What Do I Do If I Can’t Get My Federal Student Aid Id To Work

There may be several reasons why your Federal Student Aid ID isn’t working.

You may be entering something incorrectly. To use your FSA ID, you must enter your user name and password exactly as you entered them when you created your ID.

The U.S. Department of Education may not have completed their match with the Social Security Administration . Your FSA ID is considered to be conditional until your information is verified with the SSA. You may use your FSA ID to:

Sign an initial Free Application for Federal Student Aid , and

Participate in the Internal Revenue Service data retrieval and transfer process.

Once they complete verification with the SSA , you’ll be able to use your FSA ID to access your personal information on Federal Student Aid websites.

Their records show that the SSN, name, and date of birth you provided on your FSA ID application do not match the information on file with the SSA.

Apply for an FSA ID again if you believe you entered incorrect information when you applied the first time.

Contact the SSA if you believe their information is incorrect.

You haven’t created your FSA ID yet. If you previously used your FSA Personal Identification Number to access information on FSA websites, you’ll need to create an FSA ID. To create an FSA ID, select Create Account

Learn more about IDR recertification requirements and what happens if you don’t recertify.

Get Your Credit In Order

At the end of the day, lenders want to make sure that you can pay back the money that they lend you. The more creditworthy you are when you apply, the better your chances of approval and the lower your interest rates will be.

- Check your credit score early and often as you prepare to apply for private student loans. Aim for a 690 or better FICO credit score to get the best loan terms.

- Raise your credit score by disputing and correcting any errors on your credit report.

- Pay your bills on time and keep your credit utilization low. Try not to spend more than 30% of your available credit at a given time, and try not to open too many new accounts. Taken together, these factors make up the majority of your credit score.

Get The Status Of A Recent Payment

You May Like: Do Loan Originators Make Commission

What Loans Can You Get With A Fair Credit Rating

May 22, 2020 By Allen Francis

When you borrow money today, you only rob yourself of money in the future. This is especially true if you dont have a job, money, or assets to collateralize a loan. Still, you have a few loan options if you have at least a fair credit rating.

Considering current events, perhaps taking out a loan is not a priority now.

38 million Americans filed for unemployment benefits over the past nine weeks. Because so many people have reported difficulties in accessing the application system, a lot more than 38 million may be unemployed.

Tens of millions of Americans, especially so-called, nonessential, workers, are out of work.

And they may need a loan to get through this rough period but cant get one because they are out of work.

Or, you may already have unmanageable debt already and just dont see the point of taking out a loan.

The average American is burdened with over $90,500 in personal debts. And that was before the pandemic hit.

Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Don’t Miss: Becu Auto Loan Payoff

More About The Fsa Id

The FSA ID replaced the Federal Student PIN in 2015, so students who havent taken out new student loans or havent logged into the Federal Student Aid website since 2015 might not have an FSA ID yet.

Students who dont have an FSA ID can create one on studentaid.ed.gov.. Once you sign up for an FSA ID, the federal government will verify your information with the Social Security Administration. Once your information is verified, you will be able to use your FSA ID to obtain information about your federal student loans.

The site, managed by the U.S. Department of Education, can provide a convenient way to get a full picture of all your federal loans, including:

How many federal student loans you have Their loan types The original balance on each loan Current loan balances Whether any loans are in default Loan service providers names Contact information of the loan service providers

What If There Isn’t Enough Money In My Checking Or Savings Account On My Due Date Or Withdrawal Date

If there’s not enough money in your account to cover your automatic payment, we’ll attempt to withdraw the money twice, just like we would if it were a returned check.

Your financial institution may apply overdraft fees if you don’t have enough money in your account on your due date or withdrawal date. We are not responsible for any overdraft fees assessed by your financial institution. If you have three consecutive failed payment attempts, we’ll automatically deactivate your Auto Pay. If you’re receiving an interest rate reduction for using Auto Pay, you’ll lose the incentive. Depending on the type of loan you have, you may be able to regain this benefit by re-enrolling in Auto Pay.

Don’t Miss: Credit Score For Usaa Auto Loan

Register Online With The National Student Loans Service Centre

Once you have been assessed by OSAP and approved for funding, NSLSC will send you a welcome email within two to three business days . Follow the link in the email to start the registration process. If you receive the email and would like to verify its authenticity, please contact NSLSC.

You will be presented with two options for confirming your identity and registering your account with NSLSC. You can use either a SecureKey Sign-in Partner or GCKey. You will be taken to an external website to complete this identity verification process.

SecureKey Sign-In Partners are groups like banks and credit unions that have partnered with SecureKey Technologies to enable their customers to use their online credentials to access Government of Canada services. Your banking information will not be shared with the government through this service. See a list of participating banks.

If your financial institution is not a SecureKey Sign-in Partner or you prefer not to use this service, you can obtain credentials through GCKey, a Government of Canada service.

When Will My Loan Be Disbursed

A federal student loan must generally be paid out in multiple disbursements. You will likely receive a portion just before or at the beginning of each term . If your school doesn’t use terms, you’ll usually get half at the beginning of and half at the midpoint of the academic year. Contact your school’s financial aid office for dates and details.

Read Also: Can You Use A Va Loan To Buy Land And A Manufactured Home

Master Student Financial Assistance Agreement

The Master Student Financial Assistance Agreement outlines the terms of accepting and repaying your student loans. It replaces past federal and provincial loan agreements. You only have to sign this multi-year agreement once as it covers present and future student loans.

You will only have to re-sign a new MSFAA if you apply for financial assistance after:

- taking a 2-year break from school, or

- permanently moving to another province/territory

Your MSFAA will not show grant or loan amounts. You will receive a Notice of Assessment from your province or territory that tells you how much student aid you will receive.

What Do I Do If I Can’t Afford To Make My Payments

Don’t wait to change to a more affordable option! Learn how you may be able to:

- One loan servicerof your choice!

- One contact for managing your student debtonline and on the phone.

The Power of CHOICE

Consolidation gives you the opportunity to choose one of the U.S. Department of Education’s consolidation servicers to complete and service your Direct Consolidation loan.

Keep in mind it’s important to understand if consolidation is the right solution for you.

Recommended Reading: Drb Student Loan Refinancing Review

What’s The Difference Between Subsidized And Unsubsidized Federal Student Loans

The main difference between subsidized and unsubsidized loans is who is responsible to pay the interest on the loan while you are enrolled in school at least half-time.

- With subsidized loans, the federal government pays the interest on the loan while you’re in school at least half-time and during a deferment.

- With unsubsidized loans, the borrower is responsible topay the interest on the loan.

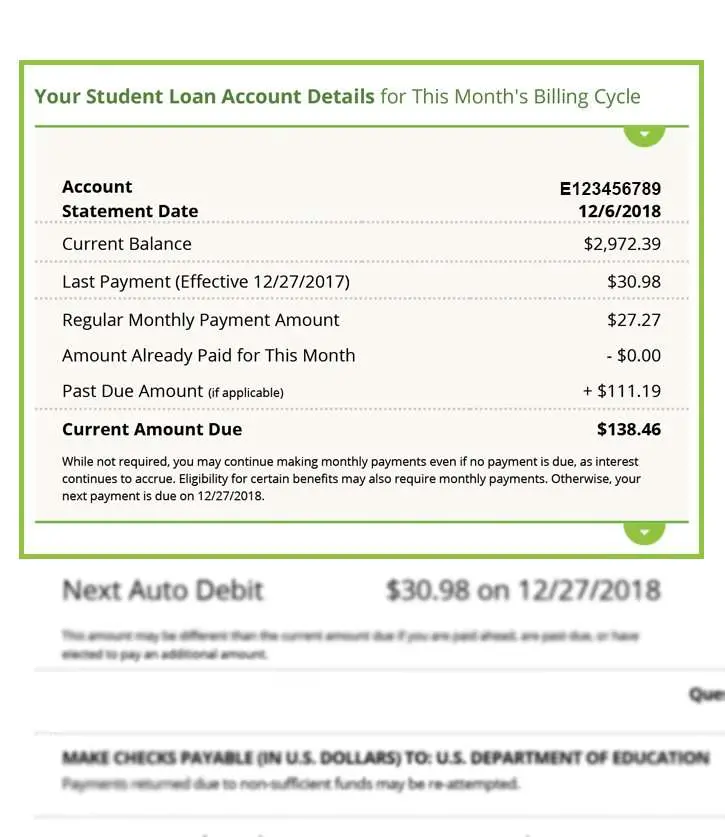

Statement And Due Date

We send you your monthly billing statement for each account about three weeks before a payment is due. Your monthly statement and Nelnet.com account will show your current amount due and due date for that account. For more information on your monthly billing statements, visit Statement Overview.

If you have multiple accounts, it’s possible you may have different due dates. Log in to your Nelnet.com account to view your most up-to-date account information. You can call us anytime to request that we align the due dates on all of your loans to a date between the 1st and 28th of each month.

IMPORTANT: If you have both Department of Education-owned loans and loans owned by other lenders , you must send your payments separately to the address on the front of your statement to have them applied correctly to your loans. If you make your monthly payment online, you’re able to submit a single payment for all of your accounts.

Also Check: Va Loan Mobile Home Requirements

Think About Refinancing In The Future

After graduation you may be able to refinance your student loan debt and secure a lower interest rate. Going through the effort of refinancing can save you money by reducing your monthly payments and its typically easy to check rates using a tool like Credible where you can check a bunch of interest rates at the same time.

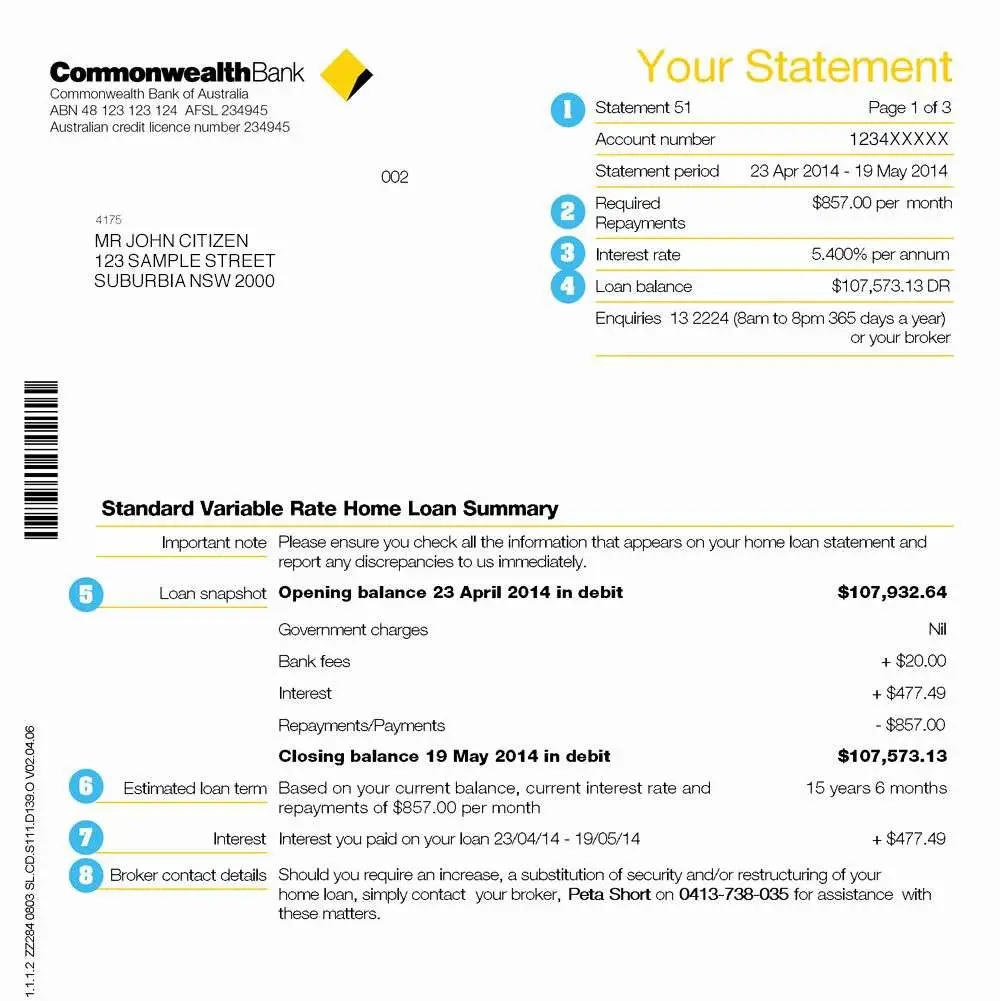

Student Loan Billing Statement

Every month that you owe a payment, youll receive an official billing statement to repay your student loan.

Your account number will be plainly listed as account number, on your billing statement.

Think of a credit card billing statement. Your account number is plainly identifiable on it.

Your student loan account number should be plainly noticeable near the top of your billing statement.

Corporate lending and facilitation services like Fannie Mae and various other federal student loan services feature plainly distinguishable account numbers on their billing statements.

You May Like: Refinance Auto Usaa

What Interest Payments Are Included On My 2020 1098

Interest payments made on your student loan accounts in 2020 may be deductible on your 2020 tax return. The interest on payments received by 5:00 p.m. Central on December 31, 2020, is included on your 2020 1098-E.

Interest payments may include amounts that were applied towards principal. Capitalized interest and origination fees are sometimes tax deductible. If you have questions about how the amount on your 1098-E statement was calculated, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

What Happens To My Auto Pay Withdrawal Amount When Or If My Payment Amount Changes

Your monthly payment amount is set and won’t change unless your repayment terms change, for example, if you change your repayment plan or exit a deferment or forbearance. If it does change and you are enrolled in Auto Pay, you will receive a new payment schedule detailing your new payment amount and date. A few weeks later, you’ll receive an email reminding you of the change.

If you are in school and transitioning to repayment while enrolled in Auto Pay, your payments will also change. When they do, you will receive a payment schedule letting you know your new payment amount and withdrawal date. You will receive an email reminder before your payment is withdrawn.

If you are in school and making payments through Auto Pay, you may change your Auto Pay withdrawal amount and date at any time.

You May Like: Can I Refinance My Sofi Personal Loan

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through September 30, 2021.

Paying Back Student Loan Debt

With federal student loans, there are multiple payment plans available:

Standard repayment plan: This is a ten-year repayment plan and students who choose this will typically pay less back, over time, than in other plans. This isnt a good choice if the student is interested in obtaining Public Service Loan Forgiveness . Graduated repayment plan: With this plan, payments increase every two years. This can help students who expect their income to increase, but they would pay more interest over time than if on the standard repayment plan. Extended repayment plan: Payments can be made during a period of up to 25 years. This can help with monthly payment amounts, but students will pay back more over the life of the loan than those who use the standard or graduated repayment plans. Income-based repayment plan : There are four different plans where student loan payments factor in the borrowers income this can be a good choice for those who plan to use PSLF, but borrowers will typically pay back more than under the standard plan.

PSLF is a forgiveness program that borrowers employed by a governmental or non-profit organization might qualify for. If a student has been denied for PSLF in the past, there is currently a Temporary Expanded Public Service Loan Forgiveness program to explore.

Recommended: How Much Do I Owe in Student Loans?

Don’t Miss: Can I Refinance My Sofi Personal Loan

Realistic Loan Options With A Fair Credit Rating

I dont suggest taking out a loan if youre struggling financially and wont be able to pay it back responsibly.

However, pandemic or no pandemic, it is still hard to get through life financially without assuming debt.

Be realistic about your ability to take out a loan. Understand that your inability to take out a loan now doesnt mean your situation is hopeless.

Things take time. Responsibly handle your debt problems now and taking out a loan in the near future wont be an impossibility.

If youre in over your head with debt, I dont have to tell you about how hard it is to get a loan.

And owning massive debt usually means having a bad credit score.

Getting a loan with a bad credit score negates the usefulness of getting one in the first place.

Ill tell you what you need to do to rehab your credit and become creditworthy enough for a loan.

If you have fair credit, there are many loan opportunities available to you.

Focus on borrowing a few hundred or a few thousand dollars only. You only increase your probability of acquiring more unmanageable debt if you borrow tens of thousands of dollars with only a fair credit rating. Dont borrow more money than you can realistically pay back.

Your Payment Could Be $0

Income-driven repayment plans can be a viable solution for reducing your regular monthly payment amount, in some cases even making your monthly payment amount as little as $0 a month. Under these plans, your payment is based on your income.

If you receive a statement for $0 due, it may mean you have paid extra in the past that fully covered this months payment amount, or your current repayment plan requires no payment at this time or you are just entering repayment and no payment is due at this time. You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run.

If you are not required to make a payment this month, you wont be considered past due if you dont make a payment or pay less than your regular monthly payment amount. However, we encourage you to continue paying as much as you can, because interest may continue to accrue on your outstanding principal balance.

Read Also: Personal Loan To Buy Land