The Student Loan Payment Restart Was Delayed Heres What To Do

Payments are now on hold until May 1. President Biden wants borrowers to get into more affordable payment plans if they need to.

- Read in app

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

The reprieve that federal student loan borrowers received almost two years ago is getting a little longer.

President Biden has extended the timeout to May 1, so almost 27 million borrowers with federal student loans will no longer be expected to restart their payments in February.

Those loans have essentially been frozen in time since March 2020 because of the pandemic. Most federalborrowers havent had to pay a bill, their loans stopped accruing interest, and those in default received a break from collections.

Mr. Biden asked borrowers to prepare for payments to resume. In a statement, the Education Department said the pause would provide additional time to ensure their contact information is up to date and to consider enrolling in electronic debit and income-driven repayment plans to support a smooth transition to repayment.

Thats good advice, especially if the upheaval of the past two years means your personal circumstances and financial life look entirely different today. If youre anxious about making payments again, you have plenty of options and now is the time to thoroughly evaluate them.

Heres what you need to know about the restart and the payment plans that might help you.

Reservist Status In The Canadian Forces

If you are a reservist in the Canadian Forces on a designated operation you can delay repayment and interest on your student loan.

Complete the Confirmation of Posting Assignment for Full-Time Students form and submit it with your loan application to maintain your interest-free status. Make sure you attach a copy of your notification of posting instructions that you received from the Department of National Defence.

If you need help with this, contact your provincial or territorial student aid office.

How To Check Student Loan Balance

In the past few years, there has been a huge increase in student loan debt for US students. With the college bubble about to burst, it is important for students to stay on top of their loans and keep themselves from falling into debt. This article covers how to check your loan balance and update any payments or payments due so that you are never late on anything again!

You May Like: Is The Student Loan Forgiveness Program Legit

How To Figure Out Your Total Student Loan Balance

Do you know the total you owe on your student loans? Heres how you can figure out your total student loan balance.

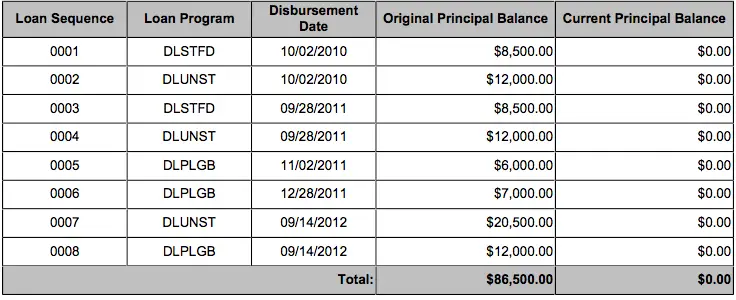

Paying for college with student loans has become the norm, but unfortunately things can get confusing quickly when you take on student debt. Thats because most students dont get just one student loan — they get new student loans for each semester or school year and have a mix of different kinds of federal and private student loans.

When you have multiple student loans to pay, and multiple different loan servicers to deal with, its easy to lose track of the total loan balance you owe. The problem is, unless you know what your loan balance is, its really hard to make a payoff plan or even estimate what your monthly payments will be. In a worst-case scenario, paying some of your loans could slip through the cracks and you could end up late in making loan payments.

Youll want to make sure you know your total student loan balance so you dont end up making costly mistakes — but how exactly can you figure out the total you owe? There are a few different steps you may need to take depending on what kinds of debt youve taken on.

What Happens Before Default

Before federal student loans default, they enter a status known as delinquency. Loans are considered delinquent as soon as you miss a payment, although your servicer wont report these late payments to credit bureaus until 90 days have passed.

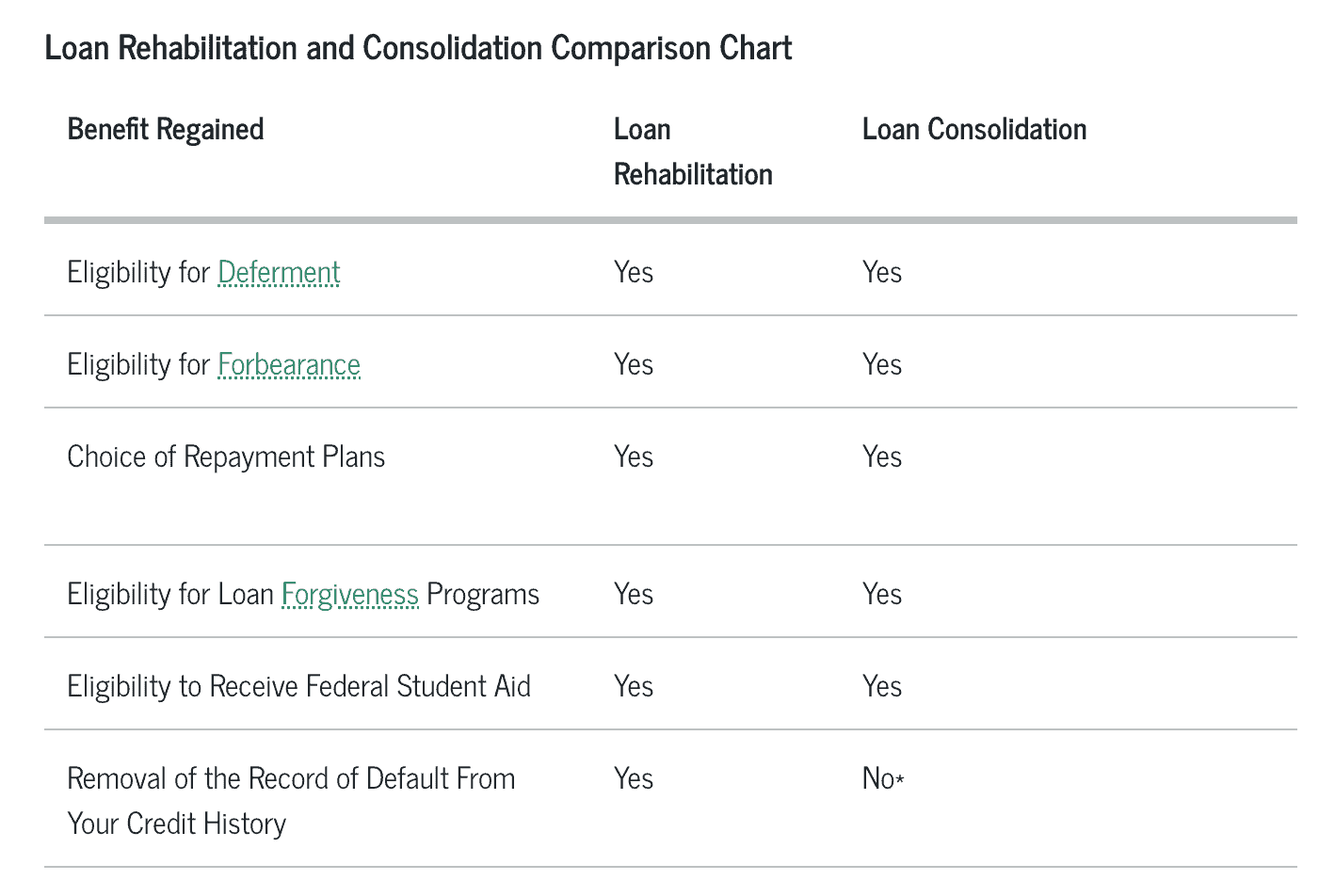

Delinquent federal student loans are eligible for postponements and repayment plans that could make payments more affordable, such as income-driven repayment, deferment and forbearance. You cannot use these options once loans default, so contact your servicer immediately if you fall behind on your payments.

Many private lenders will help you catch up on payments by temporarily lowering your monthly payment or allowing you to pause repayment with a deferment or forbearance.

» MORE:Deferment or forbearance: Which is right for you?

Recommended Reading: What Does Carmax Pre Approval Mean

Checking Your Private Student Loan Balances

Each private student lender handles loans differently theres no national database for private loans. If youre unsure where to start, use these tips:

Your Next Steps To Manage Student Loans

Many borrowers ask: How much do I have in student loans? Now that you know how to find your student loan balance and the name of your student loan servicer, its important to focus on student loan debt repayment. There are many strategies to lower your interest rate, lower your student loan payment, and pay off student loan debt faster. You also may choose to refinance your student loans so get a lower interest rate and get out of debt more quickly. This student loan refinancing calculator shows you how much money you can save when you refinance student loans.

Read Also: Bayview Loan Servicing Reviews

How Do I Find Out If I Owe Student Loans

Ask your school for help: If youre having trouble tracking down your loans, talk to your universitys financial aid office. They can help you identify who currently manages your debt. Check your credit report: Credit reports list all of your current and past credit obligations, including student loans.

Earn Credit Card Rewards For Paying Student Loans

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Student loan debt is now one of the most extensive forms of consumer debt in the country. According to data from the U.S. Department of Education, as of 2021, approximately 42 million have student loan debt totaling roughly $1.59 trillion in the United States. The average student graduated in 2021 with roughly $39,351 in student loan debt.

If you have to repay tens of thousands of dollars in the years to come, wouldnt it be nice to earn rewards along the way? Getting 1% back would help put some money back in your pocket.

Also Check: Usaa Auto Loan Bad Credit

Lowering Your Monthly Payments

Typically, when you enter the repayment period for your loan, you have up to 91/2 years to repay it.

If you need more time to repay your loan, you can extend the repayment period to 141/2 years. This will lower your monthly payments, but it will increase the total amount you repay because more interest will accumulate over a longer period of time.

Example:

| $167 |

Finding Your Best Strategy For Managing Your Student Loans

Navigating the student loan system is complex and sometimes confusing. But now that you know where to find out your student loan balance, it should be a little easier.

Not only can you use the resources listed above to find out how much you owe on your student loans, but you can also learn details about your interest rate, monthly payment, repayment term and loan servicer.

After gathering all this important information, shift your focus to coming up with a strategy for repayment. A good place to start is with these student loan payment calculators. By crunching the numbers, you can come up with a plan for conquering your debt, and you might even find a way to pay it off ahead of schedule.

Kat Tretina and Paula Pant contributed to this article.

Read Also: Upstart Vs Avant

Can I Go To Jail For Not Paying A Student Loan

Can You Go to Jail for Not Paying Student Loan Debt? You can’t be arrested or sentenced to time behind bars for not paying student loan debt because student loans are considered “civil” debts. This type of debt includes credit card debt and medical bills, and can’t result in an arrest or jail sentence.

How To Find Student Loan Balance For Private Loans

To find your private student loan balance, you may have to do a little more work since theres no centralized system for private loan information.

The first thing to check is your credit report. You can obtain a free credit report once every twelve months. The report will contain information about your loan providers, loan balance and payment history for loans.

This should provide a good start to determine the balances, although credit reports do have mistakes sometimes. If something seems inaccurate, try finding your original loan contracts, then follow up with the loan provider directly.

You can also check with your schools financial aid office for any information they have on loans you received.

Recommended Reading: Drb Student Loan Review

Tell Me More About Income

The rules are complicated, but the gist is simple: Payments are calculated based on your earnings and readjusted each year.

After making monthly payments for a set number of years usually 20, sometimes 25 any remaining balance is forgiven.

Theres a confusing assortment of plans available, and there may even be a new one coming, though probably not for a while. For now, the alphabet soup includes PAYE, REPAYE, I.C.R., and I.B.R. .

Monthly payments are often calculated as 10 or 15 percent of discretionary income, but one plan is 20 percent. Discretionary income is usually defined as the amount earned above 150 percent of the poverty level, which is adjusted for household size. PAYE usually has the lowest payment, followed by either I.B.R. or REPAYE, depending on the specific circumstances of the borrower, said Mark Kantrowitz, a student aid expert.

Theres a dizzying variety of rules. Consider spousal income.

REPAYE has a marriage penalty, while I.B.R. and PAYE will use just the borrowers income if they file a separate return, joint income if they file a joint return, he said. REPAYE, he said, uses joint income regardless of tax filing status.

Got all that?

But they remain a more manageable solution for many borrowers.

Enrolling in I.D.R. now is a great next step, particularly if you lost your job during Covid, or your spouse lost their job and you are experiencing a drop in income, said Mike Pierce, executive director of the Student Borrower Protection Center.

Checking Your Private Student Loan Balance

When it comes to checking the balance on any private student loans, there is no convenient national database like there is for federal loans. If you remember the name of the lender for your private loans, you can contact them directly, and they should be able to help you out.

If you do not remember who the lender or servicer is for your private student loans, you can obtain a list of your outstanding debts by getting a copy of your credit report. You can get a free copy of your report from each of the three major credit reporting bureaus once a year.

Don’t Miss: How Much Car Can I Afford Based On Salary

How To Repay Your Student Loan

Your student loan is taken out of your salary once you earn over £26,575 a year, £2,214 a month or £511 a week before tax.

You repay 9 percent of anything you earn over this amount.

How much you repay isnt based on the total amount you owe, it is based on how much you earn.

For example, someone who earns £2,600 a month will repay £34 every month but someone who earns £3,200 will repay £88 a month. It doesnt matter how much these people owe.

Plan 2 loans, which are for those who started their course in the UK after September 1, 2012, are wiped 30 years after the April you were first due to repay.

When Plan 1 loans get written off depends on where you are from and when you took out the loan it could be when you are 65 years old, or 25 or 30 years after you were first due to repay.

This means you dont need to pay the full amount back if you dont manage to by them, and your student loan does not affect your credit rating.

If someone with a student loan dies, the loan will be cancelled.

If you claim certain disability benefits and can no longer work because of illness or disability, you may also be able to cancel your loan.

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

You don’t need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

Recommended Reading: Unsubsidized Loan Definition

How Can I Avoid Paying Back Student Loans

You can avoid paying more than you owe by changing your payments to direct debit in the final year of your repayments. Keep your contact details up to date so SLC can let you know how to set this up. If you have paid too much the Student Loans Company will try to: contact you to tell you how to get a refund.

Consult With Your School’s Financial Aid Office

Another alternative is to contact your school’s financial aid office if you have federal loans that do not appear on the NSLDS. The staff can dig up information about your previous loans, such as how much you borrowed and who was in charge of servicing it. Using that information, you can get in touch with the servicer to obtain the current loan balance.

Also Check: Do Underwriters Verify Bank Statements

Finding How Much You Owe In Student Loans

Finding your student loan balance is important for a few reasons.

First, because of interest and fees, your current student loan balance may be higher than when you originally took out your loans if youre just starting to make payments. Knowing your current balance helps you shape your budget and determine whether you still have a good rate.

Its also possible that your lender the company that distributes and processes your loans has transferred or sold your loans to another lender. Keeping up with your student loan information helps you know where to send payments.

Read Also: Is Bayview Loan Servicing Legitimate

Paying Those Student Loans Off

It can be intimidating to see those loan balances for the first time especially when youre operating on a just-out-of-school, entry-level salary. If youre feeling stressed about paying off those debts, it may help to explore an income-based repayment plan. These can help you lower your monthly payments until you find your financial footing.

Read Also: Usaa 84 Month Auto Loan

Also Check: Usaa Used Auto Loan

How Much Do I Have To Pay Off My Hecs Debt

You pay back your HELP debt through the tax system once you earn above the compulsory repayment threshold. The compulsory repayment threshold is different each year. The compulsory repayment threshold for the 2021-22 income year is $47,014. The compulsory repayment threshold for the 2020-21 income year was $46,620.

Use Found Money Wisely

If you receive money as a gift, earn a bonus at work or receive extra money you didnt expect, use this found money to make additional payments on your loans. Although you may be tempted to use this money for something more fun, putting it towards your student loans can help you eliminate debt more quickly.

Read Also: Usaa Car Refinance Rates

Do Student Loans Go Away After 7 Years

Student loans don’t go away after 7 years. There is no program for loan forgiveness or loan cancellation after 7 years. However, if it’s been more than 7.5 years since you made a payment on your student loan debt and you default, the debt and the missed payments can be removed from your credit report.

Finding Your Federal Student Loan Balances

You can always access student loan information through your My Federal Student Aid account, where you can find your federal student loan balances under the National Student Loan Data System . This is the U.S. Department of Education’s central database for student aid, and it keeps track of all your federal student loans.

You’ll need a Federal Student Aid ID username and password to log in to the site. The ID serves as your legal signature, and you can’t have someonewhether an employer, family member, or third partycreate an account for you, nor can you create an account for someone else. The NSLDS stores information so you can quickly check it whenever you need to, and it will tell you which loans are subsidized or unsubsidized, which is important because it can determine how much you end up paying after graduation.

If your loans are subsidized, the U.S. Department of Education pays the interest while you’re enrolled in school interest accrues during that time with unsubsidized loans. To qualify for a subsidized loan, you must be an undergraduate student who has demonstrated financial need. Unsubsidized loans are available to undergraduate, graduate, and professional degree students, and there are no financial qualifications in place.

Recommended Reading: Usaa Auto Loan Interest Rates