Calculate Your Car Loan Repayments

Estimate your monthly car loan repayments with our calculator below.

Use our car loan calculator as a general guide on what your car loan repayments will look like.

This calculator will also tell you how much you may pay in total over the life of your loan. To use this calculator, simply enter your estimated vehicle value, loan term, any initial deposit, and the amount of any balloon payment .

Car Loan Calculator Assumptions

The figures provided should be used as an estimate only, should not be relied on as true indication of your car loan repayments, or a quote or indication of pre-qualification for any car loan product. The figures are based upon the information you put into the calculator. We have made a number of assumptions when producing the calculations including:

- Loan term, vehicle purchase price, and loan amount: We assume the loan term, vehicle purchase price, and loan amount are what you enter into the calculator.

- Interest rates: We assume that the rate you enter, is the rate that will apply to your loan for the full loan term.

- Interest and repayments: The displayed total interest payable is the interest for the loan term, calculated on the entered interest rate.

- Payable over 3/4/5 years figure excludes any balloon payment

-

Available for purchasing new and demo vehicles from dealers only

-

$5,000 to $100,000 loan amount

-

Choose between a low fixed or variable rate

When you get a car loan we lend you the money to buy a vehicle.

The Hyundai Genesis S80 Spotted In Mumbai

The Hyundai Genesis S80 has been spotted testing in Mumbai. The sedan will compete with the likes of the BMW 5 Series and the Mercedes-Benz E-Class. The car made its debut in the global markets in March 2020. However, there is still no confirmation that the car will launch in India. The Genesis line-up was launched in the international markets in 2015. Currently, there are two SUVs and three sedans under the Genesis brand. The car comes with a 4-door coupe design. Some of the main interior features of the car include a 12.3-inch digital instrument cluster, a two-spoke steering wheel, and a 14-inch infotainment unit.

19 February 2021

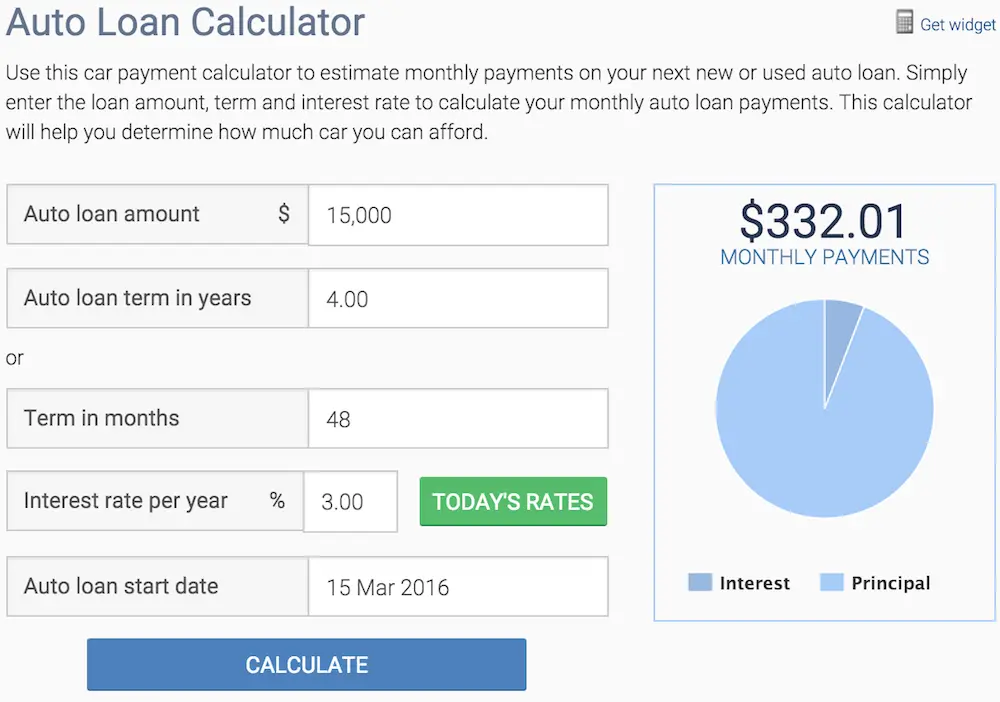

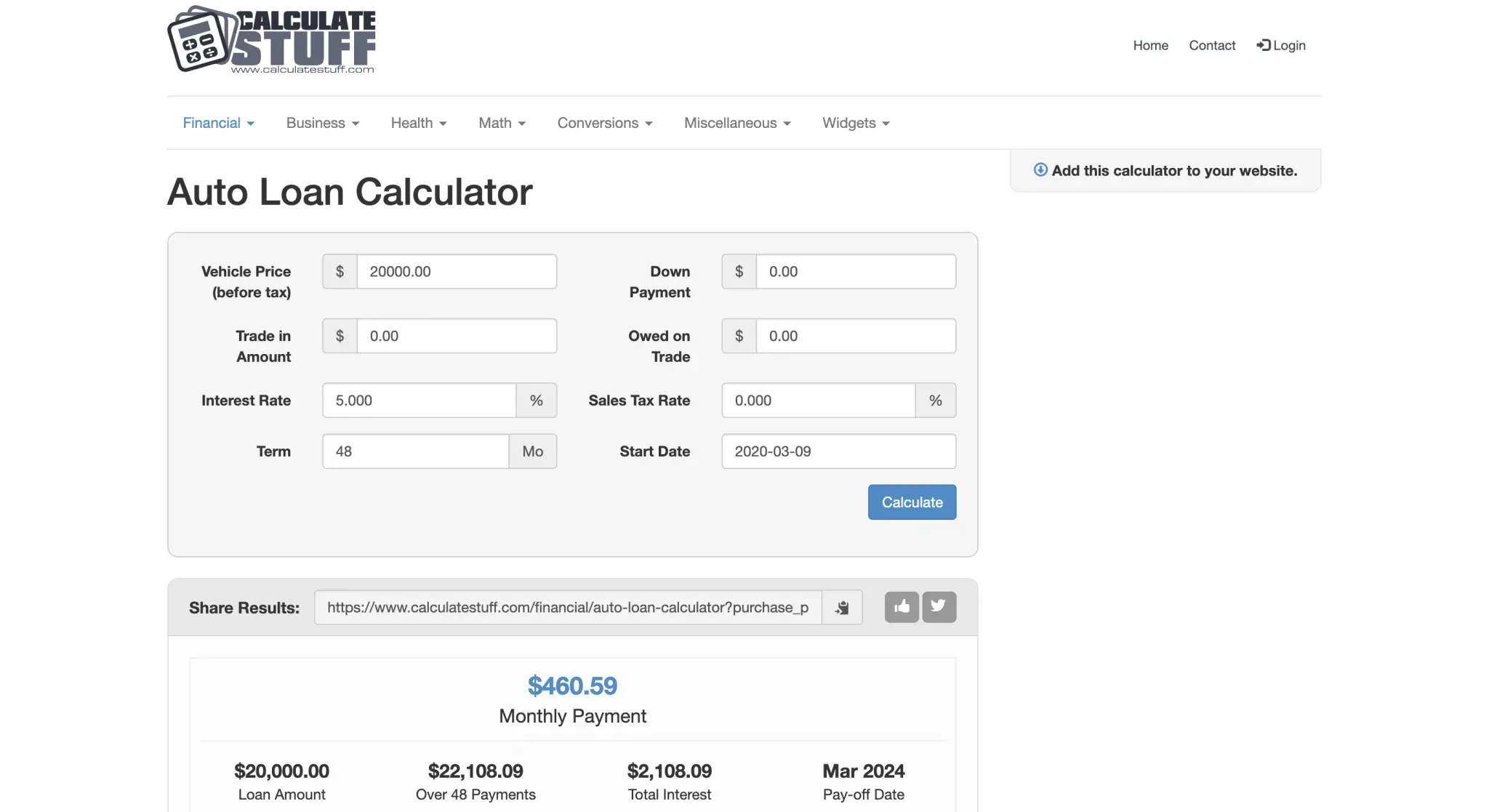

How To Use The Auto Loan Payment Calculator

Heres a guide for the information you will need to input into the auto loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, or the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

You May Like: Student Loans Fixed Or Variable

How Do I Pay Off My Car Loan Principal

How to make principal-only payments

Is there a best time within the month to make an extra payment to principal? Is There a Best Time Within the Month to Make an Extra Payment to Principal? Yes, the best time within the month to make an extra payment is the last day on which the lender will credit you for the current month, rather than deferring credit until the following month.

What happens if I pay an extra $1000 a month on my mortgage?

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, itd shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

What are the disadvantages of principal payment? Possible negatives of a Principal and Interest loan

Your limit reduces, therefore reducing the amount you can redraw. Your repayments are higher than interest only. This can be unsuitable for investment loans.

How To Use The Cleartax Car Loan Calculator

- Use the slider and select the loan amount.

- You then select the loan tenure in months.

- Move the slider and select the interest rate.

- The calculator would show you the EMI payable, total interest and the total payable amount.

- Recalculate your EMI anytime by changing the input sliders.

- EMI will be calculated instantly when you move the sliders.

Also Check: Myeddebt Ed Gov Legit

Between Choosing A Make Model And Options Shopping For A Car Can Feel Overwhelming And Youre Not Done There Car Loan Shopping Is Just As Important And Knowing How To Calculate The Apr On An Auto Loan Can Help You Determine Whether A Loan Might Be Right For You

The more you know about how to calculate the APR on a car loan, the more informed youll be when its time to either sign on the dotted line or walk away if the loan doesnt fit your financial needs.

A car loans APR is the cost youll pay to borrow money each year, expressed as a percentage. It includes not only the interest rate on the loan but also certain fees. The interest rate, on the other hand, reflects only the annual cost of borrowing the money no fees included. When comparing loans, the Consumer Financial Protection Bureau suggests looking at APRs versus interest rates, because APR more accurately reflects how much youll pay to finance a car.

Lets take a look at how to calculate APR on a car loan using a computer spreadsheet program and some of the factors that could affect the APR youre offered.

Calculating Auto Loan Payments

Read Also: Usaa Car Refinance

How Does Car Loan Emi Calculators Work

- P stands for the Principal Amount. It is the original loan amount given to you by the bank on which the interest will be calculated.

- R stands for the Rate of Interest set by the bank.

- N is the number of years given for the repayment of the loan. As you must pay the EMIs each month, the duration is calculated in the number of months.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Don’t Miss: Capital One Car Loan Apr

Variant Of The Bolero Neo Launched By Mahindra In India

The 2021 variant of the Bolero Neo has been launched by Mahindra in India at an ex-showroom price starting from Rs.8.48 lakh. The car is available from the N4 variant to the N10 variant. The N10 variant is available at an ex-showroom price starting from Rs.10 lakh. The car is available with Android Auto and Apple CarPlay. The front of the car comes with a new look. The length, height, and width of the car are 3,995 millimetres, 1,817 millimetres, and 1,795 millimetres, respectively. The car will be powered by a 1.5-litre diesel engine that is BS6 compliant. The N8 variant of the vehicle will be available at an ex-showroom price of Rs.9.48 lakh. The car will compete against the likes of the Tata Nexon and Maruti Suzuki Vitara Brezza.

16 Juy 2021

When You Pay Extra On A Car Loan Does It Go To Principal

Each month, a portion of your car payment goes to the principal and a portion to interest. At the beginning of the loan, a larger part of your payment goes to interest. So paying extra on the principal early in your loan will have the greatest impact on the overall amount of interest you pay.

then How do I figure out my loan payoff amount? The formula for estimating mortgage payoff is as follows: M = P / P = principal loan amount. i = monthly interest rate. n = number of months required to repay the loan.

Should I pay extra on my principal or escrow? If youre stuck between paying down the balance on the principal or escrow on your mortgage, always go with the principal first. Since equity is the difference between your homes worth and what you owe on the principal, paying principal first will increase your equity much faster.

Read Also: Will Va Loan On Manufactured Homes

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

Car Loan Fees And Charges For Top 3 Banks

Given below is a comparison of a few fees and charges levied by three selective banks:

| Name of the bank | Axis Bank | |

|---|---|---|

| Processing fee | 1% of the loan amount. The maximum and minimum amount that can be charged are Rs.5,000 and Rs.10,000, respectively. | Rs.3,500 to Rs.5,500 |

| 3% – 6% depending on amount of time completed* | 5% of the principal outstanding | |

| Loan cancellation | As mentioned by the bank | Rs.2,500 per instance |

| 2% per month |

Note: GST rates will be applicable over and above the rates charges mentioned above.

*HDFC Bank does not allow foreclosure within 6 months from the day the car loan was availed.

You May Like: Usaa Auto Interest Rates

How Can You Easily Calculate Car Loan Payments

Of course, math may not always be your strong suit and who has the time to sit and calculate anyway? Skip the formulas and easily find your car loan monthly payment by using an Online Auto Loan Calculator. By just inputting the necessary information, you can not only find out the due monthly amount but also compare the amounts with different rates and terms.

How Are Car Loans And Interests Calculated

When you buy a car, new or used, unless you have some cash saved up to pay off your car, the most common way is buying it via a car loan . In Malaysia, it would be extremely convenient to have your own car to move around. But when it comes to getting a car loan, many do not fully understand how to calculate car loans and interests. But before we delve deeper into that, here are some basic terms you should know.

Recommended Reading: Mortgage Loan Originator License California

Calculation Of Car Loan Emi

The table below provides you the car loan repayment schedule for a loan amount of Rs.5 lakh, EMI of 10,624, tenure of 5 years, interest rate of 10% p.a. and processing fee of 1%.

| Year |

|---|

| Rs.6,37,411 |

In the above example, if you make a prepayment of Rs.50,000 after paying 4 EMIs:

You will Save Rs.32,505 in total loan amount Loan tenure will be reduced by 7 months

Without Pre-payment

Interest: Rs.1,09,906 EMI tenure: 4 years 5 months

You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan. The online EMI Calculator offered by BankBazaar will calculate the monthly instalments as well as provide you with a detailed loan repayment table presenting you with details such as the principal amount and interest amount being paid and the outstanding balance after payment of the instalment.

Why Is The Payoff More Than The Balance

The payoff balance on a loan will always be higher than the statement balance. Thats because the balance on your loan statement is what you owed as of the date of the statement. The lender will want to collect every penny in interest due to him right up to the day you pay off the loan.

Is it better to get a 30-year loan and pay it off in 15 years?

If your aim is to pay off the mortgage sooner and you can afford higher monthly payments, a 15-year loan might be a better choice. The lower monthly payment of a 30-year loan, on the other hand, may allow you to buy more house or free up funds for other financial goals.

How can I pay off my 30-year mortgage in 15 years? Options to pay off your mortgage faster include:

How can I pay my 30-year mortgage off in 10 years? How to Pay Your 30-Year Mortgage in 10 Years

Also Check: Capitalone Com Auto Pre Approval

Use A Car Loan Payment Calculator

Skip the hassle of math formulas and get straight to the answer you’re looking for by plugging the necessary information into a loan calculator. A calculator makes it easy to input different combinations of numbers, allowing you to instantly compare the costs of loans.

Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off. These variables help you plan ways to reduce your debt. Technically, you can use car loan payment calculators on any of your loans. As long as you know your loan factors, the calculator will work.

How Do I Know What My Apr Is

Once youve received a formal and final offer on a loan, you can find out what the APR is in one of two ways.

You May Like: Loaning Signing Agent

How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more