Who Owns Your Student Loans

Do you know where your federal and prirevate student loans are?

If you dont, you should.

Its hard to make payments, defer payments, and check loan balances if you arent even sure who owns your student loans. Thankfully, finding this information is easier than you might think.

Continue reading to learn the steps you need to take to figure out, who owns my student loans?

The National Student Loan Data System

The Department of Education’s central database for student aidthe National Student Loan Data Systemprovides information about what kind of loan you have, as well as loan or grant amounts, outstanding balances, loan status, and disbursements. Identification information is required to access the database. You’ll need a user ID and password to get into the system, which you can get online. You can also access the database by calling the Federal Student Aid Information Center.

Can I Use Student Loans For Rent

Student loans can be used to pay for room and board, which would include off-campus housing like an apartment. However, when you factor in the cost of furnishing, meals, utilities, a security deposit, and other housing-related expenses, an apartment can end up costing significantly more than an on-campus dorm.

Read Also: Usaa Auto Loan Process

Temporary Expanded Public Service Loan Forgiveness

Unlike the federal student loan repayment program, PSLF has no tax implications because of the existing Internal Revenue Code. If you applied for PSLF and were denied, you may be eligible for Temporary Expanded Public Service Loan Forgiveness .

You can also look into income-driven repayment plans for student loans. For example, IBR, ICR, REPAYE, and PAYE are types of qualified repayment plans. These plans are for high-balance borrowers who may struggle to make their payments.

These repayment choices reduce your monthly payment to a tiny fraction of your discretionary income, making them more reasonable than the typical 10-year repayment plan. In addition, you are eligible for loan forgiveness if you have a leftover balance after 20 to 25 years of payments.

This option allows government personnel to cancel student loans, but there are tax implications to consider. To discuss your choices, contact your student loan servicer.

Lets talk more about the TEPSLF.

Will I Receive A Statement About Interest Paid On My Student Loans

Yes. If you paid more than $600 in interest on your loans in a calendar year, you should receive a statement from your loan servicer either electronically or via U.S. postal mail in January each year. Student loan interest payments are reported to both the Internal Revenue Service and the borrower on IRS Form 1098-E, Student Loan Interest Statement.

You may be able to deduct a portion of the interest on your income tax return. If you paid less than $600 in interest or if you don’t receive a statement, you should contact your servicer to determine the exact amount of interest paid on your student loans.

To determine what company or companies serviced your loans or how to contact them if you don’t receive a statement, sign into the National Student Loan Data System .

Don’t Miss: Bayview Loan Servicing Charlotte Nc

The Federal Employee Student Loan Forgiveness Isnt Available To Everyone

The crucial thing to remember is that the agency determines whether or not funds are available and for whom they are accessible. As a result, unlike Public Service Loan Forgiveness, its not available to every full-time employee in the public sector.

Your employer must offer a program, and you must meet and satisfy the eligibility standards listed below.

Though forgiveness for government employees might be a significant benefit, with a total reward of up to $60,000, one potential issue could be a larger tax burden. Unfortunately, student loan repayment aid is not tax-exempt and must be reported on your tax return as part of your gross income.

Why Might I Have Multiple Student Loan Servicers

If you have multiple student loans, chances are you have multiple student loan servicers. For example, if you have two or more federal student loans, the Department of Education may assign more than one loan servicer to handle your accounts.

Likewise, if you have private student loans with different lenders, you could have a different servicer for each loan. When dealing with multiple student loan servicers, you might consider automating payments to ensure you dont miss any payments.

Also Check: Diy Loan Agreement

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Should I Do Fixed Or Variable Student Loan

Servicer Of Your Federal Student Loans

Your federal student loans may or may not all be with Nelnet or another servicer. It’s important that you know which servicer provides customer service for each of your student loansand it’s simple to verify. You can access all of your federal student loan data at StudentAid.gov by logging in with your FSA ID. To create or update an FSA ID, visit FSAID.ed.gov.

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Don’t Miss: Marcus Goldman Sachs Loan Reviews

Can I Switch Student Loan Servicers

You cant change your student loan servicer because you’re dissatisfied with your current loan servicer. But you might receive a new loan servicer when you refinance, consolidate, or make other changes to your student loans.

If youre consolidating multiple federal student loans into a single loan, you can select the loan servicing company youd like to work with when you apply. Along the same lines, if you’re an employee of a public entity and you sign up for Public Service Loan Forgiveness, FedLoan Servicing will become your servicer until its contract expires.

Also, when you refinance your student loans with a private lender, youll be working with a new lender and servicer.

Remember, no matter who your loan servicer is, its a private company whose options may not always be the best fit for you. Look out for your own best interests by understanding the terms of your loans, and always ask questions if youre unsure about your loan servicing options.

If refinancing is the right option for you, Credible lets you easily compare student loan refinance rates, all in one place.

How Can I Get A New Loan Servicer

If you want to switch loan servicers, you can get a new one by consolidating your loans with a Direct Consolidation Loan or by letting your servicer know you plan on applying for PSLF. Otherwise, youre stuck with your current loan servicer.

The only other way to get a new servicer is to refinance your student loans with a private lender. However, youll lose out on federal loan benefits like PSLF and income-driven repayment plans.

Don’t Miss: Fha Maximum Loan Amount Texas

What Are Student Loan Servicers Responsible For

Student loan servicers are required to assist you with repayment. Theyre in charge of:

- Sending you student loan bills

- Helping you sign up for auto-pay, which lets you make payments automatically from a bank account. This typically comes with an interest rate discount of 0.25%. Some private lenders offer a higher discount if youre also a banking customer.

- Giving you guidance on repayment options, including switching federal student loan repayment plans if you need a lower monthly bill

- Postponing payments for a period of time if youre unemployed or experience other financial hardships. You can do so through the federal governments deferment and forbearance programs the option you qualify for will be based on the circumstances of your financial hardship. Private student loans also offer forbearance but typically for shorter periods of time.

- Confirming your eligibility for federal student loan forgiveness programs

- Consolidating your federal student loans into a single loan, which qualifies you for certain repayment options and can help you better keep track of your loans

Student loan servicers also must apply any extra payments you make to your account in the way you choose. For instance, your servicer may let you decide whether the extra money should go to your current balance or to a future payment. Youll save the most money on interest by requesting your payment go toward your balance, rather than advancing your due date.

Tips For Dealing With Your Loan Servicer

The Department of Education Ombudsman gives these tips for staying in touch with loan servicers:

It is usually best to communicate with your loan servicer in writing, because youll have a physical record of what has been said and done.

- Keep careful notes of all conversations you have. Follow up in writing so you have a physical record of what has been said and done.

- Request a copy of your customer service history some loan servicers make available copies of the notes that customer service representatives make on your account.

- When you speak with someone on the phone, make a note of whom you speak to and when, and what was said. When you use mail, keep a copy of your letter and of any replies you receive.

- Save the originals of all receipts, bills, letters, and e-mails regarding your account. Provide copies of the originals if you are asked for them. Send letters via certified mail, with a return receipt requested.

- Dont let the emotion of the moment get to you. If you are not getting a proper response to your questions, calmly explain again what information or resolution you are seeking.

- Be polite and courteous, but dont be afraid to give the detail of any incident and to state your concerns. Write down the facts in the order they took place and stick to what is relevant. Include important details such as your account number at the top of your letter.

- Ask for a response in a reasonable time, and be sure to tell the customer service representative how you can be reached.

You May Like: How To Transfer Car Loan To Another Bank

What Student Loan Servicers Do

Student loan servicers handle billing, customer support, repayment plans, and other services for federal student loan debt, including:

- Tracking your loans while borrowers are in school

- Collecting monthly student loan payments

- Processing requests to pause payments using deferment or forbearance and to change repayment plans

- Helping you understand your student loan repayment options

- Setting up autopay using bank account routing and account number

- Processing applications for cancellation, discharge, and loan forgiveness programs

- Maintaining loan records and answering questions about student loan bills

- Providing customer service support to borrowers

- Issuing From 1098-E tax forms to deduct student loan interest on tax returns

Note: Applying for a student loan forgiveness program could mean getting a new servicer. For example, certifying your employment for the Public Service Loan Forgiveness Program will cause your loans to be assigned to FedLoan Servicing.

How To Contact Lenders Directly

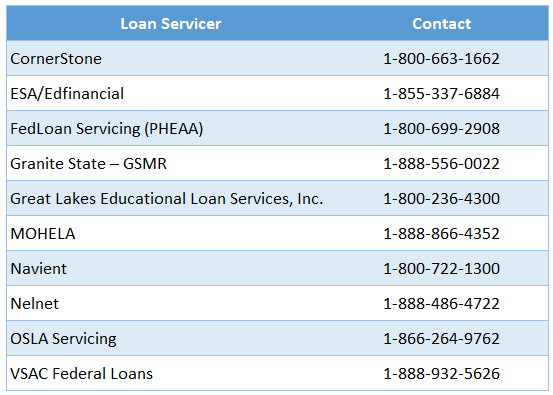

You can find loan servicers for federal loans made through the William D. Ford Federal Direct Loan Program and the Federal Family Education Loan Program here:

You can contact lenders directly using the following info:

FedLoanServicing , , 800-699-2908

Granite State GSMR, , 888-556-0022

GreatLakes Educational Loan Services, Inc., , 800-236-4300

Recommended Reading: What Is The Fha Loan Limit In Texas

Navient Borrowers: Meet Your New Student Loan Servicer

Sydney Lake

Itâs official: Navient is out of the federal student loan servicing game, effective immediately. The U.S. Department of Education on Wednesday approved the companyâs proposal to transfer loan servicing of 5.6 million Education Departmentâowned student loan accounts to Maximus, a federal contracting company.

In late September, education loan management company Navient announced its plans to stop servicing federal student loans held by the Education Department, passing off its business to Maximus. Navient will hold on to its private student loan servicing business, however.

âWe are confident this decision is in the best interest of the approximately 5.6 million federal student loan borrowers who will be serviced by Maximus and will provide the stability and high-quality service they deserve,â Richard Cordray, Federal Student Aid chief operating officer, said in a statement on Wednesday.

Why does the Education Department have such faith in Maximus, a company thatâs seemingly an outsider to federal student loan servicing? Hereâs what we know.

The New Servicer Standards

The FSA’s new standards indicate that in the new year, federal loan servicers will be assessed by how effective a servicer is at keeping borrowers from falling behind on their payments and across measures of customer service including the percentage of borrowers who end a call before reaching a customer service representative by phone and whether servicers process borrower requests accurately the first time.

“Student loan servicers will now have strong financial incentives to provide quality service to their customers,” reads the announcement, referencing contract renewals. “When the new contract terms go into effect, FSA will also require servicers to maintain core call center hours, including Saturdays, to make customer service representatives more accessible for borrowers. Further, FSA is requiring loan servicers to increase the number of Spanish-speaking customer service representatives.”

Going forward, student loan servicer contracts will “expressly prohibit loan servicers from shielding themselves from lawsuits brought to hold the companies accountable in court for poor servicing practices.”

“There will certainly be some bumps with a big service or change like this,” says DiLorenzo. “But I think at the end of the day, people are going to be in a better situation.”

Don’t miss:

Also Check: Conventional 97 Loan Vs Fha

Pay Off Federal Student Loans Anyway

If you don’t have other debts to speak of but you have some extra cash, it can also make sense to continue paying off your federal student loans during the deferment period. The fixed 0% interest rate ensures every penny you pay toward federal loans goes toward the principal of your balance right now. This means you can save money by not paying interest on those balances later, and you can also speed up your repayment timeline.

Just keep in mind that amounts you pay off won’t be eligible for student loan forgiveness if it ever comes to fruition. While President Biden is currently considering taking executive action to forgive a certain amount of student loan debt per borrower, an official decision has not yet been made.

What Happens If I Get A New Student Loan Servicer

You will start making student loan payments only when you get a new student loan servicer. Until then, continue to send payments to your current student loan servicer. Once you get a new student loan servicer, you will want to update autopay information. Also make sure to update your income and family size, which could affect your monthly student loan payment if youre enrolled in an income-driven repayment plan.

While your student loan servicer may change, one thing that wont change is the start date for federal student loan payments. Student loan relief will end definitively on January 31, 2022. Make sure youre prepared and fully understand your options for student loan repayment. Here are some popular options to save money on your student loans:

Read Also: Pre Approved Capital One Auto Loan

What Will Happen If My Loans Are Transferred To A New Servicer

In some instances, you may see some changes in your monthly payment amount or payment schedule. This is due to the different operating procedures at each servicer.

As a borrower, you should monitor this carefully and contact the servicer if you have any questions or don’t understand any changes. The servicer is there to assist you and to make sure you understand any changes to your loans.

There may be a delay in having access to your loan information online when the transfer takes place. Once the new servicer receives your loan information, they review the file and upload the information to their system. This process can take up to 14 business days. It is important to be patient during this process and to keep in communication with your servicer, allowing time for the transfer to be completed.