How Do These New Rates Affect Borrowers

If you already have federal student loans, these increased rates wont change anythingthey only apply to new loans that students borrow for the upcoming school year.

If you plan to borrow student loans in the next year, review your options. For many borrowers, federal student loans are likely still the best choice available. Most types of federal student loans dont require a credit check, and everyone who qualifies receives the same interest rate. Thats a big plus for students and young adults who may not have a robust credit history yet.

In addition, federal loans come with added protection that you wont find in the private market. You could be eligible for flexible repayment options, including income-driven repayment plans and extended forbearance and deferment options. There are also several federal forgiveness programs that could help you discharge a portion of your debt if you qualify.

Lastly, federal student loan borrowers have received extra benefits during the Covid-19 pandemic. Payments have been paused and interest rates were set at 0% beginning in March 2020. While those perks are set to expire on August 31, 2022, private loan borrowers received no such benefits during that time.

Does This Increase Affect My Student Loans

If you have existing federal student loans, there will be no impact to your interest rate. This is because federal student loans have a fixed interest rate that will not change over the life of your student loan. However, if you borrow new federal student loans after July 1, 2022, then your new federal student loans will have a higher interest rate.

Interests On Provincial Student Loans

So far, Newfoundland and Labrador, Quebec, and Manitoba are considered the most desirable provinces for obtaining student loans in Canada. Firstly, the process of getting financial aid is easier than in most other regions. In addition to this, schools in these provinces offer some of the lowest tuition rates in the country

Read Also: Car Loan Interest Rate With 600 Credit Score

Interest Rates For Fixed

Loan Status Any StatusWARNING This system may contain government information, which is restricted to authorized users ONLY. Unauthorized access, use, misuse, or modification of this computer system or of the data contained herein or in transit to/from this system constitutes a violation of Title 18, United States Code, Section 1030, and may subject the individual to civil and criminal penalties. This system and equipment are subject to monitoring to ensure proper performance of applicable security features or procedures. Such monitoring may result in the acquisition, recording, and analysis of all data being communicated, transmitted, processed, or stored in this system by a user. If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel.

ANYONE USING THIS SYSTEM EXPRESSLY CONSENTS TO SUCH MONITORING.

The Way To Get Less Interest Rate To The Figuratively Speaking

BURSAHAGA.COM” alt=”Student Loan Interest Rate > BURSAHAGA.COM”>

BURSAHAGA.COM” alt=”Student Loan Interest Rate > BURSAHAGA.COM”> When trying to figure out ways to get a lower notice price to the college loans, there are numerous strategies you can look at:

- Change your borrowing from the bank. Refinancing the college loans needs a good credit score if you want a finest rates. Verify if the there are methods you can alter your borrowing from the bank in order to re-finance so you can a reduced speed. Below are a few info that could help you to get a keen 800 credit history .

- Contrast cost. Seek the advice of anywhere between three and you can four lenders observe just what items from prices you can buy. Do not forget to become ELFI because you compare education loan loan providers to own refinancing.*

- Rating good cosigner. Sometimes, if you dont have enough income or the borrowing from the bank doesnt make it you to get an educated rates, you may be capable of getting a great cosigner . Having a beneficial cosigner that has willing to grab responsibility on mortgage for folks who default, you could find a probably all the way down rate and save money.

- Negotiate. Youre capable discuss a lower rates to the student funds. Consult your lender to find out if there are applications your will enjoy, as well as autopay, to attenuate your own student loan rate of interest.

Recommended Reading: Becu Autosmart

Federal Student Loan Interest Rates

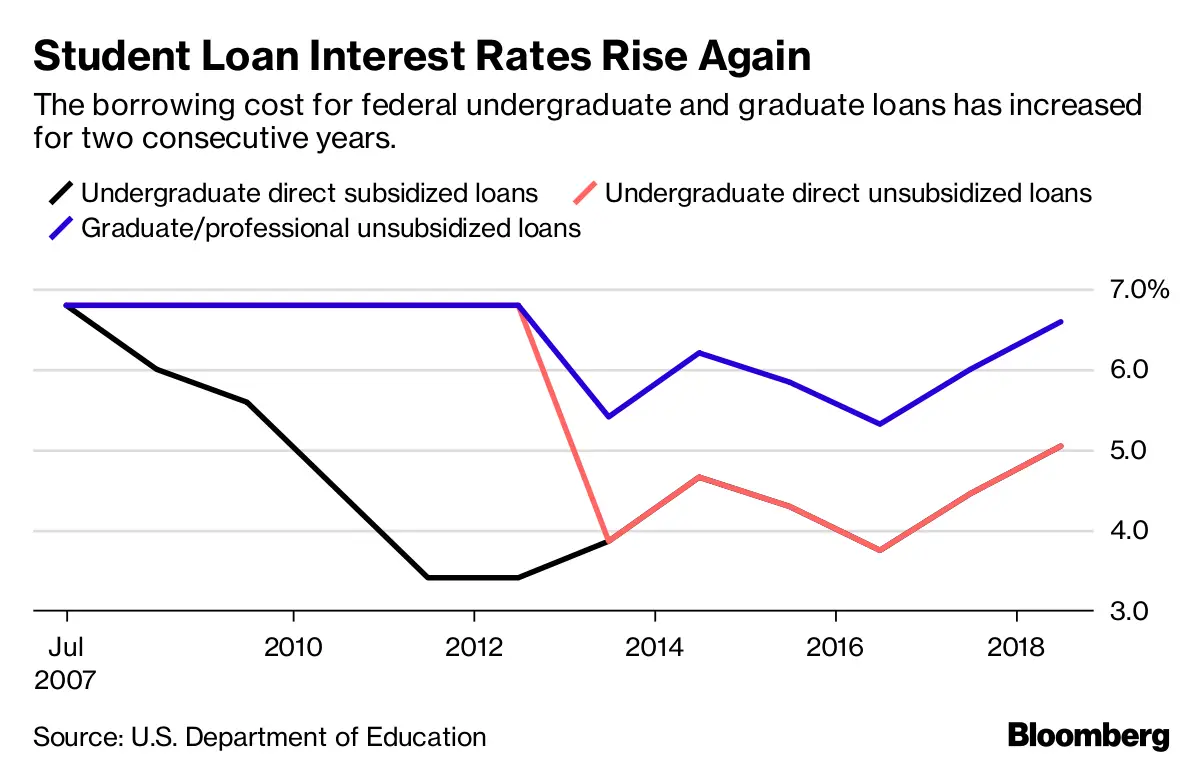

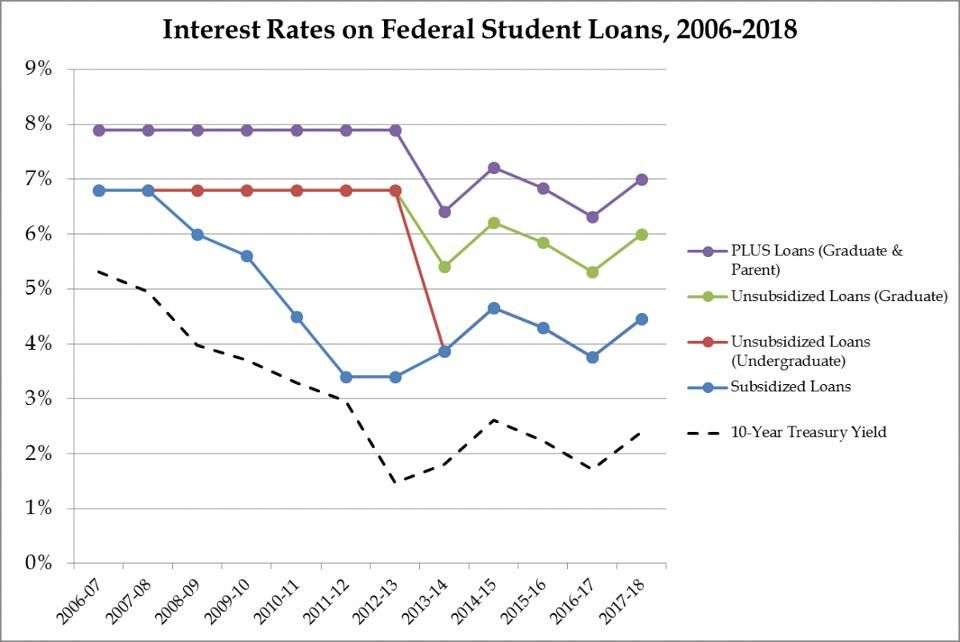

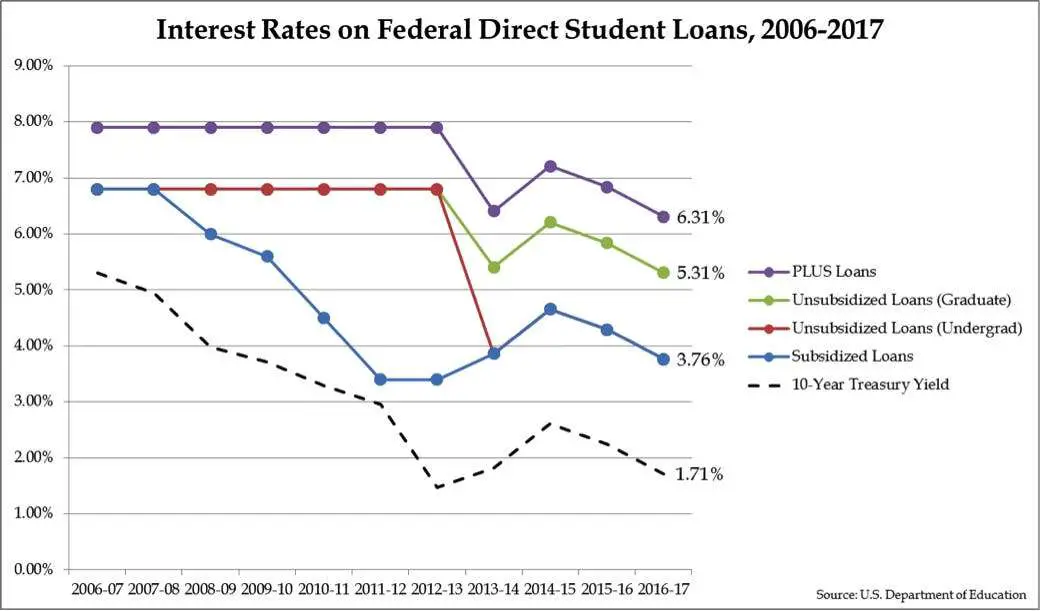

Each spring, student loan interest rates are set by Congress based on the high yield of the last 10-year Treasury note auction in May. New rates apply to student loans disbursed from July 1 to June 30 of the following year. Federal loans are fixed, meaning that the rate will not fluctuate for the life of the loan. The interest rate you receive on a federal student loan is not determined by your credit score or financial history.

Interest charges differ between subsidized and unsubsidized loans. For federal subsidized loans, the government pays your interest charges for you while youre in school at least half time, during your grace period and while youre in deferment. The amount youll owe once your loan is in repayment will include only your original principal balance, loan fees and interest accrued moving forward.

With federal unsubsidized loans, interest charges start accruing immediately after funds are disbursed. If you choose to hold off on making loan payments until later, the accumulated student loan interest gets added to your principal balance when the loan enters repayment.

With that said, interest rates on federal student loans are temporarily set to zero through Jan. 31, 2022, due to impacts of the coronavirus pandemic.

How To Calculate How Much Interest You Will Owe

Every month, the interest amount you owe on your loan is recalculated using a daily interest formula based on your total outstanding loan amount:

Interest amount = Outstanding principal balance x Number of days since last payment x Interest rate factor

The interest rate factor is your annual interest rate divided by the number of days in the year. Your loan servicer is responsible for billing you monthly and explaining how your payments are applied to your principal balance.

You can use our student loan payment calculator to see how much your loan will cost in the long run after interest is accounted for.

Note that if you enter into forbearance or deferment on your loans, or sign up for an extended or income-driven repayment plan, your loans will accrue more interest over time making them more costly.

> > Read More: How Student Loan Interest Works

Read Also: Upstart Vs Avant

Private Institutions And Other Student Loan Providers

If you dont qualify for government student loans or receive a loan large enough to cover all your post-secondary education costs, you may have to look at other options. If this is the case, here are some alternatives for you to consider:

- Student Line of Credit: Offered by most banks and credit unions, a student line of credit is similar to a regular line of credit, where you are approved for a maximum limit, but you only pay interest on the amounts you actually withdraw. Student lines of credit usually only require you to pay interest on the loan while you are in school, and some convert to installment loans once you graduate.

- Loan Connect

Difference Between Federal And Private Student Loan Interest Rates

Unlike federal student loans, interest rates for private student loans are set based on economic factors and underwriting unique to each lender that issues them. Lenders typically take into account a borrowers credit history, earning potential, and other personal financial factors.

If you borrowed a private student loan, you may have applied with a cosigner to secure a more competitive interest rate. Thats likely because most college students dont have much credit history or employment history, so interest rates on private student loans can be higher than those on federal student loans without a well-qualified cosigner.

While federal student loans have a fixed-interest rate, private student loans can have either a fixed or variable interest rate. Borrowing a variable rate loan means that the interest rate can change periodically.

You May Like: Bayview Mortgage Modification

Student Loan Repayment Statistics

Since the start of the Covid-19 pandemic, student loan payments have been flipped on their head. Federal student loan payments have been paused nationwide since March 2020, and the majority of federal loans are currently in forbearance.

At the beginning of 2020, just 2.7 million borrowers had their federal loans in forbearance. That number had shot up to 24 million borrowers by the end of 2021. However, this reprieve is set to expire in May 2022, when federal student loan payments are expected to resume.

Here are the current repayment statuses of the federal Direct Loan program.

| Status | |

|---|---|

| $112 billion | 5.1 million |

Private student loans, on the other hand, received no widespread forbearance options during the pandemic. The majority of private student debt is actively in repayment. In the third quarter of 2021, 74% of private loans were in repayment, 17.5% were deferred, 6% were in a grace period and 2.4% were in forbearance.

Sources: Federal Student Aid, MeasureOne

Student Loan Interest Rates In Canada

Most student loans in Canada have a federal portion and a provincial portion, and each amount is subject to their own student loan interest rates . You have two interest rate options to choose from for your federal student loan interest rate:

- A fixed-rate of 2% plus prime

- A variable-rate equal to the prime rate

Fixed rates are exactly as they sound fixed and unchanging throughout your loan repayment period. A variable rate is lower but fluctuates depending on Canadas prime rate. Canadas prime rate is currently 2.45% and is likely to stay low for the near future, but your loans repayment period defaults at ten years and a lot can change in ten years.

Youll apply for both your federal and provincial student loans through your province of residence. Some provinces have their own interest rates and special funding, and some work directly with the federal government for a seamless experience. For example, OSAP interest rates are Prime + 1.0%, but British Columbias mimic the federal rates above. Heres a breakdown of the loans offered by the various regions and Canada student loan interest rates:

Read Also: Max Fha Loan Amount Texas 2021

What Are The Requirements To Refinance Student Loans

Once you find a lender that best suits your financial situation, check the specific refinancing requirements. These can vary from lender to lender, but here are a few general criteria to be aware of:

- Debt-to-income ratio: Your debt-to-income ratio is a measurement of how much debt you’ve accumulated in comparison to your monthly earnings. You have a better chance of getting approved if your debt-to-income ratio is below 43 percent.

- When you apply for any loan, your credit score has a large impact. Check your lender’s credit score requirements before applying. If your credit score is in the mid-600s or lower, you may need to add a co-signer to your loan in order to qualify.

- Income: Lenders may impose a minimum income threshold, and they will likely want to see proof of employment this tells them that you have the cash to make your monthly payments.

- Refinancing amount: You will likely need to have a minimum of $5,000 in student loans outstanding if you’d like to refinance. If you have less than that, most lenders won’t work with you.

- Degree: You’ll typically need a degree to be eligible for student loan refinancing, though some lenders accept borrowers regardless of degree status.

If the lender you’re considering offers a prequalification tool, you can see your estimated rate based on your general financial history with a soft credit inquiry, which won’t hurt your credit score.

Learn more: Requirements for student loan refinancing

How Interest Rates Affect Repayment

Student loan rates determine the total amount of money a borrower must repay over the course of their loan term.

For example, lets say you were to take out a $50,000 student loan with an annual interest rate of 5%. That would mean in addition to the $50,000 youve got to borrow for your education, youll need to repay an extra $2,500 worth of interest at the end of each year. However, most student loan interest compounds, meaning, interest is charged on interest. That means your interest payment would be even more than $2,500.

You May Like: California Loan Officer License

Thinking Of Refinancing Your Student Loans Here Are Some Things To Consider

- Email icon

How much might refinancing your student loan cost you?

For 10-year fixed rate loans, the average student loan refinancing rate rose to 5.40%, up from 5.14% the week prior, according to the latest rates from Credible. And average rates on 5-year variable-rate loans increased to 3.80%, up from 3.30% the week prior. You can see the lowest rates you may qualify for here.

With more than 40 million Americans on the hook for student loan debt totaling more than $1.7 trillion dollars, it makes sense that many borrowers are looking to refinance their loans. But refinancing student loans is certainly not the right move for everyone. Consider: When you refinance a federal student loan, you are effectively taking out a new private loan to pay off their existing public loan, and therefore, any federal protections that accompanied that federal loans are lost. This means the borrower forfeits any pandemic-related forbearance , government loan forgiveness and generous income-driven repayment options.

Even if a borrower isnt currently making use of the programs and protections offered, its important to consider the potential for future need of repayment plans or loan forgiveness before doing away with the opportunity completely.

Student Debt Continues To Rise

Student debt continues to be an epidemic in our society. Since the 2008 recession, federal funding for public universities has decreased by 22%, while tuition costs have risen 27%. This has led to student loan debt thats surpassed $1.6 trillion. The debt may get worse if the education system is forced to undergo more budget cuts and if more unemployed Americans take advantage of low interest rates to go back to school.

Also Check: Capital One Car Loan Pre Approval Letter

Alternatives To Government Aid

Government-backed student loans are the lowest cost way to finance your education, but sometimes you wont qualify or receive enough to cover all your education costs. For example, if your spouse or parents earn too much money, you may not qualify, or if you have RRSP savings, you may be assessed to have a $0 need for government student loans.

Ideally, only those Canadians who do not need student loans would be denied, but this isnt always the case. If you need loans to finance your education and dont qualify for government student loans, here are your options:

Can I Lower My Interest Rate

If youve borrowed a fixed-rate student loan, your interest rate generally cannot be lowered without refinancing. However, many student loan servicers offer a 25% interest rate reduction for borrowers who enroll in an auto debit scheme.

If you have a variable-rate private student loan, your lender may lower your rate due to market activity. But, variable rates work both ways, and changes in market activity could also cause your student loan interest rate to go up.

Read Also: What Does Unsubsidized Loan Mean

My Student Loans Are Currently Paused Does This Affect Me

Federal student loan payments are currently paused through September 30, 2021 through temporary student loan forbearance. Interest rates on federal student loans are temporarily set to 0%. However, this student loan relief is for current student loans only. This interest rate increase applies to new student loans borrowed. If this student loan relief expires, your federal student loan payments and regular interest rate will resume starting October 1, 2021. Its possible that President Joe Biden may extend this student loan relief beyond September 30, but absent an extension, you should expect to restart student loan repayment on October 1.

We Offer Major Help And Minor Stress

Well help guide you through the process to find the right loan term, interest rate, and payments right for you and the family budget.

Here are some key dates to plan for prior to sending your student off to school.

Shop around for the right loan using our prequalification tool to see your estimated rates.

Make sure you’ve received confirmation that the money is scheduled to be sent to your school.

Don’t Miss: Refinance Usaa Auto Loan

Are There Any Costs Associated With Refinancing

Usually no. Many lenders do not charge origination, application or disbursement fees for refinancing student loans. If youre not sure, ask your lender about its fee structure before you refinance.

Note that when you refinance student loans, you can choose to extend your repayment terms. Opting for a long term can result in higher interest costs over the life of your loan. If you want to reduce the amount you pay in interest, consider selecting a shorter repayment term.

Why Choose Student Loans From Sallie Mae

Whether youre looking for a school loan to help pay for your undergraduate or specialized graduate degree, or a parent helping your student pay for college, our student loans for students are designed to help you meet your financial and educational needs.

Our student loan customers benefit from

- Applying for a student loan only once to get the money needed for the entire school year

- Student loans that feature 100% coverage for all school-certified expenses like tuition, fees, books, housing, meals, travel, and even a laptop4

- Multi-Year Advantage: Returning undergraduate and graduate school loan customers with cosigners have over a 90% approval rate,5 faster student loan applications, and the convenience of managing all private loans with one lender.

- No origination fee

- Competitive interest rates

- Multiple repayment options on loans for students

- 0.25 percentage point interest rate discount when enrolled in and making monthly payments by auto debit6

- Free access to FICO® Scores, updated quarterly online7

- 100% U.S.-based customer service teams

Read Also: Usaa Rv Loan Rates Calculator