How To Find Your Student Loan Account Number: 2 Simple Steps

If youre looking for your student loan account number, this article is going to show you how.

According to the National Center for Education Statistics, as of the 2016-2017 school year, there were 44.2 million students enrolled in higher education institutions in the United States. Of those students, 71 percent had taken out student loans to finance their education. The average amount of debt per borrower was $28,650.

The total amount of outstanding student loan debt in the United States is $1.48 trillion.

If youre one of the millions of Americans with student loan debt, knowing your account number is important. Your account number is how your loan servicer identifies your loan and keeps track of your monthly payments.

Its not as hard as it seems, and with a little patience and dedication, it should be easy enough for anyone to find their student loan account number in two simple steps. In this blog post, well show you how to find your student loan account number using the National Student Loan Data System .

Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

Figure Out Your Own Student Loan Needs And Goals

Ultimately, finding a repayment plan that works for you depends on your financial situation and your repayment personality.

Thats why its important to figure out your student loan goals. Ask yourself:

- Do I want to pay off my debt as quickly as possible?

- Are there other financial goals I should put before student loan repayment?

- Are my student loan payments affordable right now?

- Can I refinance my student loans to lower my interest rate?

For example, if you work in public service and dont make much money, you might want to pursue the Public Service Loan Forgiveness Program. Or if you make a decent income and can afford to pay extra on student loans, you might be more focused on paying them off.

Also Check: Usaa Prequalify Auto Loan

Repayment Is Currently Scheduled For September 2022

Federal student loan payments remain on pause through Aug. 31. If you haven’t already been paying your loans during the forbearance period, be sure you know how what your monthly payment will be now, so you can factor this into your budget. You can also explore the repayment options if you need additional assistance.

If you want to explore further deferment or forbearance options, you can do this through your account online under “Repayment options.” You can also speak to Aidvantage directly at 800-722-1300.

Find Out Where To Mail Your Payment

Don’t Miss: How Many Aer Loans Can I Have

More About The Fsa Id

The FSA ID replaced the Federal Student PIN in 2015, so students who havent taken out new student loans or havent logged into the Federal Student Aid website since 2015 might not have an FSA ID yet.

Students who dont have an FSA ID can create one on studentaid.ed.gov.. Once you sign up for an FSA ID, the federal government will verify your information with the Social Security Administration. Once your information is verified, you will be able to use your FSA ID to obtain information about your federal student loans.

The site, managed by the U.S. Department of Education, can provide a convenient way to get a full picture of all your federal loans, including:

How many federal student loans you have Their loan types The original balance on each loan Current loan balances Whether any loans are in default Loan service providers names Contact information of the loan service providers

Getting Your Loan Out Of Collection

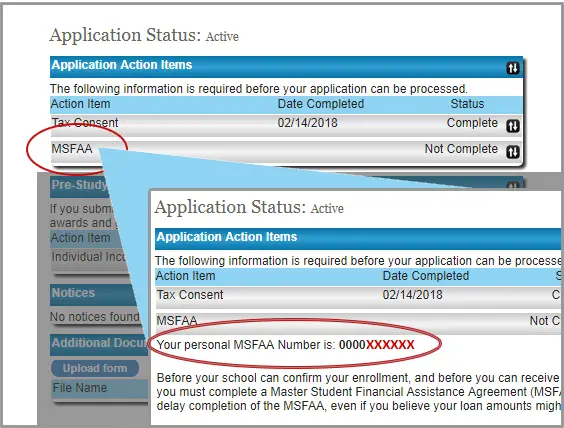

When you miss 9 months of payments, your federal student loan is sent to the Canada Revenue Agency for collection. Once in collection, you are no longer able to get student aid. To be able to get student aid again, you must bring your loan up to date.

- Contact the CRA to make a payment arrangement and bring your loan up to date

For the provincial or territorial part of your student loan, you need to contact your province or territory. For borrowers from Saskatchewan you may contact the CRA for both federal and provincial parts of your student loan.

Read Also: Mlo Average Salary

Thats A Lot To Consider How Do I Choose The Best Plan

Analyzing the plans is an agonizing exercise, which is why you should visit the loan simulator tool at StudentAid.gov. It will guide you through the options and help you decide which plan best fits your goals finding the lowest-payment plan, for example, versus paying loans off as soon as possible.

It is, fortunately, easy to use: When you sign in, it should automatically use your loans in its calculations. You can also compare plans side by side how much theyll cost over time, both monthly and in total, and if any debt would be forgiven.

For most borrowers, income-driven or extended plans will yield the lowest monthly payment, experts said.

How To Identify Lenders

If youre not sure who your student loan servicer is, there are a few ways to find out:

- Check your credit report. You can get a free copy of your credit report from each of the three major credit bureaus every 12 months at AnnualCreditReport.com.

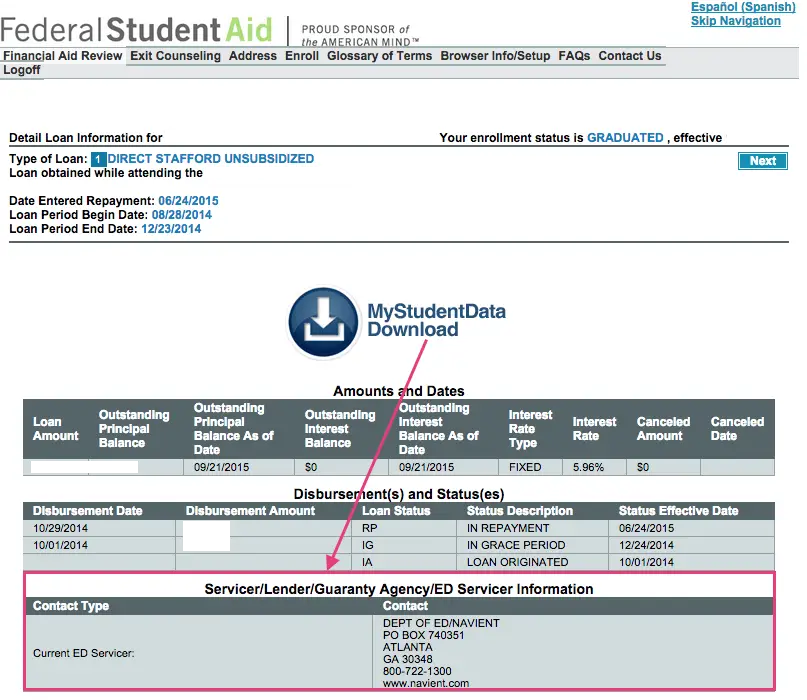

- Use the National Student Loan Data System . This is the U.S. Department of Educations central database for student aid. Youll need to log in with your FSA ID to access your information. Once youre logged in, click on Financial Aid Review to see all of your federal student loans and loan servicers.

- Contact your schools financial aid office. Your school may have your loan information on file.

Once youve determined who your loan servicer is, you can contact them to get your account number.

Also Check: Usaa Car Loan Calculator

What Is An Fsa Id

An FSA ID is a username and password that you can use to log in to federal student aid websites. Your FSA ID proves your identity when you access your financial aid information and electronically sign Federal Student Aid documents. If you dont already have an FSA ID, you can create one on the FSA ID website.

The FSA ID replaced the Federal Student Pin in May 2015. Students who already had a Federal Student Pin will still be able to use it to log in to federal student aid websites.

Youll need your FSA ID to:

- Complete the FAFSA form

- Sign your Master Promissory Note

- Access your financial aid information on StudentLoans.gov

Why Did Navient Exit The Student Loan Industry

Navient was long under fire from the Consumer Financial Protection Bureau, which sued the loan servicer in 2017: It claimed that the company had pushed borrowers into costly, subprime private loans they would be unable to repay. In January, Navient canceled $1.7 billion in private student loans for nearly 66,000 borrowers after coming under scrutiny for engaging in abusive and deceptive practices, including targeting students the company allegedly knew couldn’t pay back loans.

In 2020, the US Department of Education announced changes to loan servicing in an effort to modernize the federal student loan system. As part of the Next Gen Initiative, the Department of Education extended its partnership with five of the 10 current loan servicers, which would continue servicing federal student loans, but under stricter government regulations. Navient, along with FedLoan and Granite State, opted to end their participation in federal student loan servicing at the end of 2021.

Michael Lux, a student loan expert, attorney and founder of the Student Loan Sherpa, said that the “increase in federal regulation and government scrutiny over federal loan servicing is almost certainly to blame for Navient’s departure.”

Also Check: Usaa Auto Refinance Rate

Review Free Annual Credit Reports

The FSA website is the best way to see all your federal student loans, but it wont list any private student debt you might have. To see these student loans, you can request your free annual credit report.

Your credit report will include the following information:

- All the student loans you have, including both private and federal student loans.

- The lender or student loan servicer that holds each loan. You should also be able to see if a student loan was transferred or sold to a new servicer.

- The student loans initial balance and most recent balance.

- Payment history, including any missed payments and the date of the most recent payment on the loan.

While a credit report will likely list all your student loans, there are no guarantees. You might want to pull reports from all three major credit bureaus to be sure no loans are missed.

How Do I Find My Student Loan Account Number If Its In Default

To find the student loan account number for a defaulted federal loan, call the Department of Educationâs Default Resolution Group, 800-621-3115. The representative can provide you with your ED ID, which is the account number for loans in default.

If the Default Resolution Group doesnât have your loans, ask the representative to check the National Student Loan Data System to check for FFEL or Perkins Loans in default. If you do, contact the collection agency that has your loans and ask for your account number.

Don’t Miss: Usaa Refinance Car

For School Aid Offices

Navient School Support

Providing support for schools to assist with borrower related issues/repayment counseling, enrollment updates, or guidance with our online reports.

Employment Verification Visit The Work Number or call 1-800-367-2884.Resources are available to assist borrowers who have tried unsuccessfully to resolve a problem through their servicer. Please refer to your state’s relevant authority.For federal loans, you can also write to the U.S. Department of Education, FSA Ombudsman, 830 First Street, Fourth Floor, NE, Washington, DC 20202-5144.

Tips For Staying Organized And Keeping Track Of Your Student Loans

As youre repaying your student loans, its important to stay organized and keep track of your progress. Here are a few tips to help you stay on top of your loans:

- Keep all of your loan documents in one place. This can help you keep track of your loan balance, payment history, and any correspondence from your lender.

- Set up a budget and make sure youre making your loan payments on time. This can help you avoid late fees and stay on track with your repayment plan schedule.

- Stay in communication with your lenders. If you have any questions about your loans, be sure to contact your lender directly.

Making your student loan payments on time is one of the most important things you can do to stay on top of your loans. By staying organized and keeping track of your progress, you can make sure youre making the most of your repayment schedule.

You May Like: Does Usaa Do Car Loans

How To Find Student Loan Account Number

The only surefire way to stay current with your student loan information is to know your student loan account number.

When you apply for a student loan, your account number will be issued to you. Finding it out wont be a difficult process.

After you apply for student aid via the federal website Studentaid.gov, youll go through an application process to find qualifying loans.

Youll receive an official letter detailing your imminent student loan and future repayment processes after approval.

Your student account number should be highlighted, boldfaced, or plainly identifiable in such a letter.

There are several ways for you to find your 10-digit student loan account number.

Finding Your Federal Student Loan Balances

You can always access student loan information through your My Federal Student Aid account, where you can find your federal student loan balances under the National Student Loan Data System . This is the U.S. Department of Education’s central database for student aid, and it keeps track of all your federal student loans.

You’ll need a Federal Student Aid ID username and password to log in to the site. The ID serves as your legal signature, and you can’t have someonewhether an employer, family member, or third partycreate an account for you, nor can you create an account for someone else. The NSLDS stores information so you can quickly check it whenever you need to, and it will tell you which loans are subsidized or unsubsidized, which is important because it can determine how much you end up paying after graduation.

If your loans are subsidized, the U.S. Department of Education pays the interest while you’re enrolled in school interest accrues during that time with unsubsidized loans. To qualify for a subsidized loan, you must be an undergraduate student who has demonstrated financial need. Unsubsidized loans are available to undergraduate, graduate, and professional degree students, and there are no financial qualifications in place.

You May Like: Mountain America Mortgage Rates

Where Else Can I Get Help

Besides your servicer, groups like The Institute of Student Loan Advisors, known as TISLA, can provide free guidance on what options may best work for you. For New York state residents, EDCAP, a nonprofit focused on student loans, also offers help.And some employers and other organizations have hired companies like Summer, which helps borrowers sort through the options.

Borrowers need to be on high alert because scam artists offering debt relief and other services for a fee are already on the prowl. If youre unsure whether the help youre being offered is legitimate, hang up, dont respond to the email and reach out to your servicer using the number printed on your bill or the government website. You can file complaints through the Federal Trade Commission and your states attorney general.

Consumers need to be very careful, said Mr. Pierce of the Student Borrower Protection Center. These people are very predatory and this is the kind of moment they leverage.

How Many Student Loan Account Numbers Do I Have

The number of student loan account numbers you have depends on your situation.

- If you have all student loans with the same servicer, you will have one account number.

- If you have student loans with different servicers, you will have one account number per servicer.

- If you have federal loans and private loans with the same servicer, you may have more than one account number for each type of loan group.

You May Like: Drb Refinance Reviews

Checking Your Private Student Loan Balances

Each private student lender handles loans differently theres no national database for private loans. If youre unsure where to start, use these tips: