What Credit Score Is Needed For A Va Home Loan

None! Instead of making a blanket rule about credit scores, the VA asks that lenders look at a persons entire loan profile. Some lenders may require certain scores, but the VA itself does not impose any credit score restrictions.

When researching your VA home loan lender options, see if they have a minimum credit score listed.

The Va Home Loan Process

1. Obtain a COE

If you think you want to get a VA home loan, youll first need to obtain a COE, or a Certificate of Eligibility, to prove that youre qualified for the loan. This can be obtained through multiple avenues, such as online, via your lender , or via snail mail.

2. Find a Lender

Next, youll want to do your research and find a VA home loan lender that can help you during the process.

3. Get a Quote

Your VA home loan lender can set you up to get a quote for the home youre looking at. Most places dont charge you to do a quote on your prospective home.

4. Add a VA Clause to Your Contract

After you get your quote, youll want to ensure that your real estate agent and lender include a VA option clause or VA escape clause in your purchase contract.

5. Lender Processing

Then, your VA home loan lender will look over your documentation, including employment, debts, and credit, and process the loan. Next, theyll ask the VA to appraise the home to make sure it is worth what you were quoted.

6. Close on Your Home

Once the VA home loan lender has approved the appraisal and concluded that the terms in the contract are correct, you can close on your new home!

Ready to look for your new home? Check out our list of the 10 best states for military retirement. And no, its not just another listicle! Find out why we think these are the best states and then decide for yourself!

What Is A Va Loan

A VA loan is guaranteed by the U.S. Department of Veterans Affairs. The loan itself isnt actually made by the government, but the fact that its backed by a government agency makes lenders feel more comfortable offering these loans, because they take on less risk than with a conventional mortgage.

As a result, its possible to get a VA loan without a down payment, and sometimes with looser credit standards. While you still need to meet certain requirements, and the lender still needs to approve you, if you qualify for a VA loan, it can help you attain homeownership with less money than youd need in the bank otherwise.

Also Check: Becu Auto Loan Payoff

When Does A Va Loan Make Sense

Whether a VA mortgage is truly worth it will depend on the lender you choose and the property youre buying.

Real estate professionals familiar with VA loans will mitigate some of the potential downside. I cant tell you how many Realtors I talked to before purchasing my home, says LaGroon. I actually had one person tell me they werent interested because they didnt want to do a VA loan. He eventually ended up working with a real estate agent who is a veteran and understood the VA loan process.

VA home loans can be appealing for younger veterans or first-time home buyers because they dont require a down payment. For those who dont have significant cash reserves, or cash from a home sale to apply to a new purchase, not having to come up with a down payment can be the difference between owning a home or renting.

If you have an existing VA mortgage, a VA streamline refinance can potentially reduce your interest rate or loan term. However, you need to pay attention to the refinancing fees to ensure it makes sense.

Interest Rate Reduction Refinance Loan

Interest rate reduction refinance loans , also known as VA streamline refinance loans, help borrowers obtain a lower interest rate by refinancing an existing VA loan. This is a VA-loan-to-VA-loan process that allows homeowners with an existing VA loan to refinance a fixed-rate loan at a lower interest rate or convert an adjustable-rate mortgage into a fixed-rate mortgage.

Don’t Miss: How Long For Sba Loan Approval

How Much Is The Va Guarantee

The U.S. Department of Veterans Affairs guarantees a generous portion of each VA loan. How much the VA guarantee ends up being depends on the loan amount.

The VA guarantees a portion of these loans for a lender. This is not money paid to a veteran, or for their benefit. Instead, the VA guarantees a portion of these loans to help lenders offset the risk of loans. By doing so, it encourages lenders to make loans available to veterans on competitive terms. Also, regardless of how much the VA will guarantee, or how high the VA loan limit is in a particular county, a veteran will have to qualify for the loan based upon income, credit, and other requirements.

VA-eligible borrowers may be interested to know how much the VA guarantees on mortgages obtained through military home loan benefits. This table shows the maximum guarantee amounts for loans ranging from small to jumbo:

|

40% of the loan amount, with a maximum of $36,000 |

Same as above |

| Up to an amount equal to 25% of the county loan limit | Same as above |

Table based on VA website

To understand the VA guarantee, one might think of VA loans in terms of small, medium and large.

Small VA loans under $144,000 may have a larger guarantee

Medium VA mortgages between $144,000 and $417,000 have up to 25% government backing

Large VA home loans over $417,000 and up to conforming loan limits also get 25% VA guarantee

When Not To Use A Va Loan

If you have good credit and 20% down

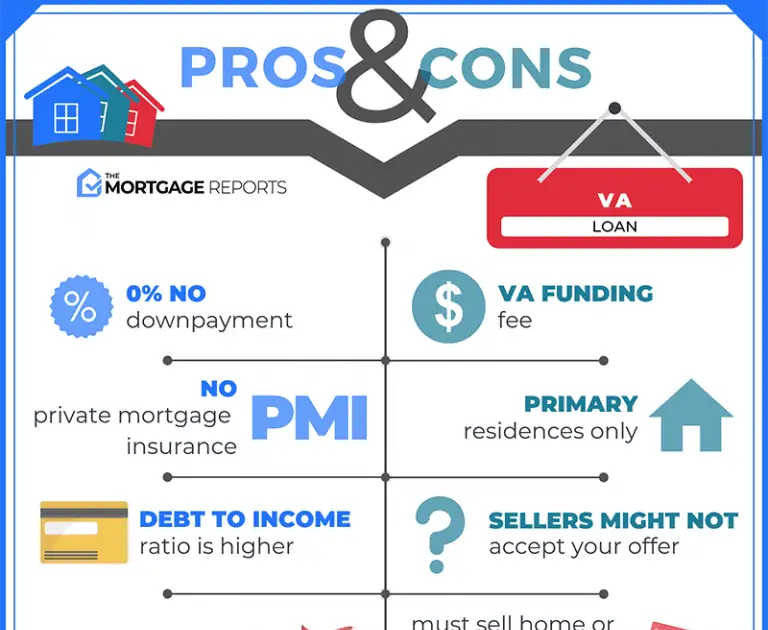

A primary advantage to VA homeloans is the lack of mortgage insurance.

However, the VA guarantee does not come free of charge. Borrowers pay an upfront funding fee, which they usually choose to add to their loan amount.

The fee ranges from 1.4 to 3.6percent, depending on the down payment percentage and whether the home buyerhas previously used his or her VA mortgage eligibility. The most common fee is2.3 percent.

On a $200,000 purchase, a 2.3 percent fee equals$4,600.

However, buyers who choose a conventional mortgage and put 20 percent down get to avoid mortgage insurance and the upfront fee. For these military home buyers, the VA funding fee might be an unnecessary expense.

Theexception: Mortgage applicants whose credit ratingor income meets VA guidelines but not those of conventional mortgages may stillopt for VA.

If youre on the CAIVRS list

To qualify for a VA loan, you mustprove youhave made good on previous government-backed debtsand that you have paid taxes.

The Credit Alert VerificationReporting System, or CAIVRS, is a database of consumers who have defaulted ongovernment obligations. These individuals are not eligible for the VAhome loan program.

If you have a non-veteran co-borrower

Veterans often apply to buy a home with a non-veteran who is not their spouse.

This is okay. However, it might not be their best choice.

The Conventional 97 mortgage, on the other hand, allows down payments as low as three percent.

Don’t Miss: Va Manufactured Home 1976

If You Have Remaining Entitlement You Do Have A Home Loan Limit

With remaining entitlement, your VA home loan limit is based on the county loan limit where you live. This means that if you default on your loan, well pay your lender up to 25% of the county loan limit minus the amount of your entitlement youve already used.

You can use your remaining entitlementeither on its own or together with a down paymentto take out another VA home loan.

You may have remaining entitlement if any of these are true. You: Have an active VA loan youre still paying back, or Paid a previous VA loan in full and still own the home, or Refinanced your VA loan into a non-VA loan and still own the home, or Had a compromise claim on a previous VA loan and didnt repay us in full, or Had a deed in lieu of foreclosure on a previous VA loan , or Had a foreclosure on a previous VA loan and didnt repay us in full

Bottom Line: Is A Va Loan Right For You

A VA loan may be a good choice if you dont have perfect credit, or you want to buy a home without a down payment but dont want to pay mortgage insurance. Just be aware that you need proof of military service to be eligible and youll likely have to pay a funding fee that could add significant cost to your loan.

About the author:

Read More

Don’t Miss: How To Transfer Car Loan To Another Person

What To Pay Attention To With A Va Loan

A VA loan isnt always the cheapest option. Because VA-backed mortgages can come with a special upfront funding fee, its always a good idea to shop around for the best mortgage rates.

Veterans get taken advantage of a lot when it comes to using their VA benefits, says David Piatek, who is a member of the West Virginia National Guard and vice president at The Federal Savings Bank in Chicago. On average, closing costs across the country are going to be 2% to 3% of the purchase price. But Piatek says veterans may get stuck paying 4% to 5% in closing costs if they dont find the best offer.

What Types Of Va Manufactured Home Loans Are Available

You may use a VA-guaranteed loan to:

- Buy a manufactured home and/or lot

- Buy and improve a lot on which to place a manufactured home you already own and occupy.

- Refinance a manufactured home loan in order to buy a lot.

- Refinance an existing VA manufactured home loan to reduce the interest rate.

VA requires manufactured homes be on permanent foundations. Guidelines and policies regarding manufactured homes can vary by lender.

Recommended Reading: How To Transfer A Car Loan

How To Apply For A Va Loan

Once you have your paperwork in order, you can apply for a loan through a VA lender. Not every institution offers VA loans, so you need to look for a lender that will work with you. In many cases, a good VA lender should be able to answer your questions and guide you through the process.

Be sure to compare loan terms and VA mortgage rates to ensure youre getting the best deal for you. Also, make sure youre aware of some of the basics of the VA loan process before starting.

Go Through The Va Appraisal And Underwriting:

Once under contract, your lender will order a VA appraisal of the property. The VA appraisal is not a home inspection, but a VA requirement to ensure the property meets fair market value and the VA’s minimum property requirements.

Around the same time underwriters will evaluate your income, financial and related documents along with the appraisal once its finalized. If everything checks out, youll be issued a clear to close and move on to your loan closing.

Don’t Miss: How To Get An Aer Loan

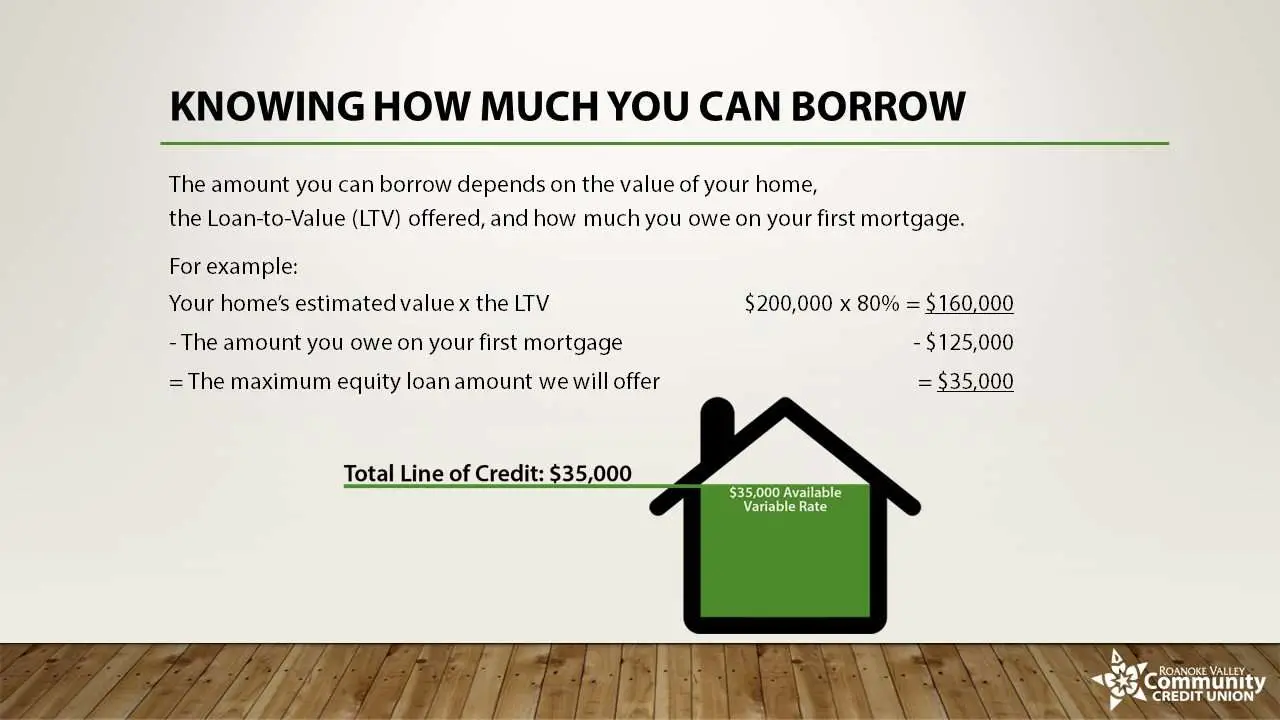

Whats The Maximum You Can Borrow

Theres no limit set by the VA on how much youre allowed to borrow for a home. But the VA does cap the amount of insurance provided to the lender, and most lenders limit the loan amount as a result. You can find out the limit in any U.S. county through the VA website.

The maximum loan limit varies from one lender to another, so this is another reason to shop around.

If youve already received a VA loan, the amount youre allowed to borrow with no down payment may be smaller.

How Does A Va

With a VA-backed home loan, we guarantee a portion of the loan you get from a private lender. If your VA-backed home loan goes into foreclosure, the guaranty allows the lender to recover some or all of their losses. Since theres less risk for the lender, theyre more likely to give you the loan under better terms. In fact, nearly 90% of all VA-backed home loans are made without a down payment.

Lenders follow our VA standards when making VA-backed home loans. They may also require you to meet additional standards before giving you a loan. These standards may include having a high enough credit score or getting an updated home appraisal .

Read Also: How To Get An Aer Loan

Certificate Of Eligibility Supporting Documents

| Military service | |

|---|---|

| Form that shows character of service and narrative reason for separation | |

| Former National Guard/Reserve member | Form that shows character of service and narrative reason for separation |

| Discharged member of the National Guard | Report of Separation and Record Service for each National Guard service period andRetirement Points Account and proof of character of service |

| Discharged member of the Reserves | Evidence of honorable service and a copy of the latest annual retirement points statement |

Va Home Loans: Top Benefits And Advantages

The G.I. Bill was enormously popular and successful the many perks and benefits that it afforded to United States military personnel and veterans were the impetus for that popularity. Few parts of the bill were met with more enthusiasm than the VA home loan provisions. Since being introduced, VA home loans have been quite popular and have helped thousands upon thousands of military personnel to get into affordable homes. If you are qualified to take out a VA home loan, you should seriously consider doing so some of the main reasons include:

No Down Payment Needed

One of the most attractive things about securing a VA home loan is that you can finance 100% of the purchase price of a home. In other words, down payments are not required. Therefore, you do not need to have a lot of money saved up for a down payment, and can use any money that you have saved to make whatever purchases you need. Nine out of ten people who secure a VA loan take advantage of this benefit and put no money down when buying a home. Without question, this is a major selling point for many people.

No Private Mortgage Insurance Required

Relaxed Qualification Standards

Low Interest Rates

No Prepayment Penalties

Don’t Miss: Loan Originator License California

How Do Va Loans Work

Basically, you fill out paperwork from the VA that verifies your eligibility for the program. You also receive whats known as your entitlement, which is the dollar amount guaranteed on each VA loan. Lenders might be willing to loan up to four times the amount of your entitlement.

With all of that in place, its possible to get a VA loan with no money down. VA loans also dont require private mortgage insurance , but you will pay a VA funding fee when you close, which will be a percentage of the loans total value. That fee helps keep the program running for future borrowers.

Can Closing Costs Be Included In Your Va Loan

When facing closing costs, you might not have the funds available. Thats OK! The VA loan allows you to include some of the closing costs into your total loan amount.

The big thing is that you can roll your funding fee into the total mortgage amount. Although youll pay more in interest, this can help you get into a home now.

The other fees that create your closing costs cannot be rolled into the loan. But you may receive seller or lender concessions to bring the upfront cash cost down.

Also Check: How To Find Your Student Loan Number

How Much Entitlement Does The Va Provide

Entitlement can be confusing for even the most experienced mortgage professionals. But it really just involves a bit of math. In most areas of the country, basic entitlement is $36,000. Additionally, secondary entitlement is $70,025. Adding those together gives you a total of $106,024 for eligible veterans. In higher cost areas, it may be even more.Additionally, the VA insures a quarter of the loan amount for loans over $144,000. Therefore, you can multiply that entitlement amount, $106,024, by four for a maximum loan amount of $424,100. Thats the total amount qualified buyers could borrow before having to factor in a down payment.

When Could I Get A Second Va Loan

Lets suggest you currently a own a home in Pensacola, Fla., financed with a VA loan. But you just received orders for a permanent change of station to Norfolk, Va. What if you want to keep your existing home in Florida and rent it out, but also want to purchase a new home in Norfolk with a second VA loan?

With enough remaining entitlement, you may be able to secure a second VA loan with little to no money down to purchase a home in your new area.

First of all, you cant purchase a home with a VA loan with the sole intent of renting it out. However, if you purchased a home with the intent of using it as your primary residence, and then you lived in it a while, you may be able to rent it out later on.Lets suggest you borrowed $150,00 for your first home. Since the VA guarantees a quarter of your loan amount, that means you tied up $37,500 of your entitlement. As mentioned before, in most parts of the country, your total entitlement is $106,025. Simple subtraction tells you that you have $68,525 left over entitlement that you have access to. And again, multiply that by four, and you have a total of $274,100. Keep in mind, this is not the max amount you could spend on a home. You would just need to factor in a down payment for anything over this amount.

Read Also: Do Pawn Shops Loan Money