You Might Also Be Interested In

At certain places on this site, you may find links to web sites operated by or under the control of third parties. Fulton Bank, N.A., Fulton Financial Corporation or any of its subsidiaries, Fulton Financial Advisors, and Fulton Private Bank do not endorse, approve, certify, or control those external sites and do not guarantee the accuracy or completeness of the information contained on those web sites. The bank may not be affiliated with organizations or third parties mentioned on the page.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

How Does My Dti Impact My Credit Score

Your income does not have a direct impact on your credit score. However, 30% of your credit score is based on your credit utilization rate, or how much debt you are using compared to the total credit you have available. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score.

The only way to bring your utilization rate down is to pay down your debts or to increase your total available credit. Having an accurately calculated ratio will help you monitor your debts and give you a better understanding of how much debt you can afford to have.

About the Author

You May Like: Drb Vs Sofi

Payment To Income Ratio And Other Factors

Your DTI ratio is important, but what about your payment to income ratio? Your PTI ratio determines your maximum car payment, and, just like your DTI ratio, you can calculate it ahead of time.

To find it, all you have to do is take your gross monthly income and multiply it by 0.20, or 20%. Subprime lenders typically cap your PTI ratio at 20%. For an example, lets use the same numbers as above: $1,400 in monthly bills and a pre-tax income of $4,000. In this case, your max vehicle payment should be no more than $800 .

Once you determine your PTI and DTI ratios, its time to plan your budget this means considering items outside of the selling price, such as interest rate, loan term, and fuel and maintenance costs.

This is especially important if youre getting a bad credit auto loan, as your interest rate is likely to be higher than average, which may increase the overall cost of the loan to beyond your PTI ratio cap.

On top of interest, the loan term affects the overall cost. Its true that the longer the loan, the lower the monthly payment. However, you pay more in interest charges as the loan term increases.

As for car insurance, you must carry the minimum full coverage amounts required by your lender and this is never cheap.

Why Is A Good Debt

A low DTI ratio shows a lender that you have a good handle on your debt and income. If you have a DTI ratio of 10%, this means that you dont spend a large majority of your gross monthly income on debt payments each month.

On the other hand, your lender might decide you have too much debt for the amount of income you earn if they see a high DTI ratio. You may want to consider improving your DTI ratio for this reason.

Don’t Miss: Va Loan Manufactured Home With Land

Income Vs Debt Why It Matters

Of course, you’re going to need money to repay an auto loan. But lenders aren’t just concerned with the money you have coming in they’re concerned with the money that’s going out as well. This is especially true if you’re a bad credit borrower.

When you have a credit score around 660 or lower, you’re most likely to qualify for an auto loan through a subprime lender. These third-party lenders work through special finance dealerships and help people in unique credit situations to get the loan they need.

In order to do this, they use additional factors besides your credit score to ensure you’re fit for financing. One of the factors that a subprime lender uses to determine your eligibility is called the debt to income ratio. This tells a lender how much available income you have in your budget each month to pay for your car loan and the required full coverage auto insurance.

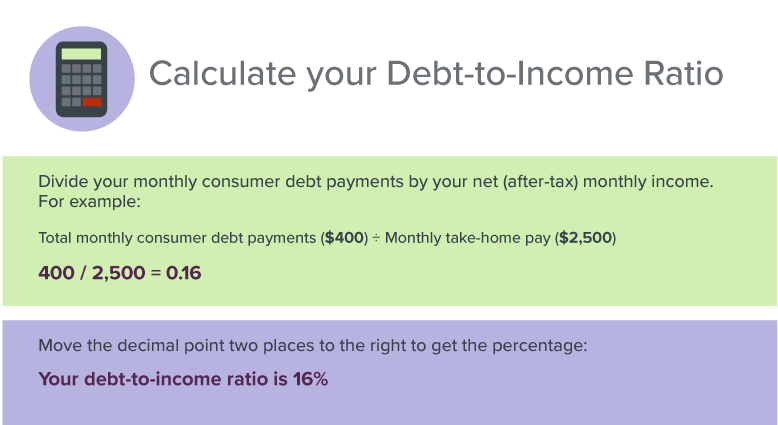

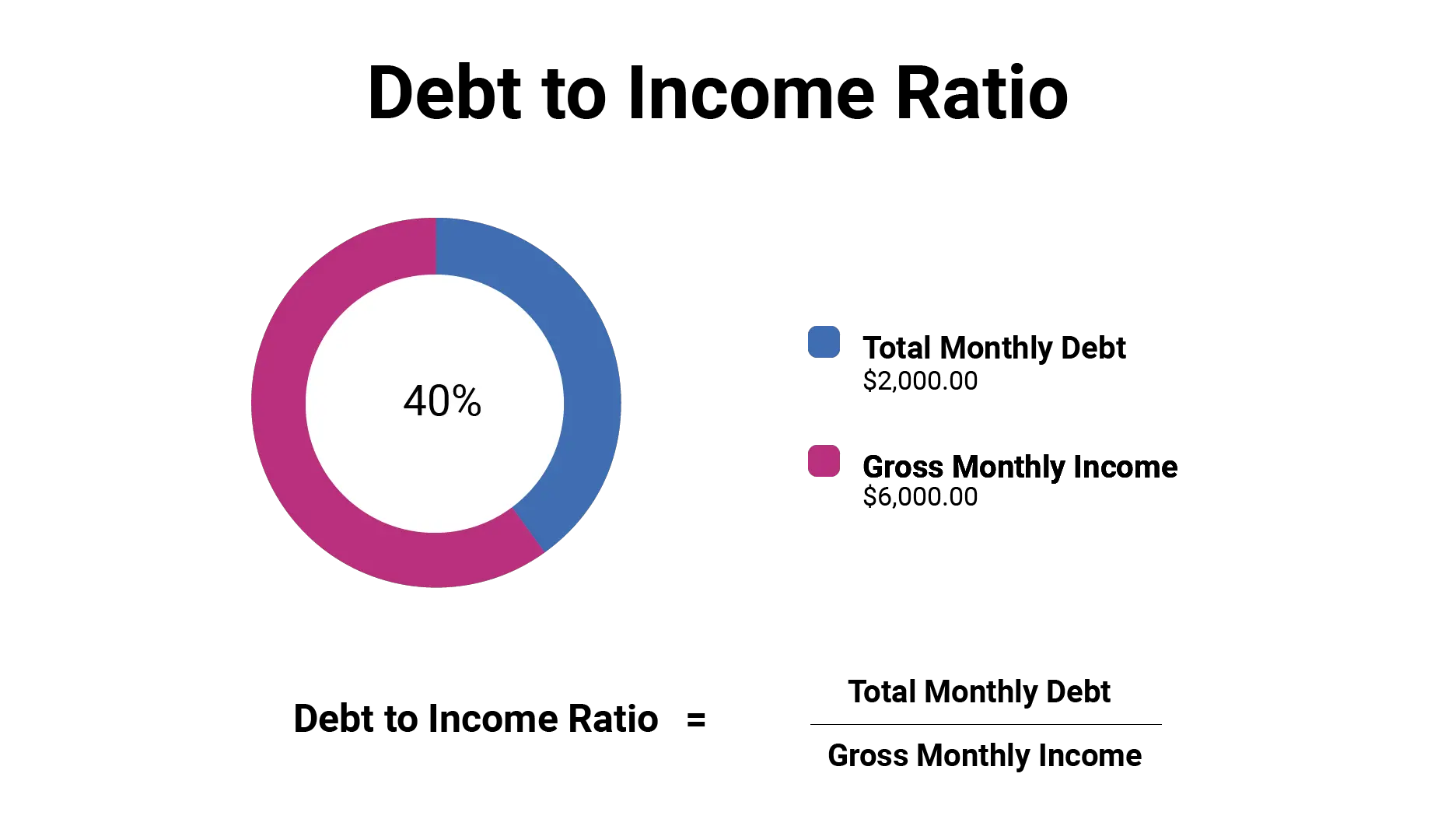

Lenders calculate your DTI by dividing your monthly recurring debts and payments by your gross monthly income. By doing this, they get a decimal answer. Once converted to a percent , subprime lenders can see how much of your income is already being used by your recurring debts.

For example: If your gross monthly income is $2,500 and the total of your existing bills is $1,200 each month, 1200/2500=0.48, which means your DTI is 48%.

If you’re not sure how much of a car loan you might qualify for, you can use online tools to help you do the math.

Why does DTI matter so much to a subprime lender?

When You Apply For A Loan Like A Mortgage Auto Loan Or Personal Loan Lenders Often Want To Know How Much Debt You Have Compared To How Much Money You Earn In Other Words They Want To Know Your Debt

Your debt-to-income ratio, or DTI, is a calculation of your monthly debt payments divided by your gross monthly income.

Lets take a look at how to calculate your debt-to-income ratio, learn why your DTI matters, understand what a good debt-to-income ratio looks like and how to lower your DTI ratio.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

Installment Loans Under 10 Months

Borrowers with installment loans under 10 months can get that monthly payment excluded from debt to income ratio calculations:

- However, auto lease payments do not count

- If borrowers has a automobile monthly payment of $400 per month and have less than ten months left on it, then this payment is discounted for calculating debt to income ratios by underwriters

- However, if this $400 per month automobile payment is a lease payment, then this exclusion does not apply

- Lenders view that with a auto lease payment, the person will get another automobile lease after the current lease payment terminates

Home Buyers who need to qualify for home loans with a direct lender with no lender overlays on government and conventional loans can contact us at GCA Mortgage Group at 262-716-8151 or text us for a faster response. Or email us at

The Average Americans Debt

The average Americans debt-to-income ratio is not a one-size-fits-all number. Debt factors include the level of education, race, and gender. While some scales put the average Americans DTI as low as 9%, the Federal Reserve notes a wide range by state, with the lowest average DTI in Washington DC and the highest average DTI in Colorado and Idaho.

Don’t Miss: Can I Refinance My Car Loan With The Same Lender

Figure Out Where You Spend Your Money

Track your spending for a week or two, and youll be astonished at the ways your money disappears. In addition to simply making you more mindful of your spending, expense tracking will help you identify all the splurges that accumulate too much outflow. Identify some places where you can cut back , and youll be surprised how much your spending adds up.

What Is The Maximum Dti For Va Loan

A DTI ratio above 41 percent for Veterans and military members will encounter additional financial scrutiny. While the VA doesn’t mandate a maximum DTI ratio, it does set a dividing line for prospective borrowers.

The VA views the DTI ratio as a guide to help lenders, and it doesn’t set a maximum ratio that borrowers must stay under. But the VA doesn’t make home loans, and mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrower’s credit, finances and more.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Whats Included In A Debt

There are many monthly expenses that wont make it into your DTI ratio calculations even though part of your income is allocated toward them. Thats because your DTI ratio typically only includes the accounts that show up on your not everything you pay monthly is part of the equation.

DTI-applicable expenses include:

Not every bill you pay will appear on your credit, though. Basic living expenses like utilities, cable, cell phone bills and monthly fees for any subscription services wont show up.

This doesnt mean there wont be any consequences for your credit if you dont pay these bills. Unpaid bills of this type can end up being reported as collections, which can have a big negative impact on your credit score. However, theres no effect from these types of accounts on your DTI.

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

Read Also: How Much To Loan Officers Make

How To Calculate Your Debt

To calculate your DTI, divide your total monthly payments by your gross monthly earnings .

For example, here’s what your monthly payments may look like:

Mortgage: $1,500

$180

Total monthly bill payments: $2,500

If your monthly debts total $2,500 and your gross monthly income is $5,000, your DTI calculation would look like: $2,500 / $5,000 = 0.5. To get the ratio as a percentage, you would then multiply 0.5 x 100 = 50%. Your DTI would be 50%.

The ideal DTI varies by lender, type of loan and loan size. Generally, a DTI of 20% or less is considered low and at or below 43% is the rule of thumb for getting a qualified mortgage, according to the CFPB. Lenders for personal loans tend to be more lenient with DTI than mortgage lenders. In all cases, however, the lower your DTI, the better. A lower DTI shows you make more than you owe and can therefore afford to take on more debt while keeping up with the monthly payments you already have.

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johns income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Recommended Reading: Do Loan Officers Make Commission

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Determine Your Gross Monthly Income

Your gross monthly income is the amount your employer pays you before taxes and other costs are deducted. Include all documented sources of income when adding up your gross pay amount.

If youre paid weekly, multiply your weekly gross income by 52, then divide it by 12. If youre paid every two weeks, multiply your gross pay by 26, then divide it by 12. Write down your gross monthly income amount.

Recommended Reading: Is Bayview Loan Servicing Legitimate

How To Get A Loan With A High Debt

A high debt-to-income ratio can result in a turned-down mortgage application. Luckily, there are ways to get approved even with high debt levels.

1. Try a more forgiving program

Different programs come with varying DTI limits. For example, Fannie Mae sets its maximum DTI at 36 percent for those with smaller down payments and lower credit scores. Forty-five is often the limit for those with higher down payments or credit scores.

FHA loans, on the other hand, allow a DTI of up to 50 percent in some cases, and your credit does not have to be top-notch.

Likewise, USDA loans are designed to promote homeownership in rural areas places where income might be lower than highly populated employment centers.

Perhaps the most lenient of all are VA loans, which is zero-down financing reserved for current and former military service members. DTI for these loans can be quite high, if justified by a high level of residual income. If youre fortunate enough to be eligible, a VA loan is likely the best option for high-debt borrowers.

2. Restructure your debts

Sometimes, you can reduce your ratios by refinancing or restructuring debt.

Student loan repayment can often be extended over a longer term. You may be able to pay off credit cards with a personal loan at a lower interest rate and payment. Or, refinance your car loan to a longer term, lower rate or both.

3. Pay down accounts

Or you can reduce your credit card balances to lower your monthly minimum.

| Balance | |

| $150 | 5.0% |

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required, and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay.For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI.Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Your homeowners insurance premium

- Student loan minimum payment: $125

- $100

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Also Check: Is Usaa Good For Auto Loans

Establish Your Estimated Monthly Mortgage Payment

Use the PITI calculation to figure out your estimated monthly mortgage payment. The PITI acronym stands for principal, interest, taxes and insurance.

Pull your estimated monthly mortgage payment from your loan estimate. The amount you see should be based on your:

- Principal and interest payment

This list doesnt include your utility bills or any miscellaneous expenses.

Dti For Conventional Loans

For a conventional loan, a debt-to-income ratio of up to 45% is usually considered acceptable. In exceptional cases, a DTI of up to 50% will be accepted by some lenders. This is usually in the case of large cash reserves and a high credit score.

This does not mean you will certainly be approved for a loan with a DTI of 45%. It means that your loan could be considered for approval with a DTI of 45% or 50% if the rest of your financial profile is solid.

Understanding your DTI ratio will help you set budgets and plan for your financial future. Understanding your DTI will prepare you to be in the best position for loan approval to purchase a new home, build a business, or take advantage of other growth opportunities.

Don’t Miss: Va Manufactured Home 1976

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individuals ability to manage monthly payments and repay debts.

Total of Monthly Debt Payments Gross Monthly Income \begin & \text = \frac } } \\ \end DTI=Gross Monthly IncomeTotal of Monthly Debt Payments

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences.

The debt-to-limit ratio, which is also called the , is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.