How I Knew I Could Start Getting Rid Of Pmi

In my case, I knew I would have to get an appraisal. The moment i remodeled my condo , I started the PMI removal process by contacting Wells Fargo directly. They pointed me to an approved appraiser who valued the home at juuust over the number I needed to meet the 80% LTV value and have my PMI removed. .

The total cost was around $600, which equates to about a year of PMI payments. But, it would have been 4-5 more years before PMI was removed automatically, so I saved thousands overall.

If you didnât type in your numbers into the calculator above, give it a go. Dont know your numbers? No problem.

You can track your homes value for free with Personal Capital. Simply enter your home as a new asset, and then you will see its Zillow Z-estimate displayed as below. Enter your mortgage as a separate account for the full picture. Then, enter the values you see on your Personal Capital dashboard into the Current Value field in the calculator above.

Use Personal Capital to keep track of your home equity, along with the rest of your investments

So, can you remove your PMI?

How To Get Rid Of Fha Pmi

Based on the current rules for case numbers on or after June 3, 2013, a borrower cannot request that a lender remove FHA PMI. But, if the loan meets the 11 year cancellation, the lender must remove the mortgage insurance at that time. So, to answer this question how to get rid of FHA PMI, a borrower must have one of the following scenarios:

Lower Your Fha Mortgage Insurance Rate

Not everyone is eligible for a conventional refinance, and thats ok. There may be a way to lower your FHA mortgage insurance cost even if you cant remove it altogether.

You may have a higher rate of MIP than what is available today because these rates have decreased since 2015.

Here is a history of FHA MIP rates charged by the Federal Housing Administration:

- Prior to January 2008: 0.50% annual MIP

If you received a loan in January 2013, for instance, you could refinance into todays lower MIP and save $40 per month per $100,000 borrowed. Plus, you may save even more by getting a lower mortgage rate.

Keep in mind, though, that your new FHA loans MIP will become noncancelable. Thats because your new loan will originate after June 2013, when FHA MIP rules changed.

You May Like: Usaa Credit Score Requirements

How Long Do You Have To Pay For Fha Insurance

Before 2013, MIP worked similarly to the private mortgage insurance that you pay on conventional loans. Once you reach 22% equity in your home, a conventional mortgage lender automatically cancels your PMI.

Todays FHA lenders no longer cancel your MIP once you reach a certain home equity percentage. The amount of time youll need to pay MIP depends on your down payment. If you have at least 10% down at the time of your purchase, youll pay MIP for 11 years. If you have less than 10% down at the closing table, youll pay MIP for the entire term length.

Why Are Fha Loans Bad

But they also come with downsides, like the fact that youre required to pay mortgage insurance upfront and every year you have your loan. Also, FHA loans come with distinct purchasing limits that vary based on where you live. This makes them a poor option if you plan to buy an expensive home for your area.

Don’t Miss: How Much Interest Will Accrue On My Student Loans

Fha Mortgage Insurance Vs Pmi For Conventional Loans

There are a few significant differences between FHA mortgage insurance premiums and PMI for conventional loans. Conventional PMI is calculated using the loan amount, credit score and LTV as the main factors in determining your monthly PMI payment. Here are some other things to know:

PMI can be cancelled or removed if you pay the balance down below 80% of the original appraised value. If you forget, the lender is required to do it automatically once it reaches 78%.

The PMI monthly insurance payment will likely be more than FHA mortgage insurance , but it is not enforced for the life of the loan.

In our example above with the $243,500 purchase and $235,000 loan amount, the monthly PMI payment would be $236.96 versus $166.46 for the FHA mortgage insurance. We used theMGIC calculatorto determine the PMI payment.

Are There Any Benefits To Paying Pmi As A Borrower

Although PMI is for the protection of the lender and not the borrower, thats not to say there arent some indirect benefits for the borrower. There are two big ones that well go over here:

- PMI enables a lower down payment: Because PMI offsets some of the risk for lenders in the event that the borrower defaults, it enables down payments as low as 3%. Without PMI, you would need a minimum of a 20% down payment for a conventional loan. PMI allows you to accomplish homeownership faster.

- PMI is tax deductible: Congress has extended the mortgage insurance tax deduction through the 2020 tax year, so if you havent filed your taxes yet, this is still deductible. You report it along with your deductible mortgage interest from the Form 1098 you should have received from your mortgage servicer.

Even if you have the money for a 20% down payment, it may make sense to make a smaller down payment and opt for PMI depending on your financial situation and your other goals. Its not necessarily a good idea to empty your savings.

Don’t Miss: Can I Refinance Fha Loan

What Does Fha Loan Mortgage Insurance Cost

The upfront mortgage insurance premium is 1.75% of the loan amount, or $1,750 for every $100,000 borrowed.

The annual premium rate is based on your loan amount and down payment. Those factors also determine how long youll owe MIP.

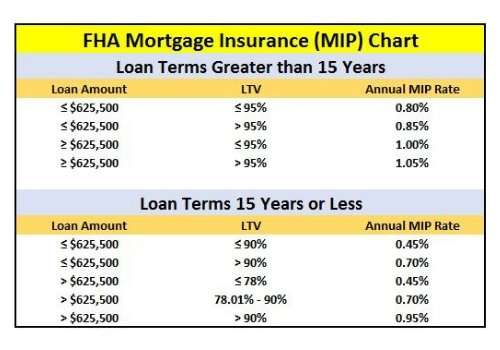

Most FHA borrowers put down less than 10% and will pay annual MIP between 0.80% and 0.85%. But those who put down 10% or more will only pay annual MIP for 11 years, after which the MIP requirement ends.

Annual MIP is divided into 1/12th payments that are included in your monthly mortgage installments.

MIP rates for a 30-year FHA loan

| Loan amount |

|---|

| Annual MIP | $1,668 |

FHA guidelines allow you to roll the upfront MIP into your loan. If you choose this option, your total loan amount would be $196,378.

Upfront MIP can also be included in your closing costs. You can pay those from your savings, or from closing cost assistance funds if you qualify for a state or local assistance program.

You can look up homebuying assistance programs through the U.S. Department of Housing and Urban Affairs website, and by Googling closing cost assistance programs in .

How Does Mip Work

If you have an FHA loan, you pay a portion of the premium up front at the close of the loan and then continue to pay mortgage insurance premiums on a monthly basis. The upfront premium is always 1.75% of the loan amount. If you cant afford to pay this at closing, it can be financed into your loan amount.

In addition to the upfront premium, theres an annual premium thats based on your loan type as well as your down payment or equity amount. If you have a standard FHA loan with a 3.5% down payment on a loan of no more than $625,500, the annual MIP is 0.85% broken into monthly payments.

If you have an FHA Streamline where you go from one FHA loan to another for the purpose of lowering your rate and/or changing your term, the MIP rates are a little better. In this case, theres an upfront rate of 0.01% of your loan amount and an annual MIP rate of 0.55%.

You May Like: Refinance Fha Loan

How Much Does Fha Mortgage Insurance Cost

FHA mortgage insurance involves two components: an upfront mortgage insurance premium and an annual mortgage insurance premium .

The upfront premium is paid when the borrower gets the loan. The borrower doesnt pay the fee immediately or in cash. Instead, the premium is added to the borrower’s loan amount. The current FHA upfront premium is 1.75 percent of the loan amount.

Loan amount: $200,000 UFMIP: 1.75 percent or $3,500

The down payment percentage is based on the loan amount without the UFMIP, so a minimum 3.5 percent down payment would still be $7,000, not $7,122.50.

How To Avoid Paying Mortgage Insurance

If you want to get a mortgage without having to carry mortgage insurance you will need to be a veteran, have 20% down, or get a piggyback loan. Other types of government home loans such as USDA loans have an MIP fee of just 0.35% which is half of what it is on FHA loans.

Conventional Loans

You can avoid paying mortgage insurance by getting a conventional loan with a 20% downpayment. If your down payment is less than This is the ideal scenario. However, most people do not have that kind of cash lying around.

Piggyback Loans

Another option is a piggyback 80-10-10 loan. This is where you put 10% down, get a loan for 80% of the purchase price, and get a 10% second mortgage loan, which would allow you to avoid paying PMI.

Some lenders offer an 80-10-10 piggyback loan. You need a 10% downpayment and would receive a loan for 80% of the home price and another for 10%.

VA Loans

If youre a veteran, you can get a VA loan, which not only doesnt require any mortgage insurance or a down payment. There is a one time upfront VA funding fee of 2.15%.

USDA Loans

If you live in a rural area, you can get a USDA loan with cheaper mortgage insurance rates than FHA loans do. The FHA rate is 0.85% of the loan amount compared to the USDA MIP rate of just 0.35%. On a $250,000 loan, mortgage insurance on a USDA loan is $100 less a month than FHA loans.

Don’t Miss: Usaa Auto Loan Apr

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Is Mortgage Insurance On A Fha Loan

Mortgage InsuranceFHALoanMortgage insurancemortgagesFHAmortgage insurance

. In this manner, how much is mortgage insurance on an FHA loan?

Paying for FHA mortgage insuranceThe upfront mortgage insurance premium costs 1.75% of your loan amount. You’ll pay the upfront premium at the closing table. If you’re borrowing $200,000, for example, your upfront MIP will be $3,500 .

Beside above, does an FHA loan require mortgage insurance? Mortgage insurance is required on most loans when borrowers put down less than 20 percent. All FHA loans require the borrower to pay two mortgage insurance premiums: Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan.

Additionally, how long does mortgage insurance stay on FHA loan?

11 years

How do I get rid of mortgage insurance on FHA loan?

Removing mortgage insuranceIt’s canceled automatically after your equity reaches 78% of the purchase price. FHA mortgage insurance can’t be canceled if you make a down payment of less than 10% you get rid of FHA mortgage insurance payments by refinancing the mortgage into a non-FHA loan.

Recommended Reading: Amortize Car Loan

How Much Room Am I Able To Manage

The response to the question a?simply how much room can I pay for?a? try a personal one and should never be left only to your mortgage lender.

How to decide how a lot quarters you can afford is to begin with your own month-to-month budget and decide what you can comfortably pay money for a property every month.

Subsequently, making use of your desired fees as starting point, use a mortgage calculator and efforts backwards to obtain the greatest homes purchase price.

Remember that this home loan rates will impact the mortgage data, so be sure to make use of latest mortgage rate within estimate. When home loan prices change, therefore really does residence affordability.

The mortgage prices become lower across the board. And several low-down-payment mortgage loans have actually below-market costs courtesy their particular government backing for example FHA financial loans and VA and USDA financial loans .

Various lenders offer various costs, which means youll be wanting examine certain mortgage proposes to find a very good package on your reduced- or no-down-payment mortgage. You can get began listed here.

Prominent Articles

Plus, old-fashioned financing limits include greater than FHA loan limits. Anytime you buy price goes beyond FHAs restriction, you ought to cut back 5percent and check out for the standard financing rather.

Natural Value Increase Cancellation

If youre requesting removal of your PMI based on natural increases in your property value 2 5 years after your loan closes, both Fannie Mae and Freddie Mac require a new appraisal, and the LTV has to be 75% or less. If your removal request comes more than 5 years after your closing, the LTV can be 80% or less with a new appraisal. These requirements apply to insurance removal based on market value increases not related to home improvements.

On a multi-unit residence or investment property, you can cancel PMI on your own when LTV reaches 70% based on the original value with Fannie Mae. Freddie Mac requires 65% for cancellation. Keep in mind that if youre requesting removal based on home improvements from Fannie Mae, you must have had the loan for at least 2 years prior to requesting PMI removal on your investment property.

You May Like: Can I Buy A Second House With My Va Loan

Understanding The Fha Mortgage Insurance Premium

What is PMI or Primary Mortgage Insurance? Do I need it and can I get a mortgage without it? Bert Sanderfur answers your questions in our latest Youtube video!

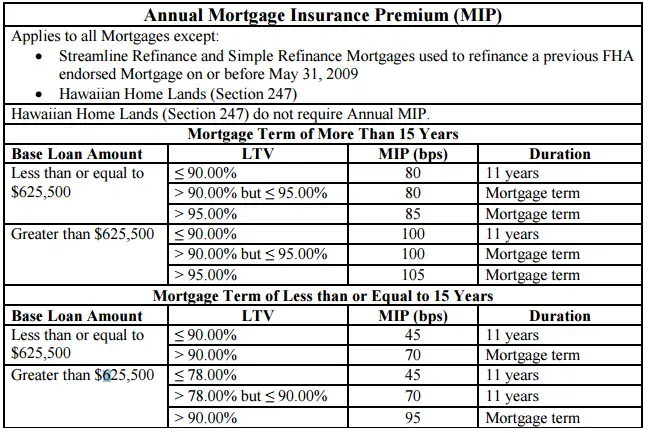

Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. FHA requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. This information is reflective as of 1-1-17 and is subject to change per regulatory guidnace from The Department of Housing and Urban Development .

Terms Less Than Or Equal To 15 Years

Heres what you can expect to pay for your annual MIP if your loan term is less than or equal to 15 years. Lets say you:

- Borrow less than or equal to $625,500, with a down payment of at least 10%. Youll pay 0.45% annually. On a $150,000 home loan, thats $675 every year, or $56.25 each month.

- Borrow less than or equal to $625,500, with a down payment of less than 10%. Youll pay 0.70% annually. On a $150,000 home loan, thats $1,050 every year, or $87.50 each month.

- Borrow more than $625,500, with a down payment greater than or equal to 22%. Youll pay 0.45% annually. On a $700,000 home loan, thats $3,150 every year, or $262.50 per month.

- Borrow more than $625,500, with a down payment greater than 10% but less than 22%. Youll pay 0.70% annually. On a $700,000 home loan, thats $4,900 a year, or about $408.33 per month.

- Borrow more than $625,500, with a down payment less than 10%. Youll pay 0.95% annually. On a $700,000 home loan, thats $6,650 a year, or about $554.17 per month.

Read Also: Mlo License Ca

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Mortgage Insurance Premiums For Fha Loans

One important difference between the mortgage insurance requirements for FHA and conventional loans is the upfront mortgage insurance premium. Every person who buys a house with an FHA loan has to pay an upfront fee which is currently 1.75% of the purchase price of the house. That means if you buy a house that costs $250,000, you have to pay an upfront premium of $4,375. Conventional loans do not have upfront mortgage insurance premiums.

Another important difference between MIP and PMI are the monthly insurance premiums. Every person who buys a house with an FHA loan must also pay monthly insurance premiums . The cost of MIP depends on the term of your mortgage, the amount of your base loan amount, and your loan-to-value ratio . While the cost of the annual premium can vary from borrower to borrower, the annual cost of MIP generally runs between 0.45% and 1.05% of the loan amount.

The same is true when you refinance an FHA loan. You will need to pay upfront and annual mortgage insurance premiums when you refinance using an FHA loan.

Read Also: How To Apply For A Second Loan With Upstart