Attorney Student Loan Forgiveness Program

This program is for attorneys who work for the U.S. Department of Justice. The Department anticipates selecting new attorneys each year for participation on a competitive basis and renewing current beneficiaries during existing service obligations, subject to availability of funds. ASLRP benefits are paid directly to the loan holder, not to the individual attorney. Initial acceptance of ASLRP funding triggers a three-year service obligation to Justice.

You can learn more about this program here.

Related: Don’t forget to check out our full guide to Student Loan Forgiveness for Lawyers.

Financial Assistance For Current Teachers

- Teacher Loan Forgiveness is available for teachers who have Direct Subsidized Loans, Direct Unsubsidized Loans, Subsidized Federal Stafford Loans, and Unsubsidized Federal Stafford Loans.

- To meet the eligibility requirements for this program a teacher must have been:

- Employed as a full-time, highly qualified elementary or secondary teacher for five complete and consecutive academic years, and

- Employed at a designated low-income school during this period.

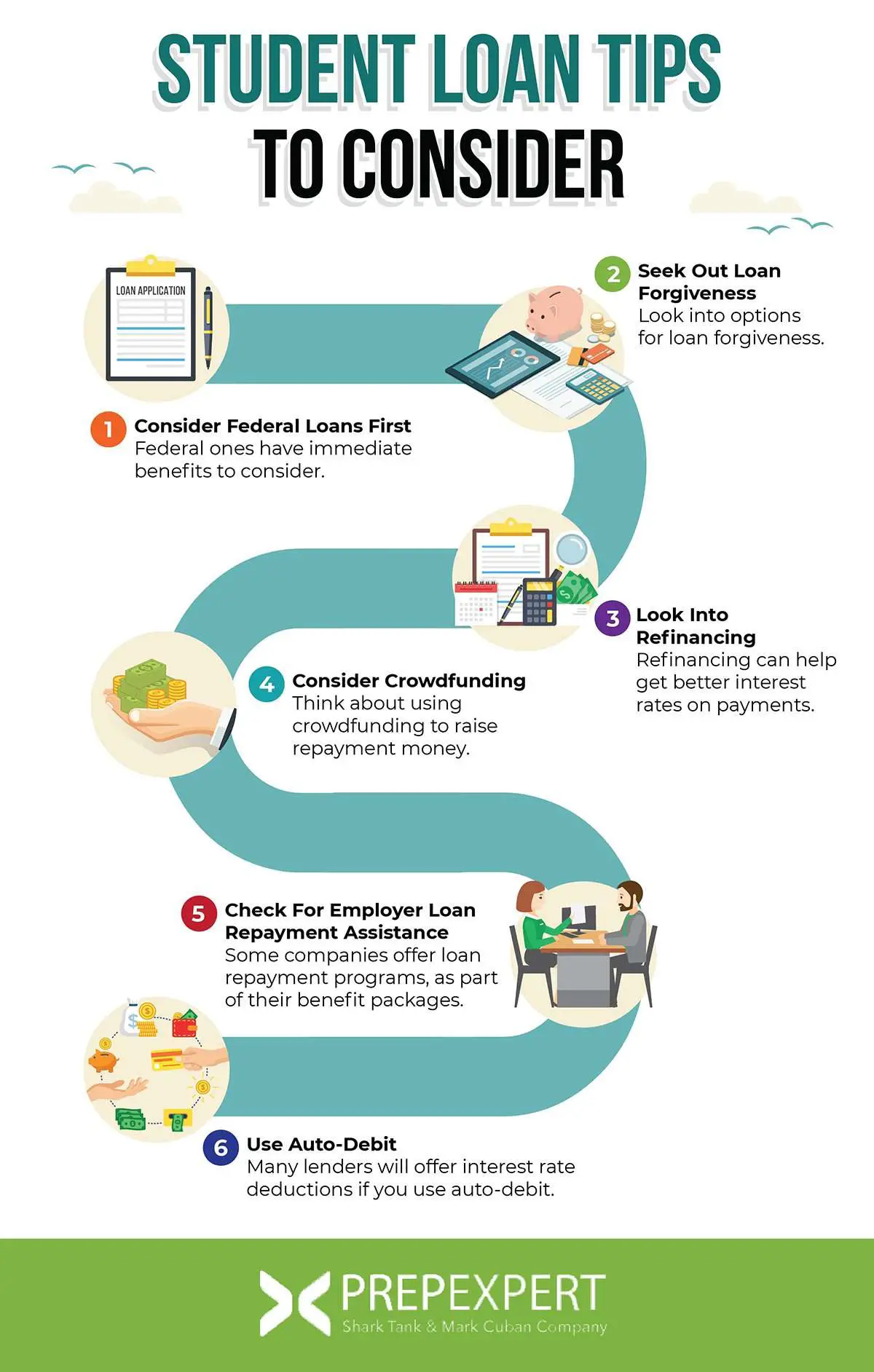

How Do I Check Which Federal Loans I Have

If borrowers are unsure about what type of loan they have, they can request that information from their loan servicer or they can check on the federal government’s website for financial aid, according to Betsy Mayotte, president of the Institute of Student Loan Advisors.

If you don’t know what kind of federal loans you have, you can see which loans by logging into your account on StudentAid.gov, going to the My Aid page and scrolling down to the Loan Breakdown section.

Recommended Reading: California Mortgage License Requirements

Nurse Corps Loan Repayment Program

If you work in an underserved community, you might be eligible for the NURSE Corps Loan Repayment Program. You can get up to 60% of your student loans paid over two years of employment. If you work for a third year, you could qualify for forgiveness toward another 25%.

What are the requirements?

To qualify for the NURSE Corps Loan Repayment Program, you must be a registered nurse, nurse practitioner or nurse faculty member. Nurses must work in a critical shortage area and serve a high-need population. Nurse faculty members must be at an accredited school of nursing.

How do you apply?

Applications are accepted once a year, and guidelines are updated annually. Check the program requirements and guidelines ahead of time and make sure to turn in your application on time.

How To Get This Student Loan Forgiveness

The Public Service Loan Forgiveness cancels federal student loans if you meet several requirements. For example, you must work full-time for an eligible public service or non-profit employer, enroll in an income-driven repayment plan and make at least 120 monthly student loan payments. After meeting eligibility requirements, the remaining balance of your federal student loans will be forgiven. To count prior student loan payments that were deemed ineligible, you can complete a limited waiver for student loan forgiveness, which is available through the U.S. Department of Education. This limited waiver is available through October 31, 2022. This limited waiver will allow you to count previous payments to help you meet the 120 monthly payments requirement. Make sure to submit an Employer Certification to the Education Department annually and each time you change employers.

Read Also: Can I Buy Two Houses With Va Loan

Do Private Student Loans Go Away After 7 Years

Unfortunately, private student loans dont ever go away. What you borrow is what youll have to pay back along with interest and potential fees.

Only federal student loans are eligible for student loan forgiveness programs, such as Public Service Loan Forgiveness or income-driven repayment forgiveness.

Additionally, the suspension of payments and interest accrual under the CARES Act due to the COVID-19 pandemic is available only for federal student loans.

Tip:

For example, you might be able to access emergency deferment and forbearance options if youve been negatively impacted by COVID-19 and have private student loans. If youre struggling to make private student loan payments, be sure to contact your lender to see what assistance might be available to you.

Learn more: Debt Relief Programs: Options to Reduce Debt

Repayment Plan Based Student Loan Forgiveness

These student loan forgiveness plans are tied to your student loan repayment plan. If you’re on one of these qualifying repayment plans, you’ll be eligible for student loan forgiveness at the end of your repayment term.

Most borrowers qualify for student loan forgiveness through one of these “secret” ways. The secret is simple: sign up for a qualifying student loan repayment plan, and any remaining balance on your loan will be forgiven at the end of the plan.

It’s important to note that these income-driven repayment plan options due have some criteria that must be met to be eligible. If you have no remaining balance at the end of the loan term, you get no student loan forgiveness.

It’s also important to note that the student loan forgiveness on these plans is typically considered taxable income. However, President Biden made all loan forgiveness and discharge tax-free Federally through December 31, 2025. Learn more about taxes and student loan forgiveness here.

You can apply for these repayment plans with student loan forgiveness by calling your lender or going online to StudentLoans.gov.

Recommended Reading: How Much Can I Qualify For A Car Loan

Which Navient Student Loans Do You Have

First of all, you should keep in mind that Sallie Mae loan forgiveness is completely different from Navients loan forgiveness programs. They both have different loan programs, co-signer options, repayment options, credit score requirements, and education loans.

Because Navient does federal loan servicing, as well, you have to separate your private loans from your federal loans . Since there are different forgiveness programs for each type of loan, it makes a huge difference.

If you dont remember which type of student loans you took out, you can always call Navient and inquire from them directly. Alternatively, you can check with the federal governments National Student Loan Data System by conducting a Financial Review.

Its best if you have federal loans since that makes you eligible for federal forgiveness programs, provided youve been making your monthly payments. However, private student loans are subject to the rules of the company that provided the direct loan. Private student loans can be eligible through the state, or in some cases, profession-specific forgiveness programsif youve been regularly making the student loan payments.

Furthermore, check if Navient is your loan servicer. Just log in on the federal student aid website with your FSA ID and check your current ED servicer. Itll most likely be Navient. However, it could also be FedLoan Servicing, Nelnet, or the Great Lakes Higher Education.

National Health Service Corps

The National Health Service Corps offers tax-free loan repayment assistance to support qualified health care providers who choose to take their skills where theyre most needed.

Licensed health care providers may earn up to $50,000 toward student loans in exchange for a two-year commitment at an NHSC-approved site through the NHSC Loan Repayment Program .

Accepted participants may serve as primary care medical, dental, or mental/behavioral health clinicians and can choose to serve longer for additional loan repayment support.

Priority consideration is given to eligible applicants whose NHSC-approved site has a HPSA score of 26 to 14, in descending order. Eligible applicants may receive up to $50,000 in loan repayment for an initial service commitment until funding is exhausted.

You can learn more about this program here.

Read Also: Transfer Car Loan To Another Bank

Will Student Loans Be Forgiven In 2021

In 2021, the federal government under President Biden has forgiven nearly $12 billion in federal student loans for borrowers under current programs, including:

- $1.5 billion for borrowers who attended schools that misled them or engaged in misconduct, e.g., ITT Tech students

- $4.5 billion for public service workers who made payments on non-qualifying FFEL Loans, late payments, and payments for less than the full amount

- $5.8 billion for borrowers who have a total and permanent disability

The Biden administration is still pursuing loan forgiveness. In a wide-ranging interview, Education Secretary Miguel Cardona said that he ârecognizes student loan debt is holding people backâ and that âpart of the conversation is examining loan forgiveness.â

However, it remains unclear whether Pres. Biden will use his executive authority to authorize widespread student loan forgiveness with the flick of a pen. While the Department of Education has recently released a memo titled, âThe Secretaryâs Legal Authority for Broad-Based Debt Cancellationâ, weâre unable to determine where that authority stops. The memo was heavily redacted. And despite clamoring for student loan debt relief, President Biden has held steadfast in his refusal to use his executive powers.

Faculty Loan Repayment Program

The Faculty Loan Repayment Program from the Health Resource and Services Administration helps recruit and retain health professions faculty members by encouraging students to pursue faculty roles in their respective health care fields. This is vital for preparing and supporting the next generation of educators.

You can receive up to $40,000 in student loan repayment, along with extra money to help offset the tax burden of the program.

You can learn more about this program here.

You May Like: What Credit Bureau Does Usaa Use

How Can You Qualify For A Closed School Loan Program

You are now aware of the fundamental requirements to qualify for closed school discharge for Westwood college. That being said, there are some other criteria you should meet to get the cancellation of your loans through a closed school program.

Initially granted, you should ensure that you were not enrolled at another school studying a similar program there, after having transferred your credits from Westwood. Second, you cannot have finished all the coursework but havent gotten your diploma due to the school closure. So, if you have completed all the tasks and the only thing left was receiving your diploma, you will not qualify for this discharge program.

Now think if you meet both of the requirements mentioned above. If yes, then I do not see any reason why you would not be eligible for Westwood college loan forgiveness.

Public Service Loan Forgiveness Program

The Public Service Loan Forgiveness Program is designed for people working full-time in public service jobs, either for the government or a nonprofit organization.

- Who qualifies: All full-time employees of the local, state, or federal government or qualified non-profit organization. For example, charter school teachers, professors, police officers, military service members, nurses, etc. Hereâs a list of qualifying employers.

- Which loans are eligible: All Direct Loans, including Direct Parent PLUS Loans, and, if consolidated, FFEL and Federal Perkins Loans.

- How to apply: Before applying for PSLF, you have to make 10 years of qualifying payments towards Direct Loans while working full-time in public service. Once youâve done those things, you can submit a PSLF Employment Certification and Application Form to your loan servicer.

- How long until loans are forgiven: At least 10 years. You have to make 120 monthly payments before youâre eligible.

Recommended Reading: Mortgage Originator License California

Teacher Loan Forgiveness Program

Student loan forgiveness for teachers is neither generous nor easy to qualify for. Teachers can have up to $17,500 of their federal direct and Stafford student loans forgiven by teaching for five complete and consecutive academic years at a qualifying low-income school or educational service agency. Loans that were issued before Oct. 1, 1998, are not eligible.

You must be classified as a highly qualified teacher, which means having at least a bachelor’s degree and having full state certification. Only science and math teachers at the secondary level, and special education teachers at the elementary or secondary level, are eligible for $17,500 in forgiveness. Forgiveness is capped at $5,000 for other teachers.

You can qualify for both teacher and public service loan forgiveness , but you can’t use the same years of service to be eligible for both programs. So you’d need 15 years of teaching service to qualify for both programs, along with meeting all the specific requirements to earn each type of forgiveness.

Which Program Is Better For You

Ideally, there is not any massive difference between these two programs for Westwood college loan forgiveness. Both of them will benefit you almost at the same level. That said, I would be a little inclined to go for the closed school loan program. Well, mainly because it will take more time with the application of the Borrowers Defense Discharge. Also, I believe that closed school loan forgiveness programs are relatively easier to get approved. Therefore, I would choose it over the first option.

Don’t Miss: Capital One Auto Loan Private Party

How To Apply For Itt Tech Student Loan Forgiveness

If you’re a defrauded former ITT Tech student, you’ll want to apply for loan forgiveness through a closed school discharge application.

There are two ways to complete the closed school discharge application:

If you received a closed school loan discharge application from your loan servicer, complete and return the form as you’re directed.

Fill out this application from Federal Student Aid and send it to your loan servicer.

Alternatively, you can contact your loan servicer directly and ask for assistance in the application process.

Help For Teachers And Medical Professionals

Theres further assistance for teachers in the Teacher Loan Forgiveness Program, which targets teachers educating kids from low-income backgrounds and may be able to get you up to $17,500 to use toward loan repayment. And teachers can seek out loan repayment assistance for teachers offered by many states. You often need to have a state license and teach for at least two years.

Additionally, theres student loan assistance for nurses from federal and state programs, like the Nurse Corps Loan Repayment Program, which foots the bill for up to 85% of unpaid nursing education debt. And the National Health Service Corps Loan Repayment Program gives out money to licensed health care providers. Also under NHSC, students in their last year of medical schooling may get loan repayment help through the Students to Services Loan Repayment Program. The Indian Health Services Loan Repayment Program encourages clinicians to work in American Indian and Alaska Native communities by providing repayment assistance on student loans, up to $40,000.

The National Institutes of Health has its own program with aid to medical workers specifically involved in research. Known as NIH LRP, the program can repay up to $50,000 annually of a researchers educational debt.

Also Check: How Much To Spend On Car Based On Income

You Work For The Government Or A Nonprofit Organization

There are three options to get your loans forgiven after working in public service for at least 10 years. The Public Service Loan Forgiveness Program is the main pathway to apply for forgiveness, but few borrowers met the programâs complicated requirements.

Federal lawmakers tried to fix PSLF by temporarily expanding it to count payments made under the wrong repayment plan. But the TEPSLF program helped only a handful more people. It didnât help people with government-backed bank loans known as Federal Family Education Loans.

In October 2021, the Biden Administration temporarily fixed the âwrong loanâ issue by expanding PSLF once more to count payments toward FFEL Loans. The PSLF Waiver offers a limited opportunity to get credit for FFEL Loan payments, late payments, and payments made under an ineligible repayment plan.

- Whose eligible: Youâre eligible if you work full-time for the government or a nonprofit company that provides a qualified public service.

- How to apply: Submit the PSLF & TEPSLF Employment Certification form to FedLoan Servicing.

- When to apply: You can submit the PSLF form to check how many payments youâve made or after youâve made 120 qualifying payments.

- Application:

Learn More:Guide to the Public Service Loan Forgiveness Program

How Should You Write The Application For Borrowers Defense

Westwood college loan forgiveness does not come for free. You should file a claim of Borrowers Defense against Westwood for it. But the point is your statement should be crystal clear, and you should be able to show that you took loans because of their illegitimate behavior.

A representative from the Education Department will be reading your application. It means you have to indicate that you would not have taken that loan if it was not for the deceptive actions you experienced. And those actions were the main motive behind your attendance to the Westwood college.

The good side of the Westwood college issue is it is not something complicated to prove their wrongful act towards you. They have already confessed their fault of breaching consumer protection act.

You May Like: Refinance Car Usaa

Tax Consequences From Student Loan Forgiveness

It’s important to note that while these “secret” student loan forgiveness options could be helpful to some borrowers, for others they may result in tax consequences .

However, President Biden recently signed the American Recovery Act, which makes all loan discharge and student loan forgiveness, regardless of loan type or program, tax free. This is in effect through December 31, 2025. State taxes may vary, so the information below may still apply for your state tax return.

What happens is the forgiven amount of the student loan is added to the borrowers taxable income for the year. So, if you had $50,000 in student loans forgiven under these repayment plans, it is considered income. If you made $35,000 working, your total income for the year would now be $85,000. The result? A higher tax bill.

However, for many borrowers, this tax bill is much more manageable than the original debt itself, so the plan makes sense. Using a very simple example, here is what the tax bill will look like in both scenarios:

As you can see, with these repayment plans, you’ll owe an additional $11,377 in Federal Income Tax in the year you do it. However, that’s cheaper than paying the original $50,000 plus interest. Furthermore, there are options to work out a repayment plan with the IRS if you need to, which may also be helpful in your situation.