How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

How To Calculate The Apr Of A Mortgage

Just like with a credit card, mortgage lenders are required by law to provide an APR to borrowers, so you wont need to figure it out for yourself. If your lender will not give you an APR, walk away and find other loan offers even if the products appear to be a good deal. That is not the kind of lender you want to trust with your mortgage.

The APR of a mortgage includes the loan amount, interest rate, discount points, and other costs of financing a home. You will need to include all these expenses when calculating your APR and finding out how much youll pay over the full loan term.

However, if you want to learn how to calculate the APR, here is a step-by-step guide on how to calculate the APR of a fixed-rate mortgage. For this example, lets say you have a $330K mortgage with a 10-year-term, a monthly payment of $1,500, and that you paid $2,000 in points and $2,000 in origination fees.

Be aware that these steps are for mortgages with fixed rates. It is different for mortgages with variable APR rates. A variable APR means the rate can change depending on various factors and will stay the same for one year. Therefore it is much more difficult to predict total interest charges that will accrue over the life of the loan.

Why Is Apr Important

Knowing the APR on a car loan is important because it helps you understand how much borrowing money from that lender will cost you. The lower the APR, the less youll pay to finance your car.

When comparing loans side by side, pay attention to the APRs to help identify the least expensive loan. The difference of even just one percentage point can add up over time.

For example, lets say youre comparing two $23,000 loans, each with a four-year term. One loan has a 5% APR and the other has a 6% APR. Youd end up paying $503 more in interest on the loan with the 6% APR than you would on the loan at 5% APR.

Also Check: Sba Veterans Advantage 7(a) Loan Calculator

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

How Is A Car Loan Apr Calculated

It would be great to borrow $20,000 for a car and simply repay the $20,000 and be done with it, but unless you borrow from a generous relative or close friend, it doesn’t work that way. An auto loan includes interest on the principal balance, and often some additional fees as well.

The annual percentage rate is what you’ll actually pay to finance the purchase of a vehicle. It’s the yearly cost of your interest rate. You can find out what yours is the easy way: Simply ask your lender. The Truth in Lending Act, a federal law, requires that all lenders provide this information before someone commits to a loan agreement. Alternatively, you can grab a calculator and figure it out the good old-fashioned way if you’re good at math and would rather not take someone else’s word for it.

Video of the Day

Tip

The APR on your loan tells you how much it’s going to cost you to borrow money to buy a car.

Also Check: Where Do I Find My Student Loan Account Number

How To Find The Apr Of A Credit Card

As a credit card user, chances are you will have to take on some credit card debt at some point in your life. Credit card providers in the United States are required by law to disclose the interest rate of their credit cards to customers. The annual rate youll pay depends on the credit card you choose and your credit score. Those with high credit scores will receive offers with lower interest rates, while those with lower credit scores will receive offers for credit cards with a higher interest rate. When shopping for credit cards, be sure to note the interest rate of the card being offered and compare its APR vs. that of other cards.

Here are some helpful tips from SuperMoney on how to improve your credit score and get better loan offers, credit card offers, and lower interest rates.

Car Loan Calculator Jd Power

What finance/car loan interest rate do you qualify for? 3.95% is based on average credit score. 5. Loan Term

Use Carvanas auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments.What is the usual loan term for an auto loan?How do you calculate monthly car payments?

Use our new and used auto loan payment calculator to estimate your monthly payments, finance rates, payment schedule and more with U.S. Bank.

Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for

Heres an example of an annual amortization schedule. Car Price: $20,000. Interest Rate: 4.5%. Loan Term: 60 months. Down Payment: $2,000. Sales Tax: 6%. Titles

Jul 26, 2021 If youve ever applied for a car loan, a mortgage or a credit card, youve probably seen the term annual percentage rate .

Lets calculate a monthly budget that works for you. Vehicle budget APR. Estimated based on your credit rating. How financing works at CarMax.

With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though its there for convenience for anyone who Loan Term: monthsYour State: Select AlabamaAlaskaArizona

Nov 8, 2018 Before choosing your next new vehicle, learn more about calculating your interest rate, how to calculate payments, and more with this guide

Also Check: Usaa Loan Credit Score Requirements

How To Calculate Apr On A Car Loan

Heres how to calculate APR for a car loan in four steps:

For example: To calculate APR on a $16,000 vehicle loan for five years with a $400 per month payment:

Example : An Alternative Way To Calculate Apr For A Car Loan

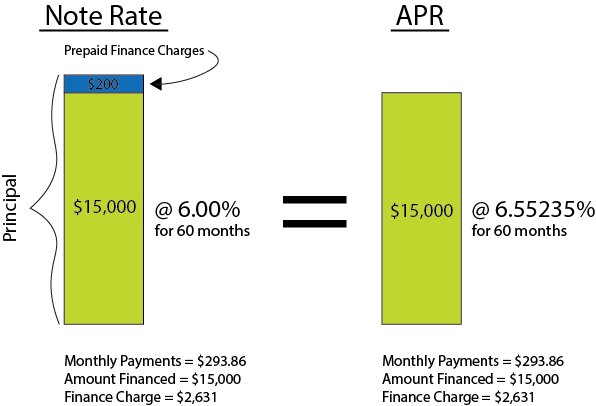

Another way to calculate your APR is to think about what your note rate and APR actually reflect.

Your note rate reflects the interest charges you pay per year for the amount you borrow whereas your APR reflects the portion of your finance charge you pay per year for the amount you finance . The equations below represent these concepts.

You cannot really use these equations directly to calculate your note rate and APR, because your loan amount falls during the course of your loan as you pay it down, and as you pay off your loan balance your interest charges fall in accordance with amortization .

However, you can estimate your note rate and APR using an average of your loan balance over a 12 month period.

You would pay $838.89 in interest charges under the note rate during the first year and $905.02 in interest charges + prepaid finance charges in your first year under the APR. To calculate an estimate of the note rate, you can divide the $838.89 by the average loan balance over the first year, which is $13,978. You will get a note rate of roughly 6% .

And if you want to estimate the APR, you can divide the $905.02 by the average balance of the amount financed over the first year, which is $13,888. Your estimated APR will be about 6.52% , which is very close to the 6.55% APR in this example.

Read Also: Usaa Pre Qualify Auto Loan

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. As of October 6, 2021, the average APRs according to a Bankrate study are the following.

The Truth In Lending Act Mandate Of Apr Disclosure

In 1968, Congress passed the Federal Truth in Lending Act. The law introduced the concept of the APR, a game-changer for the credit industry.

Before this act was passed, lenders used a variety of misleading and inconsistent methods to calculate interest. Now, most lenders must disclose the total cost of loans by providing potential borrowers with an APR.

However, some lenders prefer not to disclose the APR of their products and instead advertise the cost as a flat fee or monthly interest. This article will teach you how to calculate the APR of the main loan products available.

Don’t Miss: How Long For Sba Approval

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

How To Calculate Apr On A Car Title Loan

Look up the length of the loan terms in weeks and the cost to borrow the amount you need for that long. You can find this on the car title loan information or by asking the lender.

Divide 52 by the number of weeks in the car loan term to find out how many terms there would be per year if you were to borrow the money. For example, with the usual two-week term, 52 / 2 gives 26 terms per year.

Multiply the total cost per loan term by the number of terms per year to calculate how much you would have to pay to borrow the money for a year. For example, if the lender charges $50 in fees and interest to get a title loan for two weeks, multiply $50 times 26 to get an annual cost of $1,300.

Divide the annual cost by the amount you are borrowing and multiply the result by 100 to find out what percent of the loan amount you are charged in interest and fees each year. If your title loan was for $400, divide $1,300 by $400 and multiply by 100 to calculate an APR of 325 percent

Tips

-

Because of the high cost of borrowing with a car title loan, consider borrowing the money through another source. Options include a personal loan from a bank or credit union, a credit card cash advance or a loan from a friend or family member.

References

You May Like: How To Get Mortgage License In California

What You Need To Know

Before you can calculate your exact payments, you’ll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information. Just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once you’ve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

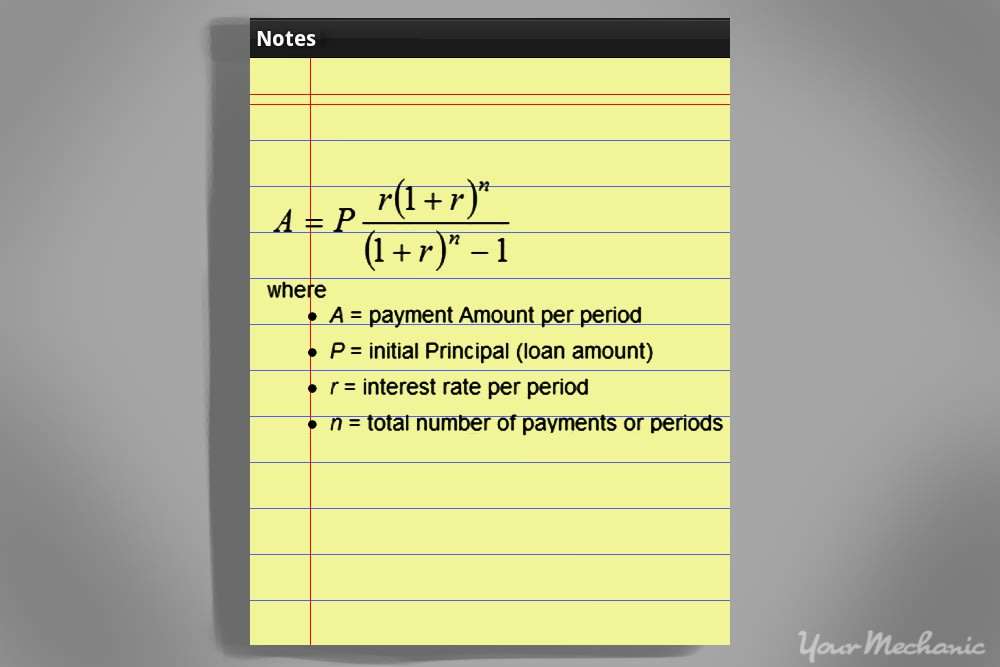

What Is The Loan Payment Formula

The payment on a loan can also be calculated by dividing the original loan amount by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

Recommended Reading: Refinance Car Loan Usaa

Amortizing Your Prepaid Finance Charges

You pay your prepaid finance charges at the beginning of your loan, hence the term prepaid. Still, you pay back the principal on your loan with your monthly payments, so you can think of your prepaid finance charges as another type of interest charge. Because of how car loan interest works, you pay more interest at the beginning of your loan than near the end as your loan balance decreases, a process known as amortization. So, under APR you pay your prepaid finance charges via amortization as well.

In our example, the $200 of prepaid finance charges are paid down via amortization as the graph below depicts .

The orange portion of the lines depict the portion of the finance charge for each monthly payment that is made up of the prepaid finance charges. As you can see, both the blue interest charges and the orange prepaid finance charges decrease over the course of the loan as you pay down your loan balance. If you add up all the interest charges and prepaid finance charges, you will find that the total finance charge is $2,631, making the total of payments for this loan $17,631 .

The Difference Between An Interest Rate And The Annual Percentage Rate Apr On An Auto Loan

Most car loan contracts list two rates, your APR and your interest rate.

Interest rate or note rate is the lower of the two rates and represents the cost per year of borrowing money NOT including fees or interest accrued to the day of your first payment.

is the higher of the two rates and represents the total cost of financing your vehicle per year , including fees and interest accrued to the day of your first payment. APRs are useful for comparing loan offers from different lenders because they reflect the total cost of financing. The higher the APR, the more youll pay over the life of the loan.

Mathematically, these rates will give you the same monthly payments and will result in you paying the same amount for your car in the long run. However, the higher the APR, the more youll pay over the life of the loan. Lenders will give you both rates on your car loan paperwork so that you can better understand your loan.

The distinction between these rates is simple in many ways, but it is important that you understand how to interpret each.

Don’t Miss: Usaa Auto Loan Bad Credit

How Is Apr Calculated

Okay, now it’s time to break out your calculators and your math skills as we talk about how your APR is calculated. It’s actually a pretty simple equation once you understand the numbers you’re considering. Your APR will include all the prepaid finance charges that you’re giving the bank in return for giving you the loan.

Both the interest rate and the APR will get you to the same number, which is your car payment amount. Basically to find your APR, you calculate one year, or 12 months, times your interest rate. For example, say you have a 3% interest rate on your loan. You then multiply .03 x 12 and there is your APR at 3.6%.

Example Of A Calculation

Let’s say you’re paying $20,000 for the car and you’re putting down $2,000. Your loan balance is $18,000, and you’re paying a 4-percent interest rate. That comes out to total interest of about $1,500. Additional fees add up to another $1,500. Now you’re at $3,000

Divide that $3,000 by your loan amount, or $18,000. This works out to .1666. Divide this by 1,440 for a four-year loan: 48 months times 30 days in a month equals 1,440. This results in a figure of .000115. Multiply this number by 365 days in a year, then by 100 to get your APR of 4.22 percent.

This is the easiest way to calculate APR. You could also use a spreadsheet if you really want to roll your shirtsleeves up and do some work, or use one of the calculators found on the internet. You can also just look on your proposed loan contract if you don’t want to do much work at all.

Read Also: Bayview Loan Servicing Dallas Tx