Fha Streamline Refinance Characteristics And Benefits

FHA streamline refinancing is sometimes called FHA-to-FHA refinancing to distinguish it from non-FHA refinancing products.

FHA streamline refinancing bears some resemblance to VA streamline refinancing, also known as IRRRL. However, VA streamline refinancing is only available to eligible military service members and their immediate families, while FHA streamline refinancing is available to most homeowners with existing, nondelinquent FHA loans.

average return of 618%

According to the U.S. Department of Housing and Urban Development , all FHA streamline refinances must meet certain qualifying criteria:

- The home loan to be refinanced must already be FHA insured. Conventional loans and other non-FHA mortgage loans, including VA loans, are not eligible.

- The borrower must be current on the existing loans payments.

- The refinance must result in a net tangible benefit to the borrower, defined broadly as leaving the borrower in a better financial position than the existing FHA home loan does.

- Borrowers can take out no more than $500 cash on the refinanced loan, not including refunds of any unused escrow balances on the existing loan. Borrowers who wish to take out more cash must opt for an FHA cash-out refinance, a different loan type thats not eligible for the streamline process.

- The loan amount cannot be increased to include, or wrap, closing costs, the sole exception being upfront mortgage insurance premiums .

Refinancing An Fha Loan Into A Conventional Loan

If youre an FHA borrower, youre not limited to only refinancing into another FHA loan. As you pay down your mortgage , you may have enough equity to refinance out of an FHA loan and into a conventional loan, like a fixed rate or adjustable rate mortgage . Though conventional loan rates are slighter higher, your mortgage insurance payments may be much less than those of an FHA loan. Plus, in some cases, FHA loan insurance is permanent, and that is not always the case for a conventional loan.

What Is Streamline Refinance Program

4.9/5Streamline refinancerefinancemortgageStreamlinemortgage

Similarly, it is asked, is a streamline refinance a good idea?

In addition to less paperwork, an FHA Streamline Refinance offers tangible benefits as well. The primary tangible benefit is a lower interest rate, which could reduce the amount of your monthly payments. As with any mortgage product, this rate may be fixed or adjustable.

Also, do I have to pay closing costs on a FHA streamline refinance? As with your original FHA loan, you are required to pay closing costs. You can choose to have the closing costs built into your loan, but you must have the property reappraised. You can only roll the closing costs into your new FHA Streamline loan if there’s enough equity in the property to cover the additional amount.

Also Know, what is the benefit of a streamline refinance?

The primary benefits of streamline refinancing include: Minimal credit requirements. Limited asset and income verification. No appraisal required.

How long does a streamline refinance take?

210-day âwaiting periodâ after buying or refinancingThe FHA requires that borrowers make 6 mortgage payments on their current FHA-insured loan, and that 210 days pass from the most recent closing date, in order to be eligible for a Streamline Refinance.

Recommended Reading: Stilt Interest Rates

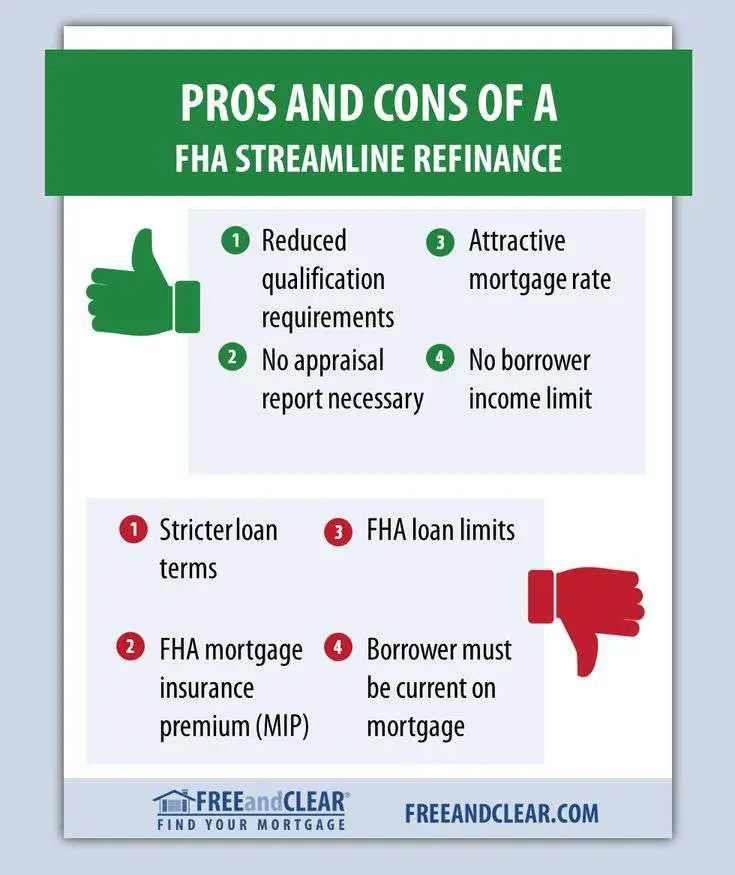

Pros And Cons Of An Fha Streamline Refinance

To help you make an informed decision about whether an FHA streamline refinance is right for you, compare the pros and cons.

Pros

- You wont need to provide income documents.

- Your employment is not verified.

- Your other debts wont be considered.

- You wont need an appraisal.

- Youll pay lower closing costs .

- Youll provide less documentation and likely have a faster turn-around time.

- You can use it for a primary residence, vacation home or a rental property.

Cons

- Youll have to pay a higher rate or get an appraisal to roll closing costs into the loan.

- You wont qualify if you havent made seven consecutive payments on your current FHA loan.

- You must have a current FHA mortgage.

- You cant remove a co-borrower*.

- You cant take more than $500 cash out .

- Youll pay a fresh upfront mortgage-insurance premium and continue shelling out monthly premium payments. The upfront premium is 1.75%, except for FHA loans originated before April 2009 those require an upfront premium of only 0.01%.

*Except in cases of divorce, legal separation or death, as long as the remaining borrower proves theyve made payments for six months prior to the refinance application.

Basics Of Fha Mortgage

FHA or Federal Housing Administration mortgage is a government agency that operates as part of the Housing and Urban Development. This program promotes access to home ownership and stability in the mortgage market. FHA does not make loans it insures loans made by private lenders who are authorized to deal in FHA mortgages.

This guarantee allows certain types of borrowers to obtain mortgages on more favorable terms compared in the private mortgage market.

Read Also: Refinance Auto Loan Calculator Usaa

Loan Balances May Not Increase To Cover Loan Costs

FHA does not allow you to roll closing costs into your new loan balance on an FHA Streamline Refinance.

The maximum mortgage amount on your new loan is equal to your current principal balance plus your upfront mortgage insurance premium.

All other costs including origination charges, title charges, and prepaid taxes and insurance must be either paid by the borrower as cash at closing, or credited by the loan officer in full.

The latter is called a nocost FHA Streamline. Using this option, your lender covers the closing costs. But you pay a higher interest rate in exchange. So youll ultimately pay more over the life of the loan.

You Have To Pay Mortgage Insurance

Youre required to pay a mortgage insurance premium with both an FHA loan and an FHA Streamline. When you first get an FHA loan, you pay MIP, which protects your lender if you default on your loan. Youll continue to pay MIP when you refinance. If youre looking to stop paying mortgage insurance, a conventional loan may be a better choice, depending on how much equity you have.

The only way to remove MIP is to convert your FHA loan into a conventional loan and reach 20% equity in your home.

Read Also: Credit Score Needed For Usaa Auto Loan

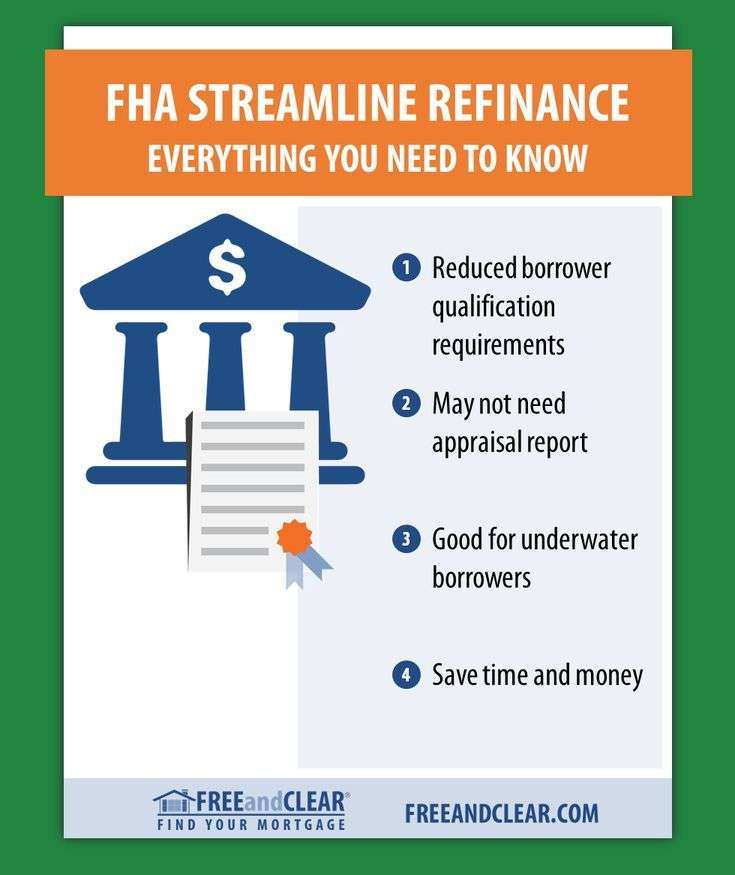

Fha Streamline Refinance: What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

An FHA streamline refinance lets you skip right past one of the biggest hurdles to getting an FHA loan: The appraisal. This shortcut saves you time and money, but not everyone can take advantage of it. Only borrowers who meet certain conditions can get a break when refinancing a home purchase loan that was originally backed by the Federal Housing Administration.

Here’s what you need to know if you want to score this refinance.

Reasons To Consider The Benefits Of An Fha Streamline Refinance

If youve been looking into refinancing, you may be worried about how much paperwork will be involved. You likely remember meeting several requirements to get your current mortgage. These same requirements can come with a refinance loan, but not in all cases.

The FHA streamline refinance loan is different from many other refinancing options you may have learned about, as it is often much simpler to get.

Not having to provide several forms of documentation is just one of the benefits of FHA streamline refinance.

Don’t Miss: Mlo License Ca

Sometimes It Pays To Refinance

The FHA Streamline Refinance program gets its name because it allows borrowers to refinance an existing FHA loan to a lower rate more quickly. Avoiding a lot of paperwork, and often without an appraisal, the Streamline option saves borrowers time and money.

You can reduce the interest rate on your current mortgage without a full credit check, yet you need to have paid your mortgage on time over the last 12 months. There is no requirement for income verification either. FHA Streamline loans have reduced paperwork, simple requirements for eligibility, and a list of features which makes it very attractive for borrowers.

If you have an existing FHA mortgage, you’ve already proven you are a good credit risk for an FHA-guaranteed loan. Because of this, you don’t need to calculate a debt-to-income ratio for the new FHA Streamline loan, but it’s always a good idea to have a second look at your finances for your own information.

Under the FHA Streamline program, your new loan can’t exceed the original amount you borrowed to purchase the home. There might not be a need for an appraisal either, depending on your current home equity and loan balance. You do have the option to get your property reappraised and qualify for a higher amount if the value of the property has increased.

While the information presented is from the official FHA guidelines, some lenders may have additional requirements for borrowers to meet.

Employment And Income Are Not Verified

The FHA does not require verification of a borrowers employment or annual income as part of the FHA Streamline process, unless the borrower needs a credit qualifying loan.

For noncredit qualifying Streamline loans, there is no verification of employment, nor are there paystubs, W2s or tax returns required for approval.

Also Check: Carmax Loan Approval

Who Needs Fha Streamline Refinance Loans

In some cases, people with FHA loans may need even better terms, and in those situations, the best option is to apply for an FHA Streamline refinance loan. While FHA loans are a good option for lower down payments and less strict credit requirements this lenience can result in higher interest rates. When you choose to refinance your FHA loan, you can pay off the loan faster or even pay lower monthly payments.

Similarly, if your current loan is an adjustable-rate, you may want to apply for a new loan with a fixed rate. An adjustable-rate changes regularly and that can make paying off the loan unpredictable. When you qualify for a fixed rate, it never changes. This means you pay the same payment every month for the lifetime of the loan.

Fha And Refinance Mortgage Rates

Determining the FHA mortgage rate depends on the arrangement between the lender and the borrower. An affordable interest rate plus a low down payment may be granted in favor of the borrower if he passes the qualification set by the FHA. The FHA mortgage rate to be imposed can be determined based on the amount and term of loan. Also, the type of interest rate , down payment, discount points and closing costs have a bearing on the FHA mortgage rate.

Read Also: Flex Modification Calculator

Have You Missed Any Payments

To prove you are in good standing on your current mortgage, you must have no payments that were more than 30 days late in the past six months.

In the past 12 months, you cannot have more than one payment thats more than 30 days late.

While these requirements may seem complicated, you should have no issues as long as you have made your payments on time and your lender determines that a streamline refinance will be beneficial to you.

Fha Streamline Vs Fha Cashout Refinance

Compared to FHA Streamline Refinance loans, the FHAs cashout refinance has an obvious benefit: you can use it to access cash from your home equity.

Say, for example, that you owe $250,000 on your current loan but your home is worth $350,000. The difference between these two numbers $100,000 is your home equity.

With a cashout loan, you could access part of this equity while also refinancing your entire mortgage. Your loan amount would increase as a result.

With a Streamline Refinance, your loan amount cannot increase to generate cash back, even if you do have the equity to back a larger loan.

If youre considering a cashout refinance instead of a Streamline loan, know that:

- Youll need to qualify with your debt, income, and credit score

- Youll need a new home appraisal to verify your homes value

- You can refinance any type of mortgage, not just an FHA loan

- Your loan amount will increase so your annual MIP will, too

- You wont be able to access all your equity only up to 80%

- Your mortgage rate could increase since cashout loans are riskier

A Streamline loan is designed for simplicity, so it can dodge most of the additional steps cashout loans require.

Read Also: Nslds.ed.gov Legit

What Borrowers Need To Know About The Fha Streamline Refinance Program

An FHA Streamline Refinance is not your average mortgage refinance. The government-backed program has some unique positives. But there are also some drawbacks to keep in mind.

Youll have to decide if this unique option is the right fit for your finances. Consider the factors below before jumping into this opportunity.

Fha Streamline Refinance Rates

You may be able to get a better rate by refinancing your original FHA loan, depending on the current rates. Rates change constantly, but at the time of publishing, you could secure a rate as low as 5.4% APR for a 30-year fixed-rate streamline loan .

Keep in mind that there are upfront costs with an FHA streamline refinance. Youll have to pay closing costs, which are due at closing and cannot be lumped into the loan balance .

In addition, youll have to pay upfront mortgage insurance premiums , which can be 1.75% of the loan amount . Typical closing costs range from $1,000 to $4,500.

You May Like: Auto Loan Rates Credit Score 600

Fha Streamline Waiting Period

Theres a waiting period between when you first closed your loan and when you can refinance. So, if youve just closed on your loan, then youre not eligible for an FHA streamline refinance.

The FHA streamline refinance waiting period requirements include:

- You have made at least six on-time payments on your current FHA mortgage

- Its been at least six months since your first payment due date

- 210 days have passed since the day your current mortgage closed

For example, if your current FHA loan closed on November 28, 2018, then your first mortgage payment was due on January 1, 2019. You can refinance as soon as July 1, 2019 210+ days after closing and six months after your first payment.

Refinance Even If You Owe More Than Your Home Is Worth

Unlike many mortgage refi options, an FHA Streamline allows you to refinance even if you have an underwater mortgage, or you owe more on your home than its worth.

The loan amount for your FHA Streamline is primarily determined by the outstanding principal balance of your loan so if your home value has declined, you may still be able to use an FHA Streamline to refinance.

Recommended Reading: How Long Does An Sba Loan Take To Get Approved

Requirements For Fha Streamline Refinancing

To take advantage of the FHA Streamline Refinancing program, you must meet a few key requirements:

- You must have an existing FHA-insured mortgage.

- You must be current on your mortgage.

- You are allowed no more than one late payment in the past year, and are required to have made the six most recent payments on time.

- The refinance must produce a net tangible benefit for the borrower. It must either result in at least a 0.5 percentage point reduction in the combined interest rate and Mortgage Insurance Premium or, the benefit can occur from refinancing into either an adjustable-rate mortgage , or a fixed-rate mortgage .

- The new loan must not exceed the initial mortgage amount.

- The refinance cannot be used to obtain cash in excess of $500.

- You must pay on the original FHA mortgage for at least 210 days before qualifying for the refinancing.

Tip: Donât have an FHA-insured mortgage? There are several other refinancing options available. Learn more about Pennymac Refinancing.

Sorry the service is unavailable currently. Please visit Experience.com website to view Pennymac, LLC. reviews

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Does Carvana Prequalify Hurt Credit

Fha Refinance Rates Today

Current FHA rates are some of the lowest in history. According to Ellie Maes March 2021 Origination Report, the average 30-year rate on FHA loans hovered at 2.99% in March.

The refinance interest rate youll qualify for depends on factors like your credit score, interest rate type, and loan type. Youll have to speak to lenders to determine the specific FHA refinance rate youre eligible for. Compare quotes from three to four lenders to make sure youre getting the best rate and terms the CFPB reports that comparison shopping can save borrowers approximately $300 per year and thousands over the life of the loan.