How Long Does It Take To Close A Va Loan

Most VA loans close in 40 to 50 days, which is standard for the mortgage industry regardless of the type of financing.

In fact, dig into the numbers a bit and you don’t find much difference between VA and conventional loans.

For the first three months of 2019, the average conventional purchase loan closed in 47 days, compared to 49 days for VA loans, according to Ellie Mae

Lets review five key factors that could affect the timeline of a VA loan purchase. Knowing the details of the VA loan process is important for you and your customers.

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

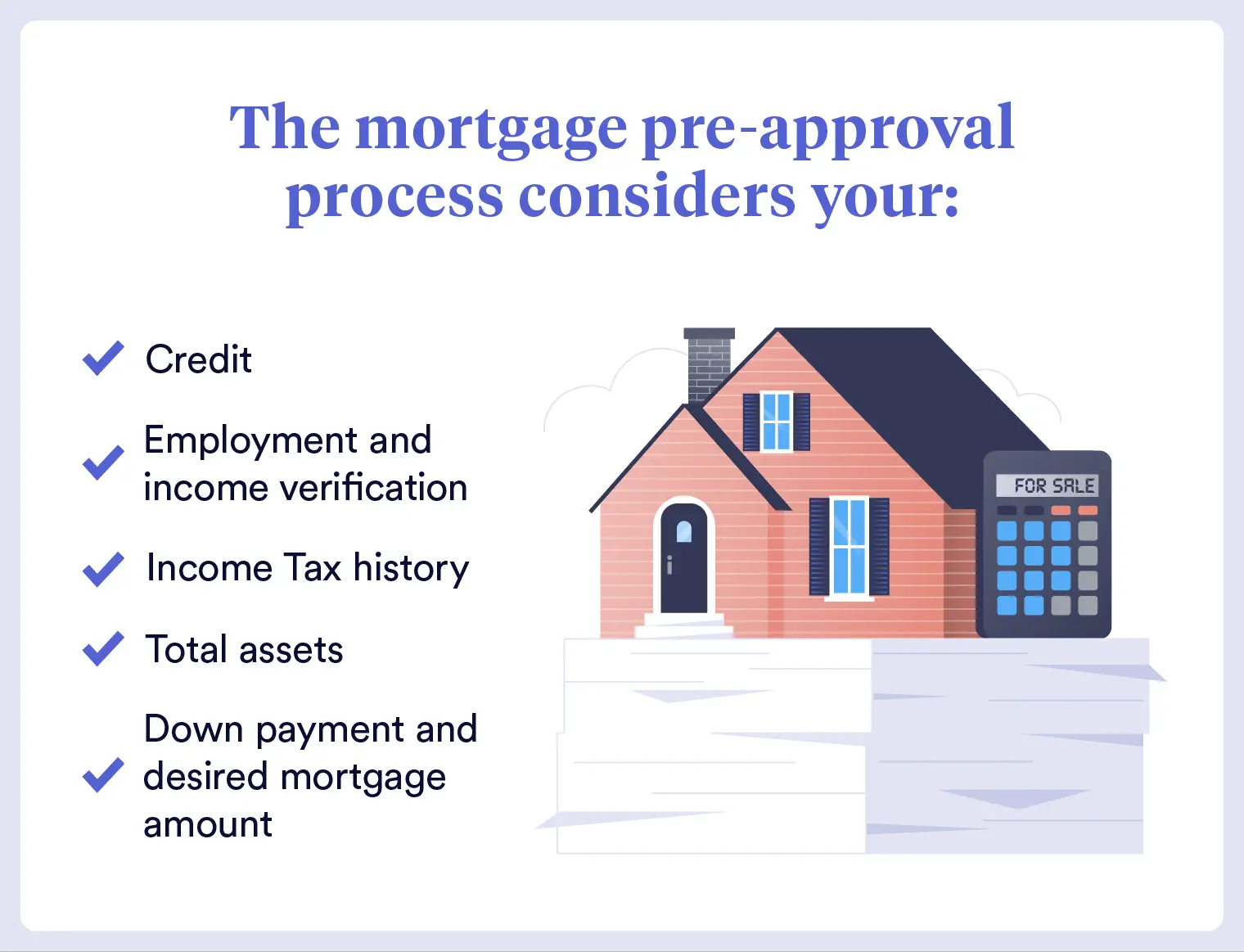

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

How Long Does It Take To Get Approved For A Va Home Loan

October 5, 2018 By JMcHood

The VA loan carries an unfortunate myth that it takes too long to process. Normally, this isnt the case. It takes just about as long as many other loan programs. What it really depends on is the lenders workload and how well you respond to the lenders needs.

On average, you can get approved and close on a VA loan in 30 to 45 days. Again, this will vary by lender and even by borrower, though. Below are the factors that affect your approval time.

Recommended Reading: Is First Loan Com Legit

Factor #: How Long Will The Va Appraisal Take

A home purchased with a VA home loan is subject to a VA appraisal. And only a VA-approved appraiser can perform a VA appraisal.

VA lenders are responsible for ordering VA appraisals, which are completed in 10 days on average. But as VA appraisers are in short supply in rural areas, buyers should expect the VA appraisal to take longer in sparsely-populated locales.

Is It Hard To Get A Va Loan

We mentioned documentation theres quite a bit of it for a VA loan, but most of this documentation is actually handled by the lender. The servicemember provides most of the same types of documentation they normally would for any loan, such as:

- Social security number you provide this and your current residence on an application.

- Proof of employment and proof of income this is usually your most recent pay stubs.

- Tax Information Usually, the last two years. Proves ongoing income and stable employment.

- Bank Accounts and Balances Lenders want to know what assets you already have and whether you have cash to close.

In addition, theres some specific documentation you need to provide to determine your eligibility with the VA. Theres also a unique process to determine if the home you want to buy meets the VA guidelines . Because of some of these unique processes VA loans can take a bit longer than conventional loans.

Recommended Reading: Usaa Refinance Car

How Long Does Va Loan Pre Approval Take

loantakeapprovedVA loanwouldloanApproval

. Thereof, how long does it take for a VA loan to be approved?

Most VA loans close in 40 to 50 days, which is standard for the mortgage industry regardless of the type of financing. In fact, dig into the numbers a bit and you don’t find much difference between VA and conventional loans. Let’s review five key factors that could affect the timeline of a VA loan purchase.

Similarly, how do you get pre approved for a VA loan? The Goals of Prequalification

Hereof, what does VA loan pre approval mean?

Preapproval on a VA home loan sends a message to real estate agents and sellers that you’re ready to become a military homeowner. The preapproval process gives lendersand borrowers alikea more accurate financial picture than the prequalification process.

How long does pre approval take?

The pre–approval process may take one to three days, and after you are pre–approved, you will receive a pre–approval letter as evidence that you have a lender that has already verified your assets. The letter is typically valid for sixty to ninety days however, it can be updated with reverification of the information.

Who Qualifies For A Va Loan

For those who are eligible, VA loans are attractive because they dont require a down payment. They also have lower interest rates than many other types of mortgage loans you can get for similar terms. They dont have monthly mortgage insurance.

Although lenders set their own requirements for certain aspects of qualification, VA loans have more lenient credit requirements than many other mortgage programs.

Not all who have served in the Armed Forces qualify for a VA loan. You must meet at least one of the following criteria to qualify:

- Served 181 days of active service during peacetime.

- Served 90 consecutive days of active service during wartime.

- Served more than 6 years of service with the National Guard or Reserves or 90 days under Title 32 with at least 30 of those days being consecutive.

- Are the spouse of a service member who lost their life in the line of duty or as the result of a service-connected disability. You generally cannot have remarried, although there are exceptions.

Recommended Reading: What Happens If You Default On Sba Loan

How Fast Can A Va Loan Be Processed

VA loans are home finance loans that are underwritten by the Department of Veteran’s Affairs and issued to eligible veterans to help them own a home. While these loans come with many benefits, they can be fairly time consuming from contract to close because of the strict underwriting requirements that the VA has for issuing insurance on loans granted by private lenders. Knowing the time frame and steps required to process a VA loan is critical for buying a home.

Va Appraisal Required Repairs

Related to the VA appraisal, the VA may mandate appraisal-related repairs. If the VA-approved appraiser identifies significant issues with the property , the VA may impose repair requirements. In other words, fix the broken toilet, or we wont sign off on the loan. Fixing a toilet should be a quick process. But, if major issues arise in the appraisal, the buyer and seller may spend significant time negotiating responsibility for the repairs then actually completing those repairs.

Also Check: Becu Auto Loan Payoff

What Paperwork Is Required

VA borrowers have to provide most of the same paperwork as any borrower looking for a conventional loan. This includes:

- Proof of income to determine ability to pay and qualification amounts.

- Recent bank statements to determine assets

- Loan application and authorization to pull credit

Your lender will use this information to determine if you meet their credit and lending criteria. VA borrowers also need to prove eligibility based on their service criteria . This means the VA requires that certain forms be provided to prove eligibility. These include:

Factor #: How Long Will Underwriting Take

Post-appraisal, any VA loan file is subject to final underwriting. If an underwriter needs additional documentation or notices an eligibility problem, the closing date could change.

A word of advice for buyers: Youre extremely close to the finish line, so try not to panic. Be as helpful as possible during this phase, and youll likely be in good shape for a quick close.

You May Like: How To Find Student Loan Number

Use A Mortgage Calculator

Before going through the hassle of calling a loan officer, its good to make sure you can first afford a mortgage payment. There are many costs associated with a mortgage besides just the monthly payment, such as PMI, home insurance, and HOA fees.

You can easily see if you can afford a mortgage based on your income with our home affordability calculator.

Va Condo Approval Checklist

The VA has to review the condo associations documents and bylaws to look for any potential conflicts. Their goal is to ensure that veteran homebuyers arent purchasing in highly restrictive developments or in a development that will make reselling the property difficult.

Here are some general guidelines for VA condo approval:

- The condo development must have more than one unit

- At least half of the units need to be owner-occupied

- No single entity can own more than 10% of the units

- At least 85% of residents should be up to date on HOA dues

- At least 75% of the units in a new construction condominium development must be sold

Don’t Miss: How Much To Loan Officers Make

Your Mortgage: How Long Does It Take To Get Pre

Everyone knows they are supposed to get pre-approved for a home loan before they go house shopping. Its one of those annoying pieces of advice you cant escape, like wear sunscreen.

Groan. You have to do it. But how long will it take to get pre-approved for your home loan so you can get to the fun part?

Fortunately, the approval process isnt as tedious as most new home buyers think its going to be.

Online application and computerized analysis have made everything faster and easier.

Ready to get approved? Start now.

In this article:

You may think it will take a long time to get pre-approved. The process is actually easier than you think:

How Fast Do You Respond To The Underwriter

Once you turn in your documents along with a purchase contract, your job isnt over. The underwriter will go over these documents and decide if he needs more documentation. Sometimes questions pop up after looking closely at your pay stubs. For example, if you have deductions coming out of your paycheck that the underwriter cannot decipher, he may ask questions. Underwriters often carefully evaluate your asset statements too. If there are any red flags popping up after evaluating them, there may be a need for further documentation.

Its up to you to stay in contact with your loan officer to see what the underwriter needs. Then, its your responsibility to get him the documentation he needs quickly. The longer you take, the more your file gets pushed to the back of the line. This could delay the amount of time it takes to get your loan approval.

Read Also: How To Get Loan Officer License In California

The Length Of Your Va Loan Could Take Longer Than Most

While ICEs reported average time to close is 55 days, that means plenty of homes take longer to close. With some factors completely out of your control, you should prepare for the possibility of a longer loan.

On the flip side, your loan could close much quicker than the 55 days. To increase your chances of this, be sure to have everything ready. Prequalification and preapproval are important steps, and the sooner you begin those, the sooner you can begin your journey toward a new home.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Cookie Settings.Do Not Sell My Personal Information.

What If I Dont Meet The Minimum Service Requirements

You may still be able to get a COE if you were discharged for one of the reasons listed below.

You must have been discharged for one of these reasons:

- Hardship, or

- The convenience of the government , or

- Early out , or

- Reduction in force, or

- Certain medical conditions, or

- A service-connected disability

Don’t Miss: How Much Do Loan Officers Make Per Loan

Receive Your Va Loan Preapproval Letter

Once your lender and loan officer has reviewed all your information, youll get an official preapproval letter. This will indicate that youve been conditionally approved for your loan, and it will also have an estimated loan amount youre eligible to borrow. You can use this number to guide your home search.

You should also include the preapproval letter in any offers you submit. This can give sellers more confidence in your offers not to mention your ability to purchase their home quickly and without issue.

Do Preapproval Letters Expire

Technically, no, but your lender may find it necessary to re-review your financial information 60 to 90 days after issuing the letter. Or, if you become preapproved and make a large purchase that requires additional monthly payments, your debt-to-income ratio may increase beyond the point of handling the payments for a mortgage, which would impact your purchasing power as a borrower.

The re-review of your preapproval comes from the fact that your documents were previewed before taking on the extra risk associated with additional debt.

The voiding of your preapproval comes from the fact that your documents were previewed before taking on the extra risk associated with additional debt.

All of the conditions listed in the letter are important, and your mortgage can and will fall apart if any of them aren’t met. Aside from changes in credit, the two largest conditions involve the appraisal on the property you hope to purchase and a final approval from the lender’s underwriting experts.

Your loan officer will order an appraisal once you enter into a purchase agreement on a property. If all is well, an underwriter will ultimately examine your entire loan file, from tax statements and W-2s to recent bank transactions and credit scores. It is the underwriter’s job is to make sure the loan application meets both the VA’s and the lender’s in-house requirements.

» VA Loans: Get preapproved online

Don’t Miss: How Long For Sba Loan Approval

Purchasing With Another Veteran

Another veteran who has VA loan entitlement can be a co-borrower, as long as this person will live in the home with you as his or her primary residence. Theyll face the same credit and financial scrutiny as a spouse. VA approval is required for this type of setup, unless the veteran happens to be your spouse. You can choose to use your entitlement solely in cases like this or opt for a dual entitlement scenario, with each eligible borrower utilizes a portion of their VA loan entitlement. Its usually best to talk with a VA lender in more detail about how to proceed in cases like this.

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Also Check: What To Do If Lender Rejects Your Loan Application

Can Va Loans Close In 30 Days

Buying a home takes time. When youre buying a home with a VA loan, it can seem like the process takes even longer than normal. If time is of the essence and you need to close on a property as fast as possible, any delay can mean a serious and costly headache. So, how fast can you close on a VA loan? Is it as fast as traditional mortgages?

How Long Does It Take To Get Pre

Getting pre-approved for a mortgage can be a stressful, complicated process involving stacks of personal documents and unforgiving loan underwriters. However, there are ways to make this process faster, easier, and less stressful.

If youâre looking to buy in a hot market, you can bet that youâll face plenty of competition. In dense, popular cities like Washington, D.C. or San Francisco, where supply is low, demand is high, and prices rise seemingly by the hour, bidding wars are common. So how do you maximize your chances of getting your dream home?

Pre-approval for a mortgage is one of the best ways to show sellers youâre a serious, qualified buyer, and that you could quickly and smoothly close on a sale. Thatâs because pre-approval is the product of a careful, exhaustive investigation into your finances by your lender, and represents a firm promise on the lenderâs part to issue you a mortgage. A pre-approval letter is essentially a guarantee.

Pre-qualification is simply an estimate of how much of a loan you might qualify for, based on self-reported financial information. For that reason, sellers take pre-approval much more seriously than pre-qualification.

But because itâs the product of a long process, pre-approval isnât an instant, snap-of-a-finger process. In this post, weâll go into detail on how long pre-approval can take, and why.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan