages,â says Brian Jass, CRPC and advisor with Great Waters Financial in Minneapolis.

How A Home Equity Loan Works

Home equity loans can be an excellent option when you want to access your equity but dont want to refinance your mortgage. You can use the funds from a home equity loan to make home improvements or put them toward non-home expenses, like debt consolidation or college tuition.

Since home equity loans are a type of second mortgage, you wont refinance your existing mortgage. Instead, repayment works much like your original mortgage. Youll make monthly payments toward your home equity loan over a fixed term until the loan is paid off. If you fall behind on your payments, your lender can foreclose on the home.

Here are some of the main benefits of a home equity loan:

- Fixed monthly payments and interest rate

- No need to refinance your first mortgage

- Lenders may waive or reduce closing costs

In addition, your interest payments might be tax-deductible. Youll just need to make sure youre using the funds for qualifying repairs and capital improvements on the home securing the loan.

You May Like: How Much Is My Student Loan Payment Going To Be

Tax Deductibility Of Mortgages And Home Equity Loans

Ironically, home equity loans and mortgages have become more similar in one respect: their tax deductibility. The reason is the Tax Cuts and Jobs Act of 2017.

Before the Tax Cuts and Jobs Act, you could deduct only up to $100,000 of the debt on a home equity loan.

Under the act, interest on a mortgage is tax deductible for mortgages of up to either $1 million or $750,000 . This new limit applies to home equity loans as well: $750,000 is now the total threshold for deductions on all residential debt.

However, theres a catch. Homeowners used to be able to deduct the interest on a home equity loan or a HELOC no matter how they used the moneybe it on home improvements or to pay off high-interest debt, such as credit card balances or student loans. The act suspended the deduction for interest paid on home equity loans from 2018 through 2025 unless they are used to buy, build, or substantially improve the taxpayers home that secures the loan.

The IRS states:

Under the new law…interest on a home equity loan used to build an addition to an existing home is typically deductible, while interest on the same loan used to pay personal living expenses, such as credit card debts, is not. As under prior law, the loan must be secured by the taxpayers main home or second home , not exceed the cost of the home, and meet other requirements.

Apply For Your Mortgage Refinance With Confidence

Taking out any of these loans will affect the way you handle paying your mortgage going forward. Depending on which choice you make, your monthly payment can go up or down, or the length of your loan could change.

Be sure to reach out to a financial professional you trust if you need help choosing between using your homeâs equity or refinancing your loan to better terms.

Still looking for the right rate? We’re here to help.

Don’t Miss: What Credit Score For Home Loan

Home Equity Line Of Credit Vs Cash

HELOCs and cash-out refi loans differ in two ways: how they affect your primary mortgage, and how their interest rates and payments are structured.

Just like a rate and term refinance, a cash-out refinance replaces your primary mortgage with a new one that has new rates and terms. This can be detrimental if current refinance rates are higher than mortgage rates were when you first took out your mortgage, as it means your entire home loan not just the extra cash youre taking out will have a higher interest rate. By contrast, a HELOC is a type of second mortgage, meaning it acts as a separate loan on top of your primary mortgage. This makes it a good way to tap into your home equity without altering your primary mortgage.

A cash-out refi is typically a fixed-rate mortgage that requires equal monthly payments over a repayment term that often lasts 15 to 30 years.

HELOCs variable interest rates fluctuate with the prime rate something to bear in mind in todays rising rate environment. HELOC rates will almost always remain lower than , but they can be expected to keep rising along with market rates.

You must make HELOC payments each month, but during the draw period, the minimum payment required is often a relatively-low interest-only payment. You always have the option to pay more than the minimum, however, and its wise to do so if possible. Paying more can lower the amount of the principal-plus-interest payments you must make during the repayment period.

What Is A Debt

Your debt-to-income ratio indicates the percentage of your monthly income that is committed to paying off debt. That includes debts such as credit cards, auto loans, mortgages, home equity loans, and home equity lines of credit. If you make child support payments or pay alimony, those can also count toward your DTI.

To calculate your DTI, divide your total monthly debt payments by your total gross income. For example, if your monthly debt payments total $3,000 and your gross monthly income is $6,000, your DTI is 50%

Also Check: Why Did My Student Loan Interest Rate Go Up

Home Equity Loan Vs Refinance: Whats Right For Me

So, home equity loan vs. refinance, which is right for you? At the end of the day, youll have cash in your pocket, but with two different means of obtaining it. Are you comfortable with a second mortgage at higher interest rates and your home being held as collateral or a new low-interest rate on a more efficient first mortgage?

Whichever way you choose to cash out your homes equity, be sure to compare your current or prospective mortgage company with other lenders to ensure youre getting competitive rates on the market. For instance, you may want to compare mortgage rates of traditional lenders to those of online mortgage lenders. To get an estimate of exactly how much influence the interest rate has on your mortgage, we recommend inputting your figures into a mortgage calculator with taxes and comparing them to current refinance rates.

For questions about equity, refinancing and any other mortgage questions you might have, contact a Wyndham Capital mortgage loan officer.

Refinancing Involves Replacing Your Current Loan But A Home Equity Loan Doesnt

When you refinance your existing home loan, youâre ending your current mortgage and taking out a new one in its place. So, if you switch lenders at the same time you refinance that means the new lender will pay out your old loan to discharge your mortgage and place a mortgage of their own over your property. By contrast, a home equity loan is usually a separate loan you can take out in addition to your mortgage after you have enough equity.

Usually, you must leave at least 20 per cent of equity in the property, i.e. you can only borrow up to a total of 80 per cent of its value across all loans although some lenders may let you borrow more with Lenders Mortgage Insurance .

Recommended Reading: How Can I Repay My Student Loan