Overborrowing: Just Say No

Believe it or not, lenders may offer you more money than you really need to pay for school. Yes, they’re increasing their risk of not getting paid back by allowing you to potentially overextend yourself. But they’re also increasing their potential profits by having you pay them more interest.

Student loans are so hard to discharge in bankruptcy and can be collected in so many ways that you should assume lenders don’t have your best interests at heart. That said, it’s your job to figure out the smallest amount you need to borrow to earn your degree.

“You always have the option to turn down additional loans or even reduce the amount for which you are approved,” says Josh Simpson, an investment advisor representative with Lake Advisory Group. The strategy of only borrowing what you need may seem obvious but it is often overlooked, he says.

How Do You Apply For Unsubsidized Student Loans

To apply for an unsubsidized student loan, you may need to fill out a Free Application for Federal Student Aid. Once its submitted, schools use the information from the FAFSA to make any financial aid package that they send you. To be eligible to fill out the FAFSA, you must be a U.S. citizen or eligible non citizen with a valid Social Security number. You also must meet other requirements:

- Registered with the Selective Service if youre a male student

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program

- For Direct Loan Program funds, be enrolled at least half time

- Maintain satisfactory academic progress

How Private Student Loans Change The Interest Payment Picture

Let’s say the federal student loan limits don’t fully cover your tuition and fee shortfall after grants, scholarships, and parental contributions. What does the math look like with larger loan amounts and private loan interest rates?

We’ll assume you’ll need to borrow $15,000 per year and you’ll max out your federal loans. That leaves $7,500 to $9,500 per year in private loans.

| Private Student Loan Interest Accumulation During School | |

|---|---|

| Loan year | |

| $40,742 | $42,225 |

Table created by the author with the help of calculations from Student Loan Hero’s “Student Loan Deferment Calculator.”

Private student loan interest rates depend on many factors. This includes your , your cosigner’s credit history , market interest rates, and the lender’s offerings. You’ll also have the option of a fixed- or variable-rate loan. Remember that variable loan rates often start out lower than fixed rates but can escalate over time.

For simplicity, we chose a 9.0% fixed interest rate for our private student loan example in the table above. Private lenders are not required to offer a grace period, but many do, so we showed that option as well.

You May Like: Does Va Loan Work For Manufactured Homes

Public Service And Teacher Loan Forgiveness

Public Service Loan Forgiveness is available after 10 years of qualifying payments and employment, only for Direct Loans . The Teacher Loan Forgiveness Program is available for loans in both the Direct and FFEL programs. All federal loans issued since July 1, 2010 are Direct Loans. Teachers with Perkins loans may be eligible for a loan cancellation if they meet certain requirements. More information for teachers can be found at studentaid.gov.

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan anytime. Still, most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the “grace period” when the government continues to pay the interest due on the loans.

When your loan enters its repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicer’s website in most cases.

Also Check: Does Fha Loan On Manufactured Homes

Evaluate Costs/benefits Of Unsubsidized Loans

If a students parents have significant investments held in non-retirement accounts and/or have relatively high income, a family may not be eligible for subsidized loans, work-study programs, or need-based scholarships. But all families should qualify for unsubsidized loans. Students and their parents may consider the cost of borrowing to decide whether theyll accept these loans to pay for college.

Federal Student Loan Fees

When you are approved for a direct federal loan, you may be surprised to learn that you won’t receive the full amount. The reason is that you must pay a loan fee of (1.057% for Direct Subsidized and Direct Unsubsidized, and 4.228% for Direct PLUS loans issued between Oct. 1, 2020, and Oct. 1, 2022, which is taken out of your loan principal. However, you still have to pay interest on the full principal even though you don’t actually get that amount.

For example, someone with a $7,500 loan and a 1.057% loan origination fee would receive $7,420.73. But they are still responsible to pay the full $7,500 when it comes time for repayment.

Be aware that, in response to the COVID-19 pandemic, there is 0% interest and a suspension of payments from March 13, 2020, through Jan. 31, 2022.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

How To Earn Money To Pay Down Unsubsidized Loans

We know finding flexible work isnt always easy. The following is a list of some common ways students can make a little extra money to start paying down unsubsidized student loans:

- Work-study. Students receiving financial aid may qualify for flexible on-campus employment in dorms, dining halls, or student unions.

- Tutoring. If you excel in math, science, Spanish, or any other subject, consider tutoring other students in your spare time. Youll earn some extra cash and make some new friends.

- Become a tour guide. If you love your school, why not convince other students to attend? Plus, youll get essential public speaking skills.

- Ride-sharing. If you have a car, consider driving for Lyft or Uber every once in a while. You can work more in slow periods and ease off during finals.

- Research assistant. Teaming up with a professor in your field as a research assistant can help you earn a little money on the side while developing your skills and expertise.

- Internships. Getting a summer internship is an excellent way to start making connections with potential employers and build your resume.

If you can work even a few hours per week during the school year, youll be able to start paying down interest on your unsubsidized loans. Youll be grateful when you become debt-free faster than your peers.

Do Unsubsidized Loans Accrue Interest During Grace Period

If you have unsubsidized loans, you may either pay the interest during the in-school deferment and grace periods, or the interest will be capitalized when repayment begins. Capitalization is when interest that accrued during the grace period or other deferment is added to the loan principal when repayment begins.

You May Like: How Long For Sba Loan Approval

How Interest Works For Unsubsidized Loans

Understanding how interest works for unsubsidized student loans is equally as straightforward:

The minute a loan is disbursed, the borrower is responsible for the accrued interest.

In other words, Uncle Sam isn’t helping you out on this one.

This is why graduate student loans are subsidized students don’t demonstrate financial hardship .

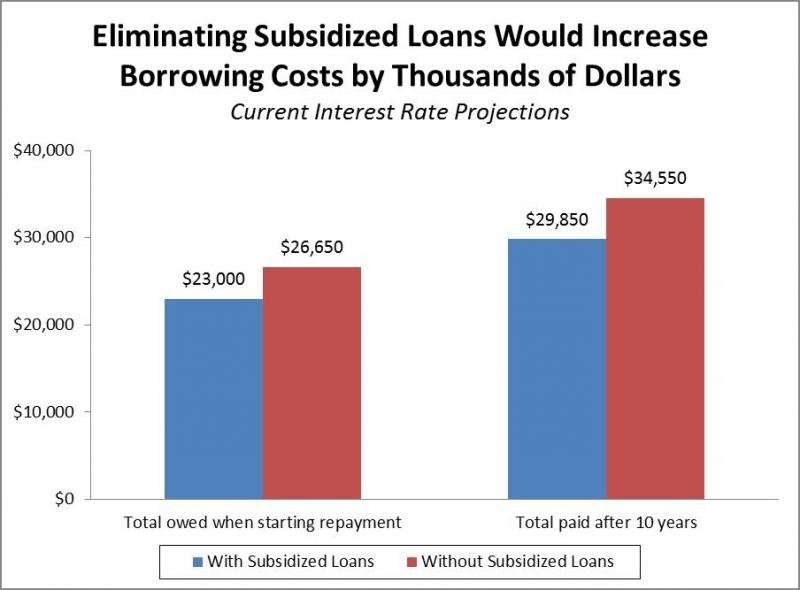

The problem with unsubsidized student loans is that a $20,000 loan could end up being $26,000 or more before a borrower can even start to make payments.

Unsubsidized Loans 101:

- Unsubsidized loans have $31,000 lending limits

- Interest accrues at the disbursement of the loan

- Do not have to demonstrate Financial need

- End up costing more than subsidized loans

Direct Loans And Federal Family Education Loan Program Loans

Direct Loans and Federal Family Education Loan Program Loans offer quite a few repayment plans.

The Standard Repayment Plan has fixed payments to ensure a loan is paid off within 10 years. Direct Subsidized and Unsubsidized Loans, Subsidized and Unsubsidized Federal Stafford Loans, PLUS loans, and all Consolidation Loans are eligible for this plan, where borrowers will pay less over time than those who repay their loans with other plans.

The Graduated Repayment Plan has lower payments at first, with payments typically increasing every two years, allowing you to pay off your loans within 10 years. However, it will cost more than the Standard Plan over time. Direct Subsidized and Unsubsidized Loans, Subsidized and Unsubsidized Federal Stafford Loans, PLUS loans, and all Consolidation Loans are eligible for this plan.

The Extended Repayment Plan can be fixed or graduated and ensures loans are paid off within 25 years. Direct Subsidized and Unsubsidized Loans, Subsidized and Unsubsidized Federal Stafford Loans, PLUS loans, and all Consolidation Loans are eligible for this plan however, you will pay more over time than under the Standard Plan. Monthly payments will be less than under the 10-year Standard or Graduated Repayment plans, but FFEL and Direct Loan borrowers must have more than $30,000 in outstanding loans to be eligible.

Read Also: Bayview Loan Servicing Class Action Lawsuit

Refinancing Unsubsidized Student Loans

In order to refinance student loans, in most scenarios, private lenders will require an income source before agreeing to refinance.

This option is most applicable for graduates with a job. Always be sure to weigh the pros and cons of shifting federally funded loans to private.

If the loans have already gained interest, it may be worth staying with the federal perks. Going back to grad school is a good reason to consider refinancing since unsubsidized student loans still collect interest even if you’re in school.

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a first year dependent undergraduate student. Her cost of attendance for Fall and Spring terms is $17,600. Albertas expected family contribution is $10,000 and her other financial aid totals $9,000.

Because Albertas EFC and other financial Aid exceed her Cost of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $5,500. Even though her cost of attendance minus other financial aid is $8,600, she can only receive up to her annual loan maximum .

Also Check: Does Va Loan Work For Manufactured Homes

Why Should You Pay Interest On Unsubsidized Loans While In School

If you have a $100,000 loan at 6.6% interest, youll need to pay $6,600 worth of interest each year. If you successfully pay off the interest every year, youll finish college with $100,000 in debt the amount you originally borrowed.

If you pay $1,000 each month, starting six months after graduating, you will finish paying off your student loans in just over 12 years . Now, thats still about two years longer than if you had subsidized loans. However, its a full eight years earlier than if you hadnt paid interest while in school.

In this example, if you graduate college when youre 22, paying down interest while in school is the difference between being debt-free in your early 30s or your 40s. Thats almost a decade of less stress and greater financial flexibility.

What Is An Unsubsidized Loan

An unsubsidized loan, which is also referred to as a direct unsubsidized loan or unsubsidized Stafford loan, is a low-cost, fixed-rate federal government student loan that can benefit both undergraduate and graduate students. Financial need is not mandatory, which implies that students from wealthy families can still apply for the direct unsubsidized loans.

If you take an unsubsidized student loan, pay all interest accrued in the entire schooling period. It has no grace period and interest will accrue regardless of deferment periods. It differs from subsidized loans in different aspects. Subsidized loans are only meant for undergraduate college students still in school pursuing their courses and in need of help to pay for their tuition fees and related expenses. The loan is determined by the cost of the attendance minus the expected family contribution and other forms of financial aid the student is expected to receive, for example, scholarships and grants.

To qualify for an unsubsidized loan, you must first visit and complete the Free Application for Federal Student Aid . It is free to apply for FAFSA. If you qualify for the unsubsidized loan, your school notifies you.

To accurately know what is an unsubsidized loan, know what costs are covered. Unsubsidized loans cover for the cost of attendance, which includes:

- Room and board

image via: pixabay

Don’t Miss: How Do I Find Out My Auto Loan Account Number

How Compound Interest Works

Compound interest is charged based on the overall loan balance, including both principal and accrued but unpaid interest .

So, compound interest involves charging interest on interest. If the interest isnt paid as it accrues, it can be capitalized, or added to the balance of the loan.

For example, if the loan balance starts at $10,000 and the interest due after one year is capitalized, the new loan balance becomes $10,500 and the interest accrued in year two is $525 .

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Rv Loan With 670 Credit Score

Federal Direct Unsubsidized Loan

Available to undergraduate and eligible non-degree students

- Interest rate:

- 2.75%

- 3.73%

Subsidized And Unsubsidized Loans

Subsidized Loans are loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid . Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods.

Unsubsidized Loans are loans for both undergraduate and graduate students that are not based on financial need. Eligibility is determined by your cost of attendance minus other financial aid . Interest is charged during in-school, deferment, and grace periods. Unlike a subsidized loan, you are responsible for the interest from the time the unsubsidized loan is disbursed until its paid in full. You can choose to pay the interest or allow it to accrue and be capitalized . Capitalizing the interest will increase the amount you have to repay. See for more important information on the capitalization of interest.

| Loan Type |

|---|

| Requirement | |

|---|---|

| Deferment | You may receive a deferment if you are enrolled in school at least half-time or for unemployment or economic hardship |

| Repayment | There is a 6 month grace period that starts the day after you graduate, leave school, or drop below half-time enrollment. You do not have to begin making payments until your grace period ends. |

More information regarding student loans, program requirements, and managing repayment can be found at .

Also Check: Aer Loans

How Do You Apply For A Federal Direct Unsubsidized Loan

The first step to finding out what kind of financial aid you qualify for, including Federal Direct Unsubsidized Loans and Subsidized Loans, is to fill out the Free Application for Federal Student Aid .

Your school will then use your FAFSA to present you with a financial aid package, which may include Federal Direct Unsubsidized and Subsidized Loans and other forms of financial aid like scholarships, grants, or eligibility for the work-study program.

The financial aid and loans youre eligible for is determined by your financial need, the cost of school, and things like your year in school and if youre a dependent or not.

Student Loan Interest: Does It Accumulate During School

First, figure out whether your student loans accrue interest while you’re in school or if interest doesn’t accrue until after graduation. This depends on the type of loan you have.

| Will Your Student Loan Accumulate Interest During School? |

|---|

| Loan type |

| $29,790 | $30,398 |

Table created by the author with interest rates from the Federal Student Aid Office, “Subsidized and Unsubsidized Loans.”

You can do the math for your own loans by looking up the federal student loan limits, along with current and past interest rates at the Federal Student Aid website. We performed our calculations using Student Loan Hero’s Student Loan Deferment Calculator.

Also Check: Aer Loan Requirements