When Youre Not Underwater On Your Current Loan

Generally speaking, its easier to find a lender wholl work with you when your car is worth more than your remaining loan balance.

New cars can lose about 20% of their original value within the first year, and an average of 15% to 25% each of the next four years, according to Carfax. So time is of the essence.

Some lenders wont even consider refinancing an older car. Capital One, for example, only refinances loans for vehicles that are seven years old or newer.

If your car is relatively new and still has equity, now could be a good time to refinance.

You Hate Your Current Lender

Many people choose to refinance simply because they dont like the way their current lender does business. Rude customer service reps or poor record keeping can really sour a relationship with a lender. If you really cant stand your current lender, refinancing with a new lender may help alleviate some of your frustrations.

Shop For Rates And Terms At Banks And Online Lenders

Research is key in refinancing personal loans before refinancing, compare rates and terms from multiple lenders. A new loan with a lower interest rate isnt necessarily better if youre paying more for it overall in fees or by extending it unnecessarily.

Refinancing a loan may cost additional fees and will change the terms of the loan, says Jeff Wood, CPA and partner at Lift Financial. Your current loan may have a prepayment penalty in order to replace it. All of these factors must be considered to determine if a refinance makes sense, both personally and financially.

If youre not looking for lower monthly payments, it may also be unwise to extend the maturity of your new loan past the maturity of the current loan. Even if you get a lower interest rate, you could end up paying more in interest over a longer time frame. To compare the overall costs of your loans, try using a personal loan calculator.

Don’t Miss: Usaa Student Loan Refinancing

Consider The Time Remaining On Your Loan

How far along are you in your car loan repayment schedule? If you only have a year or two left, you may be better off just sticking with your original loan.

Extending your loan repayment period can lower your monthly payments. But when you add in the extra money you’ll pay in interest charges, you may end up paying a lot more overall.

On the other hand, refinancing into a shorter repayment term could be a really good idea. Shorter terms tend to unlock lower interest rates. Your monthly payment will probably go up with a shorter term, but if you qualify for a much better interest rate than what you have now, it may not rise as much as you’d think. And you could save a ton of money overall.

What Is Auto Loan Refinancing

When you refinance your auto loan, you replace your existing loan with a new loan. This strategy can help you save money on your monthly payments via a lower interest rate or longer term. Auto loan refinancing may also allow you to pay off your car loan faster so you can finally own your vehicle free and clear.

Don’t Miss: Can I Roll Closing Costs Into My Va Loan

Three Questions To Ask Before Refinancing Your Car Loan

1. Is there a prepayment penalty for paying off my existing car loan early?

Although its rare prepayment penalties still exist. Youll need to crunch the numbers and see if its still beneficial to refinance.

2. Have I waited too long to refinance my auto loan?

Rates are typically the lowest for new vehicles. If the majority of your interest and principal is paid off, there may not be enough savings in it to make it worth your while.

3. Did my credit score change for the worse?

If it is too low to be approved for financing that includes a lower interest rate, you should hold off on refinancing your car loan.

When Should I Refinance My Auto Loan

The short answer is that you can apply for refinancing anytime you want. However, there are some general guidelines to help you get the best terms and rate. Youll want to wait about three months after your initial loan just to make sure the title has completely transferred properly. This option is best if you have stellar credit. If you dont, wait at least six months and build a solid payment history. If its your first auto loan, wait even longer to demonstrate good financial habits.If youre thinking about refinancing, youre probably most interested in a lower monthly payment and who isnt? However, lower payments can sometimes cost you more over the life of your loan. Before you apply to refinance your current auto loan, here are some things to consider to help determine if its right for you. And if you have questions, were here to help.

Also Check: How To Refinance An Avant Loan

How Refinancing A Personal Loan Affects Your Credit Score

When you refinance, youll be subject to a credit check. This can lower your credit score slightly, but the drop should be temporary especially if you practice good financial habits with your new loan.

Credit inquiries and new accounts can negatively affect your credit score in the short term, but making on-time payments on a new loan will help your credit score over the long term, Awumey says.

Keep in mind that a small hit could hurt if youre also looking to buy a new car or move into a new apartment. Car dealers and landlords check your credit score, and refinancing your loan at the wrong time could make it more difficult to find a vehicle or housing.

Exactly How Many Times Can You Refinance Your Car Loan

Theres no legal limit on how many times you can refinance a car. That said, the lender you want to refinance with must agree, and each has its own rules. Lenders are in the business to make money, and if a lender sees that youve already refinanced your car several times, it might decide not to issue a loan offer.

Recommended Reading: Pre Approved Auto Loan Usaa

How Soon Can I Refinance After Buying A Car

Is there such thing as refinancing a car loan too early?

Unless you pay for your new car in cash, youll likely take out a car loan. When you do so, know that you dont have to commit to your initial loan forever. There may come a point where you want to refinance your auto loan to accommodate your new needs or priorities. But how soon can you move forward with a refinance after you buy a car?

2021 Auto Refinance Rates

You Didnt Get The Best Offer The First Time Around

Even if interest rates havent dropped or your financial situation hasnt improved significantly, it may be worth shopping around for better loan terms anyway. For example, you may have received a loan with an interest rate of 7% when other lenders were offering lower rates.

This may be especially wise if you got your original loan from a car dealer, as dealers sometimes offer higher interest rates to make extra money.

You May Like: Usaa Auto Loans Bad Credit

If I Shop Around For Rates Will That Hurt My Score More

A common misconception is if you shop around for rates and have your credit pulled multiple times, this will hurt your credit score beyond doing just a single application.

This is not true. The credit scoring agencies of both FICO and Vantage are aware this is happening, and they encourage borrowers to shop around. Making multiple hard inquiries within a few weeks span will behave as one single credit pull as far as your score is concerned.

How To Refinance A Car

For the most part, refinancing a car loan is similar to getting a car loan for a new purchase. Start by doing your research on various lenders to get an idea of what terms are available and which offers you might qualify for.

With some lenders, you may be able to submit an application to get pre-qualified. This process typically doesn’t affect your credit but can be valuable in helping you see what you qualify for based on your credit scores.

Once you have enough offers to compare, select the best one for you and submit an official application. The lender may require information on you, the car and your existing car loan. Provide this information as quickly as possible to make the process go smoothly.

If you get approved and you accept the terms the lender offers, finalize the loan by signing the paperwork. The lender will pay off your existing loan directly.

During this process, don’t forget to continue making payments on your current loan until it’s paid in full. The last thing you want is to have your credit dinged because your new lender didn’t pay off the old loan in time.

You May Like: Can You Use Fha Loan If You Already Own House

How Often Can You Refinance A Car Loan And Mistakes To Avoid

Buying a car is a big decision. For many people, its one of the largest purchases they will make aside from buying their home. While it can be challenging to choose the right car to buy and take out a loan for the initial purchase, refinancing a car loan can be an even greater mystery since its not something you do often! Here are some questions you should be asking if you are in the market for a refinance.

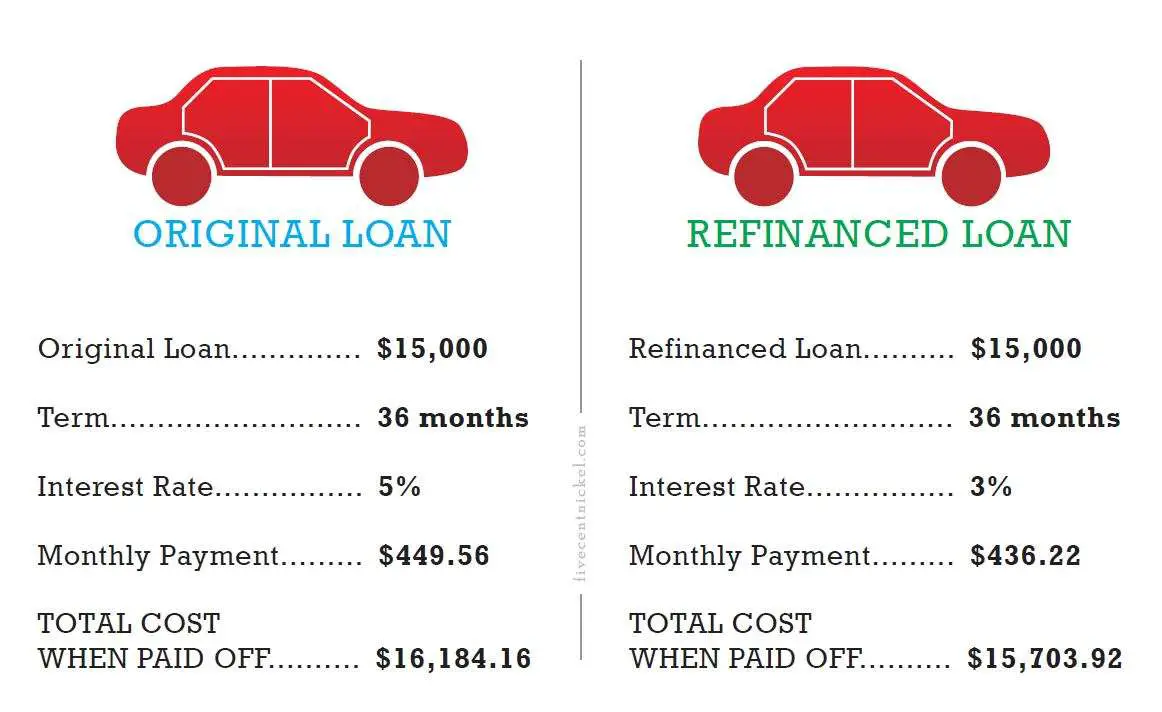

The Best Reason To Refinance: Pay Less Interest

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. That lower rate means you pay less for your car after taking all of your borrowing costs into account. Because the interest rate is also part of your monthly payment calculation, your required payment should also decrease. As a result, managing your monthly cash flow becomes an easier task.

When you can replace your existing loan at a lower rate, its best to refinance as early as possible. Most auto loans are amortizing loans, which means you pay a fixed monthly payment with interest costs built into the payment.

Over time, you pay down your debt, but you pay most of your interest costs at the beginning of the loanso get that rate down sooner than later to start cutting costs. An amortization table can show you exactly how much you can save by refinancing.

Also Check: Usaa Student Loan Refinance

Youve Had The Loan For At Least 90 Days

How soon can you refinance a car you just purchased?

Most lenders require that youve had the loan for a few months before you can apply to refinance. When you apply through LendingClub, the minimum required is 90 days. This is usually to confirm that youre making on-time payments, so stay on top of those payments if youre hoping to refinance in the near future.

How To Sell A Car In Nys

Category: Cars 1. About transferring vehicle ownership and acceptable proofs of A DMV-licensed automobile dealer must have acceptable proof of ownership for a vehicle before they can sell that vehicle to you. Most NY State automobile Cars, trucks and motorcycles · Trailers · Vehicles purchased from dealers How to Sell

Recommended Reading: Drb Refinance Review

Is My Credit Pulled When I Apply For An Auto Loan Refinance

Yes, any time you apply to refinance your current auto loan, you are creating a hard inquiry. All this means if the lender will review your credit report as part of their decision-making process for your new loan.

Keep in mind, the hard inquiry may cause a small dip in your credit score because a new loan often means added debt to the credit reporting agencies. With added debt, the chances of a borrower missing a payment increases, thus lowering your overall score.

However, once the credit reporting agency sees the old loan paid off, the amount of debt decreased and a few monthly payments made on time, your credit score should increase again.

Is Refinancing Worth It

If youre simply refinancing, and you know youll get a better rate and save yourself some money, its really a no-brainer. If, however, youre not sure youll save any money, use this auto refinance calculator to estimate your savings and decide if it makes good financial sense to refinance.

In many cases, people refinance because they need to lower their monthly payment, usually due to some unforeseen financial crisis. Finding balance between your immediate financial needs and long-term financial health is never easy but if you do the math and plan accordingly, you can make the right financial decision for you and your family.

If refinancing your vehicle is necessary to improve your cash flow, you may refinance now to get back into a positive financial situation. Once your personal finances have stabilized, start making extra payments on your auto loan to pay it down faster, provided that there arent prepayment penalties on your new loan. Youll pay off your auto loan sooner and save yourself some interest expense.

Also Check: Va Loan On Manufactured Home

You Want A Lower Monthly Payment

Even consumers with clear credit histories and top scores may not like the cost of their current monthly payments. You might find that you can get a longer term loan by getting pre-approved financing from a bank, credit union or private lender. You should compare a new loan with the terms and rates of your existing financing. LendingTrees Auto Refinance Calculator crunches monthly payment figures, allowing buyers to type in different interest rates and loan terms to find the sweet spot.

Just beware of choosing a loan with a longer term. It may save you money on your monthly payment, but you will ultimately pay more interest over time.

Heres an example to show you how much more youll pay with a longer-term loan.

For those who can increase their monthly payment without too much stress, shortening the term may be a good strategy. Monthly payments will be higher, but the car will be paid off sooner, lowering the total amount of paid interest. The bottom line: If youre considering changing the term in refinancing, be sure the interest rate and refinancing charges are low enough to make it worthwhile.

How Long To Wait Before Refinancing Your Auto Loan

Good news: Consumers can refinance their car as many times as they want and as often as they can find a lender willing to approve them for a new loan.

You can even refinance your car loan the moment you get it home from the dealership if you realize you can land a better loan. There are no legal restrictions on financing a car later on, although it may be harder to find a willing lender as the years and miles accrue on the vehicle. Each lender has its own set of requirements. At Bank of America, for example, the car must be less than 10 years old and have fewer than 125,000 miles on it to qualify for refinancing.

Just because you can refinance doesnt necessarily mean itll be easy.

Look at your original loan contract to see if you have to jump through any hoops first. The Federal Trade Commission warns that finance companies and banks can impose prepayment penalties on their contracts, which are fees they charge if you decide to pay off your loan earlier than planned. And, of course, by refinancing with a new lender, you are doing exactly that.

According to online auto retailer Cars Direct, prepayment penalties are allowed by the government in the District of Columbia and 36 states.

Also Check: How To Refinance An Avant Loan

Advantages Of Refinancing A Personal Loan

While the advantages of refinancing your personal loan will depend on your goals, they can generally include everything from getting a lower interest rate to reducing the overall cost of your loan.

- Better interest rate: If rates have dropped or you have improved your credit score, you could be able to save money on interest.

- Faster loan payoff: If youre comfortable making higher monthly payments and you want to get out of debt faster, you can refinance a personal loan to a shorter term. This has the added benefit of reducing the amount of interest youll pay overall.

- Extended repayment periods: Extending your loan repayment can help your payments feel more manageable if youre having difficulty making them on time, since lengthening the terms will reduce your monthly bill.

- Payment stability: Refinancing can provide payment stability if youre switching from a variable rate to a fixed rate.

When Can You Refinance A Car Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you recently bought a car, you may wonder when you can refinance your car loan to reduce the interest rate or lower the payment.

Strictly speaking, you can refinance your auto loan as soon as you find a lender that will approve the new loan. That may be a challenge since most lenders wont refinance until the original car loan has been open for at least two to three months.

Delayed lender approval can be an obstacle to refinancing your car loan, but there are potential benefits to waiting.

Recommended Reading: How Long For Sba Loan Approval