Do Student Loans Count In Debt

Just like any other debt, your student loan will be considered in your debt-to-income ratio. The DTI ratio considers your gross monthly income compared to your monthly debts. Ideally, you want your outgoing payments, including the estimate of new home cost, to be at or below 41 percent of your monthly income.

What Other Options Are There Besides Ibr

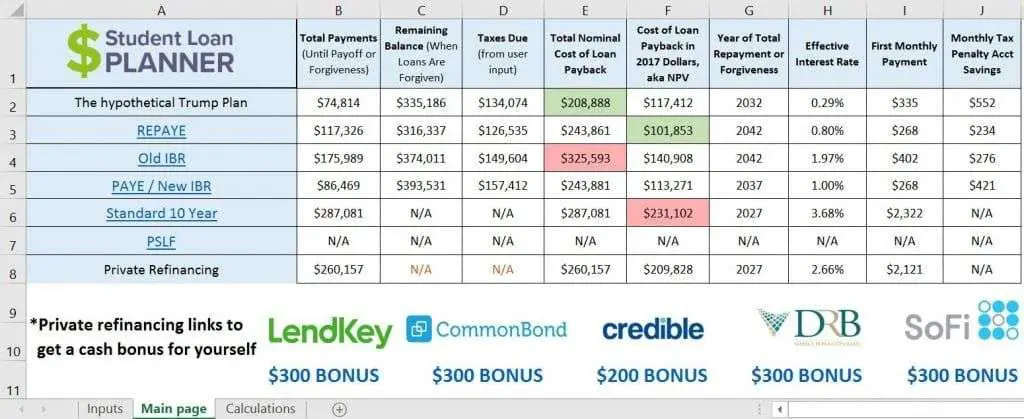

There are other options besides income-based student loan repayment such as PAYE and REPAYE.

You can see our PAYE student loan calculator and the REPAYE student loan calculator, which are two examples of income-driven student loan repayment programs.

PAYE, or pay as you earn,enables you to pay 10% of your discretionary income toward student loan repayment. PAYE is only available to new borrowers as of October 1, 2007, or later. After that, so long as your monthly payment is less than the Standard Repayment Plan, you may receive student loan forgiveness. PAYE forgives undergraduate student loans after 20 years.

REPAYE, or revised pay as you earn,also enables you to pay10% of your discretionary income toward student loan repayment. REPAYE is available to any student loan borrower who has qualifying student loans regardless of when borrowed. REPAYE forgives graduate student loans after 25 years.

Can You Get An Fha Loan With Student Loans In Default

You can not get an FHA Loan with student loans in default. The U.S. Department of Housing and Urban Development tracks all federal debt using the Credit Alert Verification Reporting System database.

If you’re in default on a federal student loan, your mortgage underwriter will need proof you’re out of default before you close.

Read Also: Does Va Loan Work For Manufactured Homes

Student Loan Forgiveness Calculation

In all of the income-driven repayment plans, the balance on your student loans is forgiven after either 20 or 25 years. If making income-driven repayments for 20-25 years, any balance on the loan is then forgiven at that time. To get your student loan forgiveness amount, we calculate how much you would normally pay on your student loan in total, and subtract it by what you would pay in any of the income-driven plans after 25 years.

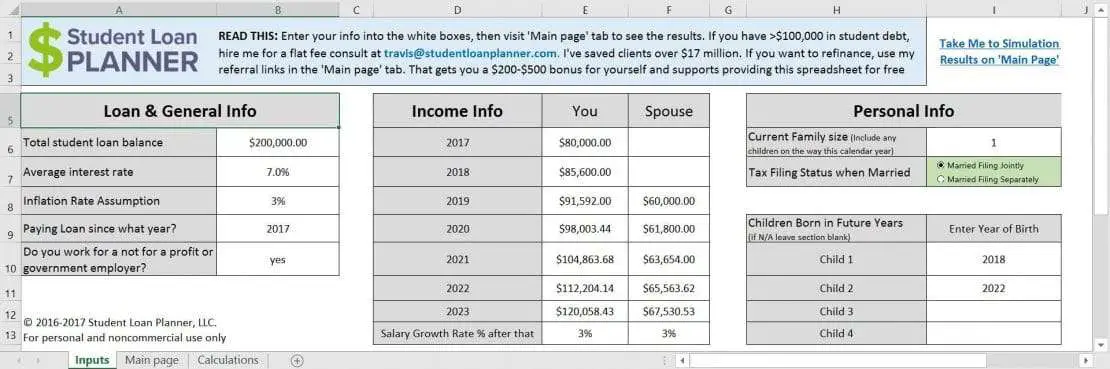

How Does Marriage Affect My Agi For Student Loans

With federal student loans, your marriage affects your AGI because at tax season you have to decide:

Should we file taxes jointly or separately for student loans?

Answer: It depends.

?: Hian Oliveira

When it comes to student loans, the decision of whether to file taxes jointly or separately is complicated. Questions I ask clients include:

- How much do you and your spouse earn?

- Do you both have federal student loans?

- Are your federal loans Direct Loans, FFEL Loans, or a combination of the two?

The answers to those questions help guide my advice on whether to file taxes jointly or separately, whether student loan consolidation makes sense, and which repayment plan is the best repayment plan.

Pro-tip. For many married borrowers where both spouses work and have federal student loans, the best repayment plan is likely the REPAYE plan. In cases where only one spouse works, filing separately might make sense. That way either spouse can use the PAYE or IBR plan and have only their AGI counted.

Further reading. An excellent review of student loans, marriage, and taxes was done by Prof. Victoria Haneman in The Collision of Student Loan Debt and Joint Marital Taxation.

Read Also: How To Transfer Car Loan To Another Person

Leaving Income Driven Repayment

You may remain in these plans regardless of whether you maintain a partial financial hardship. The rules are different depending on the type of plan. For REPAYE, for example, it never matters whether you have a partial financial hardship. You can leave the PAYE or REPAYE plans at any time if you want to switch. If you leave IBR, you must repay under a standard plan. However, you do not have to stay in the standard plan for the life of the life. You can change after making one monthly payment under the standard plan. Be advised that switching repayment plans usually means that the government will add accrued interest to the balance. You should check the rules of your particular plan and check with your servicer to make the decision that is best for you.

How Your Monthly Payments Are Calculated

Each of the four income-driven repayment plans differs in how it calculates your monthly payment. Generally, its based on a percentage of your discretionary income, which is defined as the difference between your income and a percentage of the poverty guideline for your family size and state.

According to the Department of Health and Human Services, the 2017 poverty guidelines are as follows per household:

Heres how each repayment plan breaks down.

Also Check: What Happens If You Default On Sba Loan

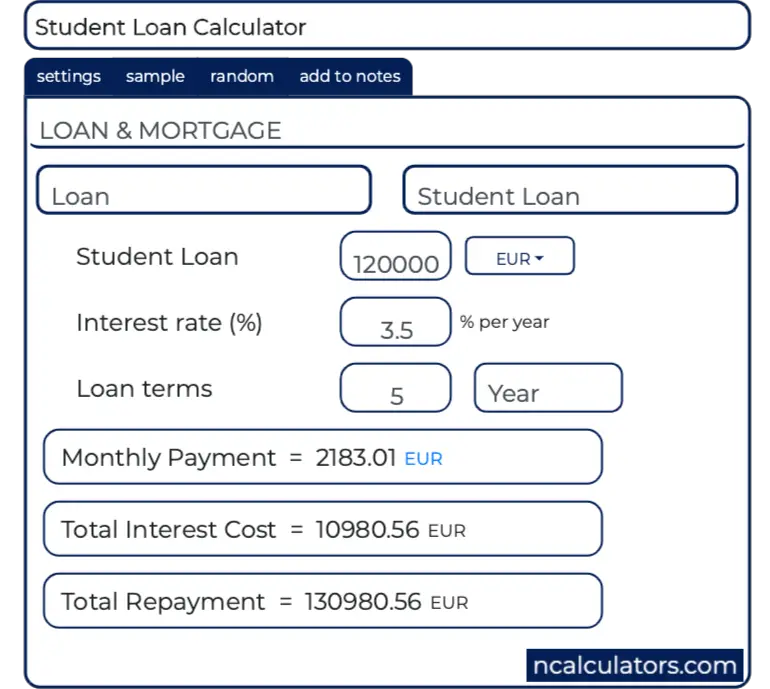

How You Can Use The Loan Amortization Calculator

You can use the information generated in the Amortization Schedule Calculator to quickly determine

- How much you must pay for various balances by adjusting the loan amount box.

- How much extra you need to pay each month to pay off your loan by a specific date by adjusting the loan term box.

- How your monthly payments and loan terms will be affected if you refinance and get a new interest rate by adjusting the loan rate box.

Make The Process Easier To Navigate

Changes to the regulations also could help boost enrollment in IDR plans among those borrowers most likely to encounter repayment challenges. For example, streamlining the number of existing plans would reduce borrower confusion and make the program easier to access and implement. Although the committee may have limited ability to consolidate congressionally authorized plans, members should look to reduce the number of plans as much as possible within this process.

Research also supports allowing borrowers who have defaulted to enroll in income-driven plans, rather than requiring them to first navigate the lengthy and complex loan rehabilitation process. Enrollment in an IDR plan substantially decreases the likelihood that borrowers who have defaulted will do so again. Still, the Consumer Financial Protection Bureau found in 2017 that fewer than 1 in 10 borrowers who completed rehabilitation were enrolled in such plans within nine months of exiting default.

Now is the time to craft regulations for income-driven plans that work for borrowers, especially those most at risk of delinquency and default and who would most benefit from lowered monthly payments. As they work toward making changes in this falls sessions, negotiators should carefully consider the potential benefits and shortcomings of various options to provide relief to low-income borrowers as they create a more affordable and accessible approach.

You May Like: What Is Chfa Loan Colorado

What Is An Amortization Schedule Calculator

Amortization is paying off a debt over time in equal installments. Part of each payment goes towards the loan principal, and part goes towards interest. This loan amortization calculator, also known as an amortization schedule calculator, can help you to determine how much you can afford to borrow, what loan term you need and when it might be wise to refinance.

The loan amortization calculator will help you determine how much each of each monthly payment goes towards the principal of your loan and how much goes to pay off interest. The ratio of principal and interest does not remain the same every month. At the beginning of your loan, more of your money goes towards interest than in later payments. The amount that goes towards principal gradually grows each month as the amount that goes towards interest decreases.

If You Have A Postgraduate Loan And A Plan 1 Plan 2 Or Plan 4 Loan

You pay back 6% of your income over the Postgraduate Loan threshold . In addition, youll pay back 9% of your income over the Plan 1, Plan 2 or Plan 4 threshold.

Example

You have a Postgraduate Loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 2 threshold of £2,274.

Your income is £650 over the Postgraduate Loan threshold and £126 over the Plan 2 threshold .

You will pay back £39 to your Postgraduate Loan and £11 to your Plan 2 loan. So your total monthly repayment will be £50.

Example

You have a Postgraduate Loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 1 threshold of £1,657.

Your income is £650 over the Postgraduate Loan threshold and £743 over the Plan 1 threshold .

You will pay back £39 to your Postgraduate Loan and £66 to your Plan 1 loan. So your total monthly repayment will be £105.

You May Like: Does Va Loan Work For Manufactured Homes

How Many People Get Forgiveness Through Income

A recent report by the National Consumer Law Center revealed that only 32 student loan borrowers have seen their loans forgiven through income-driven repayment plans in the programs 25-year history. However, this shouldnt discourage you from seeking out these programs. The report states that the plans themselves arent the issue but rather a failure on the part of loan servicers to adequately inform borrowers about their options.

If you think you qualify for income-driven repayment, reach out to your servicer directly to request access.

How To Calculate Your Monthly Payment With An Income

Roughly seven in 10 college graduates have student loan debt, with an average of $30,100 per borrowers, according to the Institute of College Access and Success. For some graduates, however, that could be as much, or more, than what they earn their first year out of school. Here are four plans that can help lower your federal student loan payments. We will also show you how to calculate your monthly payment with an income-driven repayment plan

Percentage of college graduates with student loan debt.

For graduates whose income is insufficient to pay back their federal student loans, the government has created four income-driven repayment plans to help make the process more affordable.

Generally, if a borrowers total student loan debt at graduation exceeds their annual income, they will qualify for an income-driven repayment plan, says Mark Kantrowitz, publisher and vice president of strategy at Cappex.com.

Income-driven repayment plans base your monthly payment on your income rather than on the 10-year Standard Repayment Plan. Depending on your needs, its important to review each option to find the one that suits you best.

Recommended Reading: How To Get An Aer Loan

Start With Federal Student Loans Issued Directly To Students When Calculating Payments

Most undergraduate students can borrow up to $31,000 in total for undergraduate studies.

The exception is for independent students or dependent students whose parents dont qualify for PLUS loans and need to make up for cost of attendance differences.

These undergraduates can borrow up to $57,500 for an undergraduate degree.

On an annual basis, the amount a student can borrow is between $5,500 and $12,500, depending on their year in school and whether parents qualify for PLUS loans.

Families can decide annually and on a semester-by-semester basis how much of the limit theyd like to accept or cancel.

Use the our student loan calculatorto calculate payments.

Your minimum monthly payment is based on the type of loan, the amount you owe, the length of your repayment plan and your interest rate. Youll typically have 10 to 25 years to repay federal loans entirely. Shorter lengths of repayment time or larger loans will result in higher monthly payments.

To get the most accurate results in our calculator, enter your loan amounts separately with their individual interest rates and terms.

You may have a mix of federal and private loans. If you dont know how much you have in federal student loans, search for your federal loans in the National Student Loan Data System or contact your private student loan lender.

Number Of Monthly Payments

If you take advantage of the six month non-repayment period, 114 monthly payments represent a total repayment period of 9.5 years .

If you do not take advantage of the six month non-repayment period, 120 monthly payments represent a total repayment period of 10 years .

You can select a shorter repayment period by entering a lower number of monthly payments.

Also Check: How To Find Student Loan Number

Determine Whether Your Spouse’s Income Also Counts

If you file your taxes as married filing jointly, both your and your spouse’s earnings count when determining your income.

If you are married and file separately, generally only your income counts. However, under the REPAYE Program, your spouse’s income must be factored in unless you cannot access information about their income or are separated.

Your monthly payments could rise substantially after marriage if your spouse has higher earnings than you or doesn’t bring much student loan debt into the marriage.

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

Also Check: Genisys Auto Loan Calculator

What Is The Income

Our student loan Income-Based Repayment calculator helps you understand how much money youll pay under the IBR plan offered under the governments Income-Driven repayment payment plan. Our income-based repayment calculator shows you what your monthly payment and total payment will be under the Standard Repayment Plan and Student loan Income-Based Repayment. With this calculator, you can also see how much student loan forgiveness you will receive under the student loan income-based repayment plan.

What If My Income Changes

Initial enrollment in IBR requires financial hardship, but borrowers can stay in the program and continue to take advantage of smaller monthly payments even if their salaries increase down the road. IBR payments can increase or decrease if your income or family size change, but they will never be more than what youd pay on the standard plan regardless of how much you earn. To remain in the program, borrowers must submit proof of income each year.

Also Check: Genisys Loan Calculator

Amortized Loan: Fixed Amount Paid Periodically

Many consumer loans fall into this category of loans that have regular payments that are amortized uniformly over their lifetime. Routine payments are made on principal and interest until the loan reaches maturity . Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. The word âloanâ will probably refer to this type in everyday conversation, not the type in the second or third calculation. Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need:

Understand Your Repayment Options

After you know who and how much you owe, and have a sense of your personal budget, itâs time to learn about your repayment options. Your repayment plan determines how much you pay each month, including what you may pay in interest, over the life of your loan.

This means that choosing a repayment plan is usually about paying as much as you can afford each month , but not more than you can afford (to avoid missing payments.

Read Also: Is Federal Student Loan Forgiveness Real

Also Check: How Much To Loan Officers Make

If You Enroll In Repaye

Your payments in an income-driven repayment program like REPAYE will depend on your income. Lets say youre making $55,660, the median income for workers who are just starting out and have a bachelors degree. Your monthly payments in REPAYE would start at $308 and gradually increase to $469. Thats an average monthly payment of $389.

How Are Student Loan Payments Calculated

Student loan payments, like other loan payments, are calculated based on the details of your loan. This includes how long you plan to be in repayment on the loan, the interest rate you received, and the total amount you borrowed.

The higher your interest rate and balance, the higher your monthly payment will be. In addition, the shorter your repayment term, the higher your monthly payment will be and vice-versa.

In the first several years of a student loan repayment term, you pay more toward interest accrued than you do the principal balance. However, as you continue to make the same monthly payment, your principal balance starts to go down quicker.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan 2 threshold of £2,274.

Your income is £317 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £28 and repayments will go towards both plans.