Loans For Buying Existing Businesses

If you want to buy another business with the goal of actively running it, you might take out a loan to help you do so, and interest payments on that loan will be deductible.

If you want to buy another business but dont expect to actively run it, thats considered an investment, not a business expense. You may or may not be able to deduct interest on that loan, so speak to your accountant to see what your specific situation calls for.

Are Loan Origination Fees Negotiable

Although loan origination fees are unavoidable, they are negotiable. You may be able to negotiate your origination charges down if youre applying for a large loan amount or if you have strong credit.

Sometimes, having a large down payment can also put you in a stronger position for negotiating lender origination fees. Just keep in mind that theres no guarantee a lender will be willing to negotiate with you, but it never hurts to ask.

Can You Deduct Loan Origination Fees On Your Taxes

Related Articles

Owning a home can be an extremely expensive proposition for many individuals across the country. Although mortgage lending opens the door to home ownership for many Americans, monthly mortgage payments are just one of many expenses that must be covered when you close on a property.

There is a silver lining, however. The expenses you pay to initiate mortgage lending, commonly referred to as loan origination fees, are tax deductible for all new homeowners. Recognizing the fact that new homeowners invest a significant amount of money into their home during the early stages of the buying process, the Internal Revenue Service has provided this valuable method for reducing your tax burden during this important time.

Tip

The IRS allows home buyers to deduct some of their upfront costs associated with their new loan, including the loan origination fee.

You May Like: What Credit Score To Get Fha Loan

Do I Have To Pay A Loan Origination Fee

Typically, yes. Its nearly impossible to avoid paying origination costs. Even when lenders advertise no origination fees, the actual origination charge is usually hidden into interest rates or other processing fees. To understand how much youre actually paying in origination charges, ask your lender to be transparent about their policies.

Final Thoughts: Are Loan Origination Fees Tax Deductible For A Business

From the above, your question Are loan origination fees tax deductible for a business? has been answered. Its clear that you can benefit from tax relief on interest charged on business loans. Loan origination fees fall under the category of interest.

Although some situations can limit the amount of interest you can deduct, youll still save some cash. Most importantly, avoid taking personal loans even if you intend to use them for business.

Should your interest situation be a little complex for you, you can engage an accountant. Go for a professional with vast knowledge in tax codes to guide you effectively.

Do you have any question? Feel free to contact us or call 610-5626.

Also Check: Legit Loans For Bad Credit

Fees Deductible Over Five Years

You can deduct certain fees you incur when you get a loan to buy or improve your business property. These fees include:

- application, appraisal, processing, and insurance fees

- loan guarantee fees

- loan brokerage and finder’s fees

- legal fees related to financing

You deduct these fees over a period of five years, regardless of the term of your loan. Deduct 20% in the current tax year and 20% in each of the next four years. The 20% limit is reduced proportionally for fiscal periods of less than 12 months.

If you repay the loan before the end of the five-year period, you can deduct the remaining financing fees then. The number of years for which you can deduct these fees is not related to the term of your loan.

What Is A Loan Origination Fee

A loan origination fee is what the mortgage lender charges you for all the paperwork and documentation thats associated with your real estate transaction. The loan origination fee includes the fees associated with your loan as well as a fee thats paid to the loan officer who initiates and completes your loan transaction.

This fee is only paid if and when the loan funds, therefore part of the loan origination fee serves as a commission to the broker who processed the loan. Loan origination fees are usually broken down into mortgage points, which are a percentage of your loan amount.

Read Also: How To Get Out Of New Car Loan

Loans To Purchase A Business

In the event that the loan you obtain is to purchase an enthusiasm for a partnership or LLC, look for advice on how much intrigue is deductible. The intrigue ought to be allocated among the assets of the company. Its reasoning relies upon the assets the business claims.

The approach of reasoning can be a business cost or venture cost. Premium deducted as a venture cost is increasingly constrained. Cash obtained to purchase a C-corporation is regarded as speculation premium. This applies to small corporations and those whose stocks are not yet traded on an open market.

Can You Write Off Realtor Fees

6) Move to get a bigger tax deduction. Thats because almost every expense associated with moving can be deducted. This includes the cost of selling your old home and purchasing your new home, including realtor commissions, legal fees, even your mortgage penalties are dollar-for-dollar tax deductible.

Also Check: What Will My Auto Loan Interest Rate Be

The Bottom Line: The Us Tax Code Continues To Incentivize Homeownership

Even if you cant deduct all your closing costs, the U.S. tax code still encourages people to buy homes through the mortgage interest and property tax deductions. In addition, refinancing can be a great way to save money on mortgage interest long-term. Ready to take advantage of all the benefits you can be receiving by buying real estate? Read more about the tax advantages of real estate and see how you can make the most of real estate tax breaks.

Consolidate debt with a cash-out refinance.

Your home equity could help you save money.

Banks Win Tax Battle Over Loan Fees Deduction

| By , J.D., LL.M., Managing Editor and Tax Law Analyst for CCH’s Federal Tax Guidance Group, contributing author, CCH FOCUS. |

The banking industry won the latest round in an important battle waging on an unlikely frontthe Internal Revenue Services treatment of loan origination costs. The U.S. Court of Appeals for the Third Circuit recently entered the fray and decided in favor of banks being allowed to deduct these expenses in the year incurred, rather than having to capitalize them over the life of the loans . This ruling overturns an IRS victory in the Tax Court, distinguishes two Supreme Court cases and runs counter to established financial accounting standards.

Recommended Reading: How To Figure Out Car Loan Interest Rate

Itemized Deductions And Schedule A

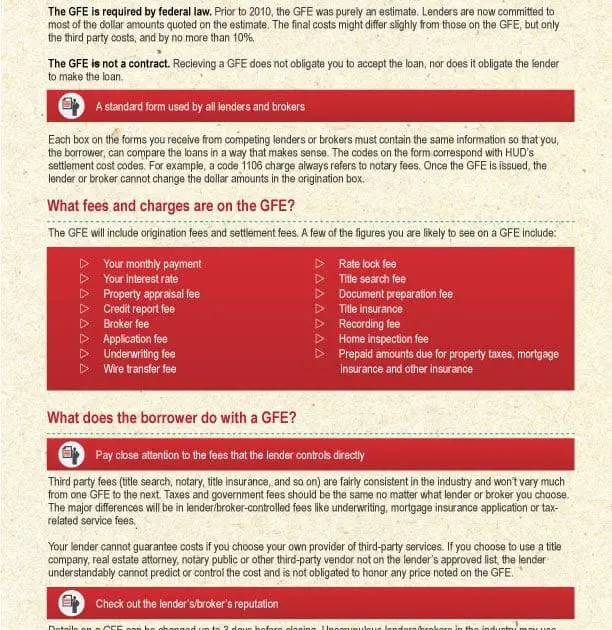

Mortgage lenders charge “origination fees” and other closing costs to borrowers, and the lenders use these fees to cover their business costs. The IRS allows taxpayers to deduct these fees, as well as loan interest and “points.” The borrower deducts the origination fees on Schedule A, which lists the amount and type of all deductible expenses. Loan origination fees charged by lenders for reverse mortgages are also deductible.

How Much Mortgage Interest Can I Deduct

You can still deduct the interest you pay on your mortgage loan each year. But the Tax Cuts and Jobs Act did place some limits here, too. If you purchased your home before December 16, 2017, when the act went into effect, you can deduct the interest payments you make on up to $1 million in mortgage debt. If you bought your home after that date, you can deduct the mortgage interest you pay on up to $750,000 in mortgage debt.

Also Check: How Much Interest Is On An Unsubsidized Loan

What Are Itemized Expenses

Itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses from a Federally declared disaster. You may also include gifts to charity and part of the amount you paid for medical and dental expenses.

Can Origination Fees Be Changed

An origination fee is what the lender charges the borrower for making the mortgage loan. The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. … Origination fees generally cannot increase at closing, except under certain circumstances.

Recommended Reading: Is Prosper Personal Loan Legit

Other Typical Names Under Origination Fees:

Origination fees sometimes have different names depending on the lender. These fees may all be bundled into one line term or itemized. Some of the common names you might find the origination fees under include application fees, underwriting fees, or processing fees. Whatever term is used by the lender, it typically includes fees for the following tasks:

- Collecting the documents you need and organizing them.

- Verifying that all of the documents youve provided are accurate.

- Requesting the necessary information from employers, IRS, and other organizations or individuals.

- Analyzing all of your qualified income, such as self-employment earnings, deductions, rental income, and more.

- Making sure that your application meets the requirements if youre applying for government-backed loan programs.

Deducting Home Loan Origination Fee From Your Taxes Through The Point System

Although there are some restrictions, you can write off the interest that you pay on your home mortgage. You might wonder if its worth paying for discount points to lower your interest ahead of time if it eliminates the ability to write off a higher interest rate. Fortunately, the IRS considers both discount points and loan origination fee points as pre-paid interest, which means you can write off the points as mortgage insurance.

Also Check: How To Get Out Of Loan Debt

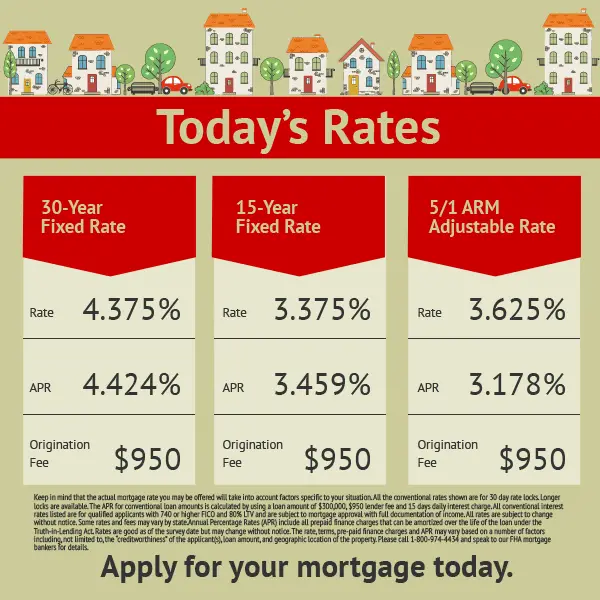

How Much Do These Fees Cost On Average

On average, home buyers pay 1% of the loan amount in the form of an origination fee. For example, on a loan of $300,000, a 1% origination fee would come out to $3,000. So the more money you borrow, the higher the fee.

If your lender is charging you a mortgage origination fee much higher than 1%, you should ask them why. This would be considered an above-average cost in today’s market, and would therefore require some investigation on your part.

You should also keep an eye out for something called the mortgage broker fee. This is money paid to the broker who acts as a middleman between the borrower and the lender. You should only be charged one or the other — but not both. So if you receive a Good Faith Estimate form that shows both a mortgage origination and a broker’s fee, you should ask some questions. In most scenarios, you would only pay one or the other.

Bottom Line On Origination Fees

The origination fee is a key factor in determining your total borrowing cost. Not all lenders will tell you the origination fee , and not all will disclose it in the same way. For example, it may be a percentage or a flat fee. Before committing to anything or signing any documents, you need to make sure you understand the origination fee and include it in your calculations.

Knowing the APR of a loan or other financing product enables you to figure out the true cost of that financing over a year. As a result, you can compare different types of financing accurately and choose the product thats the best fit for your small business.

See Your Business Loan Options

Also Check: Federal Employee Payroll Deduction Loan

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Are Loan Origination Fees Tax Deductible For A Business

Loan origination fees are charged at a rate of 0.5% to 1% of the loan value. However, businesses often pay at a rate of 1% to 6%. One question that commonly arises is: Are loan origination fees tax deductible for a business?

With the wide variety of lending institutions available today, the fees are at the discretion of the lender. Most non-traditional lending companies allow you to negotiate the origination fees. They will also guide you on fees that are tax deductible and those that are not.

Keep on reading to learn more!

Read Also: What Does Pre Qualified Loan Mean

Is Your Loan Origination Fee Tax Deductible

Buying a home comes with tax benefits, but its important to know what is and isnt tax deductible. Learn whether your loan origination fee is tax deductible.

One of the lesser known benefits of becoming a homeowner is the tax deductions you will receive. However, knowing what homebuyer costs qualify for a tax deduction can be confusing. You undoubtedly signed a mountain of paperwork at your closing, but do you really know what you signed?

Assuming you dont buy homes regularly, you arent expected to know all the finer pointsthats what your real estate agent is for. But now that youve closed on your house, moved in, and have finally gotten settled, its time to look at the future implications of your purchase.

When its time to file your taxes, youll need to go back to your closing documents to determine what your allowable deductions are and how you need to properly file them in your tax return. Were going to cover one piece of the closing cost puzzlethe loan origination fee.

Where Can I Find Deductible And Non

You can find out which loan origination fees are deductible and which ones arent by looking at the settlement statement you signed at your closing. The settlement statement should clearly identify the prepaid interest, which will help you separate the two types of fees. Remember, you can deduct the prepaid interest on your loan, but you cant deduct the other miscellaneous fees such as the appraisal and title fees, the legal fees, or any of the prepaid property taxes.

Also Check: Student Loan Monthly Payment Calculator

Which Closing Costs Are Not Tax

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes. Other closing costs are not. These include:

- Owners title insurance

There is one tax benefit to these costs, though. You can add these closing fees to the cost basis of your home when you sell it. This lowers the amount of profit that you make. This can help reduce any capital gains tax you might have to pay on your home.

When you sell a home, you won’t have to pay capital gains taxes on the first $250,000 of your sale if you are single or $500,000 if youre married. For example, if youre married and sell your home for a $300,000 profit, you wont have to pay any capital gains taxes on it.

However, if youre married and sell your home for $600,000, youd have to pay capital gains taxes on $100,000 of your home sale. You can, though, as we just mentioned, reduce this tax burden by adding your cost basis thats where your loan closing costs come in and the costs of any improvements that you made to the home.

Tax Tip: Student Loan Interest Deduction

Out of all of the seasons that we look forward to throughout the year, tax season is generally not one of them. All of the forms, calculations, and software needed for filing can get exhausting. But the best part about it is the opportunity to maximize your return, and student loans can play an important role in doing so. Depending on the type of loan, a student loan interest deduction may be available. Ask your tax professional and possibly a financial aid advisor at your institution to discover how you can take advantage of the opportunity.

You may deduct up to $2,500, which is equivalent of up to $500 reduction in your tax liability depending on the federal tax bracket you belong to. A qualified loan must have been taken out for the singular purpose of paying education expenses and cannot be from a related person or made under an eligible employer plan. Many of us also use credit cards regularly to pay for supplies and fees.

Don’t Miss: First Time Home Buyers Loans

Are Mortgage Discount Points Tax Deductible

Most homebuyers take out a mortgage to pay for the purchase of a home. Typically, mortgage lenders charge borrowers certain up-front costs, known as loan origination fees, at the closing. To make a loan origination fee deductible, it must represent prepaid mortgage interest, also known as points.

TL DR

Points, or prepaid mortgage interest charges, are the only loan origination fees that are tax deductible.

What Is A Mortgage Origination Fee

What is a mortgage origination fee? In simple terms, it is the cost of doing business with a lender. It’s a fee charged by a broker or lender for originating a home loan. In this context, “origination” is just another word for creation. The lender is charging you a certain amount of money to create — or originate — your home loan.

These fees are generally expressed as a percentage of the total amount being borrowed. The bigger the loan, the bigger the fee. They are typically paid up front, as part of the borrower’s closing costs .

The mortgage origination fee makes up the bulk of the lender’s up-front profit. Many of the other closing cost fees you pay at closing will go toward other people besides the lender. For example, title-related fees will be paid to the title company, appraisal costs are paid to the appraiser, etc. The origination fee is how the lender makes money on the front end of the transaction.

Don’t Miss: How Much Down Payment Needed For Fha Loan